Get instant access to this case solution for only $19

Sun Brewing (B) Case Solution

The three options were:

-

Hold on to the shares in SIL and continue to participate in the management of the Company as a strong third party.

-

Completely exit by selling their remaining stake.

-

Can do an equity swap with InBev.

Following questions are answered in this case study solution

-

Discuss the advantages and disadvantages for each of the three options that the Khemka family is facing.

-

Estimate the value of Sun Brewing using the discounted cash flow model and compare this estimate to the value of comparable companies?

-

How much are the voting rights in SUN Brewing worth?

-

What explains the premium on the voting shares and how does this premium effect the valuation of the family's cash flow and control rights?

Case Analysis for Sun Brewing (B)

• Hold on to the shares in SIL and continue to participate in the management of the Company as a strong third party.

Advantages

-

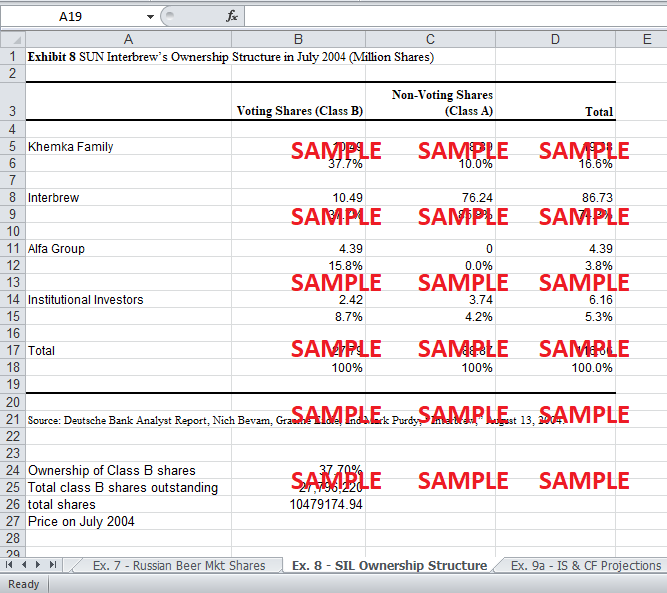

That the voting stake is the same that is 37.7% that will not reduce their say in the company.

-

The sun knew the company, and the industry and the dynamics by now and it was easier to improve the performance of the company.

-

The company is doing well, and a lot of capital injection is not required.

Disadvantages

-

Lower dividends on the nonvoting shares as shares have been sold out.

• Completely exit by selling their remaining stake.

Advantages

-

More cash in hand

-

Investment can be used in new attractive ventures and markets

Disadvantages

-

Forgoing the current and future profits of Sun Interbrew Limited

-

The current market for Russian beer was growing and had prospects of further growth that could lead to improving the value of the shares and profits of the company

-

Dividends of Sun Interbrew limited will be forgone.

• Get an Equity Swap with In Bev.

Advantages

-

Higher share value if the company grows well

-

The company has good prospects of growth

-

More value for money invested

Disadvantages

-

Less voting power if other companies have higher amount of shares

-

No say in the management if other companies have a higher amount of shares.

2. Estimate the value of Sun Brewing using the discounted cash flow model and compare this estimate to the value of comparable companies?

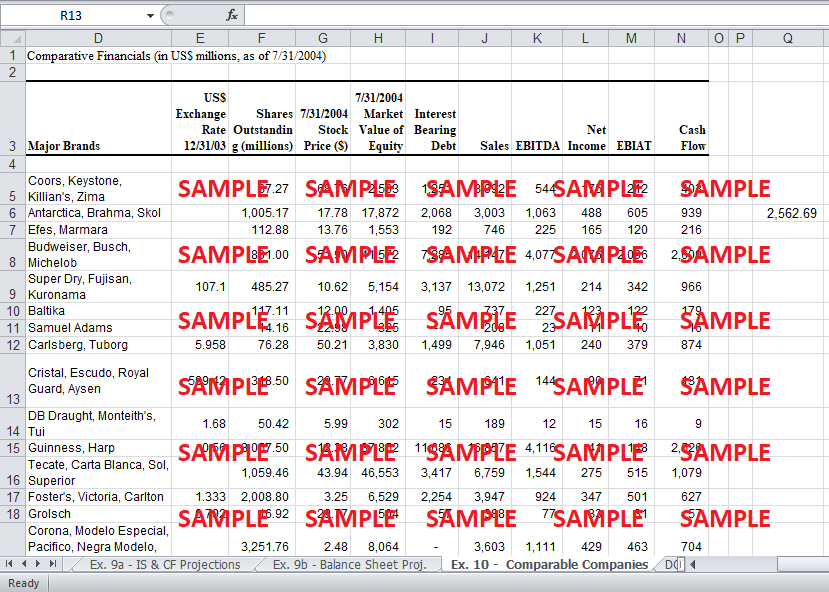

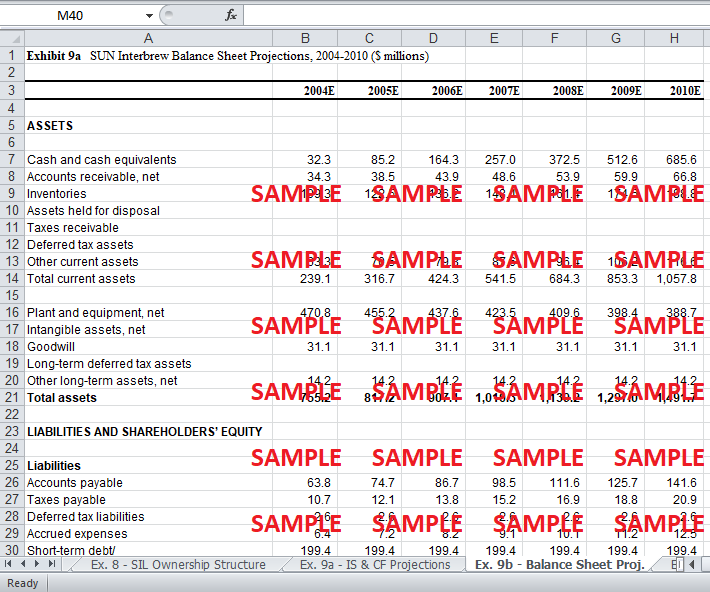

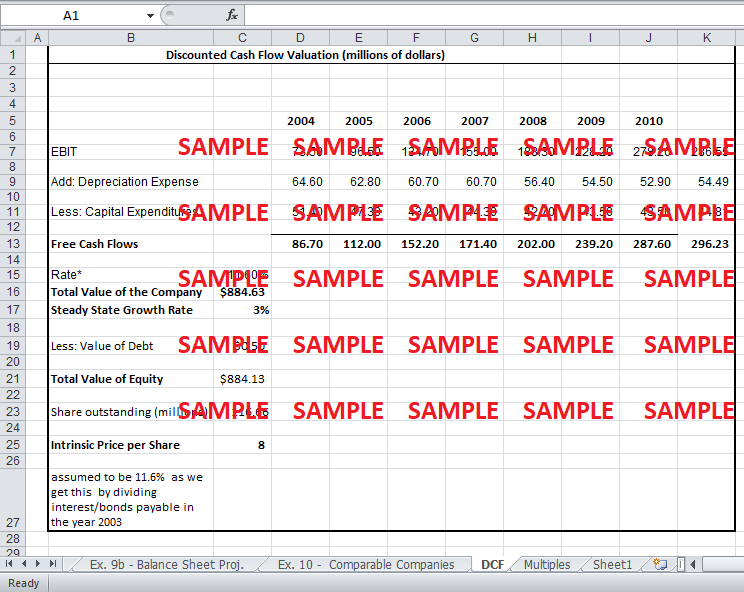

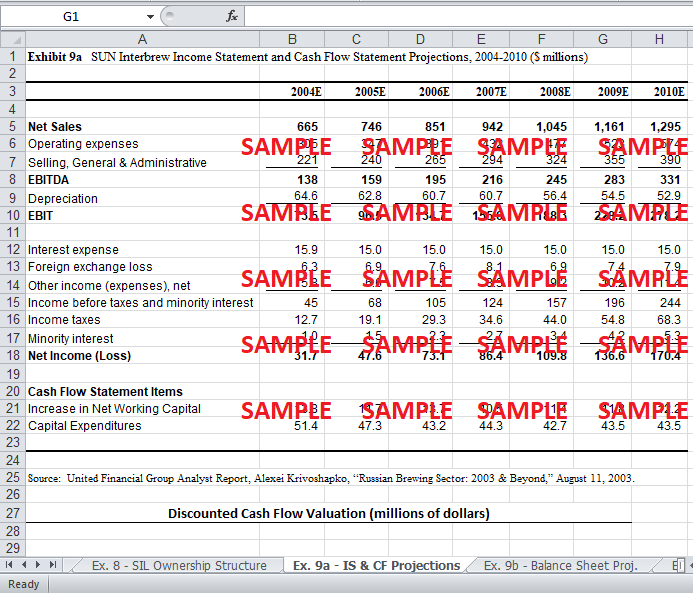

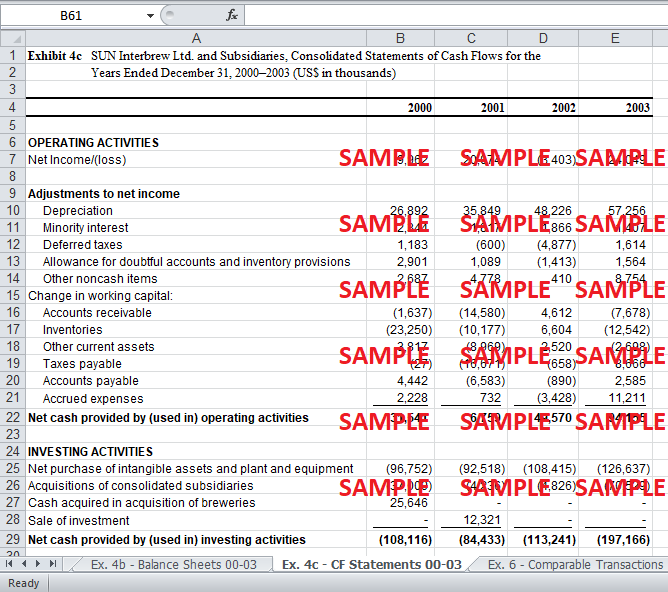

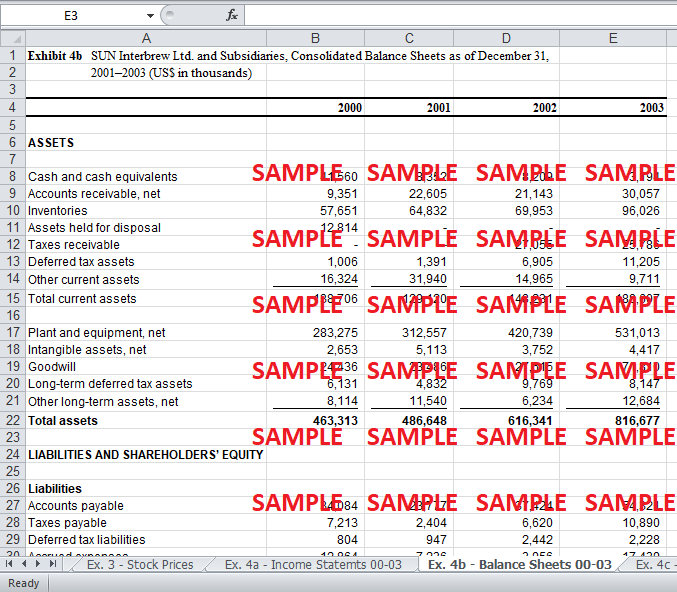

There are different methods to take out the value of the shares. Two of the prevalent methods are the discounted cash flow method and the market multiples method. In the discounted cash flow method, first of all, Free cash flows have to be taken out. Free cash flows are cash flows you arrive at when no non-cash element is included. Free cash flows are calculated by adding depreciation to EBIAT(Earnings before interest and taxes) and subtracting capital expenditure. Free Cash flows are discounted at the prevailing interest rate. The discounted flow model discounts the future free cash flows at the interest rate to know what exact value will they be today at time 0.The inflows of the years are then added together to get the value of the total value from which the value of debt is subtracted to get the total value of equity that is then divided by the outstanding shares to get the intrinsic value of the share that is $ 8 per share given in the calculations below.

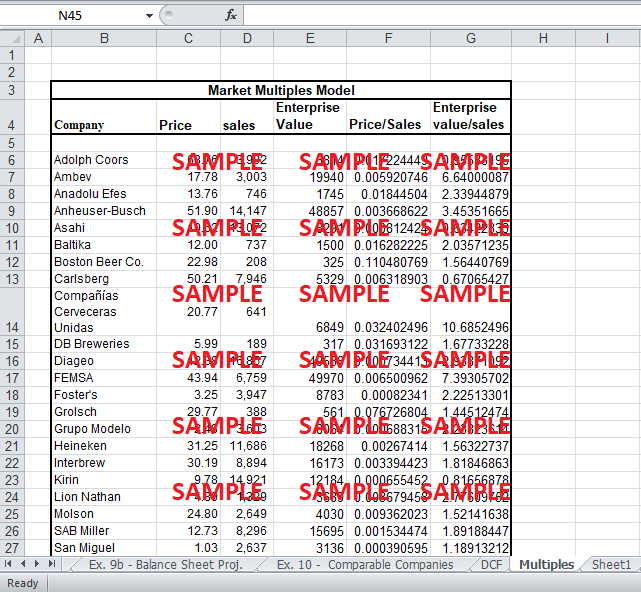

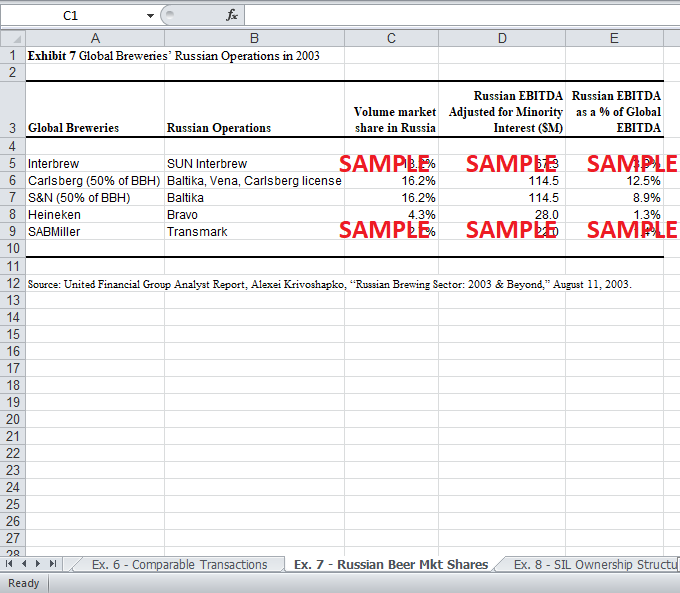

A different way to calculate the intrinsic price of the share is comparable multiples in which comparable companies are sorted out on the based on size, location and other variables. In this case, the comparable companies have been provided we take two comparables Price/Sales and Price/enterprise value. In the Price/Sales method, price/sales of all the comparable companies are calculated and then an average is taken out which is multiplied by the current Sales of the company to get an intrinsic value of the share. As per the method of Price/Sales, the price came to $ 9.38 per share.

In the market multiple method price/enterprise value, the price/enterprise value of all the comparable companies is taken out, and an average is calculated which is multiplied by the sales of the company. This will give you an enterprise value. To calculate the price, you deduct long term debt from the enterprise value to get the total value of Equity. After getting the value of the equity, you divide it by the outstanding shares to get an intrinsic value of the share. As per the method of Enterprise value/Sales, the value derived was $ 14.15.

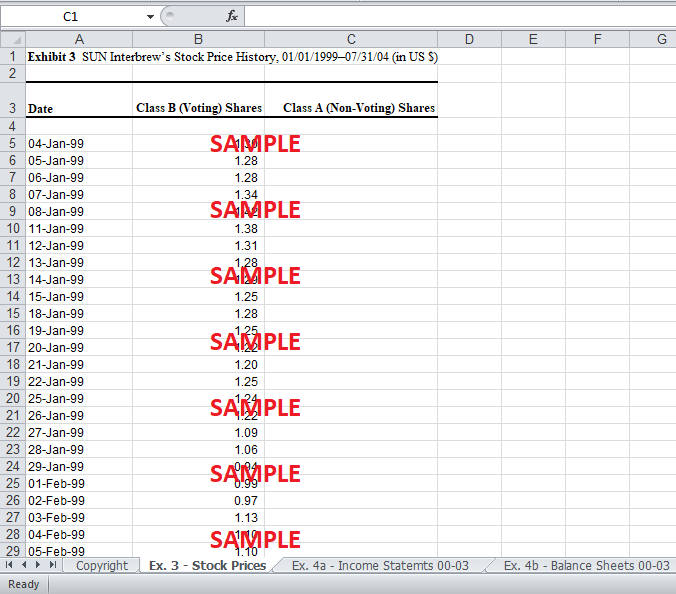

In the discounted flow model, the price of the share got calculated to $ 8 per share. As per the market multiples approach with the multiple Price/Sales, Price came to $ 9.38. As per the market multiples approach with the multiple Enterprise Value /Sales, the price came to $ 14.15. The market price of the share on July 31, 2004, is $13.4 Class B Voting shares and $8.40 Class A Non-Voting Shares.

As per the discounted cash flow model Class A and Class B are overpriced. As per the Market Multiple approach of Price/Sales method Class B share is overpriced and Class A share is underpriced. As per the Market Multiple approach of Enterprise Value of Sales, Class A shares and Class B shares are underpriced.

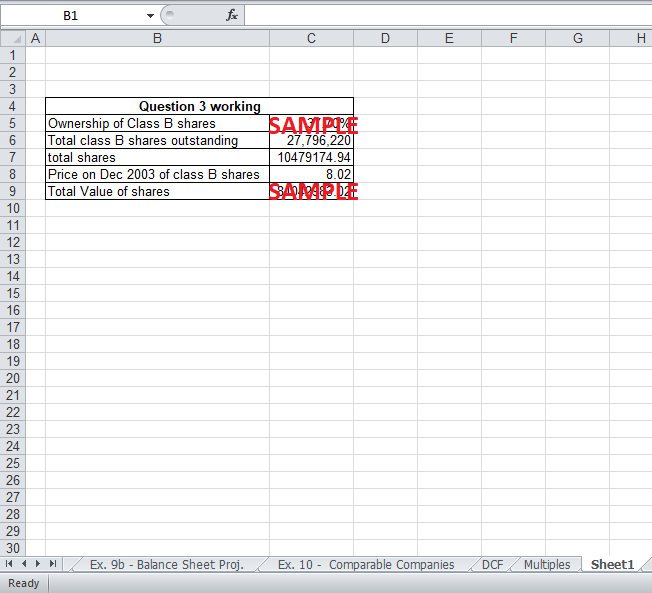

3. How much are the voting rights in SUN Brewing worth?

Voting rights are the rights you get when you purchase voting shares of the company. Sun Brew owns 37.7% of the voting shares on July 31, 2004.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.