Get instant access to this case solution for only $19

Bidding for Antamina Case Solution

This case analyzed the bidding process for copper mine that was offered as a sale in connection with the overall strategy of Peruvian government to privatize the national institutions. The auction process comprises of different options that make this auction a real option. Three distinct options are provided to the bidders, and the choice of selection lies with Peruvian government. For the purpose of evaluating the real options, Monte Carlo simulation is employed to value the discounted cash flows. For each of the option, the NPV of mine is calculated. This net present value will offer the benchmark to the bidders for the final bid. The primary structure of the auction process gave rise to incentives that affected the value of the auction.

Following questions are answered in this case study solution:

-

In what way is the development of a copper mine like Antamina a real option? In what way is the bidding structure put in place by the Peruvian government an option? What is the correspondence between these real options and financial options? What other real options does the owner of the Antamina have?

-

Conceptually, how would you build a real options model to value the Antamina project? What data and assumptions would you need? What would be the key assumptions and limitations of the model? Review the model suggested in the reading on the basis of your reactions to these questions?

-

Consider the bids that should be made for the property under these three different sets of auction procedures:

-

If the winning bidder was legally forced to develop Antamina after completing the exploration phase, and was required to pay the Peruvian government up-front for this project, what is the most they would be willing to bid?

-

If the winning bidder could choose whether or not to develop Antamina at the end of two years, but was required to pay the Peruvian government a single fee up-front for the right to develop the project, what is the most they would be willing to pay? Under this alternative, there is no investment commitment or penalty; the firm merely pays the government up front, and has the right to develop at the end of two years. If they don’t develop at year two, they lose the right to develop the field.

-

Under the current bidding rules, the winning bidder states both an initial cash payment as well as an investment commitment that is paid only if they choose to develop the field. Bids are developed by summing up-front amount and 30% of the investment commitment. If you proceed with development, but fail to spend the full investment commitment, the Peruvian government will fine you 30% of the difference. What is the most you would be willing to bid under these rules? How would you trade-off these two components of the bid?

-

What are the incentives brought about by the different auction rules? Do the rules seem to meet what you perceive to be the goals of the Peruvian government?

Case Analysis for Bidding for Antamina

1. In what way is the development of a copper mine like Antamina a real option? In what way is the bidding structure put in place by the Peruvian government an option? What is the correspondence between these real options and financial options? What other real options does the owner of the Antamina have?

Real option corresponds to an option in the investment opportunity that becomes available in lieu of an alternative or choice structure. Real options are not in any sense related to derivative instruments which are predominantly financial options. In real option, there is a tangible asset present at hand and the investment opportunity changes its value in relation to the options available with this tangible asset. Three basic types of real options comprise:

-

the option to abandon

-

the option of Timing / Growth

-

the option to defer

In the case of Antamina, the mine itself comprise of a real option in a sense that the successful bidder had the right to develop the mine after exploration. This feature of the investment makes this option to bid a real option.

The auction process put forward by the Peruvian government was a little subtle. The successful bidder has the option to invest in the mine in the first two years. If the investment fell short of a predetermined amount, subsequent decision by the government of will decides the fate of the bidder. In essence, the bidder has three distinct options and the outcome in the three outcomes is also different. The successful bidder will have the option to put the amount of money in the exploration in the first two years.

The following table shows the correspondence between real option and financial options.

|

Real Option |

Variable |

Financial Option |

|

Present value of expected cash flows |

V |

Stock price |

|

Present value of investment outlays (cost |

I |

Exercise price of the option |

|

of converting the investment |

|

|

|

opportunity into the option’s underlying |

|

|

|

asset) |

|

|

|

Length of deferral time |

T |

Time to maturity |

|

Time value money |

rf |

Risk-free rate |

|

Volatility of project’s returns |

σ2 |

Variance of stock returns |

For every underlying variable, the correspondence is established between real option and financial option. Currently, the owner of Antamina has the option to defer the auction of mine and invest in mine.

2. Conceptually, how would you build a real options model to value the Antamina project? What data and assumptions would you need? What would be the key assumptions and limitations of the model? Review the model suggested in the reading on the basis of your reactions to these questions?

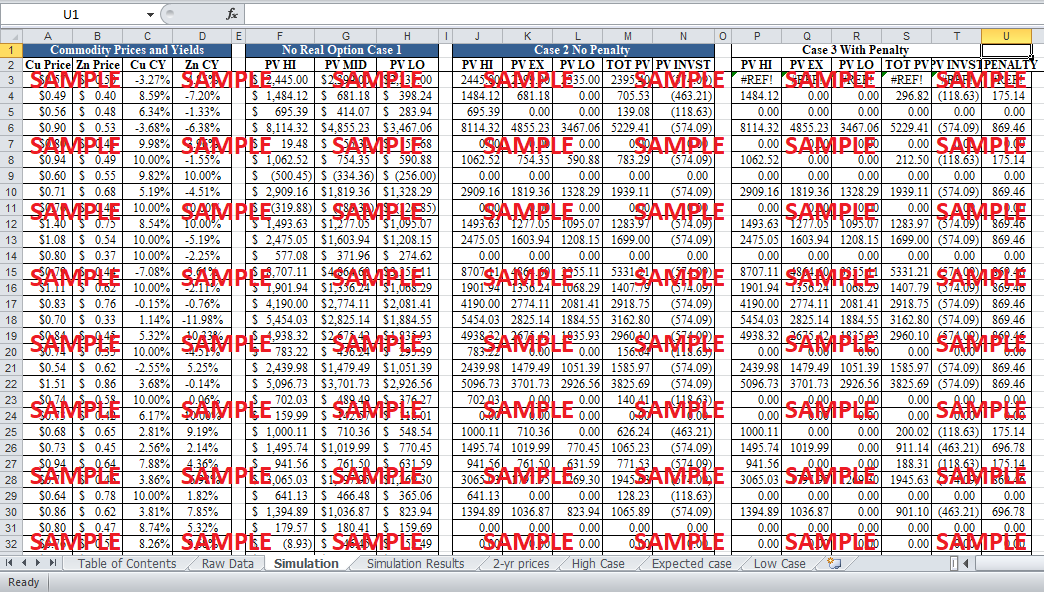

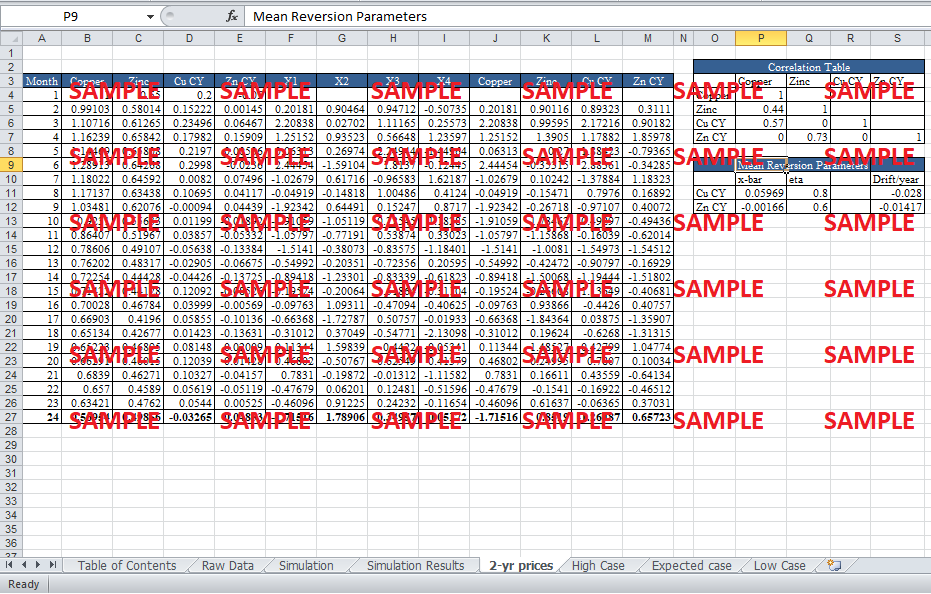

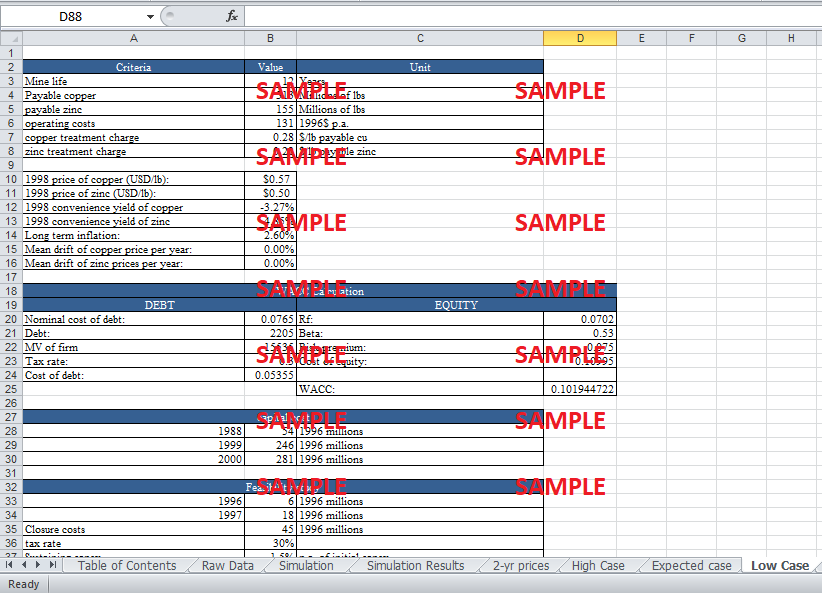

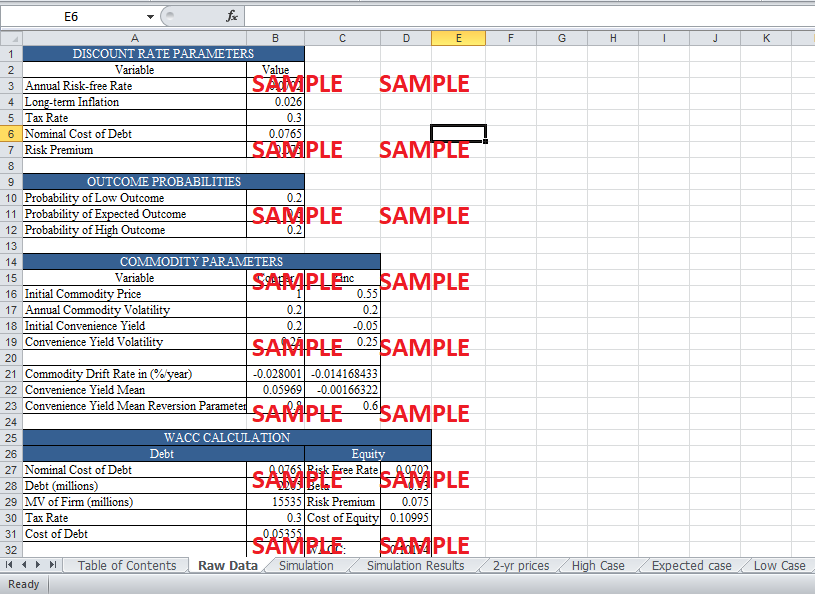

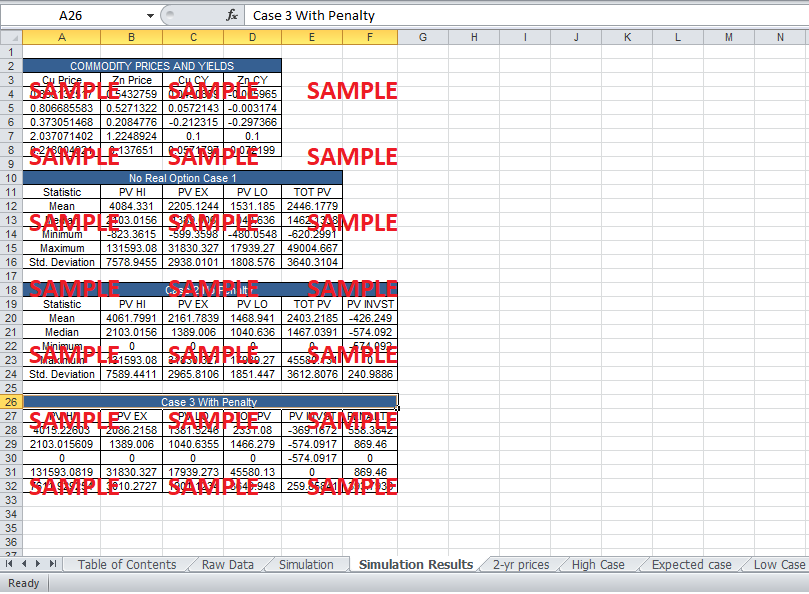

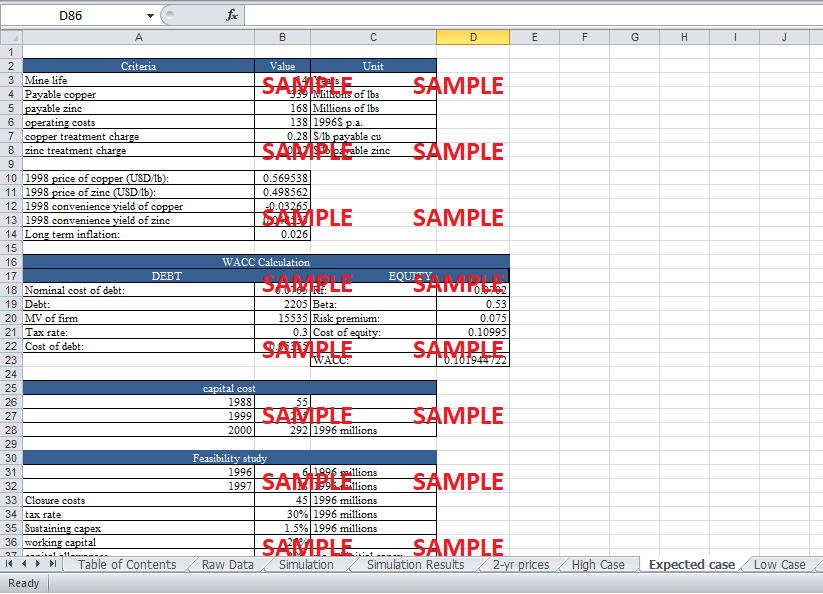

The real option pertaining to the valuation of Antamina will be complex. In the present case, the real option model is suitable for valuation of the project as it accounts for the future flexibility in the strategic decision making. There are always some basic assumptions that a real option model constitutes. The first assumption constitutes the uncertainty regarding the future process of zinc and copper. The futures prices of zinc and copper can be simulated by using a Monte Carlo simulation model in Microsoft excel. In this way, the uncertainty regarding the future prices can be reduced. For each run of Monte Carlo simulation, a price and convenience yield path is constructed on a monthly basis according to the commodity’s volatility, mean reversion parameters, and correlations with the other parameters. The final price and convenience yield path is used as an input in order to calculate a 20 year forward curve of copper and zinc prices. This value is used in the 'discounted cash flow analysis' to model the future prices. Also, in the calculation of weighted average cost of capital, there are certain assumptions required including the long term inflation rate and hence the cost of equity. The model suggested in the readings is quite similar to one developed conceptually.

3. Consider the bids that should be made for the property under these three different sets of auction procedures:

i. If the winning bidder was legally forced to develop Antamina after completing the exploration phase, and was required to pay the Peruvian government up-front for this project, what is the most they would be willing to bid?

In this case, the winning bidder was going to be forced to develop the site and make investment in first two years. However, the successful bidder did not have the option to abandon the project after two years of the exploration phase. Ideally, the bid should be comparatively low in this case. The bid analysis can be carried out by developing a discounted cash flow model. After finding the present value of mine for two years, the present values of the investment and the feasibility study are going to be subtracted in order to find the project NPV. The bid would be placed a little above or equal to the NPV value. The calculations show that the $1504 million.

ii. If the winning bidder could choose whether or not to develop Antamina at the end of two years, but was required to pay the Peruvian government a single fee up-front for the right to develop the project, what is the most they would be willing to pay? Under this alternative, there is no investment commitment or penalty; the firm merely pays the government up front, and has the right to develop at the end of two years. If they don’t develop at year two, they lose the right to develop the field.

In this case, the winning bidder was not going to be forced to develop the site and the initial investment on the mine was must. Therefore, the successful bidder had the option to abandon the project after two years of the exploration phase. Ideally, the bid should be comparatively high in this case. The bid analysis can be carried out by developing a discounted cash flow model. After finding the present value of mine for two years, the present values of the investment and the feasibility study are going to be subtracted in order to find the project's NPV. The bid would be placed a little above or equal to the NPV value. The calculations show that the $1605 million.

iii. Under the current bidding rules, the winning bidder states both an initial cash payment as well as an investment commitment that is paid only if they choose to develop the field. Bids are developed by summing up-front amount and 30% of the investment commitment. If you proceed with development, but fail to spend the full investment commitment, the Peruvian government will fine you 30% of the difference. What is the most you would be willing to bid under these rules? How would you trade-off these two components of the bid?

In this case, the winning bidder was not going to be forced to develop the site; however, upon choosing to abandon the project; the bidder has to pay a predetermined penalty. Therefore, in essence the successful bidder had the option to abandon the project after two years of the exploration phase. Ideally, the bid should be comparatively low in this case.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.