Get instant access to this case solution for only $19

Pacific Grove Spice Company Case Solution

Pacific Groove Spice Company is a company that sells a selection of food, spices, teas and coffees. Due to ever increasing awareness regarding diet and flavour in public, the company has experienced tremendous growth and is in constant need of funds. Debra Peterson, the CEO of the company, is evaluating different options to raise the funds required to invest in accounts receivable, inventory and fixed assets. Need for funds became more critical when the chief supplier of funds to the company, the Bank, asked the company to decrease the debt to asset ratio so that it remains less than 55 % by the next year to continue availing the loan from the bank. Raising funds through equity issuance is an option but since the transaction costs associated with a small scale arrangement have reduced the sale price to $ 27.50 as compared to market price of $ 32.50, this option may not be ideal. But the need for funds is so crucial at this stage of business that such costs can be ignored. Company is also considering producing a TV cooking show. Feasibility analysis of this project has very convincing reasons to approve the project i.e. IRR is 41 %. Another source of finance and business expansion for the company is the acquisition of a business of comparable size. Debra is very seriously considering acquiring “High Country Seasonings” but she has to establish that the purchase price offered is reasonable. The CEO is evaluating different options that can help the company to maximize the shareholder’s wealth.

Following questions are answered in this case study solution:

-

Should Pacific accept an offer from a cable cooking network to produce and sponsor a new program?

-

Should Pacific acquire High Country Seasonings----a privately owned spice company with sales revenue approximately 22% of Pacific’s?

-

Should Pacific raise new equity Capital by selling shares of common stock?

Pacific Grove Spice Company Case Analysis

1. Should Pacific accept an offer from a cable cooking network to produce and sponsor a new program?

Yes, the company should accept the offer because this project is extremely beneficial for the company and among different alternatives; this project has the highest IRR i.e.41 %. The payback period of the initial investment is less than two years. Not only is the project beneficial for the company financially, it also helps to create synergy by boosting the company’s own sales. From a marketing point of view, this is a great opportunity for the company to strengthen the brand name of the company. Debra Peterson realizes the importance of this project and it is very unlikely that the company does not pursue this project. The scenario analysis shows that even if sales projections are 75 % true, even then the project is adding a lot of value to the company. The upfront capital required for the project can be easily obtained through common stock issuance. As far as investment in working capital is concerned, company will have the option to get a loan from Bank because by the end of the financial year 2012, company would have complied with their terms. Until then, raising funds through equity issuance is a good option available for the company.

2. Should Pacific acquire High Country Seasonings----a privately owned spice company with sales revenue approximately 22% of Pacific’s?

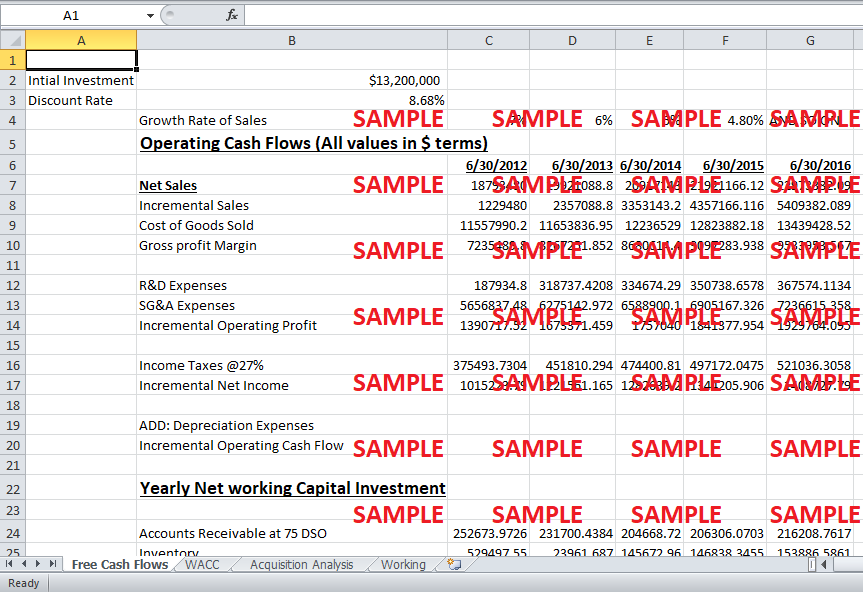

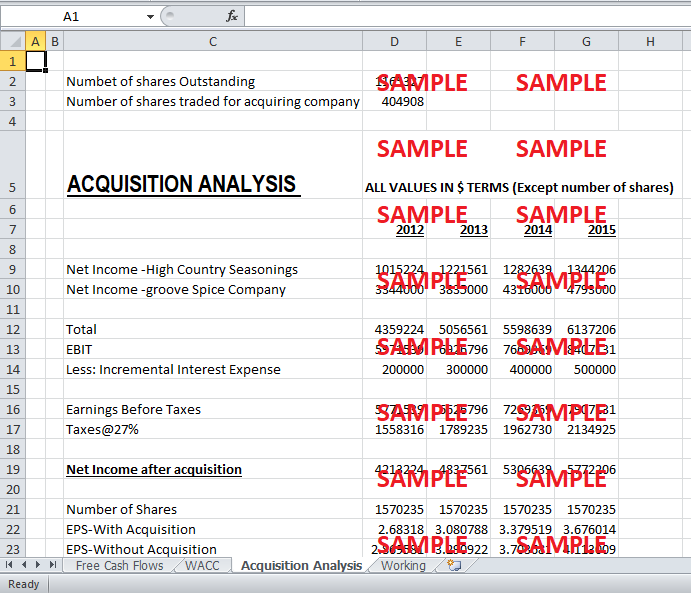

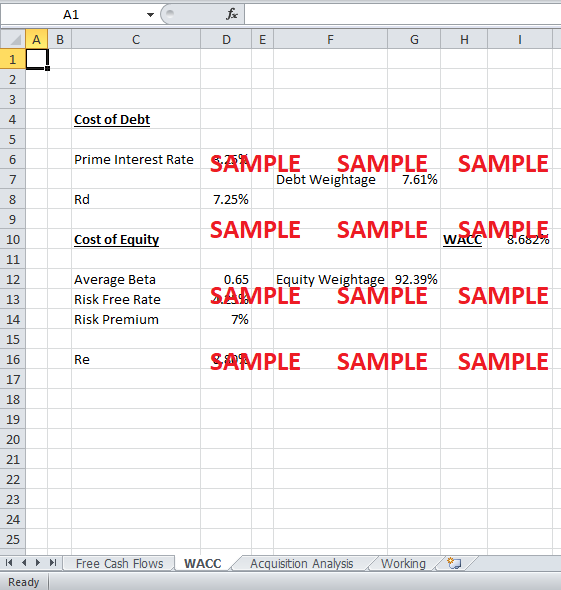

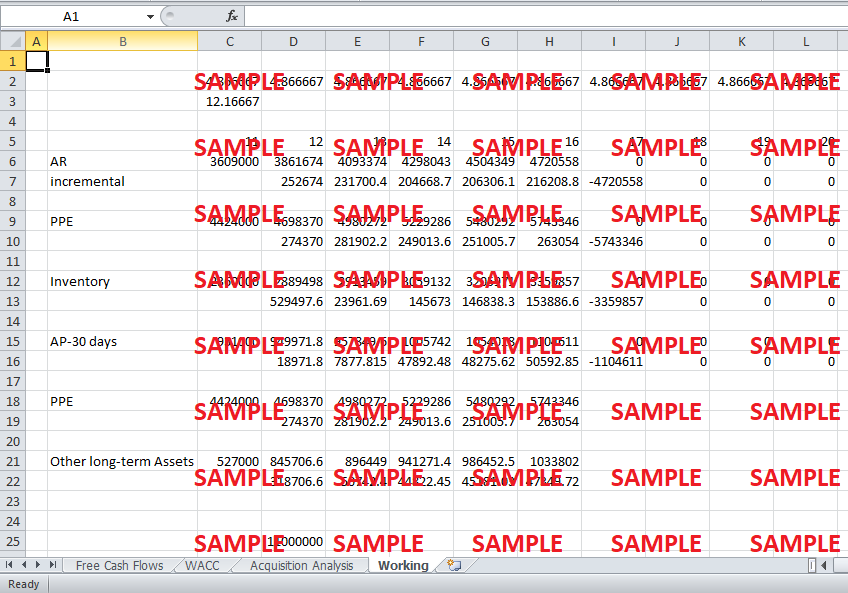

No. Apparently the idea of acquisition seems very convincing, but if we look from a shareholder’s perspective, the company looses in terms of Earning per share. The Atwood sisters are asking for shares worth $ 13,200,000 from Debra in exchange of the acquisition. The number of shares that have to be issued comes out to be 404,908. As shown in excel sheet, the NPV of the project comes out to $ 4,731,596. The WACC used as the discount rate in this analysis is calculated by assigning the weight age of debt to cost of debt and the rest of weight age to Cost of equity. Cost of debt is calculated by adding the prime interest rate of 3.25 % with 4 %. This rate represents the riskiness associated with lending to the company as this rate is charged by banks. Cost of equity is calculated using CAPM where beta comes from the average of betas of companies of comparable businesses and sizes. Long-term Treasury bond rate i.e. 4.25 % is treated as the risk free rate. Hence, cost of equity comes out to be 8.8 % and WACC comes out to 8.682 %. Using the estimates given in the case, Net Operating Income is calculated by finding out the values of Operating revenue and Operating costs. Hence in this way, income statement data is projected for next 4 years.

Similarly, data for increases in net working capital were projected based on the estimates given in the case. Free cash flows can be calculated by subtracting the increases in Net working capital and Capital expenditures from Net operating Income. These cash flows are then discounted at WACC. Although NPV of these cash flows comes out to be a large positive number, acquisition of the company is still not beneficial for the company because of a number of reasons. This large NPV as it is not the value that will be added to the company in case of acquisition by Groove Spice. Groove Spice has to pay the premium above the equity value of High Country Seasons i.e. ($ 13,200,000 - $ 9.724000 = $ 3,476,000). The dilution of shares through share issuance could only be compensated if the shares of the company after acquisition earned at least the same return as before the acquisition.

But, as we can see, the synergy created by the combination of two companies is not enough to cover the costs of acquisition. EPS of groove Spice Company without the acquisition according to financial projections for next 4 years is $ 2.86, $ 3.29, $ 3.7 and $ 4.11 for years 2012 to 2015 respectively. If we include the acquisition scenario, EPS for next four years come out to be $ 2.683, $ 3.08, $ 3.37 and $ 3.67. It can be noticed that the company is better off without the acquisition. As far as raising funds to finance growth is concerned, common stock issuance is a better option as explained below.

3. Should Pacific raise new equity Capital by selling shares of common stock?

The price that the investment group has offered is $ 27.50. This price is net of the transaction charges. If the company raises cash through common stock, then after a year, both of the requirements mentioned by the bank will be fulfilled. The balance sheet of the company for June 30, 2012, assuming the common stock issuance, shows that Equity multiplier is less than 2.7 and debt to total assets ratio is less than 55 %.The Equity Multiplier is the ratio of total assets to total stockholders equity. This ratio comes out to be 2.50. Debt as a percentage of total assets comes out to be 52.37 %. The amount of debt is the sum of Notes payable, current portion of long term loan and Long term loan remaining. As explained in the last question, it is not beneficial for the company to Acquire High Country Seasons. The reduction in the share price due to transaction costs will be more than compensated by investing the money in the business or projects like “cooking show on TV” that have very high rates of returns. So, Equity issue becomes even more important for the company because the company needs funds for new profitable projects. Hence, the company should raise funds by issuing shares of common stock because it is the available option for the company until the Bank’s conditions are fulfilled. Following is the balance sheet projection for year 2012 adjusted by the common stock issue scenario.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.