Get instant access to this case solution for only $19

Southport Minerals Inc Case Solution

It was year 1964, when the US sulphur industry experienced reduced supplies and increasing prices due to the supply demand mismatch which resulted into enhanced profitability of firms. Therefore, US largest sulphur producer, Southport Minerals was in search of an investment opportunity due to the sharp increase in the company’s profitability. Consequently, due to its highly stable financial situation the company invested into a number of expansion programs. Besides, Southport was moving forward towards diversification in order to decrease its dependency solely on sulphur. Embarked on the diversification program with no debt and increased stock prices, Southport minerals were eventually able to find an Indonesian opportunity to exploit. Extracting the copper from the Firstburg Mountain was the lucrative investment opportunity based on the high prices of copper resulting into the economical extraction of it.

Following questions are answered in this case study solution

-

What are the risks of the Firstburg investment proposal?

-

How did the specific financing choice available to Southport Minerals alter both the risk and return potential of the Firstburg investment proposal? How effective was it in dealing with the project risks?

-

If you were trying to negotiate an improvement in the terms of the Firstburg financing proposals, in which of the following areas would you concentrate your efforts, and why would you concentrate them there? (a) interest rates; (b) debt maturities; (c) allowable dividends; (d) price terms?

-

Which method of analyzing the value of the Firstburg investments proposal to Southport Minerals is most reasonable? Why are the other methods less reasonable? Provide your best estimate of the project’s value by using the adjusted present value approach.

Case Analysis for Southport Minerals Inc

1. What are the risks of the Firstburg investment proposal?

Based on the history of investing activities of Southport Minerals, it has emerged to the surface that the major risk of investing in the foreign country is the expropriate risk. It is the risk of confiscation of the investment due to the sudden change in the government regulation or political development. It was based on the Cuban experience of investment when Southport wrote off the $19 million equity investment resulting due to the expropriation of 75% completed project property. However, due to the government credit guarantees Southport Minerals was able to secure itself from the inherent political and operating risk to some extent.

Besides, another major risk was the output risk i.e. the availability of the amount of the copper ore to be extracted from the mine. Although the initial investigation turned out to support investment in the company, but the difficulty in extraction cannot be known until one enters into the field.

2. How did the specific financing choice available to Southport Minerals alter both the risk and return potential of the Firstburg investment proposal? How effective was it in dealing with the project risks?

After the initial investigation of the investment opportunity, Southport estimated the total development cost including the interest, construction costs and working capital required, the insurance costs and the pre-operating costs. The total was estimated to be $120 million followed by the lowest operating costs in the world later. However, the company possessed zero debt; hence, it was capable of debt financing. Therefore, it looked for various financing options and finally negotiated a number of financing option with three different governments along with the US based insurance company.

The company decided the establishment of an Indonesian subsidiary for which it contracted to sell two-third of the output to the consortium of Japan smelters who in return would lend $ 20 Million to the newly established subsidiary. The interest rate was the actual costs of the Japan smelters; hence, they were not charging any premium. The financing option was attractive combined with the sharing of the expropriation risk with the Japanese government.

Besides, another decided financing option was the German smelter which was about to induce German bank to lend $ 22 million in return of the one third of the output to be sold to the German smelters. Therefore, not only the company was able to get the loan but also it is developing the long-term customer relationships. Moreover, the expropriation risk is further subdivided with the German government.

Moreover, the remaining amount was arranged domestically with the involvement of the US government in return for the use of the US manufactured equipment. The total amount was $ 18 Million. Besides, the US insurance company was able to lend around $ 40 Million guaranteed by the US government agency with further purchase and use of US manufactured equipment. Lastly, the $ 20 Million was invested by the parent company i.e. the Southport minerals Inc.

Therefore, with the involvement of the large number of parties including the three different governments the project risk is shared and hence reduced per entity. Moreover, the potential buyers are also identified through the financing decision process.

3. If you were trying to negotiate an improvement in terms of the Firstburg financing proposals, in which of the following areas would you concentrate your efforts, and why would you concentrate them there? (a) interest rates; (b) debt maturities; (c) allowable dividends; (d) price terms?

The financing proposal is worth adopting if the net worth of the project is positive i.e. the return on investment should be greater than the outlay of cash for investment. In short, the NPV of the project should be positive. Therefore, in order to negotiate the improvement in the financing proposals of the Firstburg, the company should focus on negotiating the interest rates which determines the interest expenses of the subsidiary. Therefore, if the interest expense is higher the cash outflow will be greater and the net present value will be reduced. Therefore, interest rate should be lower. Moreover, smaller are the debt maturities greater will be the cash outflow per year; therefore, the debt maturities should be extended through negotiation for improving the financing plan. In conclusion, the company should concentrate its efforts on the negotiation of interest rates and the debt maturities.

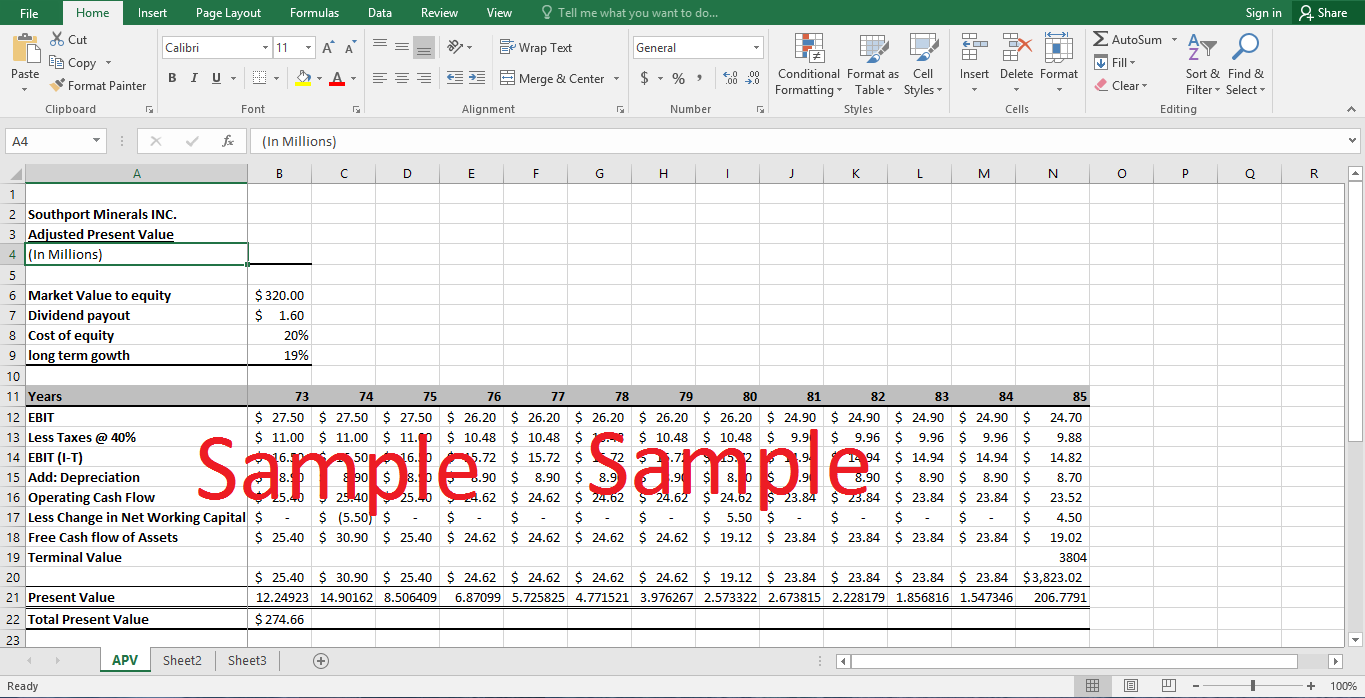

4. Which method of analysing the value of the Firstburg investments proposal to Southport Minerals is most reasonable? Why are the other methods less reasonable? Provide your best estimate of the project’s value by using the adjusted present value approach.

After finalizing the financing decision, the company faced some serious problems while deciding the projects’ net worth against the investment to be made. There was the conflict on the four different approaches which calculated four different net present values based on the assumptions used. Therefore, in order to take the final decision of taking the project it was essential to decide the most appropriate method for estimating the net worth of the project. Following are the approaches and their level of appropriateness:

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.