Get instant access to this case solution for only $19

Southland Corp A Case Solution

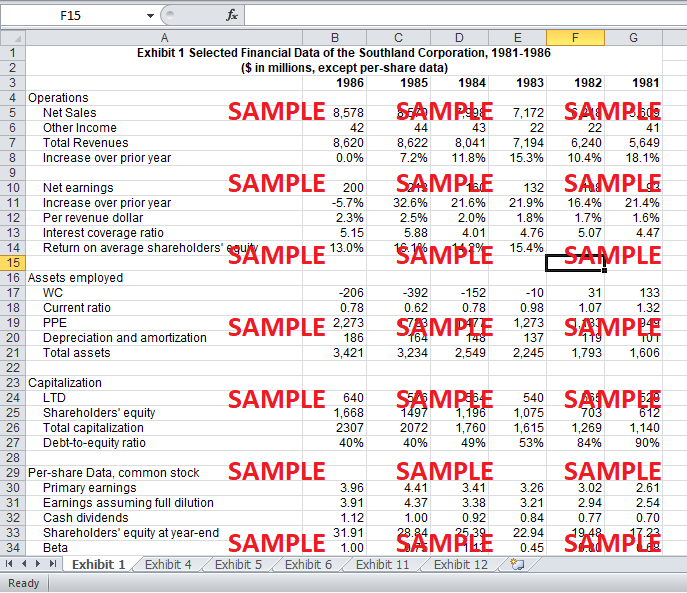

The company Southland operates as a chain of retailing stores worldwide which initially began as an ice store in 1927. The stores named as “seven eleven” have grown around the world and has made Southland the largest convenience store chain. The target market of these stores mainly ranged from lunch time customers, weekend shoppers and customers who wanted a quick visit for grocery to late shoppers. The most running sale items for the retail chain were milk, gasoline, cigarettes, soft drinks, beers, money orders and video rentals. Southland had also acquired Citgo which was petroleum and lubricants refining company.

Following questions are answered in this case study solution

-

Industry of Southland

-

Business Strategy of Southland

-

What are the possible motives for a LBO of Southland?

-

Is Southland a good LBO candidate?

-

Taking the proposed LBO plan and projections at face value, estimate the value of Southlands€™s shares under the proposed LBO plan, using the CCF approaches.

-

Estimate the enterprise value and equity value that will result from the transaction (i.e., one day after the deal is completed).

-

What is the (maximum) bid that the LBO organizers should be willing to make per existing Southland share? 3) Still taking the proposed LBO plan and projections at face value, is the LBO creating or destroying value? Depending on your answer, explain what the main sources of value creation or destruction are

-

Do you think the projections are reasonable? If yes, explain your answer and estimate Southlands€™s value under your best-case (but reasonable) scenario. If not, explain your answer and estimate a more reasonable value for Southland.

-

What is your recommendation to Southland’s shareholders? Why?

Case Analysis for Southland Corp A

2. Business Strategy of Southland

The company’s operations are branched worldwide with major concentration in USA and Canada of about 6,632 stores and around 5197 stores in other 19 foreign countries. The country also has a Swedish subsidiary which operates around 58 stores in Sweden. The major customer base of the retail stores were men including truck drivers, construction workers and college students who visited this store to buy beer, snacks, tobacco and coffee. The company also had been experiencing compound annual rise in its sale of about 9% which helped it in holding a dominant share in the market. Going forward, the company was targeting more female customers as well as wealthy individuals with the intention to retain its current customer base. In addition to this, the company was also planning to add more services in its portfolio like automatic teller machines, automated money orders and video cassette rentals. Over the years, the company had also been successful in incorporating gasoline product with its brand name and sold it alongside its convenience stores.

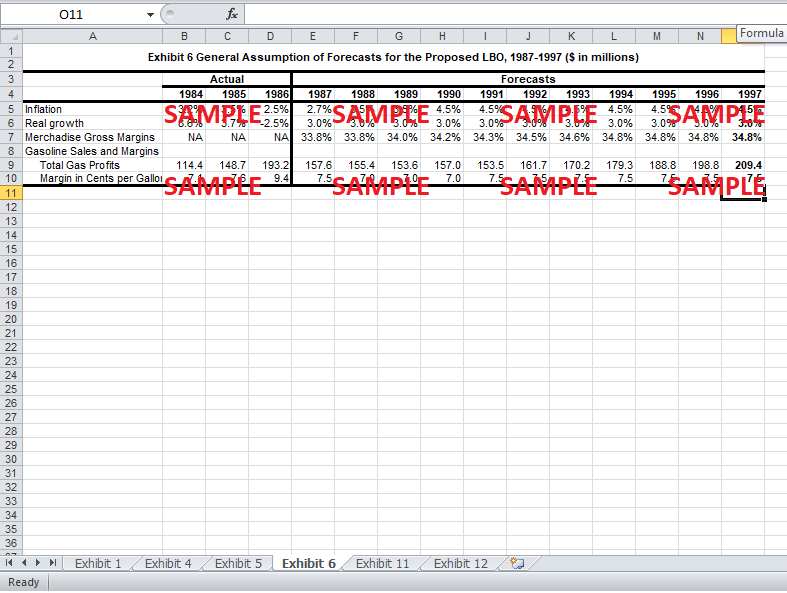

3. What are the possible motives for a LBO of Southland?

The operating plan of the company is associated with Southland’s retailing business by expecting to sell many of the other businesses it is involved in like Chief auto parts, Reddy ice, Tidel Systems and many chemical and food laboratories. Southland wanted to improve the profitability of its convenience stores by bringing in real growth in sales, rise in gross margins and reducing the general and admin expenses. The Leveraged Buyout was being planned to divest the low performing unprofitable stores with small margins and growth rates. The motive behind this LBO could also be that the investors would feel that they can run the firm more efficiently and more profitably. A successful LBO can increase the chance of the company in providing better returns lenders, investors and managers and ultimately gaining a strong market position.

4. Is Southland a good LBO candidate?

Southland is a good LBP candidate as it operates in a mature industry and is a company which has a long history. Further to this, the company has strong management who is driven to bring in some cost cutting measures which will help the business to focus on areas which have the potential for generating more cash. The cash flows are also steady which can be able to pay the debt amounts when they become due. Overall too, the company is in a great position to keep up its position in the market place and generate steady cash flows. Lastly, selling of the underperforming assets can enable the company to pay off the outstanding cash.

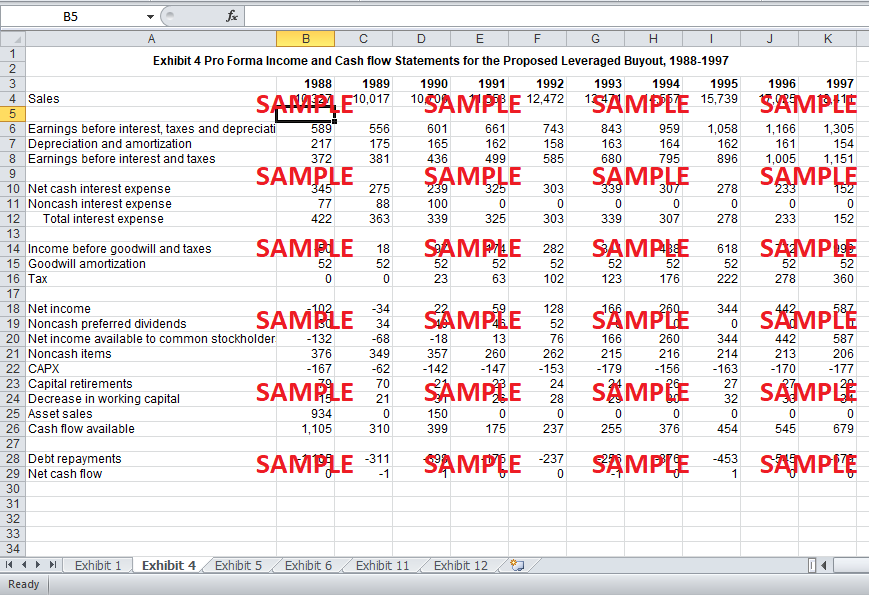

5. Taking the proposed LBO plan and projections at face value, estimate the value of Southlands€™s shares under the proposed LBO plan, using the CCF approaches.

|

Noncash preferred dividends |

30 |

34 |

40 |

46 |

52 |

0 |

0 |

0 |

0 |

0 |

|

Net income available to common stockholders |

-132 |

-68 |

-18 |

13 |

76 |

166 |

260 |

344 |

442 |

587 |

|

Noncash items |

376 |

349 |

357 |

260 |

262 |

215 |

216 |

214 |

213 |

206 |

|

CAPX |

-167 |

-62 |

-142 |

-147 |

-153 |

-179 |

-156 |

-163 |

-170 |

-177 |

|

Capital retirements |

79 |

70 |

21 |

23 |

24 |

24 |

26 |

27 |

27 |

29 |

|

Decrease in working capital |

15 |

21 |

31 |

26 |

28 |

29 |

30 |

32 |

33 |

34 |

|

Asset sales |

934 |

0 |

150 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Cash flow available |

1,105 |

310 |

399 |

175 |

237 |

255 |

376 |

454 |

545 |

679 |

|

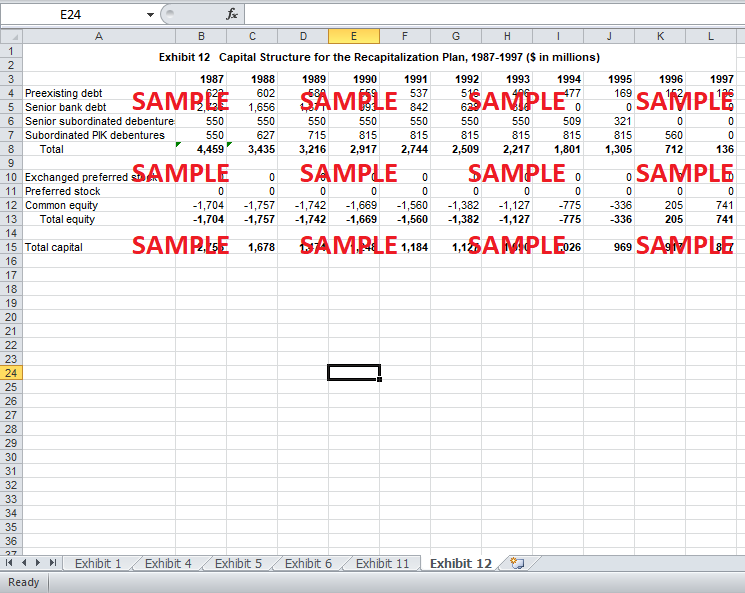

Total equity |

-1,757 |

-1,742 |

-1,669 |

-1,560 |

-1,382 |

-1,127 |

-775 |

-336 |

205 |

741 |

|

EPS |

-0.6289 |

-0.1780 |

-0.2391 |

-0.1122 |

-0.1715 |

-0.2263 |

-0.4852 |

-1.3512 |

2.6585 |

0.9163 |

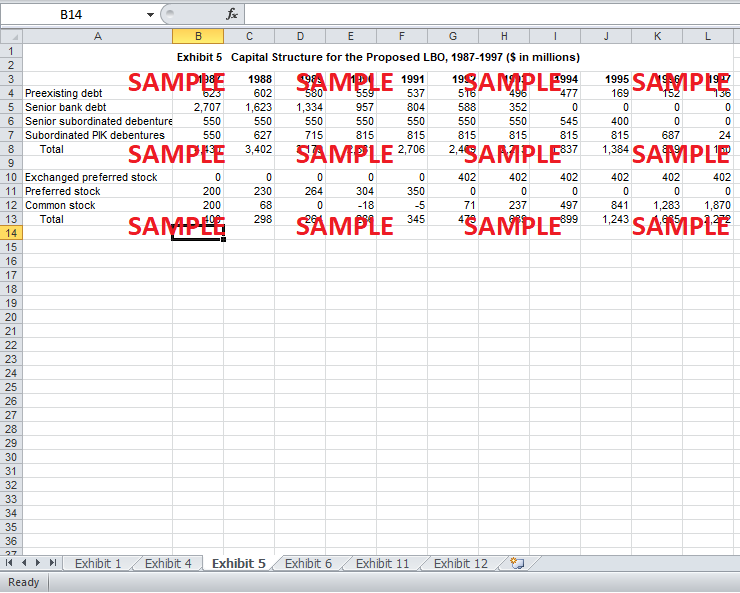

6. Estimate the enterprise value and equity value that will result from the transaction (i.e., one day after the deal is completed).

|

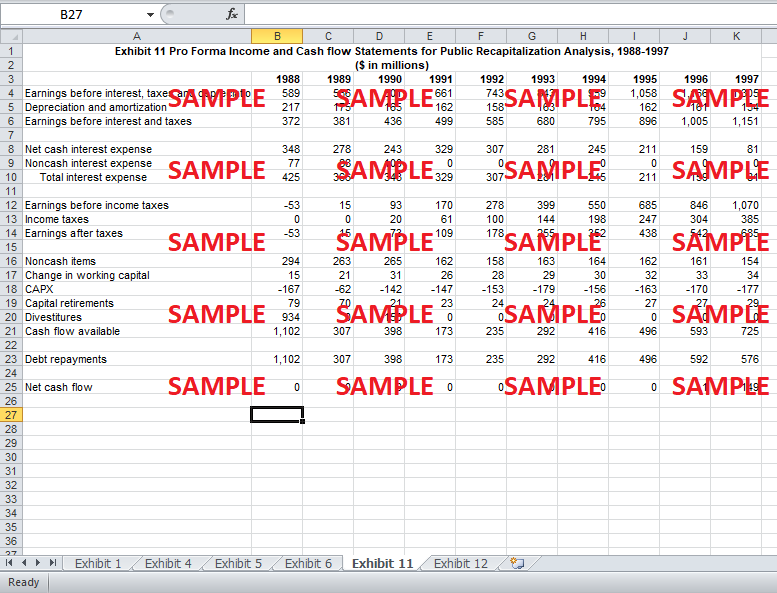

Exhibit 11 Pro Forma Income and Cash flow Statements for Public Recapitalization Analysis, 1988-1997 |

|

||||||||||

|

|

|||||||||||

|

|

1988 |

1989 |

1990 |

1991 |

1992 |

1993 |

1994 |

1995 |

1996 |

1997 |

|

|

Earnings before interest, taxes and depreciation |

589 |

556 |

601 |

661 |

743 |

843 |

959 |

1,058 |

1,166 |

1,305 |

|

|

Depreciation and amortization |

217 |

175 |

165 |

162 |

158 |

163 |

164 |

162 |

161 |

154 |

|

|

Earnings before interest and taxes |

372 |

381 |

436 |

499 |

585 |

680 |

795 |

896 |

1,005 |

1,151 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash interest expense |

348 |

278 |

243 |

329 |

307 |

281 |

245 |

211 |

159 |

81 |

|

|

Noncash interest expense |

77 |

88 |

100 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Total interest expense |

425 |

366 |

343 |

329 |

307 |

281 |

245 |

211 |

159 |

81 |

|

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.