Get instant access to this case solution for only $19

Ocean Carriers Case Solution

Ocean Carriers is a shipping company with offices in New York and Hong Kong. The Vice President of Finance of Ocean Carriers, Mary Linn, is evaluating a capital budgeting decision based on a proposed lease of a ship by an interested charterer, for three years. None of the ships in the current fleet of Ocean Carriers meets the required size specifications. Therefore, Ocean Carriers would need to purchase new capesize carrier in order to take this contract.

This report performs a detailed discounted cash flow analysis to determine the viability of the purchase of new capesize carrier for the proposed lease. The next section lists major assumptions, calculations involved and analysis based on the calculations performed.

Following questions are answered in this case study solution

-

Introduction

-

Discounted Cash Flow Analysis

-

Recommendations

Case Analysis for Ocean Carriers

2. Discounted Cash Flow Analysis

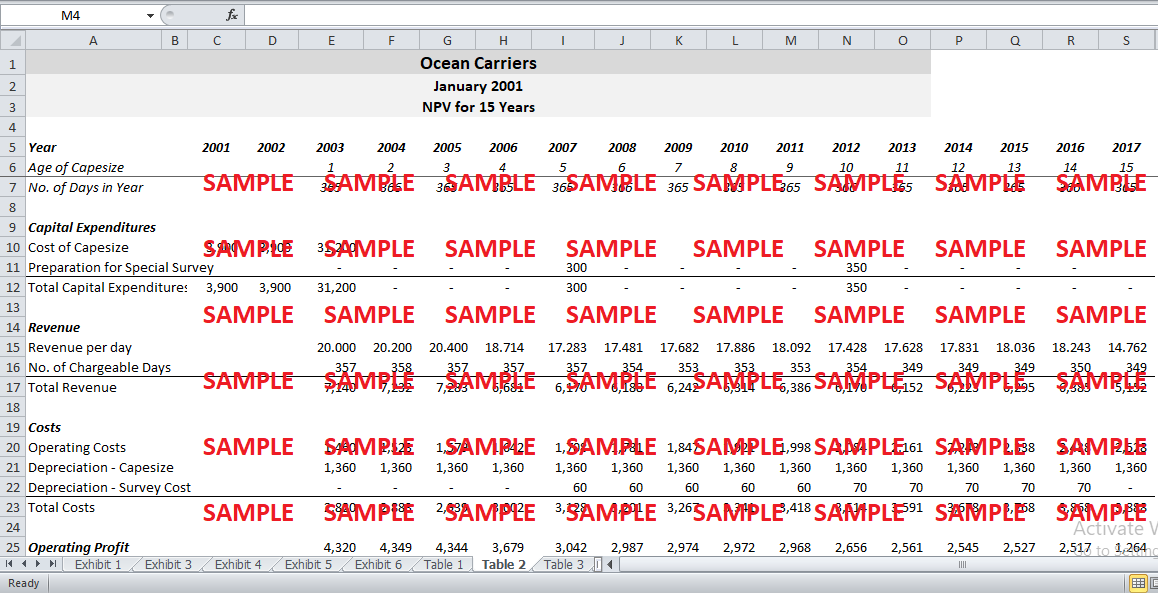

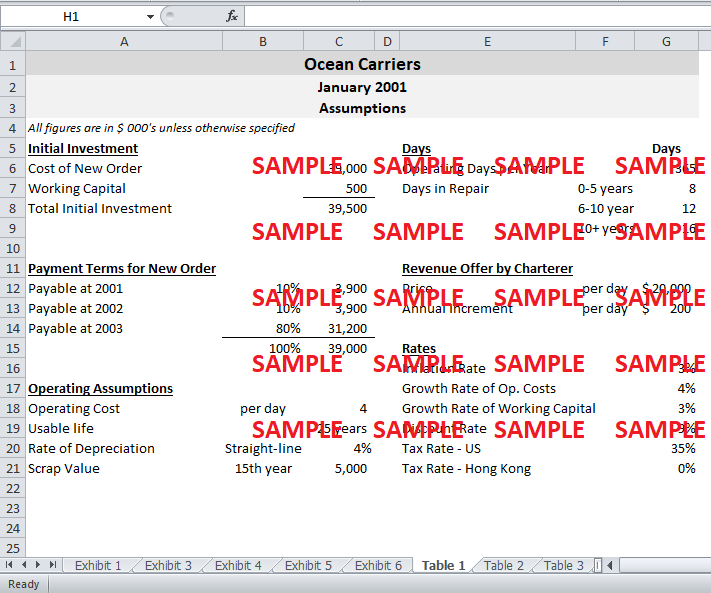

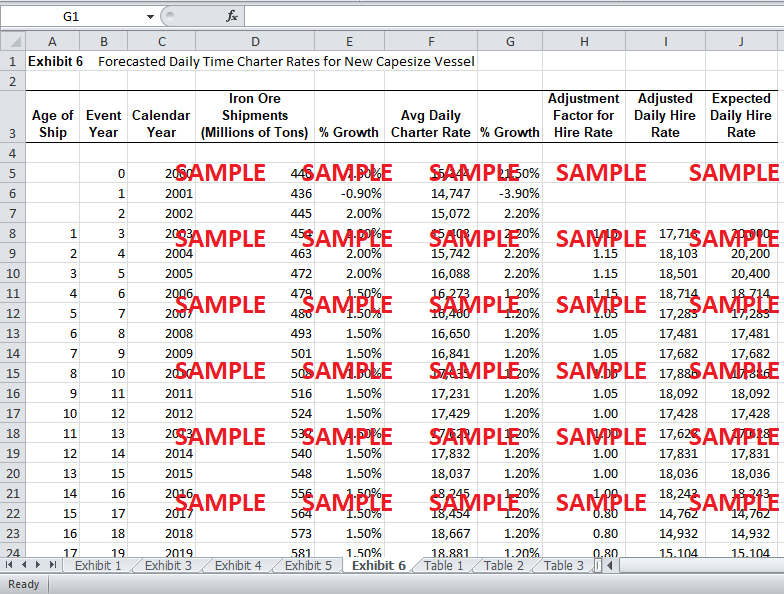

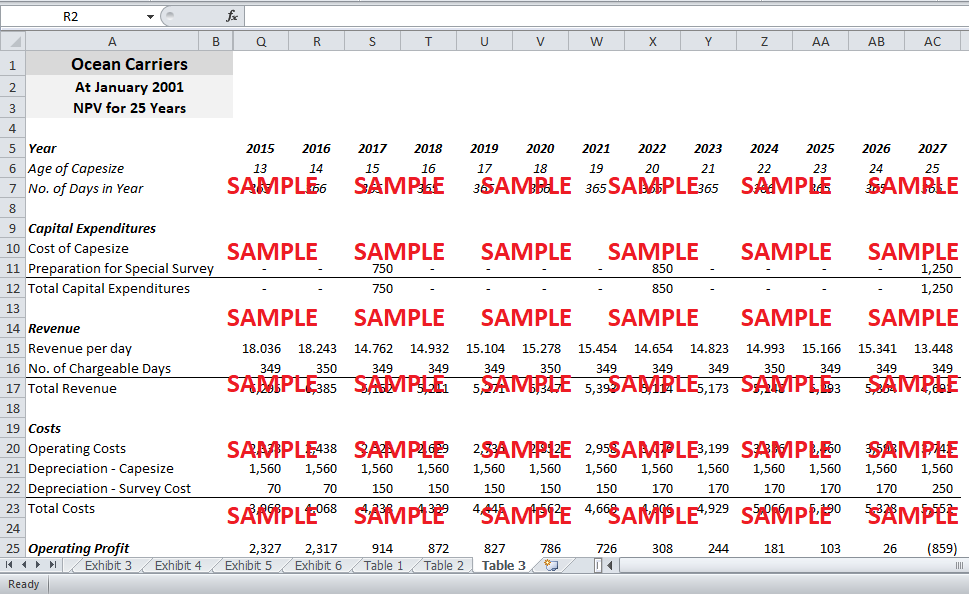

Since the interested charterer offers to pay $ 20,000 per day for the first year and increase the daily rate by $ 200 per day, these rates have been assumed as the daily rates for the first three years of operations starting from January 2003. For the years following that, spot daily rates have been assumed to be the average daily rate for calculating the revenue. Furthermore, the chargeable number of days in a year have been calculated by subtracting the number of days in repair and maintenance from the total no. of days in that year. Finally, total revenue has been calculated by simply multiplying the average daily rate as mentioned above with the number of chargeable days for the respective year.

Operating costs have been taken as $ 4,000 per day for 2003. The per-day operating costs grow at a rate 1% above the expected inflation rate. The expected inflation rate is 3%. Hence, the growth rate of operating costs per day is 4%. Lastly, the total operating costs for a year has been obtained by multiplying the no. of days of that year with the operating cost per day of $ 4,000 with the appropriate growth factor.

The total cost of procurement of the new capesize carrier is $ 39 million. The order for the carrier has to be placed two years in advance which is right now. The payment of the order will be made in three parts. 10% will be paid in the 2001 and 2002 while the rest of 80% will be paid at the time of delivery, i.e. 2003. In addition, another component of the initial investment is working capital of $ 500,000. The working capital requirements will increase annually at the inflation rate and hence, the difference would need to be financed.

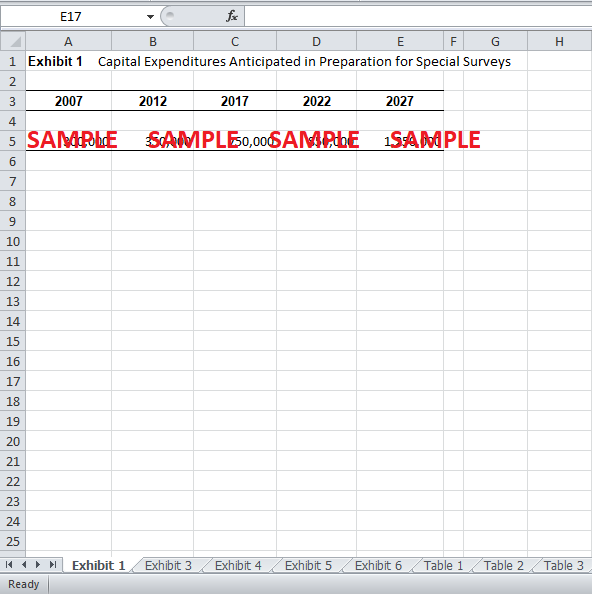

Another important capital expenditure is the cost incurred for the preparation of special survey. The international regulations necessitate a special survey to ensure the seaworthiness of the carriers every five years. The cost incurred before each survey is capitalized and depreciated over a period of 5 years. Moreover, the capesize carrier is depreciated on a straight-line basis over a period 25 years. Finally, the scrap value of the capesize is $ 5 million at the end of 15th year while $ 0 at the end of 25th years.

Although Ocean Carriers as offices in both United States and Hong Kong, the case does not make it clear as to which country’s tax laws are applicable on the company. In order to account for the uncertainty, NPV calculations have been performed for both scenarios. If Ocean Carriers were based in United States, the corporate tax rate of 35% would be applicable on the company. However, if Ocean Carriers were based in Hong Kong, no taxes, i.e. tax rate of 0% would be applicable on the company. Last but not the least, the case does not provide enough information about the discount rate or hurdle rate for the company. Hence a fixed discount rate of 9% has been assumed for analysis. See Appendix 1 for reference to the above mentioned assumptions.

It is now time to move on to the results of the discounted cash flow analysis. Since the company has a policy of not using carriers that are older than 15 years or age, it has been assumed that the new capesize will be disposed of at the end of 15th year of its age, i.e. 2017. As a consequence, the company would not have to bear the cost of $ 850,000 for third Special Survey.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.