Get instant access to this case solution for only $19

Burton Sensors Inc Case Solution

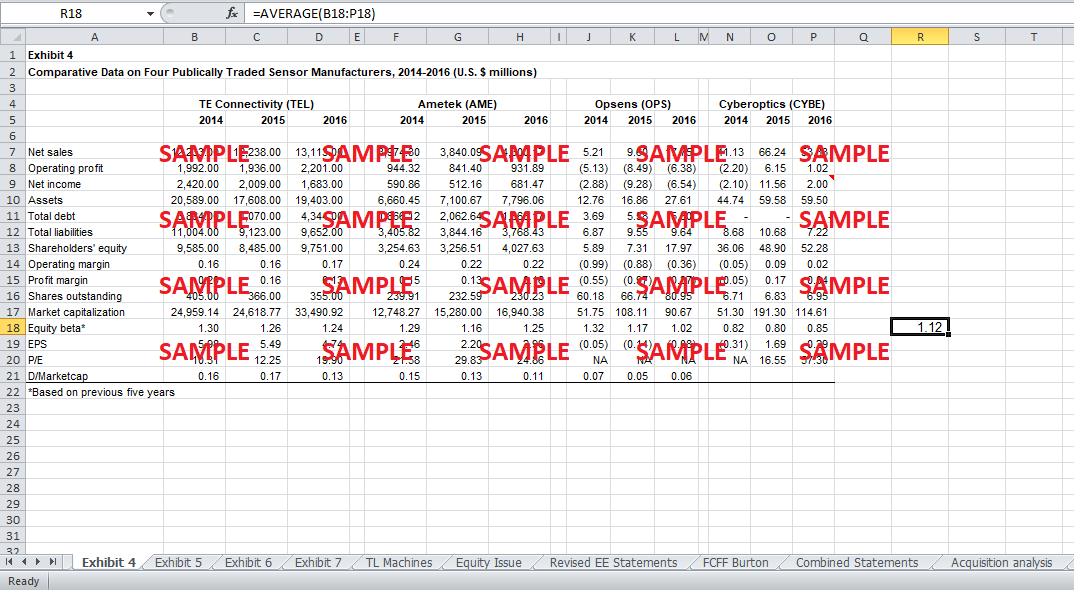

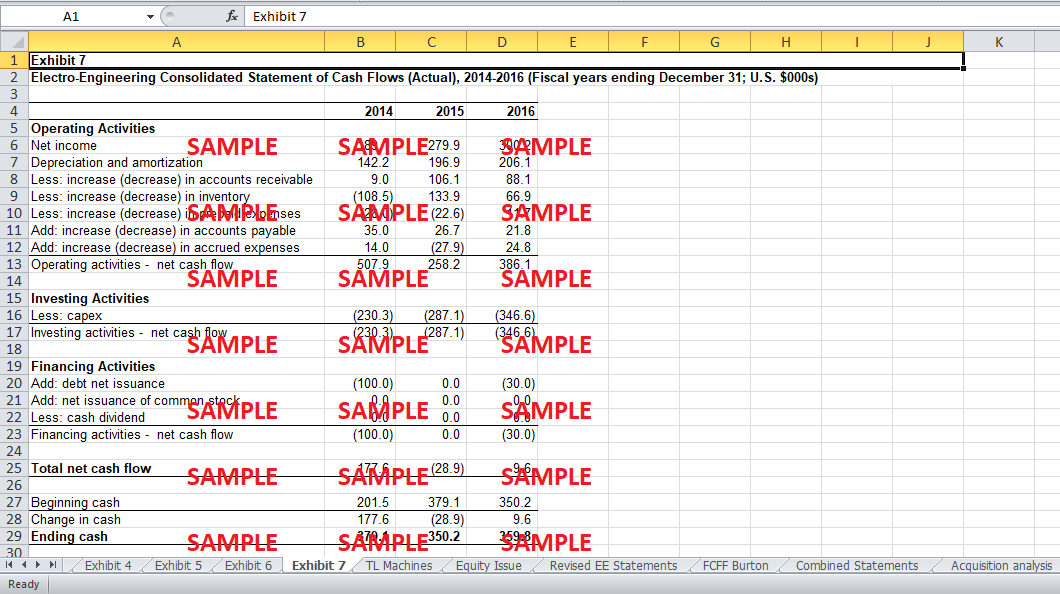

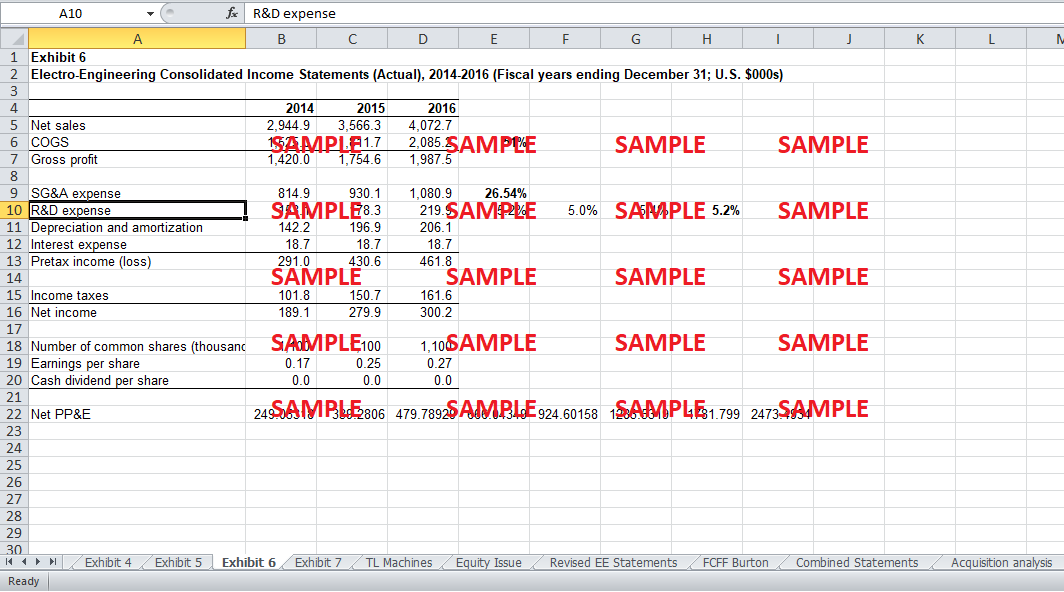

Burton Sensors is a small, rapidly growing company that manufactures temperature sensors. However, this rapid growth has led Burton to reach its debt capacity, which now seeks equity financing to sustain its high growth. At the beginning of 2017, the President of the company, Amy Marshall, faces the question of whether the company should purchase thermowell machines that could produce thermowells instead of buying the additional thermowells separately. Another issue faced by Marshall is whether it should issue common stock via private placement at lower prices or go for its conventional route of trading Over the Counter and whether it should acquire another sensor manufacturing company.

Following questions are answered in this case study solution

-

What are the most important consequences for Burton Sensors, Inc., if Marshall continues to pursue a high-growth strategy?

-

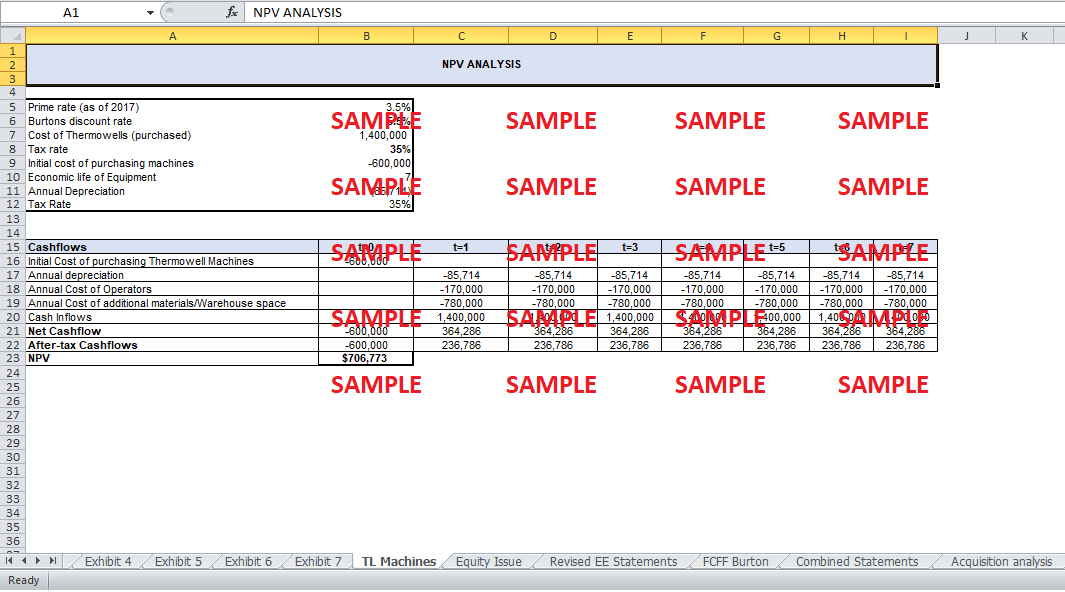

Should Marshall purchase the thermowell machines? Why or why not?

-

Should Marshall accept the offer of the private investor and issue new equity? Why or why not?

-

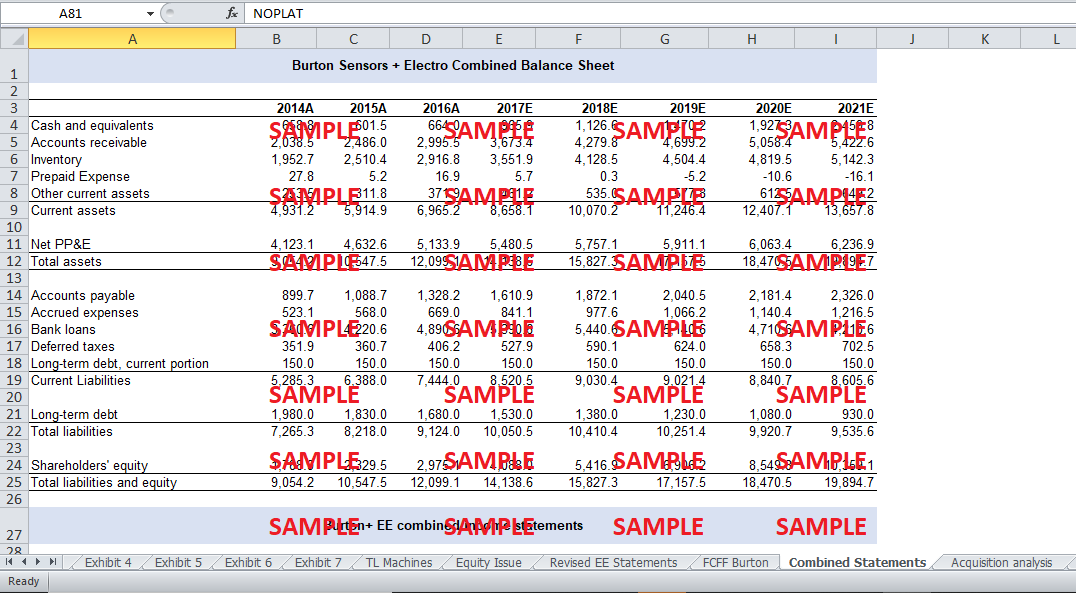

Should Marshall acquire Electro-Engineering, Inc. (EE)? Why or why not?

Case Analysis for Burton Sensors Inc

1. What are the most important consequences for Burton Sensors, Inc., if Marshall continues to pursue a high-growth strategy?

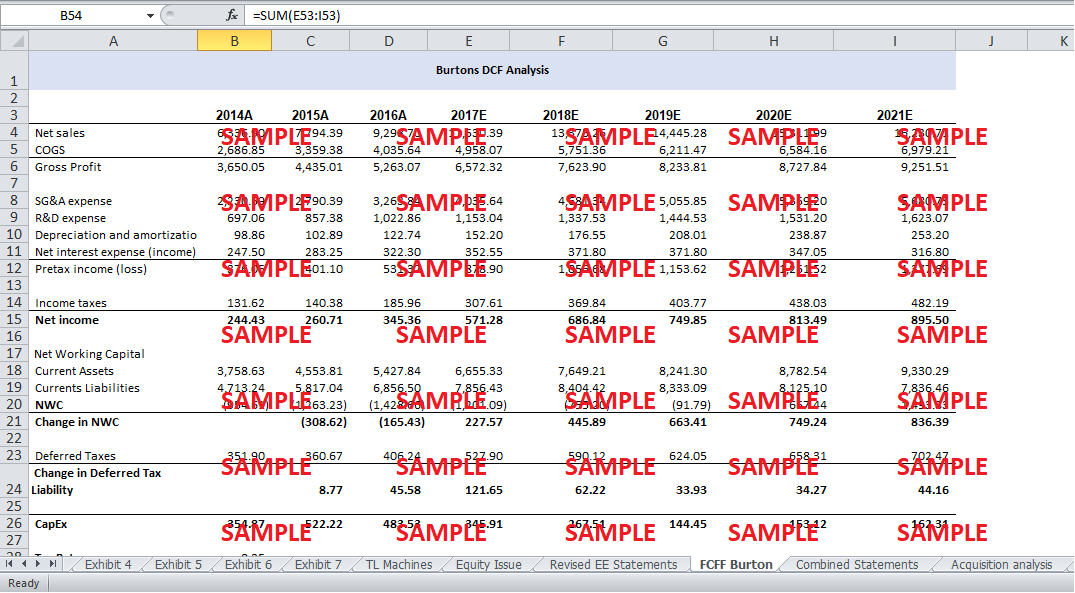

One of the consequences for continuing to pursue a high-growth strategy is that Burton may soon face a cash flow crunch. Since its sales growth outpaced its growth in cash flows, the company would have to maintain even higher levels of working capital to support its growth than it is currently maintaining.

Secondly, Burton could possibly lose the required line of credit provided by its bank. Burton already depended on short term debt, to a huge extent, to finance its operations. This has led to its total liabilities being five times its net worth, and its outstanding bank loans being 96% of the total value of its account receivables and inventory, which is far in access to industry norms. Burton's bank has informed Burton of future restrictions that it would impose on loans and until Burton can manage to stay within the two restrictions, it may have a chance of losing its desired line of credit.

Thirdly, due to the private placement, existing shareholders will experience dilution of their shares in order to raise additional equity capital. However, if this additionally raised equity capital is unable to sustain Burton's projected sales growth, there could be issues with satisfying covenants of the bank loan. Furthermore, Burton could lose customers if it did not have enough inventory to meet the potential increase in customer orders. Key sales personnel could lose confidence in the company's ability to grow.

One final consequence of continuing to pursue a high-growth strategy is taking on risky ventures which could, in fact, hurt shareholder value instead of improving it.

2. Should Marshall purchase the thermowell machines? Why or why not?

Yes, since NPV analysis (shown in excel under “TL Machines” tab) shows NPV to be positive, Marshall should purchase the thermowell machines. Any project displaying a positive NPV should be considered since the analysis indicates that a positive value leads to direct value addition to the firm. In this case, this is because the cost of purchasing these thermowell machines is much lower than the cost of purchasing thermowells separately, the equipment would only require the hiring of two operators to run the machine, and the cost-savings that the produced thermowells could generate annually would outweigh the cost of buying additional materials and renting warehouse space. It is, therefore, less costly to purchase the thermowell machines and producing thermowells in-house instead of having to buy additional thermowells.

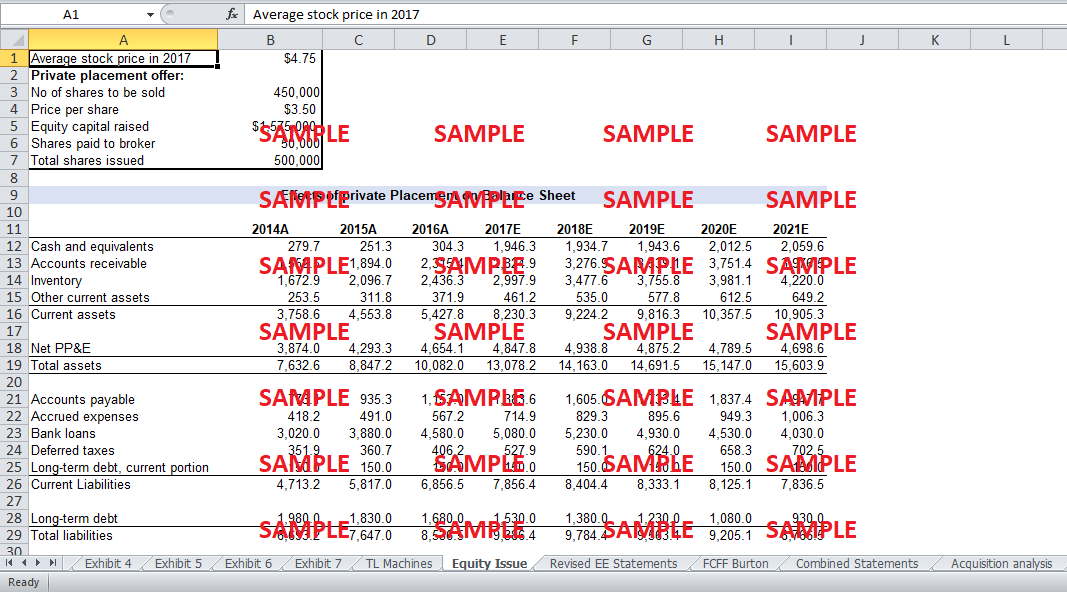

3. Should Marshall accept the offer of the private investor and issue new equity? Why or why not?

Yes, Marshal should accept the offer. A private placement can be beneficial to Burton because given how thin the market was for its shares, there is the risk that Burton would not be able to raise sufficient capital if it continues to pursue its traditional methods. With pending limitations from Burton’s bank, this could become even more important for Burton.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Reawakening The Magic Bob Iger And The Walt Disney Company Case Solution

- CMNGD Commongood Linens Scaling A Work Integration Social Enterprise Case Solution

- Biblio Credit Union Social Inequality And The Living Wage Case Solution

- Biblio Credit Union Social Inequality And The Living Wage Case Solution

- Comfort Remote Site Services LTD Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.