Get instant access to this case solution for only $19

Old Mule Farms Case Solution

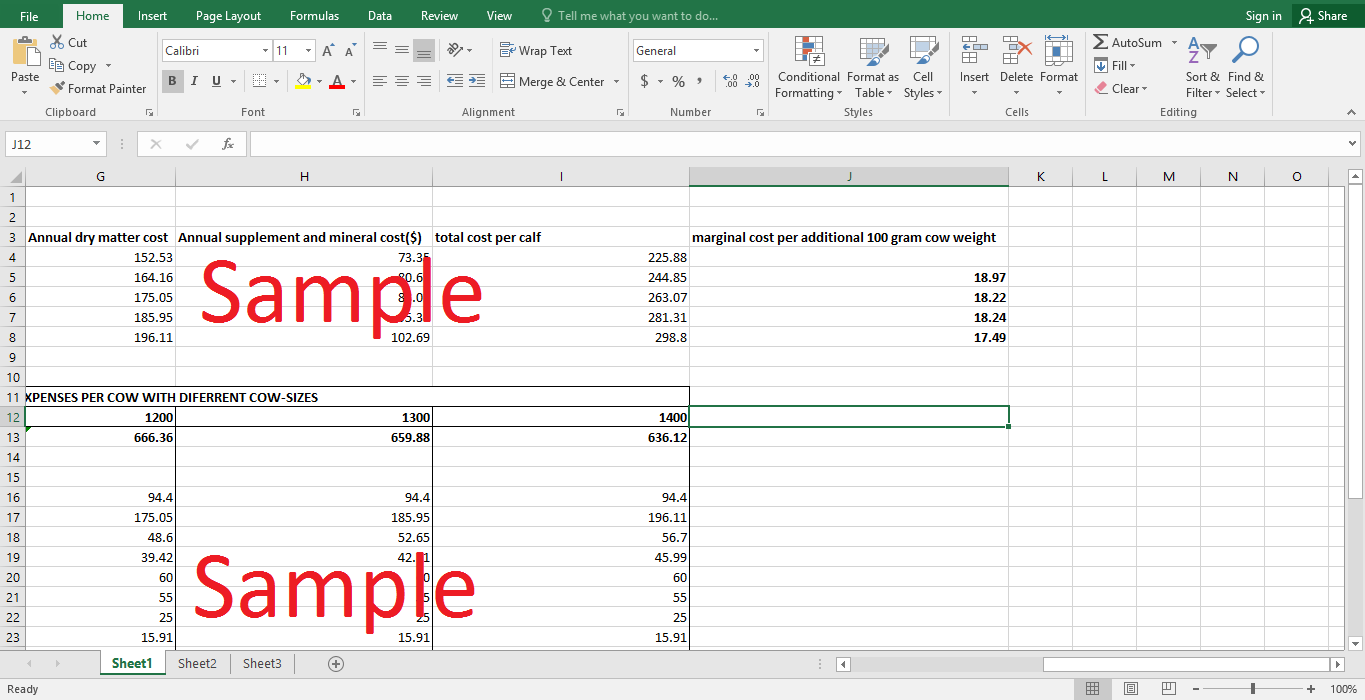

The company Old Mule Farms case study is a cow-calf operation that provides calves for feedlots to fatten up. The results change when the marginal analysis is used to infer appropriate calf size. The calculations show that the average cow weight of 1100 pounds maximizes the profit. Additional 100 pounds increase in cow size increase marginal revenue by $6.48, which is less than the increase in marginal cost of $18.22.(Table 1) Therefore, the average cow size different than 1100 will result in diminishing profits.

Following questions are answered in this case study solution:

-

What is the appropriate cow size for the herd using the 50% weaning rule? Compare the value of a calf to the cost of maintaining the cow as an alternative means of determining appropriate cow size.

-

Which method (50% weaning rule or marginal analysis) do you think provides the best measure?

-

What are the drivers in a cow-calf operation? Is the revenue-expense calculation (see Exhibit 2) clear regarding drivers? Why or why not?

-

How would you change the detailed statement of revenues and costs so that it provides information that would help Green make her decision?

-

To what extent is the Greens’ confusion a result of the failure of the accounting system?

-

How would the results of Old Mule Farms’ operations change if revenues or expenses were allocated in a different manner?

Case Study Questions Answers

2. Which method (50% weaning rule or marginal analysis) do you think provides the best measure?

Marginal analysis is the best measure because it is based on cost-benefit analysis. It is a more scientific method in the sense that it provides the average cow size at which profits are maximized. Any deviation from the prescribed size will hit profit optimality. On the other hand, 50% weaning rule is comparatively arbitrary and is not based on any concrete measure of profits.

3. What are the drivers in a cow-calf operation? Is the revenue-expense calculation (see Exhibit 2) clear regarding drivers? Why or why not?

Derivers are defined as forces or factors that determine the revenue and cost of any operation. The drivers for the cow-calf operation can be variables like a number of cows and the size of the cow. Exhibit 2 uses the number of cows as a driver of the cow-calf operation. Hence, every cost has been selected on the basis of this driver. It may not be a wise decision to use only the number of cows for revenue-expense calculation as it wholly discards the cow-size considerations that are highly crucial for determining profits for the firm.

4. How would you change the detailed statement of revenues and costs so that it provides information that would help Green make her decision?

The detailed statement of revenues can be calculated for each of the different average cow-sizes ranging from 1000 to 1400 pounds. On the basis of these statements, it can be seen how different cow sizes change net revenue per cow per year for the farm. It is possible that only a change in cow size will improve profitability without altering other cost and efficiency measures such as better health and environmental measures for the herd.

5. To what extent is the Greens' confusion a result of the failure of the accounting system?

It would be unfair to assume that the confusion is arising entirely due to the accounting system. Rather, the method used is deficient in the sense that it failed to incorporate one salient driver, average cow-size, into accounting calculations. Cow size is crucial because there are some measures of operation such as revenue per calf, forage, and mineral and supplements expenditure that are determined by cow size. Other considerations may have improved efficiency but failed to address one of the major reasons, cow-size, that is determining revenue per cow per year.

6. How would the results of Old Mule Farms' operations change if revenues or expenses were allocated in a different manner?

As shown earlier, the cow size of 1100 pounds is the most efficient. It can be seen that mere shifting the herd from the variety of cow sizes to only average 1100 pounds will result in a decrease in losses by (-45.51- (-75.51) =) $27 per cow per year. (Table 2) However, the firm is still suffering a loss of $45.51 per cow per year. It is necessary to look for other cost cut options continuously to improve the expenses numbers. The market prices of a calf are also low at $108 compared to the price of $133 in 2005 that result in low revenue per cow. Thus, it can be inferred that though cow size is a vital source to improve income figures the external and internal factors such as price are such that other improvements are also inevitable for the profitability of the firm.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.