Get instant access to this case solution for only $19

Merck & Co Evaluating a Drug Licensing Opportunity Case Solution

Merck & Co, a global research-driven pharmaceutical company, are evaluating the proposition of licensing Davanrik, a new drug with the potential to treat both depression and obesity. Patents of Merck’s most popular drugs are about to expire in a couple of years’ time hence the management needs to develop new drugs to add to the company’s drug portfolio and decrease the impact the expiring of patents will have on revenue. Davanrik is currently in pre-clinical phase and will have to pass through the three phases of the clinical approval process. Every phase requires a certain amount of time and cost and each phase is dependent upon the success of the previous phase hence evaluation of the project will be done using a “Decision Tree Diagram”.

Following questions are answered in this case study solution

-

Decision Tree Analysis

Case Analysis for Merck & Co Evaluating a Drug Licensing Opportunity

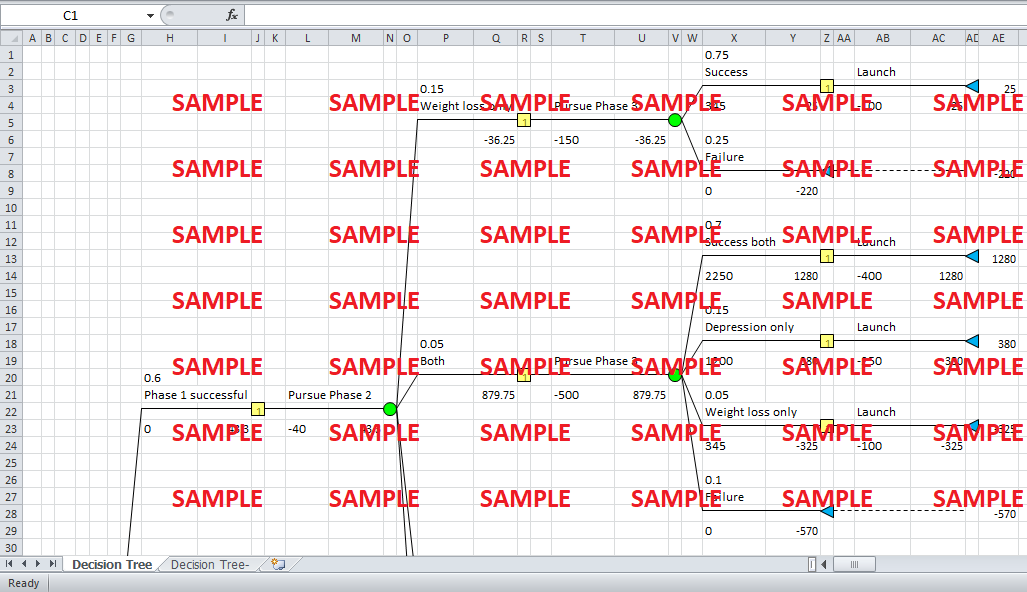

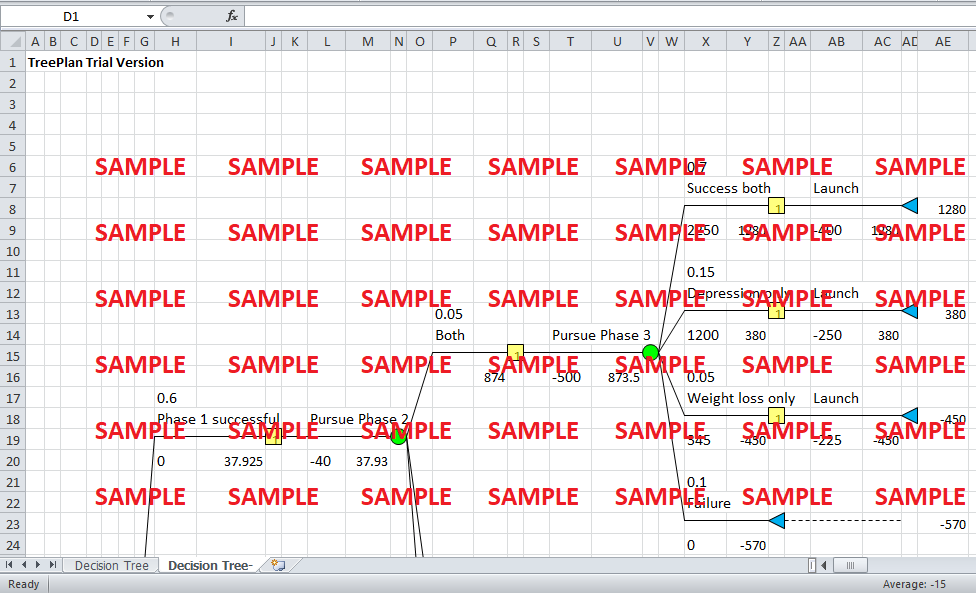

1. Decision Tree Analysis

Decision tree analysis is based on the following assumptions:

-

Inflation is negligible due to which the time value of money impact is not significant.

-

Objective of the company is to maximize its profits

-

Given probabilities and cost estimates are correct

Management will only consider the next phase of the clinical process if the previous phase gives a positive expected value. Also, each phase of the process is analyzed independently. Backward induction method is applied in decision tree analysis that is one starts from the terminal node (represented by the blue arrow) value and roll backs step wise to reach the first decision node which in the case of Merck is “license the drug or not”. Expected payoff at each event node (represented by green circle) is calculated as:

Expected payoff = (prob. of success * payoff if successful) + (prob. of failure * payoff if failure)

At each decision node (represented by a yellow box), the maximum value is chosen from all the successor nodes coming out of the decision node because the objective of the company is to maximize profits. Based on the information and estimates available the NPV of the project using decision tree comes out to be 13.98 million.

Please refer to excel sheet ‘Decision Tree’ for detailed calculations. Following observations can be made from the decision tree:

-

Positive NPV (13.98 million) suggests that Merck should go for the licensing of the drug as the project will add positive value to the company.

-

Licensing bid value should be less than the Net present value calculated via decision tree.

-

Project is of high risk-high reward type as the probability of failure increases up to 0.7 in phase 3

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.