Get instant access to this case solution for only $19

SUPERMAR, S.A Case Solution

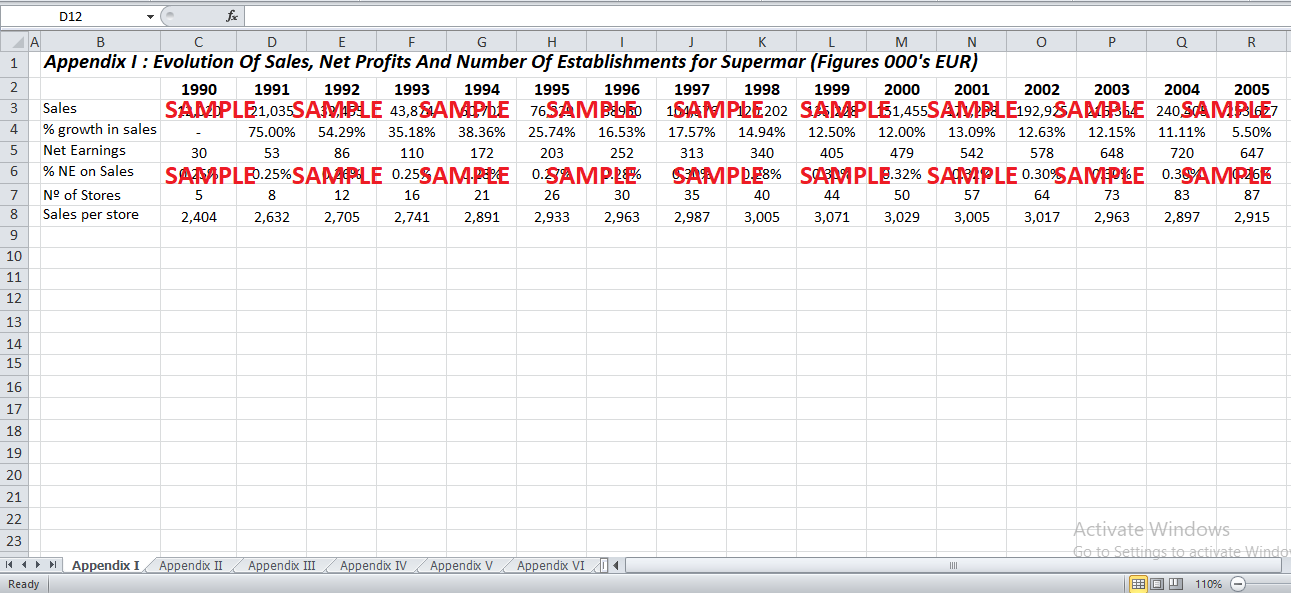

SUPERMAR, created in Canary Island, Spain in 1980s, had become the main supermarket by 1990s with more than 60 establishments, two warehouses and a head office. The quality of perishable products, a wide variety of non-perishable food products and extensive policy for customer service formed the core management policies at SUPERMAR. However, due to severe competition from hypermarkets such as Mercadona, Alcampo, Carrefour, etc., growth had slowed down. Furthermore, the market was already saturated, and growth could not be achieved by opening new stores.

The CEO and CFO of SUPERMAR decided to expand outside Canary Island by acquiring a firm in crisis, EBROSA, to rescue the family business. Facing the acquisition decision, the chief financial officer wanted to prepare a detailed valuation report for the target firm. Below are the components of the report.

Following questions are answered in this case study solution

-

Current Firm and Equity Value of SUPERMAR:

-

Under Current Capital Structure

-

Under Target Capital Structure achieved immediately

-

Under Target Capital Structure achieved progressively

-

Stand-Alone Value of EBROSA

-

Value of EBROSA under SUPERMAR’s Management

Case Analysis for SUPERMAR, S.A

1. Current Firm and Equity Value of SUPERMAR:

Under Current Capital Structure

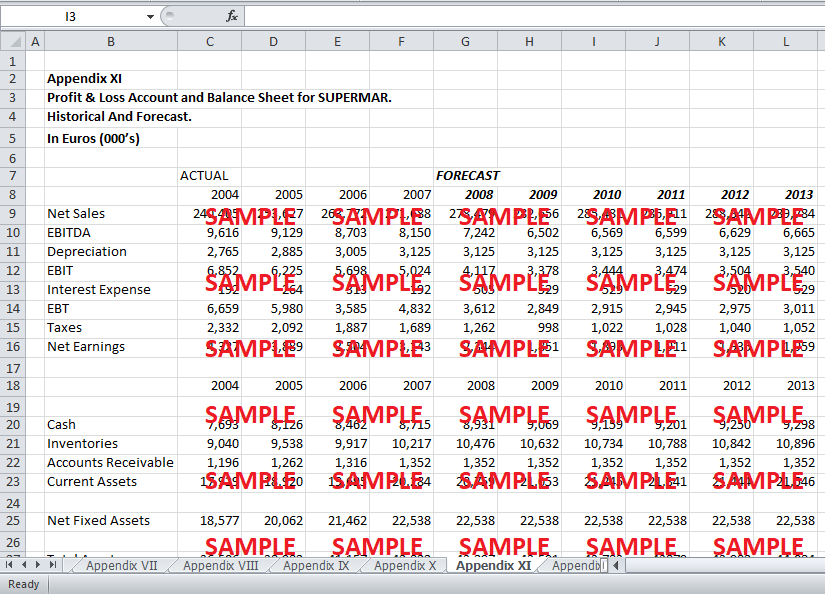

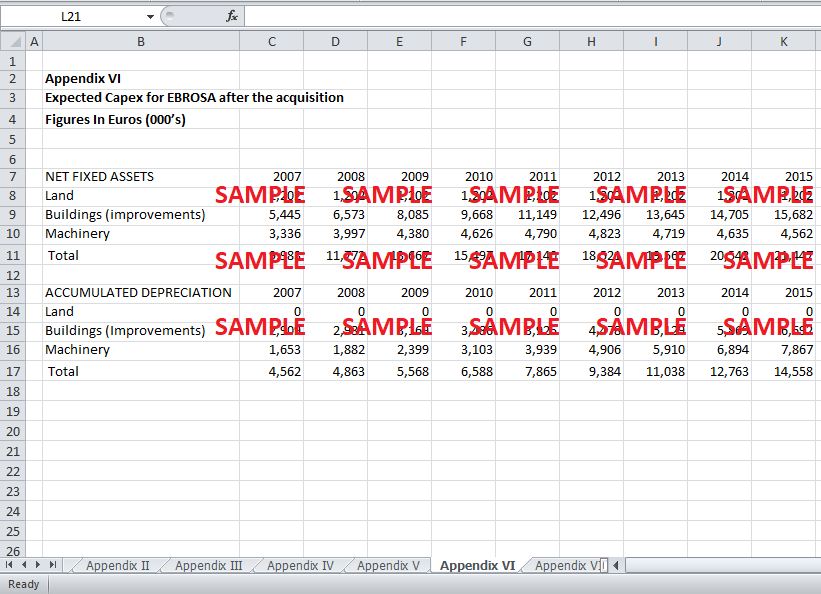

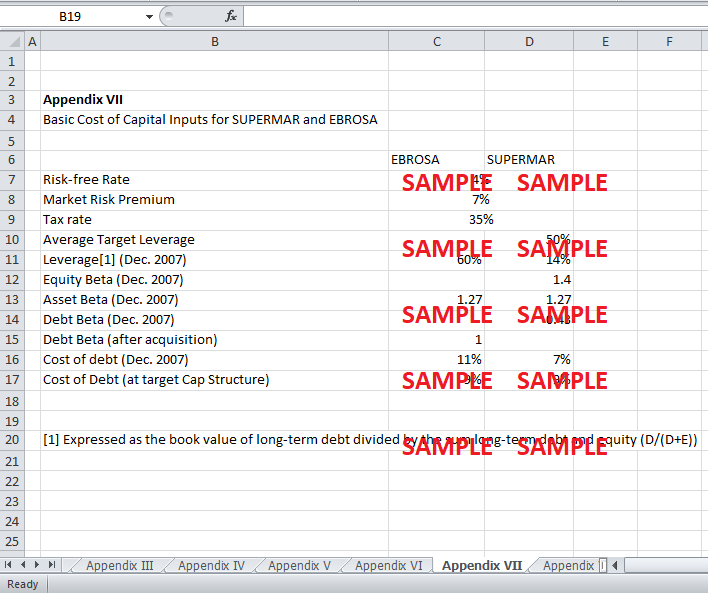

The discounted cash flow approach has been used to calculate the value of the firm (see excel sheet “Question 1a”). Firstly, expected operating cash flows have been obtained by subtracting taxes from and adding depreciation expenses back into the projected earnings before interest and tax expenses (EBIT). Secondly, the weighted average cost of capital has been used for discounting the operating cash flows, which has been calculated using the following formula:

WACC = % of equity * Cost of equity + % of debt * Cost of debt = 12.7%

Where percentage of equity is equity/(debt + equity) and percentage of debt is long term debt/(debt + equity). Moreover, cost of equity has been obtained using the Capital Asset Pricing Model (CAPM).

Cost of equity = Rf + β*(Market risk premium) = 13.8%

The values for all of the parameters in the above-mentioned equations have been obtained from Appendix VII. Using this WACC, the operating future cash flows have been discounted, and the net present value of SUPERMAR is €55,706. The value of equity of SUPERMAR is €53,458.

Under Target Capital Structure achieved immediately

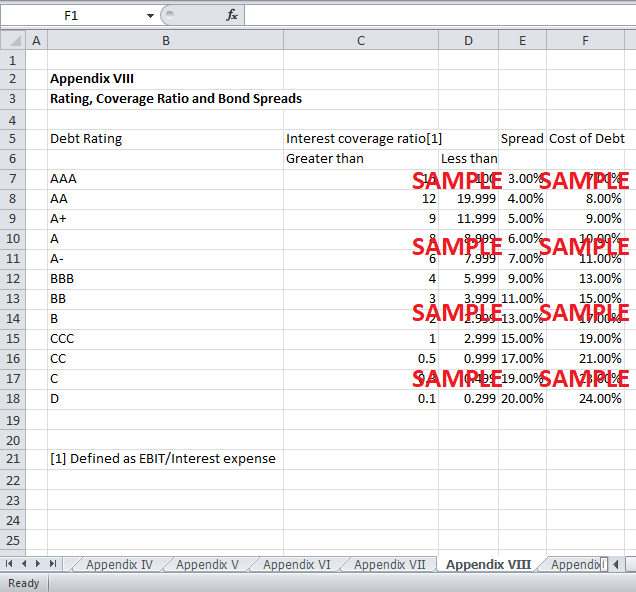

The value of SUPERMAR has also been calculated for the second case in which the firm achieves the target capital structure of 50% debt immediately (see excel sheet “Question 1b”). The cost of debt used for WACC calculation under the target capital structure is 9%. The rest of the procedure is the same as in the previous section; the net present value of the firm under target capital if 50% is €81,835. Similarly, the value of equity of the firm is €79,587.

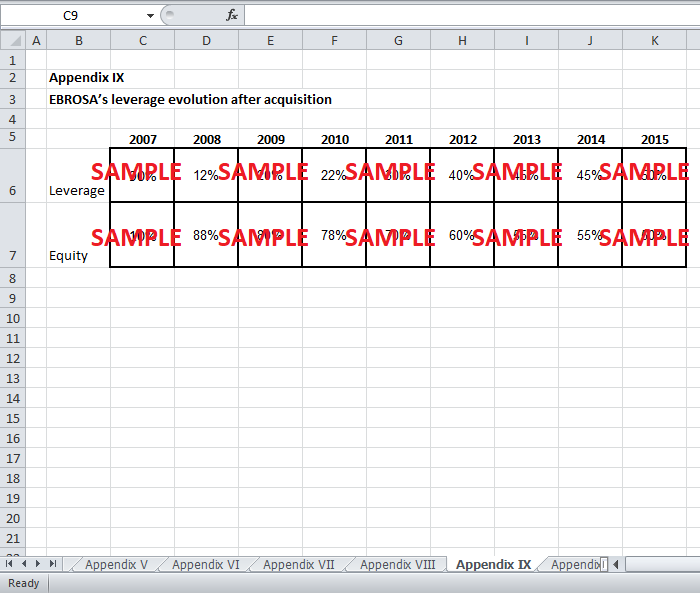

Under Target Capital Structure achieved progressively

The third cause for the valuation of the firm, SUPERMAR, assumes that the company achieved its target capital structure progressively, as opposed to immediately as in the second case (see excel sheet “Question 1c”). The evolution of the capital structure has been taken the same as in Appendix IX. The weighted average cost of capital has been calculated using the same formula as mentioned in the first section, using the cost of debt as 9%. Under this arrangement of capital structure, the value of SUPERMAR comes out to be €66,946 while the value of equity of the firm is €64,698.

2. Stand-Alone Value of EBROSA

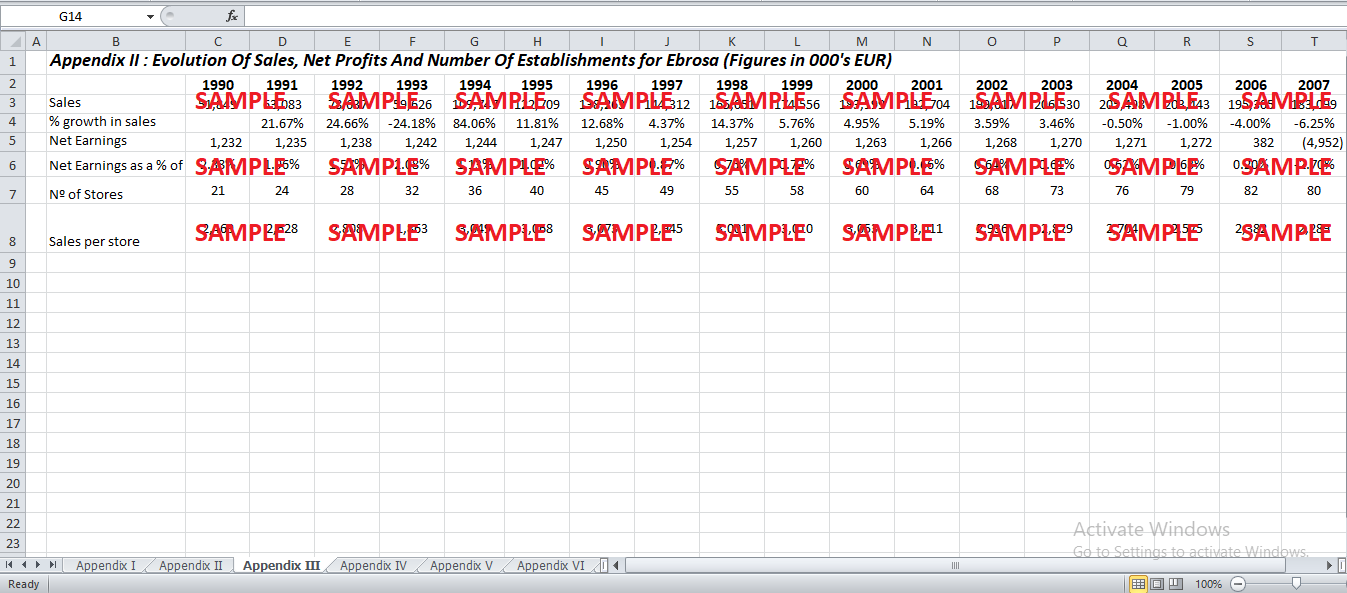

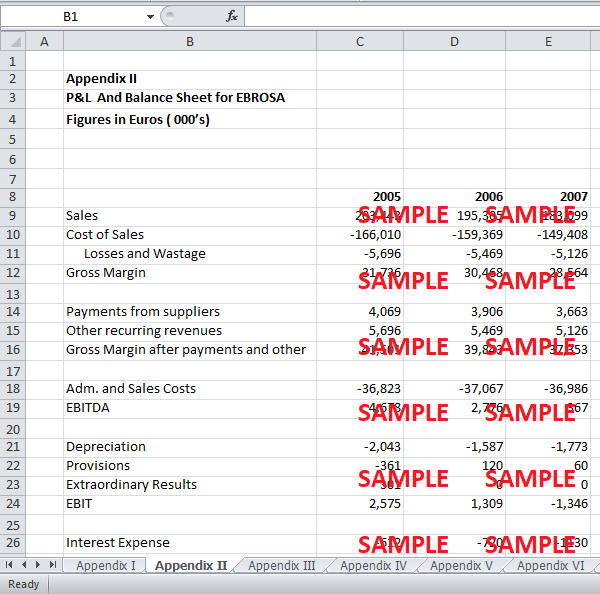

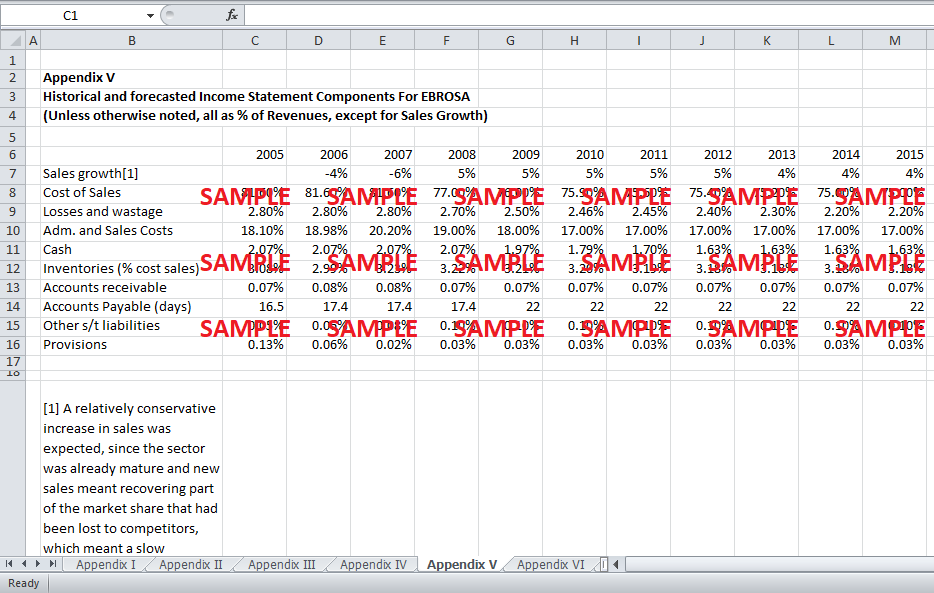

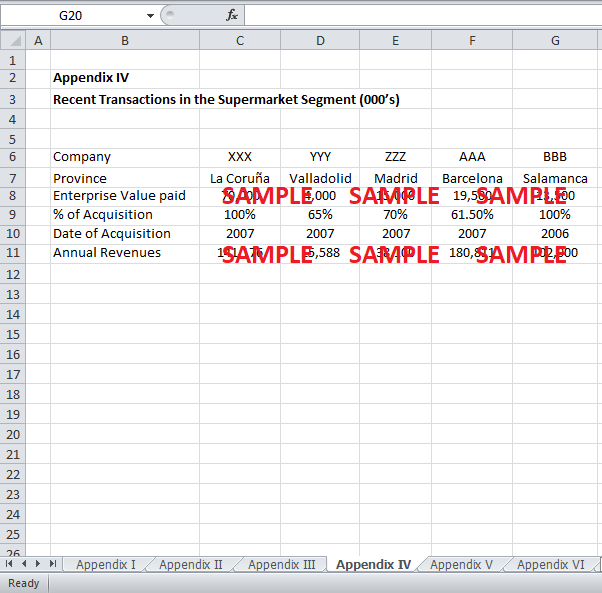

The stand-alone value of EBROSA is calculated using a relative valuation approach (see excel sheet “Question 2”). The value has been estimated using the financial statements of EBROSA from Appendix II, the commission report from Appendix III and transactional data from Appendix IV. According to the available transactional data, the multiple used for relative valuation is EV/Sales i.e. the ratio of enterprise value to annual sales of the company. The ratio has been calculated for each company that was sold in 2007. The average of these ratios has been used as the multiple using the following formula:

Value/Sales of the firm = Industry ratio

Value = Industry Ratio * Sales of the firm = 0.31 * 183,099 = €57,401

Furthermore, SUPERMAR is willing to offer a price of Assets-Current Liabilities = €13,571 for EBROSA to the venture capitalists. The valuation of EBROSA using relative valuation approach shows that the value of the firm is more than the bid. Consequently, the deal will be profitable if purchased at €13,571.

To ensure comparability a detailed discounted cash flow analysis has also been done for EBROSA’s stand-alone valuation (see excel sheet “Question 2a” and “Question 2a”).

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.