Get instant access to this case solution for only $19

Brazos Partners: The CoMark LBO Case Solution

Brazo Partners is a middle market LBO group which has access to a capital $400 million. The firm’s strategy is to buyout companies with values ranging from $25 million to $250 million along with strong cash flows and good management. CoMark was a considerable deal because it satisfies the criteria of buyouts by Brazo Partners. The partners of a new mid-market buyout fund are executing on a leveraged buyout of a strictly held modular manufacturing firm. The transaction was initially structured as a stock purchase transaction. However, later it was realized that an asset purchase transaction is more desirable from the point of view of both parties. With the asset purchase transaction, both parties would have earned maximum returns from the transaction. It was essential to satisfy the sellers because their involvement with the company in the future was necessary for its success.

Following questions are answered in this case study solution:

-

What is the Intrinsic Firm Value of CoMark?

-

Is the price being offered “fair?”

-

Does CoMark have enough Equity Free Cash Flow to satisfy its debt obligations?

-

Which party is getting the best deal?

-

How important is the difference between a “stock deal” versus an “asset deal?”

-

Is a mezzanine loan at 20% better than the seller financing, for whom?

Brazos Partners The CoMark LBO Case Analysis

1. What is the Intrinsic Firm Value of CoMark?

Intrinsic value of CoMark is based on the underlying discernment of its real value. The real value is calculated by taking into account all aspects of CoMark business including tangible and non-tangible assets and liabilities. For Brazo Partners, it is necessary to calculate the intrinsic value because the buyout decision will mainly depend whether the intrinsic value is less than, equal to or greater than the market value of CoMark.

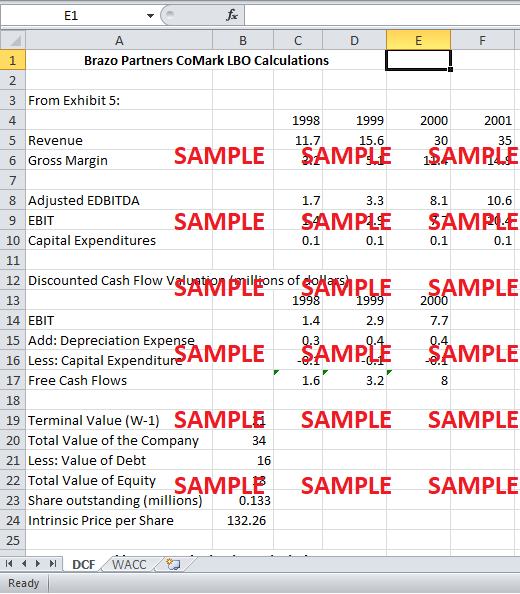

As suggested by the case facts, the current market value of CoMark hovers around 96.8 million dollars. Whereas, the true intrinsic value calculated is approximately 132 million dollars. The calculations are based on the free cash flow model. The underlying assumption is that the company will constantly grow at 5% in future. Based on these assumptions and calculations, the intrinsic value of CoMark is greater than the market value by 35.2 million dollars. This indicates that Brazo Partners should go for the buyout.

2. Is the price being offered “fair?”

Concept of a “fair price” explains the price at which the demand and supply of a specific kind of future contracts is matched by the criteria of availability, for example contract of buying and selling of a firm through leverage buyout in this case. Fair price is also known as theoretical futures price.

Initially the founders of CoMark demanded a price of 40 million dollars. However, the primary concern of the buyout mainly dealt with the sustainability of generating cash flows by the business in the future. Therefore, structuring the buyout was the main key challenging factor faced by Brazo Partners. According to the estimations projected by Brazo Partners, the company was expected to generate 50.5 and 56 million dollars in the coming two years. Based on the calculations done by Brazo Partners, they offered 38 million dollars in cash and deferred 2 million dollars to be paid over the next two years.

However, from the CoMark point of view, it was not a deal that would be accepted immediately. CoMark had a distinctive and prosperous business model. CoMark was a highly valued business because it owned its own manufacturing facilities along with a sales team that would sell the products in the market. Taking into account the situation of both parties, the buyout can be considered as a fair price deal.

3. Does CoMark have enough Equity Free Cash Flow to satisfy its debt obligations?

According to the historical financials for CoMark in exhibit 5, CoMark is an unleveraged firm which was operated completely on equity based capital. This indicates that all the free cash flow will be distributed among shareholders since the level of debt is nil. On the other hand, it is also estimated that debt level will increase by the year end 2001 to 25 million dollars. The company’s financials suggest that CoMark has estimated shareholder’s equity, and net working capital accumulate to only 17.9 million dollars which falling short of debt level by 7.1 million dollars.

4. Which party is getting the best deal?

The deal is being satisfied at the company value of 40 million dollars. CoMark will get 38 million dollars on the spot and 2 million dollars in next two years.

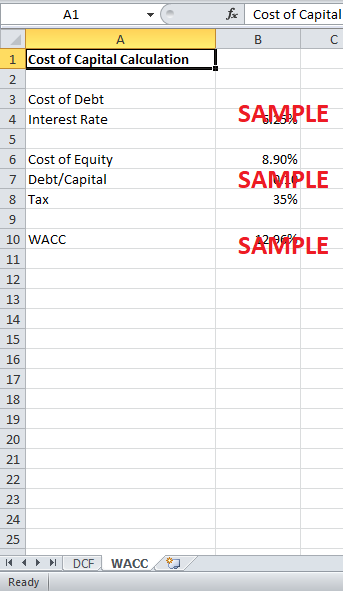

On the other hand, Brazo Partners will finance the deal using the debt of 16 million dollars at 6.25% interest rate to be paid per annum. However, for the remaining of the capital financing, Brazo Partner’s suggested to different solutions. The first solution involved re-investment of capital by sellers. This would have also benefited the CoMark management because they would have been able to retain 27% of the total equity of the firm. CoMark would have been psychologically better off because they would know that the investment is successfully made into their own business instead of going out of the firm. Secondly, Brazo Partners also proposed a subordinated seller note. The terms of seller note included time period of 10 years and interest rate of 8% to be paid per annum. Seller note was an additional intriguing gesture to CoMark shareholders besides their right of equity holding.

As opposed to the initial idea of a stock sale, both the parties gained from the asset sale in their respective regards. However, asset sale had its own drawbacks such as higher tax obligation for the management team who would have invested 4 million dollars back into the business. CoMark team would have to pay 20% as capital gains yield tax due to this transaction. This would have created difference between proceeds and the entire cost basis of the assets of the firm by 1.8 million dollars. All in all, this would have reflected in the immediate tax obligation of an additional 700,000 dollars for the newly bought out firm. Moreover, under the structure of asset sale, both parties would have generated 34.7 million dollars in the form of goodwill. This was beneficial for both the parties because goodwill could not be depreciated under stock sale transaction and it would have also impacted the financial statements and value of the firm in a profitable manner.

Therefore, it can be concluded that the deal would be a win-win situation for both the parties regardless of the side drawbacks of the transaction whether the sale was stock based or asset based.

5. How important is the difference between a “stock deal” versus an “asset deal?”

Mainly there are two conventional ways of acquiring another business which are stock purchase or asset purchase. If the transaction is asset purchase, then the buying firm does not buy the liabilities of the selling firm. Only assets are made part of the transaction. This beneficial for the buying firms in two ways:

-

The company is not liable to satisfy the debts of the acquired company,

-

The buying company can revalue and re-depreciate the acquired assets.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.