Get instant access to this case solution for only $19

Sneaker 2013 Case Solution

In the United States, New Balance is one of the biggest shoe manufacturers. As a "one-man operation manufacturing" company, New Balance had its start in 1906. It's now a worldwide brand with a solid reputation. It's safe to say that New Balance is a globally recognized brand. To meet consumer demand, a broad range of high-quality shoes are being produced. Athletes like Usain Bolt, Usain Bolt, and others have endorsed New Balance's sports footwear. New Balance has a great chance to reach out to young guys between the ages of 12 and 18. At an affordable price range, they created a medium-tech running shoe for their sponsor, Kirani James. James is a promising Olympic runner who is just in his twenties.

Monte Holiday, the company's senior vice president of product development, identified a potential in the 12- to 18-year-old male market. New Balance's opponents have yet to take advantage of this chance. Athletic footwear for individuals aged 18 to 24 years old has already received Usain Bolt's endorsement. However, New Balance was unable to participate in the race and compete in this section due to a lack of resources. As a result, New Balance saw an opportunity to reach a younger demographic in the market. A successful marketing and advertising campaign centered on the appropriate athlete may have significant effects on the company's bottom line if it could design shoes for 12- to 18-year-old males. In the 400-meter dash in London, Kirani James of Grenada won gold medals in the 400-meter sprint and 400-meter relay. In his youth, he has the potential to become a great athlete, which will draw in a younger demographic.

Following questions are answered in this case study solution:

-

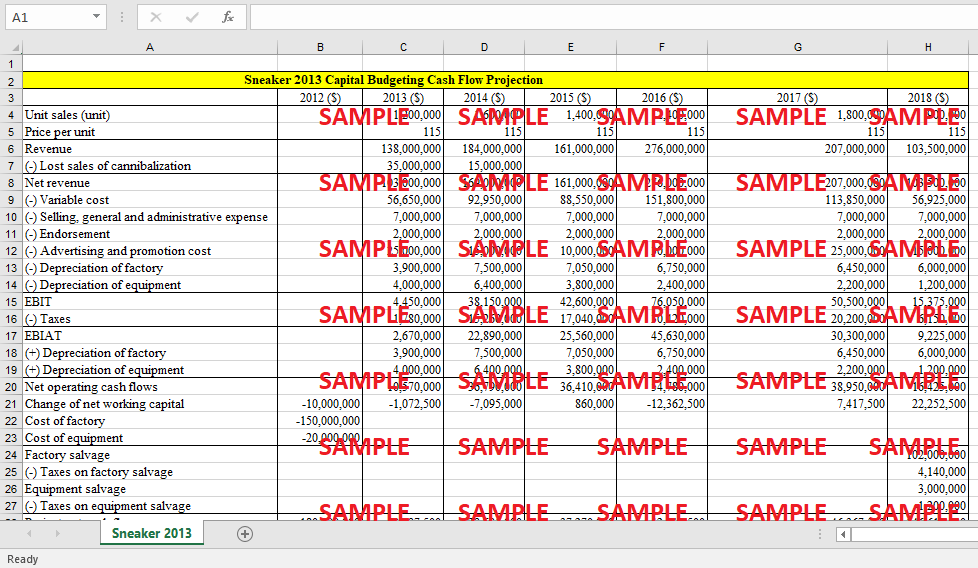

Produce a projected capital budgeting cash flow statement for the Persistence project by answering the following: (a) What is the project’s initial (year 0) investment outlay? (b) What are the project’s annual net operating cash flows? (c) What is the project’s terminal (2018) net cash flow?

-

Which project do you think is riskier? How do you think you should incorporate differences in risk into your analysis?

-

Based on the calculated payback period, net present value (NPV), and internal rate of return (IRR) for each project, which project looks better for New Balance shareholders? Why?

-

Should Rodriguez be more or less critical of cash flow forecasts for Persistence than of cash flow forecasts for Sneaker 2013? Why?

-

What is your final recommendation for Rodriguez?

-

Which cash flows should be incorporated into the project’s forecast? Why or why not?

-

Produce a projected capital budgeting cash flow statement for the Persistence project by answering the following: a. What is the project’s initial (year 0) investment outlay? b. What are the project’s annual net operating cash flows? c. What is the project’s terminal (2018) net cash flow? d. Does Persistence appear attractive from a quantitative standpoint? To answer this question, estimate the project’s payback, net present value, and internal rate of return.

Case Study Questions Answers

As new items were introduced by competitors, the competition was strong. Despite the slump in the economy, the shoe market continues to rise. The VP requested Michele Rodriquez to analyze two goods, Sneakers 2013 and Persistence, and she agreed to do so. The VP also wanted recommendations in order to choose the best choice for the project's commencement.

1. Produce a projected capital budgeting cash flow statement for the Persistence project by answering the following: (a) What is the project’s initial (year 0) investment outlay? (b) What are the project’s annual net operating cash flows? (c) What is the project’s terminal (2018) net cash flow?

a) Among the initial investment outlay in year zero is the capital expenditure for manufacturing equipment of $8 million, the change in NWC of $15 million, and the expenditure for design technology and manufacturing specifications of $50 million, all of which are expensed immediately for taxation. Consequently, the original investment in year 0 includes a tax advantage ($50 million x 40% = $20 million), resulting in a total net cost of the initial investment outlay of $53 million (in the absence of the tax benefit, the cost of the initial investment would be $73 million).

b) The projected net cash flows for the years 2013, 2014, and 2015 are $14.5 million, $22.4 million, and $46.7 million respectively. The cash flows were calculated by starting with the Persistence revenue and then subtracting variable cost, selling general & administrative expense, advertising & promotion expense, and cost of technology. This led us to the Earnings before Interest and Taxes (EBIT). The EBIT figure was then adjusted for the taxes and depreciation was added back since it was a non-cash expense. Then, the changes in (NWC) were added to the figure which led us to the final figure of the net cash flows for 2013, 2014, and 2015.

c) The terminal cash flow for the Persistence project came out to be $44.4 million. The figure was calculated by using the net income which was calculated by taking the total market value of $462 million multiplied by 20% which gave us the revenue of $92.5 million for the year 2015. Then the total variable cost, selling general & administrative expense, advertising & promotion expense, and cost of technology were subtracted from the revenue to arrive at the Earnings before Interest and taxes (EBIT) from which the taxes were subtracted to arrive at the net income of $27.8 million. The depreciation for the equipment of $1.5 million and the Net Working Capital (NWC) was added to the net income which gave the value for the terminal cash flow of $44.4 million.

2. Which project do you think is riskier? How do you think you should incorporate differences in risk into your analysis?

We believe that Persistence is the riskier of the two initiatives when compared to Sneaker 2013 in terms of financial risk. Net present value (NPV), payback time, and internal rate of return are the three factors that we use to account for variations in risk in our research (IRR). Based on the analysis above, it shows that the highest internal rate of return is the Persistence project with 22% compared to Sneaker 2013 project with 13%. Next, the Net Present Value (NPV) of the Persistence project is more than the Sneaker 2013 project with a positive value of $13.75 million and $8.59 million respectively. Lastly, the payback period of the Sneaker 2013 project is longer than the Persistence project with 5.1 years and 2.34 years respectively.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.