Get instant access to this case solution for only $19

RadNet Inc Financing An Acquisition Case Solution

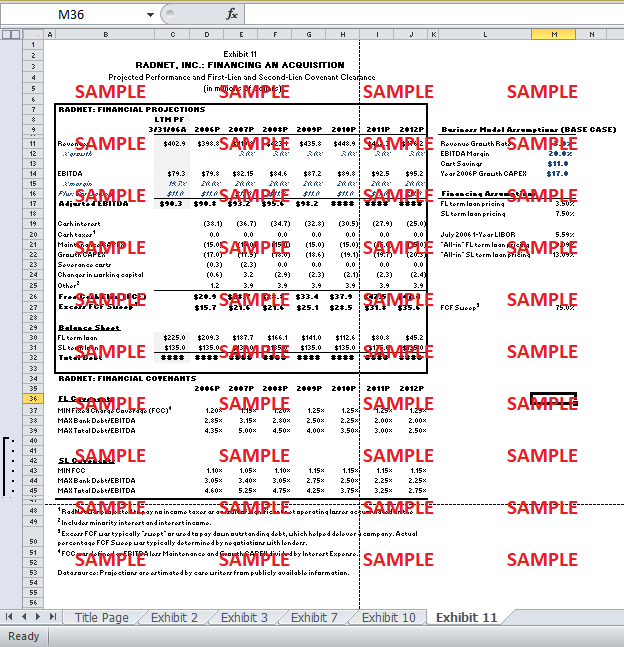

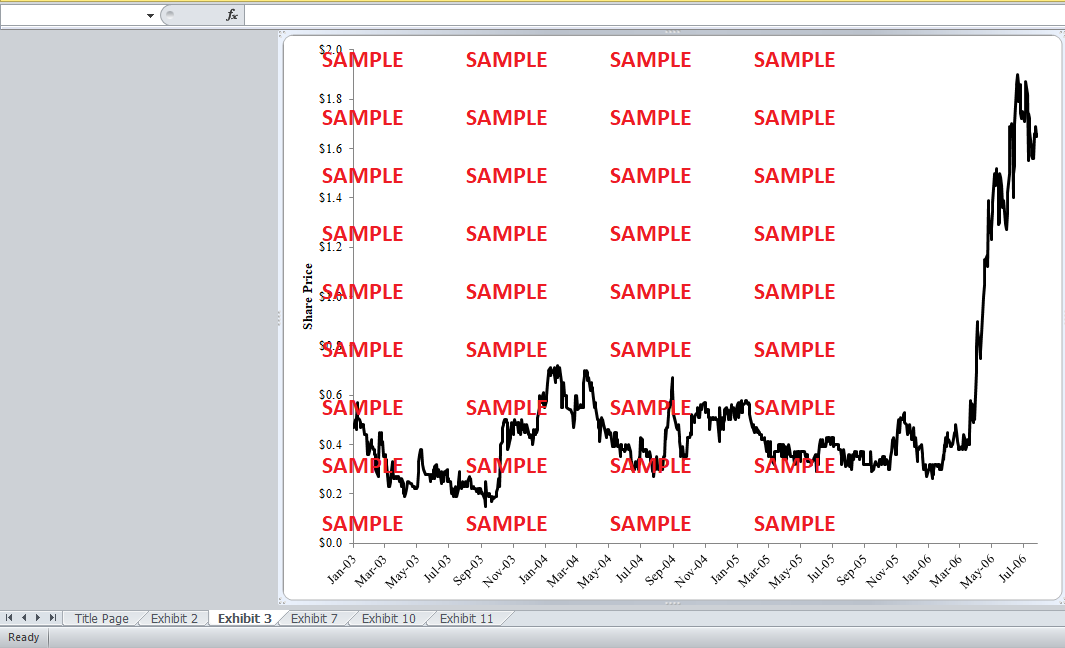

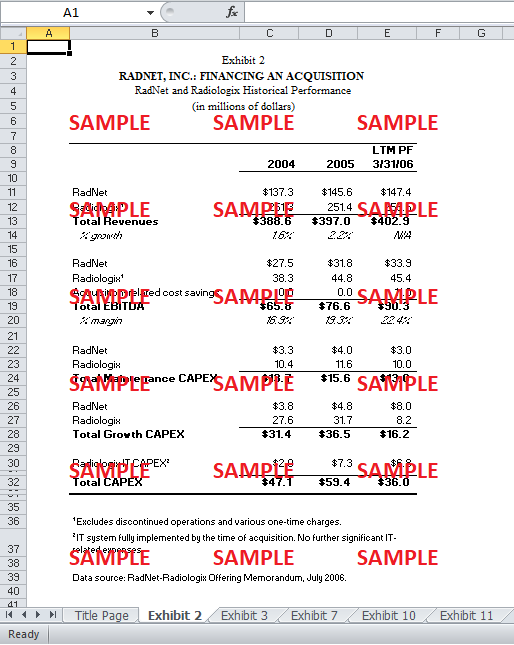

RadNet wanted to acquire Radiologix in 2006 for which, Stopler had to review certain options based on the number of funds it needed. $ 363 million was needed to pursue this choice of acquisition as this would not only help RadNet become the biggest image provider of various diagnosis but also, it will be able to cover a wide area in terms of geography, diversified revenue, high leverage, advanced up to date technology and a management that is well qualified and skilled. Along with these factors, there was a rise in demand for such diagnostic centers because the aging population was increasing rapidly, more physicists were available, greater awareness of preventive measures in the U.S. It was thus, a great move planned by RadNet but, as the company already had huge amount of leverage on its books, it was concerned excessively over the regulatory issues for rate for reimbursement. Investors had already lost confidence in the company as the stock price stated to plummet leaving behind a concern for the public.

Following questions are answered in this case study solution

-

Financing Option Chosen

Case Analysis for RadNet Inc Financing An Acquisition

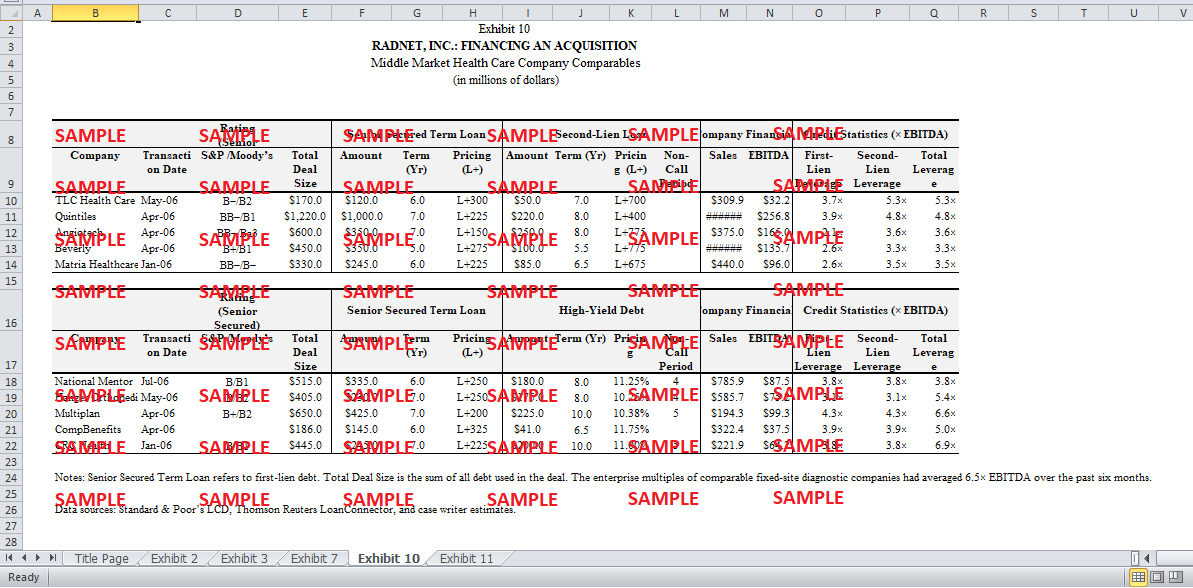

The CFO had to choose from two options to see and analyze which way was the best for raising debt as the company had already decided upon favoring more of debt rather than raise equity. The table below provides a comparison of the two tranches/ choices from which, a recommendation would further be made.

|

First Tranche: Senior debt |

Second Tranche: Public versus private debt |

|

First lien holders are paid first after the liquidation takes place |

Raise HY bonds in the public market (most liquidity and best price) |

|

Low interest cost |

Use private debt in the form of Second lien debt – GE Capital (spreads from 400 bps to 800 bps) |

|

Cutoff point for 6 months was 2.1* to 4.3* EBITDA with spreads from 150 bps to 350 bps |

Must have an established investor because the first time HY bond raise will not attract much attention |

|

GE Capital – underwrite 100% of the senior debt and then syndicate it to other lenders |

If both the FLD and SLD covenants are triggered, however, it would indicate more serious financial difficulty and require negotiations with both the bank and SLD holders, whose interests might diverge. |

|

If syndication failed, the interest rate will increase on the senior debt for compensation |

SLD allowed prepayment before maturity with minimal penalties. On the other hand, HY bonds typically had non-call provisions lasting several years that prevented companies from prepaying early. |

|

|

HY debt had a longer maturity (6 to 12 years) compared with SLD (4 to 7 years). |

|

|

HY debt was a fixed-rate obligation, whereas SLD |

|

|

The business had high operating leverage such that a relatively small decrease in top-line revenues could lead to larger decreases in operating income. GE insisted that 50% of the SLD be hedged with interest-rate swaps. |

Source: Droznik & Chaplinsky (2014)

The first tranche has several benefits such as collateralization of debt against various assets.

-

It helps a bank see how hazardous its credit is.

-

Basins credit hazard into a few classifications permitting speculators to put resources into a pail that best suits their danger unwillingness/hazard return profile.

-

Unmistakably characterizes who gets how much in the case of liquidation.

-

Improves expense of obligation for an organization - the senior obligation is clearly less expensive than junior obligation.

Organizations can thus get better rates by collateralization of "senior obligation" against more secure resources in circumstances where they don't have a "lesser obligation" (Basu, 2012).

For the first option, the interest cost is lower which is helpful for RadNet as they will have to pay a lower amount on the loan they take. Also, 100% of the loan has been underwritten by GE Capital as a guarantor which in the case will help if the other parties involved in the syndication of debt default. Also, the U.S. syndicated credit market was $1 trillion upwards in financing every year to guarantors with a different arrangement of requirements. The calculation can be seen below as it shows that the cost of borrowing will increase if the LIBOR supposed is around 1 % to 1.5%.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.