Get instant access to this case solution for only $19

Mountainarious Sporting Co. Case Solution

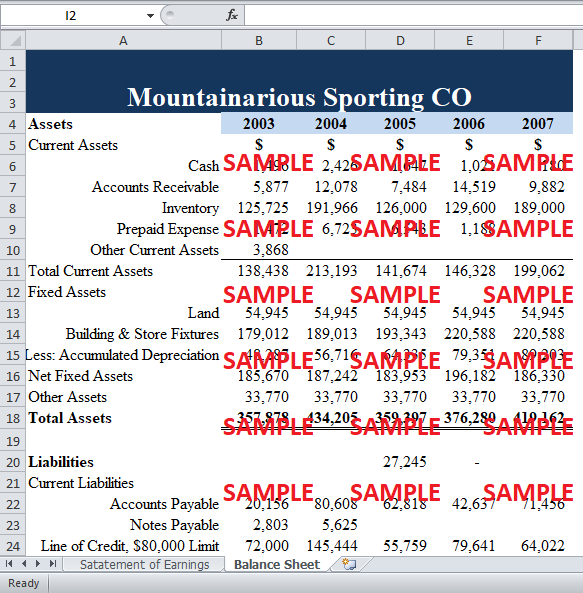

Steve Donnie, the founder of Mountainarious Sporting Co is planning to sell premium brands which requires expansion of the outlet. Donnie needs $150,000 to finance the expansion. Donnie has applied for the line of credit at Canadian Commercial Bank and the account manager Brad Macdougal his currently reviewing the financial statements of the business. The expansion of the apparel line is expected to increase the earnings but at the same time the finance cost will also increase. Macdougal has decided to finance the expansion project and extend the working capital financing.

Following questions are answered in this case study solution

-

Decision needs to be made

-

Background

-

Analysis

-

Decision & Plan of Action

Case Analysis for Mountainarious Sporting Co.

2. Background

Steve Donnie, is wrestling a strategic question to expand his Sports goods store and introducing premium brand names soft goods line of outdoor sport footwear and apparel. By tapping this opportunity, Steve thinks he will be able to derive the profitability upwards and would result in sales growth of 15% in 2008 and 30% in 2009. But for this to happen, Steve had to vacate the tenant and terminate the lease. This will result in a loss of rental payments. The new apparel line would require a different strategy. If the expansion goes profitable, Donny might consider to sell his interest in the business in order to reduce the risk.

3. Analysis

• Alternatives

Donnie had two alternatives to finance the construction of Deviltech Outfitters and further extension of the working capital requirement.

-

Donnie could sell his stake to some investor and used to proceeds to finance the expansion. This would enable Donnie to mitigate the risk of success of the new apparel line. At the same time, sharing equity will reduce Donnie’s income and profit.

-

The second alternative is to get loan from the bank. For this Donnie have already applied for the financing in Macdougal’s bank. Although doing this would increase the financial leverage of the store.

• Criteria

The criteria to evaluate the feasibility of the new store would depend upon the sales that the expansion would derive. For this some key ratios are to be analyzed such as net income growth and interest coverage ratio. Moreover, some qualitative aspects are also considered. For instance, Donnie is planning to appoint his wife as supervisor of the store who has no previous experience of sports retail business. All these things have to be evaluated by Mcdougal in order to process the loan or to buy the equity in the venture.

• Quantitative Analysis

As Donnie forecasted that the sale of soft goods will increase the sales by 15% which would result the sales figure to be $832,912 in 2008. The sales in 2009 would be increased by 30% and the sales would come out to be $1,082,785. The sales have improved significantly in 2009 resulting in an improved net income of $56,706. The % of the expenses are assumed to be the same as they were in 2007. For example, in 2007 the wages & benefits are 16% of the sales. In 2008 & 2009 the same % was applied to calculate the wages & benefits.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.