Get instant access to this case solution for only $19

Twilight Acre Farms Limited Case Solution

Twilight Acre Farms limited was a farming business that started in 1961. Their products included wheat, beans, and corn. Twilight Acre Farms was a medium-scale farming business. The farming industry itself was surrounded by small farms. In fact, two-thirds of all farms were small-scale farms. The market didn’t allow for any product differentiation; hence farms competed on non-monetary features, such as competition for contracts with buyers or custom work. At the end of the 2003 harvesting season, Steve Twynstra was in a dilemma, whether to repair one of his two combines or buy a new machine. Buying a new machine will not only save costs but will also boost the productivity of the farm. But, to finance that, Steve will need financial assistance from a bank, which will increase the business’s debt level. The machine can also be used for custom work. After the net present value analysis, he will be in a better position to decide whether to buy the machine or not.

Following questions are answered in this case study solution

-

What is the decision that Steve Twynstra needs to be make?

-

What criteria can you use to help Steve make the decision?

-

Perform a Net Present Value calculation for the new machinery investment Hint, if he buys the new machine he can sell the old one, so one must consider the incremental cash flows:

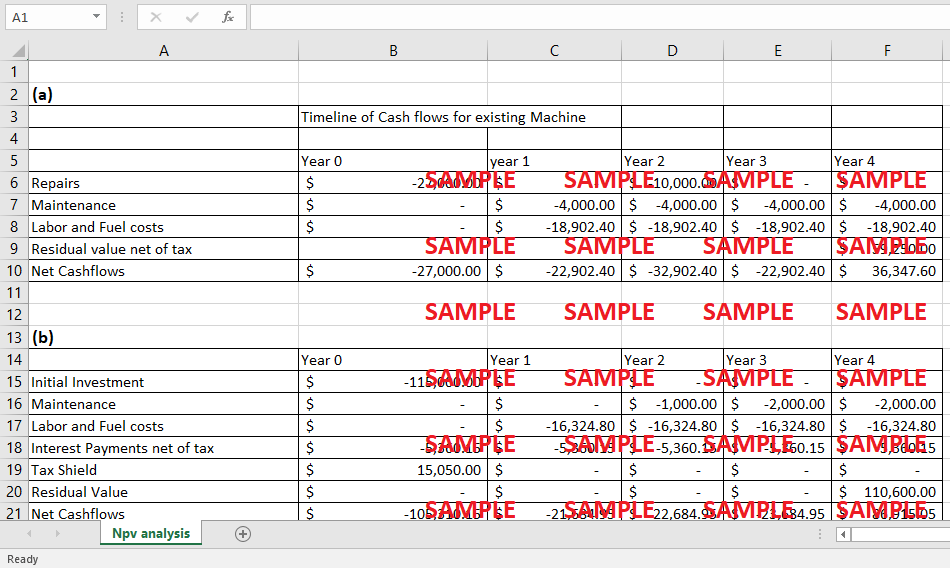

a. List on a timeline, the annual cash inflows and outflows if Steve were to repair the current combine; if he were to buy the new machine the relevant cash flows will be opposite in sign to these cash flows

b. List on a separate timeline, the cash inflows and outflows if Steve were to purchase a new combine and trade-in the old machine.

c. Assuming tax rate of 21%, Cost of Capital of 15% and Capital Cost Allowance of 30%, the Present Value of the Tax Shield is $15,050

d. Net out all the cash inflows and outflows from a, b and c and create a new time line that represents the after tax cash flows from making the new machinery investment

e. Compute the NPV of the after tax cash flows

f. Calculate the payback period (this ignores the time value of money)

-

Discuss the qualitative pros and cons of purchasing the new machine.

Case Analysis for Twilight Acre Farms Limited

1. What is the decision that Steve Twynstra needs to be make?

Since Steve Twynstra owns a farm and sells products which can’t be differentiated, he will have to engage in non-price competition, such as competing for contracts from buyers and more custom orders from customers. To achieve this goal, he needs to carefully decide whether to repair his old machinery, CaseIH or buy a new CaseIH combine that can then replace his old worn-out machine. This decision will be very important for Steve as this decision will help his farm to expand and increase its revenues and profit in the most efficient way. This decision will depend upon many factors, including whether Steve can bear the increase in the debt levels to finance the purchase of the new machine or whether or not the new machine will offer Steve the required return on capital. He will also need to take into account whether his employees will feel comfortable on the field or not when the new machine arrives with more advanced features.

2. What criteria can you use to help Steve make the decision?

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.