Get instant access to this case solution for only $19

Warren E. Buffett, 2005 Case Solution

Acquisition Pacific Corp. would create a great value for companies, Berkshire Hathaway and Scottish Power plc, and this announcement of acquisition lead to $2.55billion gain in Berkshire’s market value of equity. Berkshire Hathaway is paying around $9.4 billion for Pacific Corp. when the range of enterprise value of Pacific Corp is from $6.252 billion to $9.289 billion, calculated through multiples of comparable firms. Berkshire Investment in Big four has generated huge returns. Investment Philosophy of Warren Buffet has emphasized on intrinsic value, economic reality, and understanding of the business. Warren Buffer disagrees with conventional methods of using discount rates and diversification for reducing the risk. Berkshire Hathaway’s shareholders should support the acquisition of PacifiCorp as the Berkshire Hathaway has a lot of cash equivalents which must be invested for the positive returns and for long term growth stability.

Following questions are answered in this case study solution

-

What is the possible meaning of the changes in stock price for Berkshire Hathaway and Scottish Power plc on the day of the acquisition announcement? Specifically, what does the $2.17-billion gain in Berkshire’s market value of equity imply about the intrinsic value of PacifiCorp?

-

Based on the multiples for comparable regulated utilities, what is the range of possible values for PacifiCorp? What questions might you have about this range?

-

Assess the bid for PacifiCorp. How does it compare with the firm’s intrinsic value? As an alternative, the instructor could suggest that students perform a simple discounted cash flow (DCF) analysis.

-

How well has Berkshire Hathaway performed? How well has it performed in the aggregate? What about its investment in MidAmerican Energy Holdings?

-

What is your assessment of Berkshire’s investments in Buffett’s “Big Four”: American Express, CocaCola, Gillette, and Wells Fargo?

-

From Warren Buffett’s perspective, what is the intrinsic value? Why is it accorded such importance? How is it estimated? What are the alternatives to intrinsic value? Why does Buffett reject them?

-

Critically assess Buffett’s investment philosophy. Be prepared to identify points where you agree and disagree with him.

-

Should Berkshire Hathaway’s shareholders endorse the acquisition of PacifiCorp?

Case Analysis for Warren E. Buffett, 2005

1. What is the possible meaning of the changes in stock price for Berkshire Hathaway and Scottish Power plc on the day of the acquisition announcement? Specifically, what does the $2.55-billion gain in Berkshire’s market value of equity imply about the intrinsic value of PacifiCorp?

Acquisition of PacifiCorp would create huge positive value for both Berkshire Hathaway and Scottish Power plc and hence, stock prices increased. This acquisition would create a more diversified portfolio for Berkshire Hathaway while this acquisition was the largest deal for Buffett since 1998; hence, this acquisition was rated very high, and share prices of both companies increased.

With total of 312.18 million shares of PacifiCorp and gain of $2.55 billion, Berkshire Hathaway is paying a premium of $8.15 per share. As the total value bid in cash is 5.1 billion, so with cash of $16.33 per share, total intrinsic value comes out to be $24.48 which is very well compared to competitors.

2. Based on the multiples for comparable regulated utilities, what is the range of possible values for PacifiCorp? What questions might you have about this range?

As implied values of PacificCorp’s enterprise value and market value of equity are derived using the median and mean multiples of comparable firms. In Exhibit 10, the range of enterprise value of Pacific Corp is from $6.252 billion to $9.289 billion. Berkshire Hathaway is paying around $5.1 billion in cash and $4.3 billion in liabilities and preferred stock which is higher than the range of enterprise value of the PacificCorp. The possible question here is that why Berkshire Hathaway is paying higher than the possible range of of enterprise values. As the whole acquisition involves huge investment, are this range of intrinsic values of the company compared to its competitors and would this company be able to maintain sustainable growth over a long period of time. All these questions need to be explored before the acquisition.

3. Assess the bid for PacifiCorp. How does it compare with the firm’s intrinsic value? As an alternative, the instructor could suggest that students perform a simple discounted cash flow (DCF) analysis.

Value of the Pacific Corp can be calculated through following formula:

Market value of the company = Market Multiple * EBITDA

From Exhibit 10, using the EBITDA multiples for Alliant Energy Corp., Cinergy Corp., NSTAR, SCANA Corp. and Wisconsin Energy Corp. mean EBITDA multiple is around 8.30 while median value is 8.25. EBITDA of Pacific Corp. is $1093 million and hence using the above formula, the range value of the Pacific Corp. comes out to be $9071 million using Market Multiple of 8.30, and $9017 million if Market Multiple is 8.25. Total Value of the bid is $9.4 billion and hence it can be said that value of the bid is closer to its intrinsic value calculated through comparable firms.

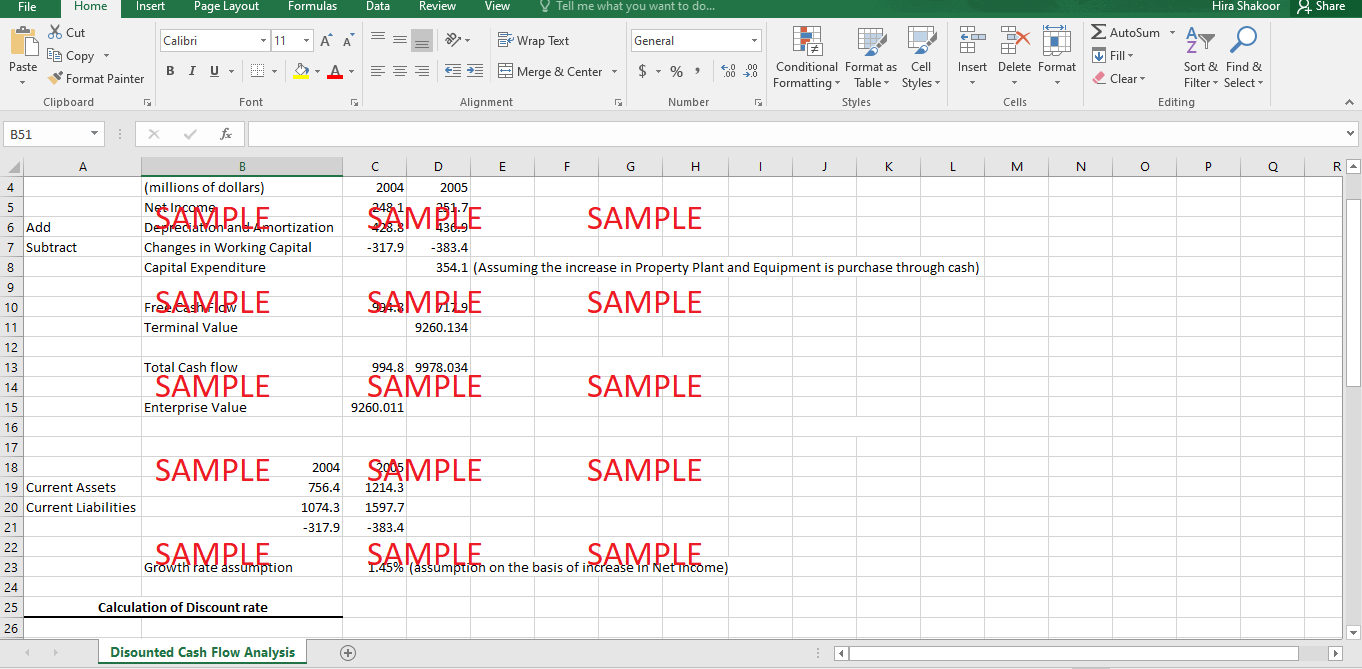

In Exhibit 10, range of enterprise value of Pacific Corp, using multiples of the comparable firms, is from $6.252 billion to $9.289 billion and hence intrinsic value would fall in this range. However, calculation of the value using EBITDA multiple, it is evident that the bid of $9.4 million could be said to be closer to the firm’s intrinsic value. Discounted Cash flow analysis, with a growth rate of 1.45% and a discount rate of 9.32%, enterprise value comes out to be $9.26 billion.

4. How well has Berkshire Hathaway performed? How well has it performed in the aggregate? What about its investment in MidAmerican Energy Holdings?

Berkshire Hathaway has performed remarkably well. It has seen a compound annual increase in wealth of 24% from 1965 to 2004. Prices of its Class A shares also increased a lot, from $102 in 1997 to $85,500 on May 24, 2005. Over the same period, the S&P’s 500 index grew from 96 to 1,194. This could be considered as quite a consistent performance over the year which has astonished most observers.

Investment in MidAmerican Energy Holdings gave a 9.9% voting interest and an 83.7% economic interest in the equity of MidAmerican. This voting interest and economic interest provide great rights to the company. MidAmerican had Net Earnings of $170 million in 2004 while it had Net Earnings of around $416 million in 2003 which shows that performance of the company has decreased along with the value of the investment of Berkshire Hathaway.

5. What is your assessment of Berkshire’s investments in Buffett’s “Big Four”: American Express, CocaCola, Gillette, and Wells Fargo?

From the Exhibit 3, it is quite evident that Berkshire’s investments in all these big four companies are quite successful, and these have generated huge returns for the company.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.