Get instant access to this case solution for only $19

Nuvo Research Inc Case Solution

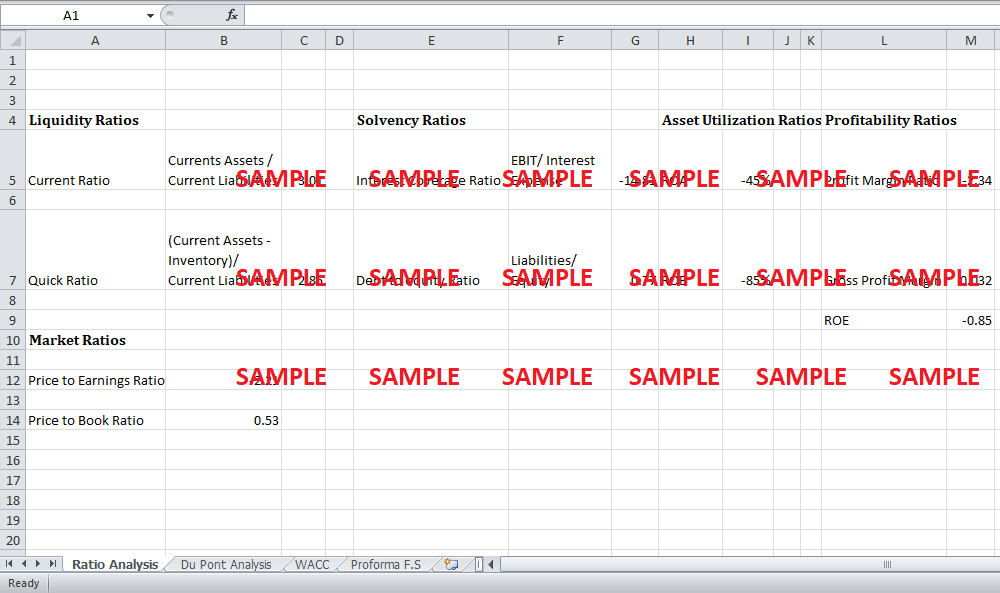

The most common and the appropriate measures of the liquidity position of a company are given by the Current Ratio and Quick Ratio. Using the balance sheet data of the company for the year 2013, the current ratio and quick ratio for the company is as follows:

Current Ratio = Current Assets / Current Liabilities = 3.01

Quick Ratio = (Current Assets – Inventory) / Current Liabilities = 2.85

Rule of thumb concerning these liquidity ratios is that a company with a current and quick ratio value of greater than 1 is considered to have a strong liquidity position. The current ratio value of 3.01 and a quick ratio of the value of 2.85 shows that the company has a very strong liquidity position and it is capable of meeting the short term liabilities.

The long term solvency position of the company can be quantified by measuring the debt to equity ratio of the company. Calculations show that the debt to equity ratio for the company remained around 0.77, which means that equity value for the company is higher than the total liabilities of the company. Thus, the long term solvency position of the company is also normal, and its leverage position of the company cannot be termed as alarming. Return on assets and return on the equity for the company remained -45% and -85% respectively and hence, the operational performance of the company remained very poor, especially because the company showed a huge loss last year too. The market ratios for the company show that the perception of the company in the market is very bad and due to consistent bad performance; the share price of the company has declined significantly. The price to earnings ratio of the company had a negative value of 2.14 for the year 2013 while the price to book ratio remained 0.55. Both of these ratios show that the stock price of the company is expected to decrease further owing to the dismal operational performance.

Following questions are answered in this case study solution:

-

Calculate:-

-

Calculate and interpret selected liquidity, long-term solvency, asset-utilization, short-term solvency, overall profitability, and market ratios in the unique context of NUVO RESEARCH.

-

You will conduct a DuPont analysis to identify the circumstances affecting the company’s operating performance

-

You include a discussion and a graph of the financial analysis or comparison of the NUVO share price on the stock exchange index. What are analysts advising investors to do in the market?

-

You will produce proforma financial statements under several scenarios, estimate cash flows, internal growth, and sustainable growth rate

-

Document and explain the most recent securities issue in the context of NRI’s operating performance and market valuation. If possible, you will discuss the firms’ IPO. You will interpret your findings in light of current securities regulation and market conditions.

-

Document and explain the financing choices used by the corporation in light of its operating performance and market conditions. You will attempt an estimation of the cost of equity, cost of debt and the average cost of capital.

Case Study Questions Answers

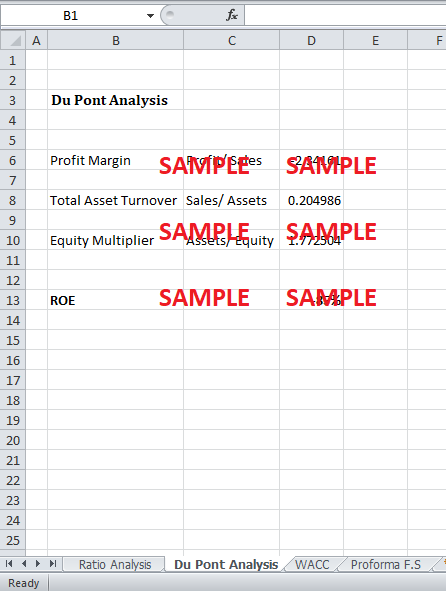

You will conduct a DuPont analysis to identify the circumstances affecting the company’s operating performance

DuPont Analysis tells us that the return on equity of a company is affected by three things; operational efficiency measured by the profit margin; assets use efficiency which is measured by total asset turnover, and financial leverage, which is measured by the Equity Multiplier.

Mathematically, the DuPont Analysis can be expressed as follows:

ROE = Profit Margin (Profit / Sales) * Total Asset Turnover (Sales / Assets) * Equity Multiplier (Assets / Equity).

Based on the calculations carried out in the excel sheet, the DuPont Analysis of the company shows that these three ratios give rise to return on the equity value of approximately -85%.

ROE = -0.85 = -2.34 * 0.204 * 1.77.

The operational efficiency of the company signified by the total assets turnover is negative because the company has a huge loss in the financial year 2013. Thus, the operational efficiency of the company remained very poor during the financial year owing to huge net loss. On the other hand, the assets turnover for the company remained around 20%, which is a quite stable figure considering the profitability status of the company. The equity multiplier of the company is also very healthy and hence, the DuPont analysis has identified the poor operational performance of the company to be the reason behind the negative return on the equity value of the company.

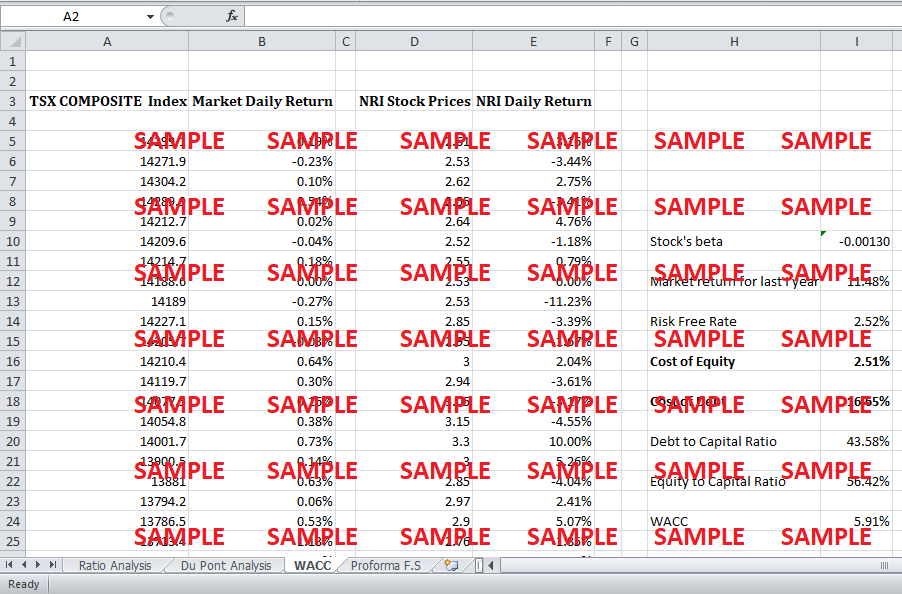

You include a discussion and a graph of the financial analysis or comparison of the NUVO share price on the stock exchange index. What are analysts advising investors to do in the market?

The following two graphs show the daily market return data for the market and the NRI Corporation for the last two years. The graph shows that the daily return on the shares of the company was very volatile as compared to the market and this pattern is expected to go on in the future due to the dismal operating performance of the company and the company and the bad reputation in the market. Under these circumstances, analysts are advising the shareholders to hold the stock until the earnings of the company start to normalize.

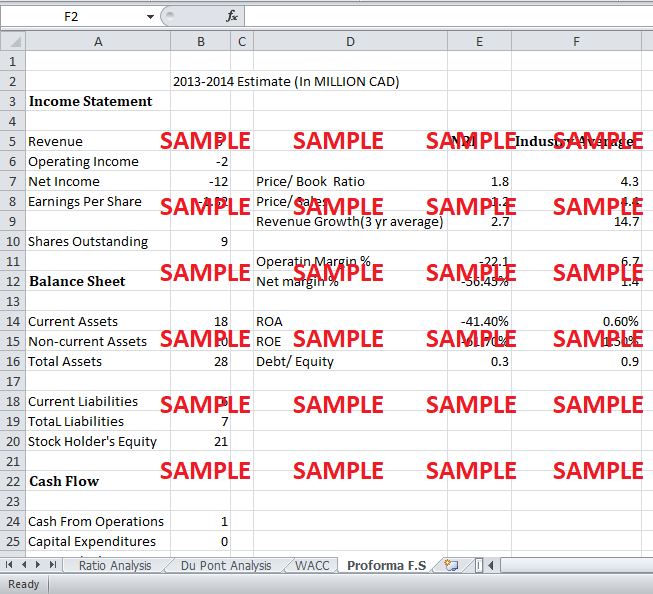

You will produce proforma financial statements under several scenarios, estimate cash flows, internal growth, and sustainable growth rate.

In the next financial year, the operational performance of the company is expected to show the loss; however, the loss is expected to decrease a little bit due to which stock price will remain stable. The company is expected to continue the historic revenue growth rate of 10.50%; however, due to huge expenses; the company is still expected to remain in loss after a year.

Document and explain the most recent securities issue in the context of NRI’s operating performance and market valuation.

A comparison of the key balance sheet and income statement performance indicators between industry and the company shows that the company is performing far below the other competitors and any security issue at this point in time will fail. The Price to book ratio of 0.55 shows the stock price is less than the book value due to consistent poor operational performance. However, successful launch of products like PENNSAID 2% can boost the sales of the company in the long run, but in the short run, the stock price is expected to remain stable at best.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.