Get instant access to this case solution for only $19

Big City Courier Case Solution

Based on the analysis and assessment, it would be recommended to Geoffrey Taylor to focus on the debtors monitoring and improve the receipts from accounts receivables by evaluating the debtor's ageing period in detail. For customers failing to pay beyond 15 days, a text reminder is sent to them, for those falling beyond 30 days, a telephonic reminder is given and for those falling beyond 45 days, a threat to take a legal action to be sent to compel them to make their payments. This would ensure that debtor recovery is high which would positively impact on the cash flows.

Following questions are answered in this case study solution

-

How important is cash to business. (Seems like a simple answer but consider profitability)

-

Prepare cash flow statements using the indirect method for Big City Courier for January, February and March 1997.

-

Use financial ratio's, e.g. profit margin (your choice which ones you choose to include) to further explain the situation at Big City Courier.

-

Detail how you think Big City Courier is financing its day-to-day operations and include in your answer what you believe to be the underlying economics of the courier business impacting these operations.

-

Describe the options/alternatives that you think are available to Big City Courier to increase its cash balance.

-

Based on your analysis and assessment identify recommendations you would make to Geoffrey Taylor, owner of Big City Courier on how he could improve the cash flow situation of his company. Ensure to include the timelines of your recommendations on the survival of the company.

Case Analysis for Big City Courier

1. How important is cash to business. (Seems like a simple answer but consider profitability)

Cash is considered the king of the business and it is very crucial for the businesses to have a better liquidity position to ensure its smooth operations (Liu, Nissim, & Thomas, 2007). In every business sector, the cash flow of the business determines whether the business will be able to pay creditors on time and finance its day to day operations. Shortage of cash may force the business to take overdraft facility which might directly hit on the interest costs as the interest is charged daily in overdraft facility. This would negatively impact the profitability of the business (Binks & Ennew, 1997). Furthermore, failure to pay the suppliers on time due to insufficient cash may lead the business to bankruptcy or cause suppliers to stop all the deliveries which would have a detrimental effect on the business’s ability to produce goods or services which would again adversely affect the profitability of the company. Therefore, it is very important to note that businesses with increasing profitability might also go bankrupt or start making huge losses due to ineffective cash flow management (Tobback, Bellotti, Moeyersoms, Stankova, & Martens, 2017).

2. Prepare cash flow statements using the indirect method for Big City Courier for January, February and March 1997.

|

Big City Courier |

|||

|

|

1997 |

||

|

|

Jan |

Feb |

March |

|

Cash Flow From Operating Activities |

in $ |

||

|

Net Income |

2,451 |

4,408 |

6,326 |

|

Add: Non-Cash Charges |

- |

- |

- |

|

Add: Changes in Working Capital |

|

|

|

|

Change in Accounts Receivable |

11,151 |

(4,952) |

(7,211) |

|

Change in Accounts Payable |

(3,355) |

(1,563) |

(342) |

|

Cash Generated from Operation |

10,247 |

(2,107) |

(1,227) |

|

|

|

|

|

|

Cash flows from Investing Activities |

|

|

|

|

Purchase of Radio Equipment |

0 |

-177 |

0 |

|

Net Cash Used in Investing Activities |

0 |

-177 |

0 |

|

|

|

|

|

|

Cash flows from Financing Activities |

|

|

|

|

Finance Cost Paid |

-211 |

-215 |

-223 |

|

Net Cash Used in Financing Activities |

-211 |

-215 |

-223 |

|

|

|

|

|

|

Net Increase in Cash and Cash Equivalents |

10,036 |

(2,499) |

(1,450) |

|

Cash and Cash Equivalents at the beginning of the period |

(9,688) |

348 |

(2,151) |

|

Cash and Cash Equivalents at the end of the period |

348 |

(2,151) |

(3,601) |

Looking at the cash flow position of the Big City Courier, it can be seen that the cash held by the business by the end of the month is gradually deteriorating over the period January to March, 1997 where it has fallen from $348 to a negative balance of $3601. This is a very concerning situation as such a balance shows that the company has a high probability of failing to make its payments of drivers commissions which can lead to delay in its services and a negative impact on its brand reputation in the market where the main focus is on the quick and timely delivery. The failure to meet these market requirements may lead the company to lose the business to its competitors due to the highly competitive couriers' industry.

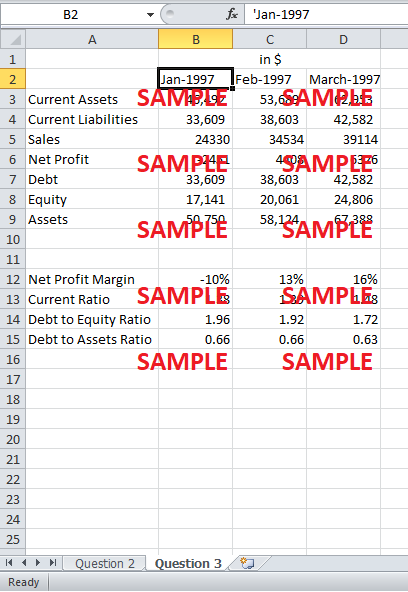

3. Use financial ratio's, e.g. profit margin (your choice which ones you choose to include) to further explain the situation at Big City Courier.

|

|

-10% |

13% |

16% |

|

Current Ratio |

1.38 |

1.39 |

1.48 |

|

Debt to Equity Ratio |

1.96 |

1.92 |

1.72 |

|

Debt to Assets Ratio |

0.66 |

0.66 |

0.63 |

It is important to note that the current ratio calculation of the Big city courier shows a rising trend over the three months’ period which is a positive sign and shows that the business is liquid. On the contrary, the cash flow does not reflect this and shows a negative balance. Through this, it can be evaluated that although the company is enjoying increasing trend of receivables, its payment to drivers which forms a huge chunk of its cost is increasing at a higher pace which has eaten up most of the cash it has received from the receivables. Furthermore, the delay in receipts of the payments from the clients also shows that the debtors ageing is not being effectively monitored which has created the cash flow problem. Therefore, there needs to be a proper system to monitor the debtors and ensure that payments are received from them before them becoming bad debts (Dhillon, García‐Fronti, Ghosal, & Miller, 2006).

Apart from this, looking at the net profit margins, it can be derived that the company's profitability has improved substantially from the past three months from a net loss margin of 10% in January, 1997 to a net profit margin of 16% in March-1997. The improved profitability gives the impression that the business has established in the market and is on a growing trend. Because of a highly competitive environment, placing tighter credit terms on receivables may cause them to switch to competitors due to very low switching costs. Such a situation would, however, adversely affect the profitability of the company. This, therefore, explains the reason why the company has gotten into a liquidity crisis despite improving its performance and volume consistently.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Onefinestay Building A Luxury Experience In The Sharing Economy Case Solution

- Burton Sensors Inc Case Solution

- Reawakening The Magic Bob Iger And The Walt Disney Company Case Solution

- CMNGD Commongood Linens Scaling A Work Integration Social Enterprise Case Solution

- Biblio Credit Union Social Inequality And The Living Wage Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.