Get instant access to this case solution for only $19

Milagrol LTDA Case Solution

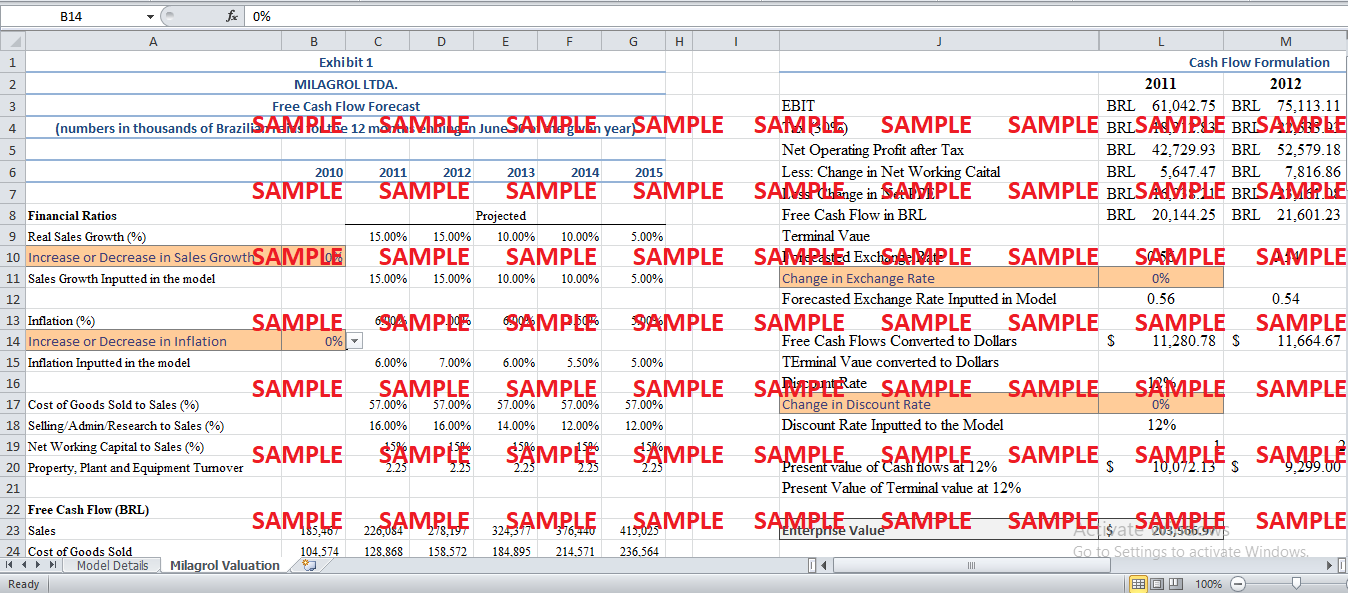

Peterson Valve Company is in the process of acquiring Milagrol Ltda. Keeping in view the scenario; this report contains a detailed evaluation of the four most important questions of the case. Firstly, the operating cash flows are dominated in the Brazilian Real. In order to value a company, these cash flows need to be forecasted in Dollar amounts. Secondly, the selection of an appropriate discount rate for the cash flow analysis is also a matter of concern. Thirdly and most importantly, the determination of a reasonable initial offer price also needs to be answered. At last, the risks of the acquisition also need to be discussed. The analysis shows that the best method to formulate cash flow constitutes the translation of BRL dominated cash flows to Dollar dominate cash flows. This is beneficial from numerous perspectives. Firstly, the adjustments to the given discount rate need not be done. Secondly, the inclusion of several vague, subjective and uncertain quantitative factors can be evaded by translation. The issue of uncertainty in forecasted exchange rate risk is tackled by including sensitivity analysis which shows that even a 10% change in forecasted exchange rates will only alter the enterprise value to $20,000. As far as the discount rate is concerned, the given 12% figure is appropriate and apposite to be used in the discounted cash flow analysis. The sensitivity analysis shows that the discount rate alters the calculated enterprise value to the maximum extent. Hence, to make sure that the discount rate is fair, a recalculation of the provided discount rate should be carried out. As far as the issue of the initial offer is concerned, it is recommended that that outputted value at the given default assumptions ($203,566) should be communicated to Milagrol as the initial bid. The cash flow and sensitivity analysis showed that with a range of assumptions, the maximum deviation in the initial offer can go up to 10%. Hence, if the initial negotiations fail, the maximum value of the offer should not exceed $223,566. The analysis also showed that both the inflation and exchange rate risk are not a huge concern for the company. Even then, Peterson should take precautionary measures. Peterson should at least engage in forward, future or swaps to counter the decrease or increase in the value of cash flows. At the same time, the investment in the Brazilian company will surely tend to diversify the investor base of Peterson. Hence, Peterson should be benefited from the investment. In any scenario, the investment in Milagrol may be subjected to quantitative risks and Peterson should engage in activities that decrease the risk of a substantial decline in either the BRL or Dollar dominated cash flows.

Following questions are answered in this case study solution

-

Executive Summary

-

Analytical Approach

-

Analysis

-

Appendix A

-

Appendix B

-

References

Case Analysis for Milagrol LTDA

2. Analytical Approach

Three distinct questions are presented in the case. Even though all the questions are interlinked as they involve the steps to reach the fair share price, yet they constitute different analytical approaches.

1: The issue of the cash flow translation from Brazilian Real to USA Dollar poses a difficulty. The estimation of a fair terminal value should also be included in the approach. There are two main approaches to valuing cross-border acquisitions. The analyst has to finally obtain a share price in the currency of the acquiring company. For this to happen, the final offer price needs to be in Dollar. Hence, either the cash flows should be translated to Dollars, or all the valuation parameters could be changed to Brazilian Real. When selecting the suitable approach, the factors of certainty, efficient forecasting and information availability need to be considered. Damodaran (2014) states that in the case of cross border acquisitions, the adjusted present value or the APV might be the best method to employ. Also, according to (Damodaran, 2012), the cash flows in a cross-border acquisition can best be tackled by forecasting different relevant parameters and subsequently constituting them into a mathematical model. Conversely, the cash flow, the discount rate and terminal values can be computed in the Brazilian Real. The final value can be discounted back at the spot price to arrive at the Dollar figures.

The application of adjusted present value is almost impossible in the current scenario as the information is limited. On the other hand, the inclusion of Brazilian currency in the valuation also poses some grave issues. Firstly, the incorporation of exchange rate, sovereign risk and other factors make the second approach too complicated and subjective. Moreover, the discount rate and terminal value also correspond to Dollar. As the exchange rate forecasts are already provided. Therefore, the translation of the cash flows in Dollar is easy. Additionally, as the discount rate and EBIT multiples are all taken from Dollar dominated companies, therefore, the second approach best suits the criteria.

2: The second question incorporates the problem of a suitable discount rate. As stated in the case, the discount rate can be applied in two manners. Firstly, the discount rate can be applied as it is, provided that the cash flows are in the relevant currency. Secondly, the discount rate can be adjusted to include additional risks. This adjusted discount rate is only used when the cash flow analysis is carried out in foreign (Brazilian Real) currency. In the current scenario, the first analytical approach shortlists Dollar dominated cash flows. Hence, there is no need to adjust the given discount rate. This given rate (12%) is well suited for the cash flow discounting.

3: The third question relates to the valuation of the Milagrol. For the purpose of valuations, several techniques can be applied. The value of a firm can be calculated by applying the relative multiple valuations (Yoo, 2006). It can also be calculated by employing discounted cash flow method (Brien & J, 2003). Moreover, the dividend discount model is also a candidate for the valuation of Milagrol (Foerster & Sapp., 2006). However, in the current scenario, the selection of the valuation approach is constrained by the amount of available information. The provided facts and figures emphasize that, in order to arrive at the enterprise value, only the discounted cash flow model can be applied. All other approaches are, therefore, irrelevant. However, the cash flow analysis incorporates some assumptions. For this purpose, rather than a fixed initial price, a range of relevant prices should be given. This can only be done when the assumptions are varied. For this purpose, sensitivity analysis is the best approach.

4: The exact measurement of the risk belongs to the quantitative regime of analysis. However, in the current scenario, the question regarding the risk includes both the quantitative and qualitative aspects. In the quantitative aspects, special attention is given to inflation rate risk and exchange rate risk. On the qualitative aspect, the sovereign risk and the geographical risks are taken into account.

3. Analysis

1. Formulation of Cash flows

-

The forecasted exchange rates are already provided with the case.

-

The spot exchange rate is $/BRL 0.549. This implies that Dollar has a relative high value as 1 USD is equal to 1.78 Brazilian Real.

-

The movement of the exchange rate is depicted in the following graph.

Figure 1: Forecasted Exchange Rate for USD/BRL

-

The forecasted exchange rate shows that Brazilian Real will continue to depreciate relative to USD.

-

The Real dominated cash flows and the terminal value (2015 EBDIT*5) are simply multiplied with the exchange rate in order to arrive at the Dollar dominated cash flows.

-

The following figure portrays the graphical representation of these cash flows.

-

Appendix A contains the detailed model which is being formulated for cash flow analysis.

Figure 2: Translation of Free cash Flow in Dollars

2. Discount Rate

-

It has already been discussed that the most suitable discount rate is the one already provided in the case.

-

As all the cash flows are dominated in Dollars, therefore, the given 12% discount rate is appropriate.

3. Valuation of Milagro

-

Under the default assumptions (given discount rate, inflation rate, sales growth rate and the forecasted exchange rates), the enterprise value of Milagrol comes out to $203,566.

-

However, the value changes as the assumptions or inputs are changed.

-

Appendix B contains a detailed sensitivity analysis and takes into account the variation in enterprise value given a range of deviations in the inputs.

-

The following four figure show a graphical representation of the analyses.

Figure 3: Inflation Rate Sensitivity Analysis

Figure 4: Sales Growth Sensitivity Analysis

Figure 5: Exchange Rate Sensitivity Analysis

Figure 6: Discount Rate Sensitivity Analysis

-

As shown in the analysis, the largest change in the enterprise value is caused by the discount rate.

-

The maximum deviation in the exchange rate can extend up to 10% of the initial or default enterprise value.

-

This shows that Peterson should not bid any higher than $223,566. This is the maximum amount that Peterson can offer.

-

The risk posed by the exchange rate and inflation should be countered by relevant financial techniques.

4. Analysis of Risks

-

Figures 3-6 depict the graphical representation of the range of values for the EV of Milagro.

-

Figures show that even though the interest rate risk and exchange rate risks bear a small magnitude in comparison to the discount rate changes, yet they are substantial enough to point out that both these factors are crucial for Milagro.

-

Brazil’s political situation is fairly stable and its economy is also strengthening.

-

Also, the inclusion of a South American country in the portfolio of Peterson (a US-based company) will tend to diversify the overall risk of the firm.

-

Brazilian economy is also growing at a fast pace and the standard sales growth percentage can also increase (Lopez & Cascione, 2011).

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.