Get instant access to this case solution for only $19

Calaveras Vineyards Case Solution

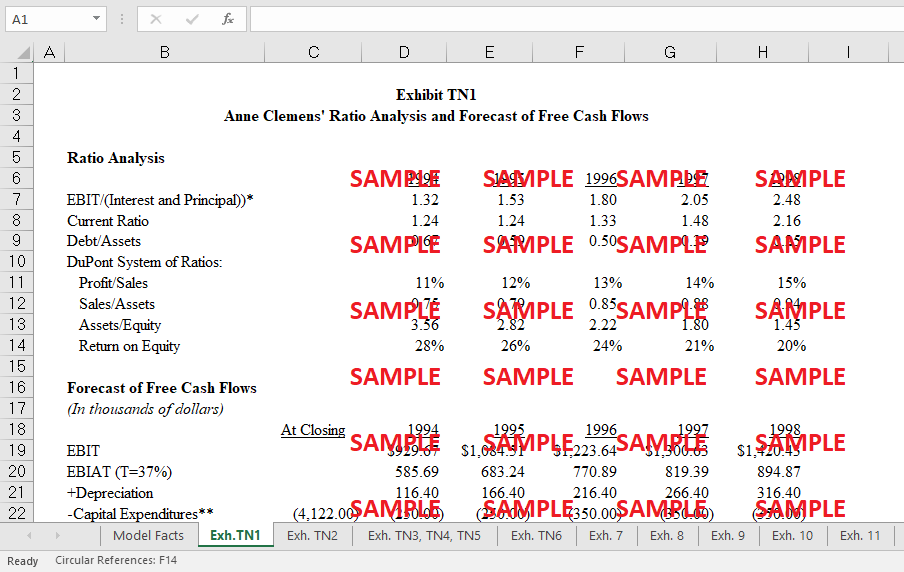

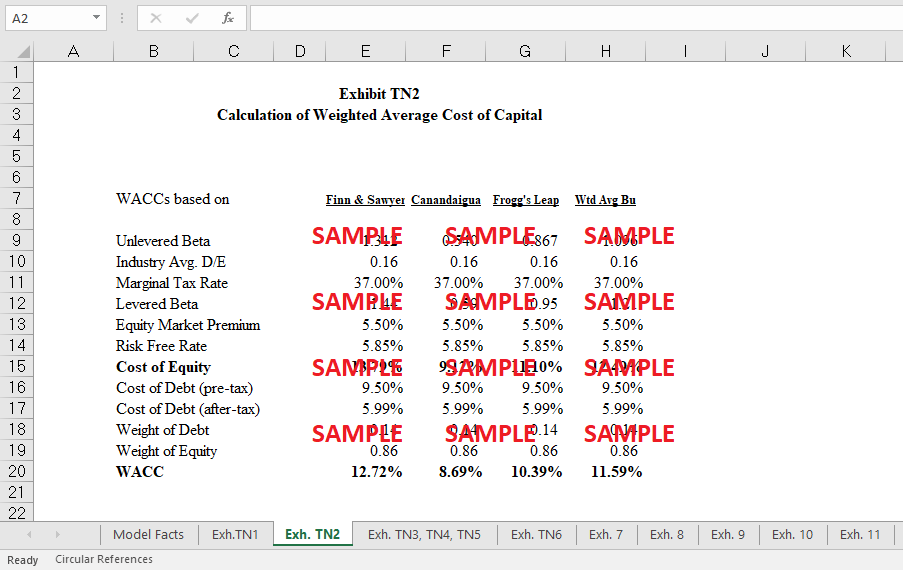

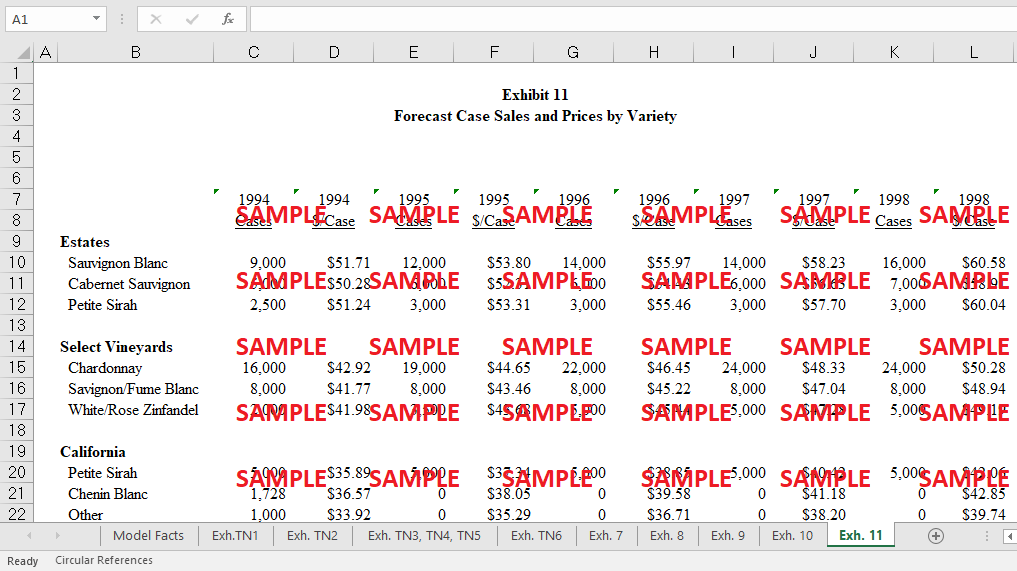

In her role as senior vice president of Goldengate Capital, Anne Clemens is a wealth management expert. In March of 1994, she received a finance proposal from Tom Howell of NationsBank for the acquisition of Calaveras Vineyards. Because Stout PLC has opted to focus on bigger breweries rather than smaller ones, Calaveras Vineyards is being sold. In two more Howell projects, Goldengate has benefited from Clemens' involvement. It's up to Clemens to determine if Goldengate Capital's $2 million term loan and $2.5 million revolvers under Calaveras Vineyards management is a good financial decision. For her to come up with an effective counteroffer, she had to assess the terms of the loan first. Calaveras Vineyards first opened its doors in 1883 to provide wine to the Catholic Church and began commercial production in the 1950s. Despite several ownership changes, the Calaveras brand and market position have maintained their strength throughout time.

Following questions are answered in this case study solution

-

Perform a discounted cashflow valuation for Calaveras Vineyards.

-

Would you advise Dr. Martinez to purchase Calaveras’ at the proposed price? Why or why not?

-

Does Dr. Martinez have any particular competitive advantage in running Calaveras relative to others, including the current owners?

-

If Dr. Martinez buys the company, how would her incentives change? Does that impact your answer to C above?

Case Analysis for Calaveras Vineyards

1. Perform a discounted cash flow valuation for Calaveras Vineyards.

|

Exhibit TN3 |

||||||||

|

Discounted Cash Flow Valuation, "Base Case" |

||||||||

|

Consistent with Anne Clemens' Forecast |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Premium or Discount on the Anticipated EBIT |

|

0% |

|

|

|

|

||

|

|

|

|

At Closing |

1994 |

1995 |

1996 |

1997 |

1998 |

|

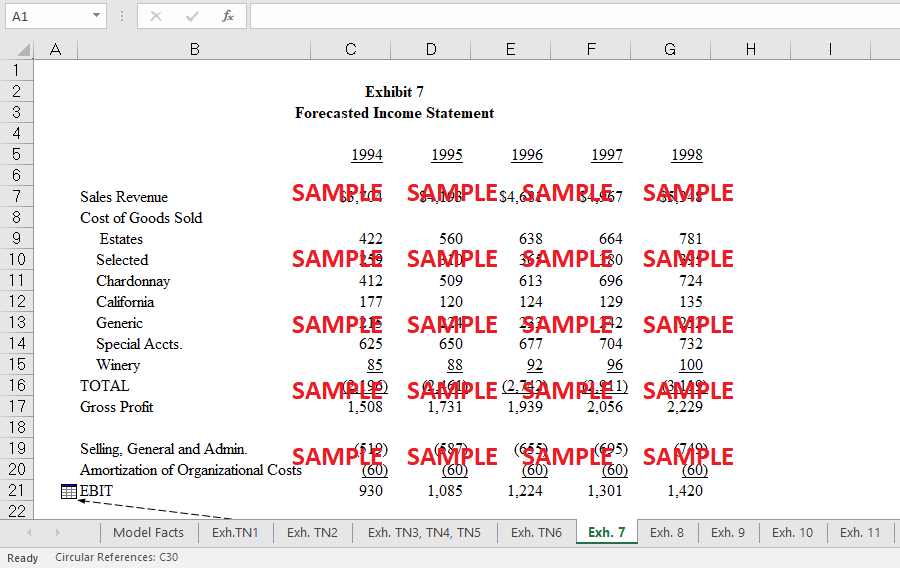

EBIT |

|

|

|

$930 |

$1,085 |

$1,224 |

$1,301 |

$1,420 |

|

EBIAT (T=37%) |

|

|

586 |

683 |

771 |

819 |

895 |

|

|

+Depreciation |

|

|

116 |

166 |

216 |

266 |

316 |

|

|

-Expenditures On Capital |

|

-$4,122 |

-250 |

-250 |

-350 |

-350 |

-350 |

|

|

+Amortization of Organizational Costs |

|

|

60 |

60 |

60 |

60 |

60 |

|

|

-Additions to Net Working Capital |

|

|

(520) |

(302) |

(201) |

(215) |

(151) |

|

|

FREE CASH FLOW |

|

($4,122) |

(7) |

358 |

496 |

580 |

770 |

|

|

Terminal Value (WACC=12%, g=4.04%) |

|

|

|

|

|

10,061 |

||

|

Total Cash Flow |

|

($4,122) |

(7) |

358 |

496 |

580 |

10,831 |

|

|

Internal Rate of Return (FCF) |

|

26% |

|

|

|

|

|

|

|

Discount Rate |

|

13.0% |

|

|

|

|

|

|

|

Present Value of Assets |

|

$6,852 |

|

|

|

|

|

|

|

Debt at Closing |

|

3,122 |

|

|

|

|

|

|

|

Value of Equity |

|

3,730 |

|

|

|

|

|

|

|

Equity Investment at Closing |

|

1,000 |

|

|

|

|

|

|

|

Net Present Value |

|

$2,730 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price Growth = |

0.02 |

|

|

|

|

|

||

2. Would you advise Dr. Martinez to purchase Calaveras’ at the proposed price? Why or why not?

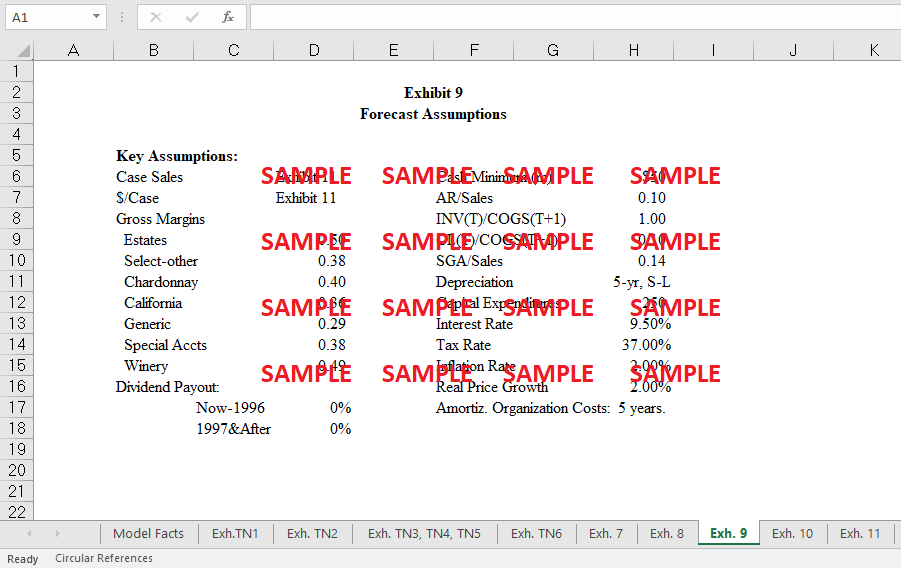

In my opinion, Dr. Martinez must give some significant consideration to the prospect of purchasing Calaveras Vineyards. My experience has led me to think that this is the case. According to the findings of both of our DCF and APV studies, the price that has been offered for Calaveras Vineyards, which is $4.122 million, is significantly lower than our projected values for the company, which are respectively $5.586 million and $6.249 million. The price that has been offered for Calaveras Vineyards is significantly lower than our projected values for the company. Calaveras Vineyards is being sold for the price of $4.122 million, according to the price that has been provided. The disparity in value that exists between these two numbers indicates that they are far off from one another.

These numbers are in line with the range of values suggested by the plan that was provided by Tom Howell, which said that the assets of Calaveras had a fair market value of between $5 and $7 million. On the other hand, the true value of Calaveras may be determined not only by the quantitative qualities but also by a wide range of extra elements in addition to those that have previously been described. These additional factors might include both internal and external aspects of the product. There has been a total of three changes in ownership in less than 10 years, and there is a possibility that there may be the fourth change shortly. This should give some investors cause for worry. This is particularly true when one considers the fact that the marketing departments have been entirely reorganized in conjunction with each change of ownership.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.