Get instant access to this case solution for only $19

The Unionville Gift Store Case Solution

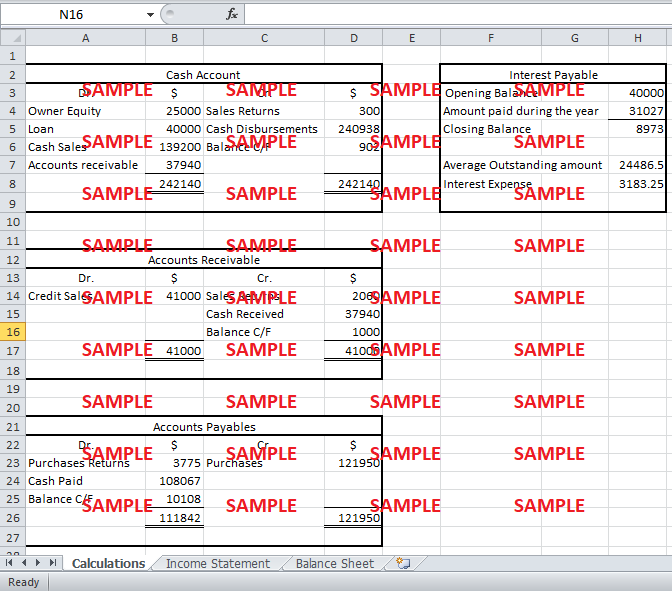

Burns purchased goods worth $119,900 and paid freight charges of $2050. As per the accounting policies, the freight was added to the invoice amount. Therefore, purchases in the books of Burns would be shown as $121,950. Some goods were returned as well during the year, which was worth $3775. Since all the purchases were done on credit, the remaining amount was charged to Accounts Payable.

Following questions are answered in this case study solution

-

General Journal for the Year Ended 31 July 2012

-

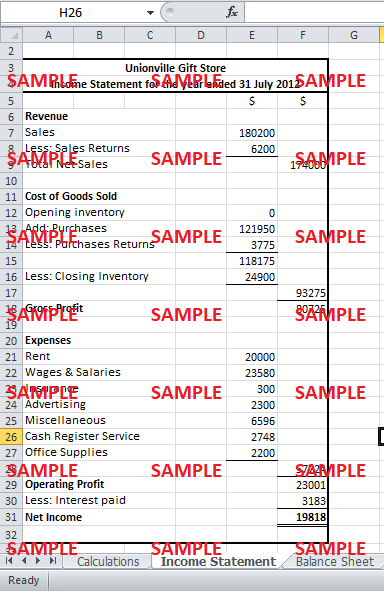

Income Statement for the year ended 31 July 2012

-

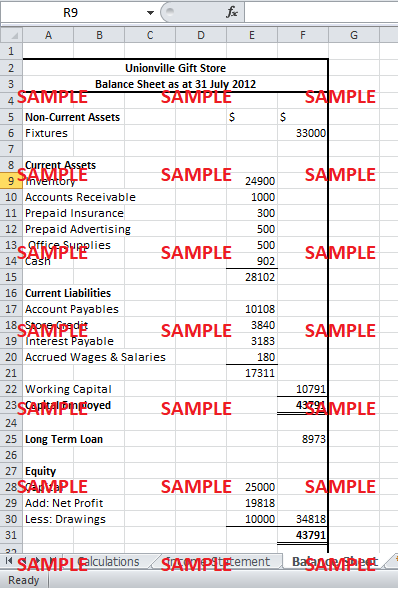

Balance Sheet as at 31 July 2012

Case Analysis for The Unionville Gift Store

1. General Journal for the Year Ended 31 July 2012

|

No. |

Debit |

Credit |

||

|

Description |

Amount ($) |

Description |

Amount ($) |

|

| 1 |

Cash |

25,000 |

Capital (Owner’s Equity) |

25,000 |

|

2 |

Cash |

40,000 |

Long term Liability |

40,000 |

|

3 |

Long-term Liability |

31,027 |

Cash |

31,027 |

|

4 |

Fixtures |

30,000 |

Cash |

33,000 |

|

5 |

Rent Expense |

20,000 |

Cash |

20,000 |

|

6 |

Wages & Salaries expense |

23,580 |

Cash |

33,400 |

|

7 |

Insurance Expense |

300 |

Cash |

600 |

|

8 |

Advertising Expense |

2,300 |

Cash |

2,800 |

|

9 |

Miscellaneous Expenses |

6,596 |

Cash |

6,596 |

|

10 |

Cash Register Service |

2,748 |

Cash |

2,748 |

| 11 |

Office Supplies Expense |

2,200 |

Cash |

2,700 |

|

12 |

Accounts Payable |

108,067 |

Cash |

108,067 |

| 13 |

Purchases |

121,950 |

Purchases Returns |

3,775 |

| 14 |

Cash |

139,200 |

Sales |

180,200 |

| 15 |

Sales Returns |

6,200 |

Cash Accounts Receivable Store Credit Payable |

300 |

| 16 |

Interest Expense |

3,183 |

Interest Payable |

3,183 |

|

No. |

Narration |

| 1 |

Burns brought $25,000 as his investment in the business. This increased the cash account and the Owner’s Capital. |

| 2 |

Burns also took a loan from a bank. Since he did not pay the entire amount in one year, it will be considered as a long-term liability. Because the liabilities have a credit nature, they will be credited when they increase. Cash account also increased. Therefore, they are debited by $40,000. |

| 3 |

During the year, Burns paid part of his Long term Loan amounting to $31,027 by cash, so it will be debited, and cash account will be credited with the same amount. |

| 4 |

Fixtures were bought during the year by cash for $30,000. Freight charges were also paid to bring in those assets. The cash account was credited with a total sum of $30,000, |

| 5 |

During the year, Rent was paid by cash. Since Rent expense has a debit balance, it was debited, and because cash balance was decreasing, the cash account was credited by $20,000. |

| 6 |

Wages and Salaries expense for the year were $23,580. $180 of this balance was still outstanding at the year-end and therefore, was considered as a current liability (Wages payable). Cash paid for Wages during the year amounted to $23,400. Personal drawings by Burns were also mistakenly added in the Wages and Salaries Amount. An adjusting entry was then recorded to account for the drawings that had been paid for by cash. |

| 7 |

During July 2012, Burns paid an insurance premium for a policy that would cover the period from 1st August 2012 to 31st July 2013. This period is not in the current year. Therefore, $300 would be considered as an expense that has been paid for in advance. It would appear on the Balance Sheet as an asset. The Insurance expense for the year would be the cash paid i.e. $600 less the prepaid amount $300, which would also turn out to be $300. This amount would be charged in the Income Statement under the head of expenses. |

| 8 |

Similarly, $500 of the advertising expenses that have been paid during the year are for an event that would occur after the year-end date. Therefore, only $2300 will be charged as Advertising Expense for the year. $500 will be considered as a prepaid expense, and cash account will be credited by $2800. |

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Groupe Ariel S A Parity Conditions And Cross Border Valuation Case Solution

- Holt Lunsford Commercial Case Solution

- Netflix Continues To Change The Face Of In-Home Movies Around The Globe Case Solution

- Toronto Dominion Bank Green Line Investor Services 1996 Case Solution

- Leadership At WildChina A Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.