Get instant access to this case solution for only $19

Pepsico Changchun Joint Venture: Capital Expenditure Analysis Case Solution

There can be multiple difference that can arise if PRC partners do the analysis. The future cash flows might be different in that case. The inflation rate was used differently which would predict the different net income and hence the net cash flows might be significantly different.

Following questions are answered in this case study solution

-

Use the information in the case to construct two sets of NPV and IRR analysis on the proposed Changchun bottling joint venture:one set excluding the concentrate sales, the other set including concentrate sales. Based on your results, what would be your decision on the proposed Changchun joint venture?

-

Comment on the financial projections that Pepsico used in its capital budgeting exercise, especially the NOPBT Cap, foreign exchange rate projection, and the discount rate.

-

What differences might there be as to how the PRC partners do the analysis (or look at the future cash flows) versus Pepsico?

Case Analysis for Pepsico Changchun Joint Venture: Capital Expenditure Analysis

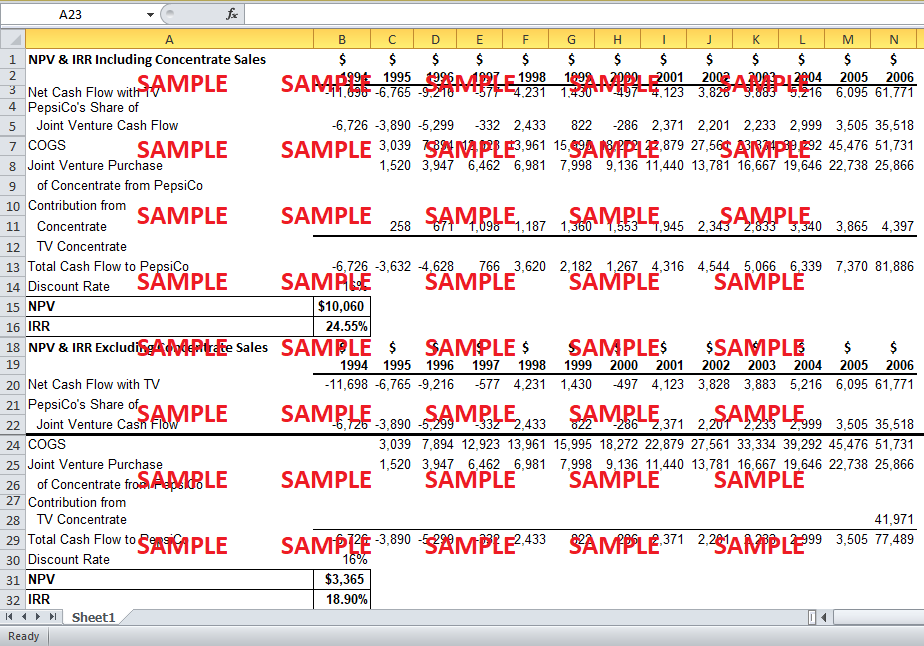

1. Use the information in the case to construct two sets of NPV and IRR analysis on the proposed Changchun bottling joint venture: one set excluding the concentrate sales, the other set including concentrate sales. Based on your results, what would be your decision on the proposed Changchun joint venture?

To calculate the present value of the joint venture, the cash flows to PepsiCo are projected first. Net cash flows are made of net income which comes from the forecasted income statement of Changchun. The depreciation and amortization are added in the net income because they are non-cash charges and must be adjusted in the cash flow. Then the cash flows are adjusted for capital expenditure and working capital changes. After incorporating the terminal value, the net cash flows are obtained for PepsiCo. As shown in Exhibit 1, the net cash flow in 1994 is -$11 Million. The cash flows are negative until 1997 after which the cash flows started to turn positive.

The first part of the Exhibit 1, shows the NPV and IRR calculation which include the sale of concentrate. As PepsiCo is proposing to control 57.5% interest in the joint venture. The total cash flow is multiplied by this percentage to calculate the share of PepsiCo. The weighted average cost of capital used is 16%. The Net present value is determined using this discount rate which comes out to be around $10, Million. The IRR comes out to be 24.55%. As IRR is greater than the discount rate, the value of joint venture will be positive for the company (Harold, 2008).

The second part does not include the contribution from concentrate. The NPV is still positive, and IRR is greater than the discount rate.

2. Comment on the financial projections that Pepsico used in its capital budgeting exercise, especially the NOPBT Cap, foreign exchange rate projection, and the discount rate.

The company has projected the Renminbi to depreciate as compared to US Dollar. This depreciation will cause the inflation to increase in Changchun as depreciation means currency will buy less foreign exchange units. The inflation has caused the prices to skyrocket in the coming years. Moreover, the company has used a pessimistic approach while projecting the cash flows. PepsiCo has been able to put a cap on the Net Operating Profit before Tax (NOPBT). The company has put 11% as the maximum margin that the company could have earned on sales. As the part of this strategy, whenever the projection will produce margins which are more than 11%, the NOPBT cap will trigger and will bring down the margins. The idea is to use a conservative approach and be prudent.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Lonestar Graphite Case Solution

- Dollar Thrifty Automotive Group: Online Discounting Case Solution

- Sitting Pretty Managing Customer Driven Innovation At Faurecia Car Seating Case Solution

- Sumeru Software Solutions: Creating A Culture Of Serene Dynamism Case Solution

- Introducing iSnack 2.0 The New Vegemite Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.