Get instant access to this case solution for only $19

Smith and Wesson Do You Feel Lucky Today Case Solution

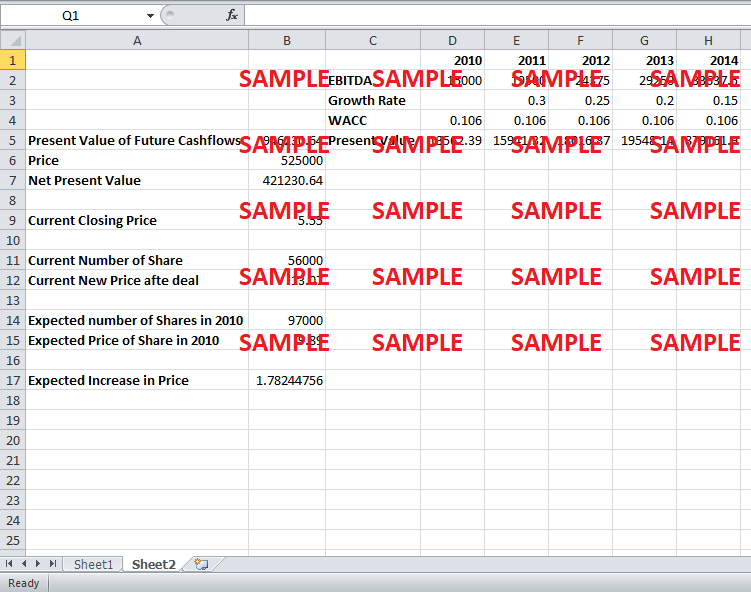

The acquisition deal offered USR a combination of cash and 4.1 million shares worth a total of $52.5 million. Judging from the deal, S&W would give long or short options to USR with a closing period of 2 years at the strike rate of the closing price on the day the deal was made. This raises quite a lot of questions over the valuation of the USR as this is a variable sale price deal depending on the price of the shares of the S&W after 2 years. Such variable sales price is also known as earn out. As shown in Exhibit 7, there is quite a lot of difference on the value of the deal depending on the share price of S&W taken into consideration.

Following questions are answered in this case study solution:

-

Is USR a good fit for S&W? Does it accomplish S&W’s objectives of diversifying away from firearms?

-

Why did S&W use an earn out as part of the compensation for USR?

-

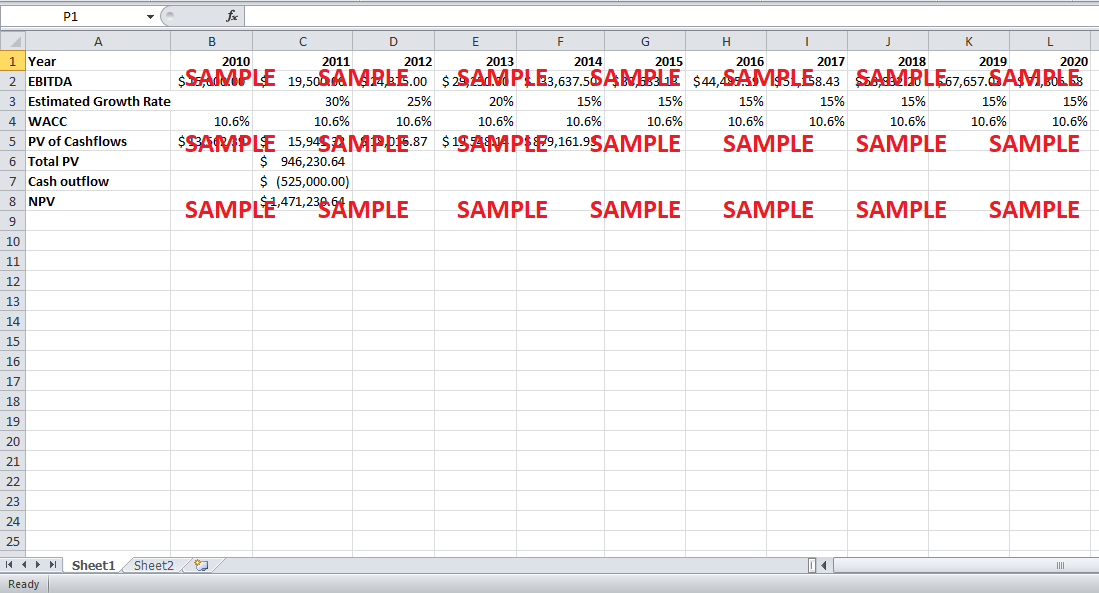

Assuming EBITDA is a close approximation for free cash flow, does the USR acquisition provide a positive net present value for S&W? Be ready to defend your methodology and assumptions used in your valuation estimate.

-

How important was the $100 million backlog information for your estimate of USR’s value to S&W?

-

How does the earn out impact your calculations?

-

Based on your NPV estimate of USR, what is the implied new stock price of S&W after acquiring USR? If you were Harry Callahan would you recommend taking a position in S&W? Would it be a long or short position?

Smith and Wesson Do You Feel Lucky Today Case Analysis

This earn out makes it quite difficult for S&W to value USR accurately as its price after 2 years is quite uncertain to the company. If the owners of USR lock in a long or short position on the options, then it becomes an obligation for S&W to provide them with those shares at that time. For an accurate judgment of the valuation of the company, S&W has to gain proper knowledge of its realizable market value after 2 years so that it can properly judge the worth of the 4.1 million shares offered by S&W.

Based on your NPV estimate of USR, what is the implied new stock price of S&W after acquiring USR? If you were Harry Callahan would you recommend taking a position in S&W? Would it be a long or short position?

Given the workings of NPV calculation, S&W is expected to end up with a positive present value of around $42 million today; proving that in the long term, this acquisition was in favor of the S&W. In other words, this takeover increases the net equity value of the S&W by up to $42 billion today. The closing price on the day of the deal should be around $ 13 per shares; however, at the end of 2010 when the share transfer is completed, the price is expected to be around $ 9.5 per share.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.