Get instant access to this case solution for only $19

Midland Energy Resources – Cost of Capital Case Solution

Midland Energy Resources, Inc is an energy company with global operations. It provides a broad range of products and services including oil and gas exploration and production, refining and marketing, and petrochemicals. Janet Mortensen, the senior vice president of project finance, has a responsibility to determine the weighted average cost of capital (WACC) for the overall company as well as its divisions. The cost of capital is not only used in the annual capital budgeting process but also utilized for performance evaluation, share repurchases, and economic value added calculations. Calculating the cost of capital, however, is not easy – many variables have to be critically evaluated when determining the cost of capital.

Following questions are answered in this case study solution

-

Cost of Debt

-

Cost of Equity

-

Cost of Capital

Case Analysis for Midland Energy Resources – Cost of Capital

1. Cost of Debt

The cost of debt is the marginal rate at which the company might be able to borrow additional capital. It is usually calculated as the yield to maturity on the future debt payments – the rate that equates the present value of debt payments to the current market value of debt. In case, the market value of debt cannot be reliably estimated, company’s often use the debt ratings (given by rating agencies) to estimate the cost of debt. The ratings estimates are indeed provided in the case of Midland, but the company prefers to use a more intricate method of calculating debt. In simple terms the method is called the bond yield plus risk premium approach. The riskfree yield on a treasury security is adjusted for a risk premium to arrive at an appropriate cost of debt. The risk premium is usually based on the debt ratings of the company, but Midland calculates it in a more complex way. However, Midland does take debt rating into account when calculating the risk premium and there is no reason to dispute the accuracy of Midland’s calculations.

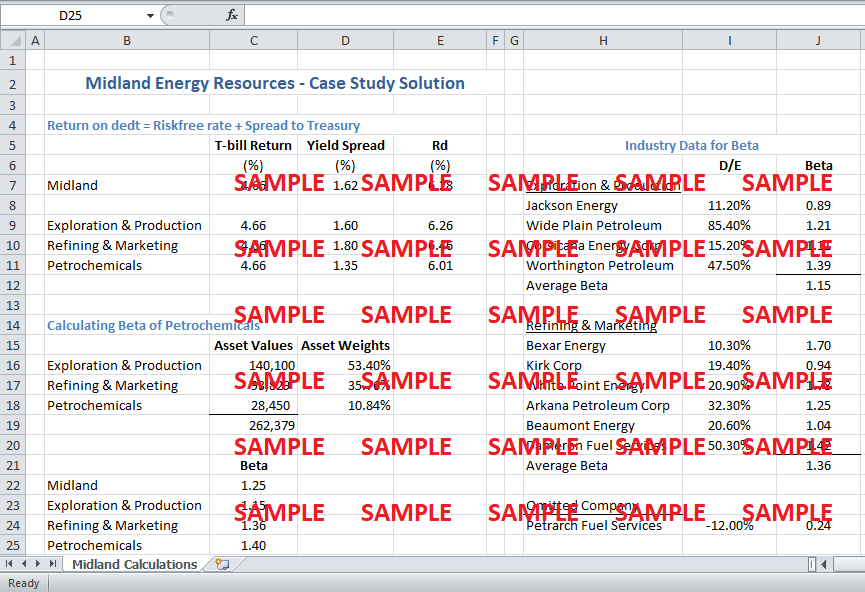

The case study provides US Treasury bond yields for three different time horizons: 1-year, 10-year, and 30-year. The time horizon the relevant Treasury bond yield should match the time horizon for the debt. Since, debt is long-term in nature, the 1-year t-bond yield is not appropriate. 30 years seem to be too long a period and the average debt of the company is not likely to last that long. Therefore, 10-year seems to be a more appropriate time horizon for selecting t-bond yield. Therefore, the 10-year t-bond yield of 4.66% is added to the relevant risk premiums to calculate the cost of debt for Midland as well as each of its operating divisions.

2. Cost of Equity

The calculation of cost of equity is much more subjective and complex than the calculation of cost of debt. Many approaches have been suggested to calculate the cost of equity. One such approach is the Capital Asset Pricing Model (CAPM):

Re = Rf + β x EMRP

In the CAPM equation, Rf stands for the risk-free rate of return, β is a measure of sensitivity of stock with the market (systematic risk), and EMRP represents the equity market risk premium.

• Riskfree Rate

The 10-year US Treasury bond rate is used to represent the riskfree rate. The rationale for using the rate as a proxy for riskfree rate is already presented in the section on cost of debt and it remains the same for cost of equity. Although it can be argued that the 30-year t-bond rate serves as a more conservative measure; and it may be more appropriate as equities have no maturity dates. However, the 10-year t-bond rate has been retained for consistency across calculations.

• Beta

Beta is a measure of the sensitivity of a stock’s returns to market returns. Technically, it is measured as a covariance of stock returns with market returns divided by the variance of stock. However, an alternative approach, as used by Midland, is to calculate beta by looking at outside sources like competitors’ betas and analysts’ reports. Midland calculates has come up with a company beta of 1.25 using outside information and there is no reason to dispute its accuracy. However, the betas for the internal divisions of Midland are hard to calculate. A number of competitor betas for Exploration & Production and Refining & Marketing divisions have been provided. An average of the betas for competitors has been assumed to as the appropriate betas for the respective two division of Midland. However, in the case of Refining & Marketing, the Petrarch Fuel Services has been omitted when calculating the average beta. Petrarch Fuel Services does not appear to be similar to Midland. Apart from its unusual leverage and beta, the company has very low long-term revenue and earnings. It is considered that the company may significantly differ from Midland in terms of size and operations.

A major hurdle arises in estimating the beta for the Petrochemicals division. There are no comparable Petrochemicals firms within the industry. Therefore, the industry average cannot be used to calculate the relevant beta. Similarly, historical data for Midland is not available as stock returns cannot be bifurcated between the different divisions. A possible approach is to distribute the overall beta of Midland among the three divisions, on the basis of weighted asset values. It can be assumed the overall beta of Midland is the asset weighted average of the betas of the individual divisions:

WExploration x βExploration + WRefining x βRefining + WPetrochemicals x βPetrochemicals = WMidland x βMidland

Based on the asset weights for the year end 2006 and the betas obtained from industry data, we find the missing beta for Petrochemicals to be 1.40. The technique of obtaining the beta for the Petrochemicals is not very robust. It is strictly based on the assertion that the asset weighted average betas of each division constitute the overall beta of the company. This may not be a very far-off contention if the betas of other division and the company beta are accurately calculated. However, the fact is that the estimates of the other betas are also speculative in nature. This makes the beta estimate for the Petrochemicals division highly subjective. Nevertheless, it appears to be the only way to calculate the beta with the available to information, and we have no choice but the employ it in the calculations.

• Equity Market Risk Premium

The Equity Market Risk Premium (EMRP) is the risk premium awarded for taking systematic risk. Systematic risk is the risk of the overall market. The premium is usually measured as the difference between market return and riskfree return. In this case study, the US Treasury bond returns have been taken as a measure of riskfree return. However, the riskfree return can be taken to be some other return as well. For instance, the 3-month US treasury bills interest serves as a good measure of the short-term riskfree return. The market return for US can be calculated by using a national level stock index like the S&P500. Although the S&P500 contain only the 500 biggest companies out of thousands of publicly traded US companies, studies on indicate that most of the unsystematic risk can be diversified away with a portfolio of 30 uncorrelated stocks. Therefore, it can be stated that the S&P500 returns will serve as a reliable indicator of market return.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Reliance Baking Soda: Optimizing Promotional Spending Case Solution

- Liston Mechanics Corporation Case Solution

- Starbucks and the Spotlight Effect: Corporate Social Responsibility and Reputation Risk Case Solution

- Rosewood Hotels & Resorts: Branding to Increase Customer Profitability and Lifetime Value Case Solution

- Microsoft- Financial Reporting Strategy Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.