Get instant access to this case solution for only $19

Primus Automation Division Case Solution

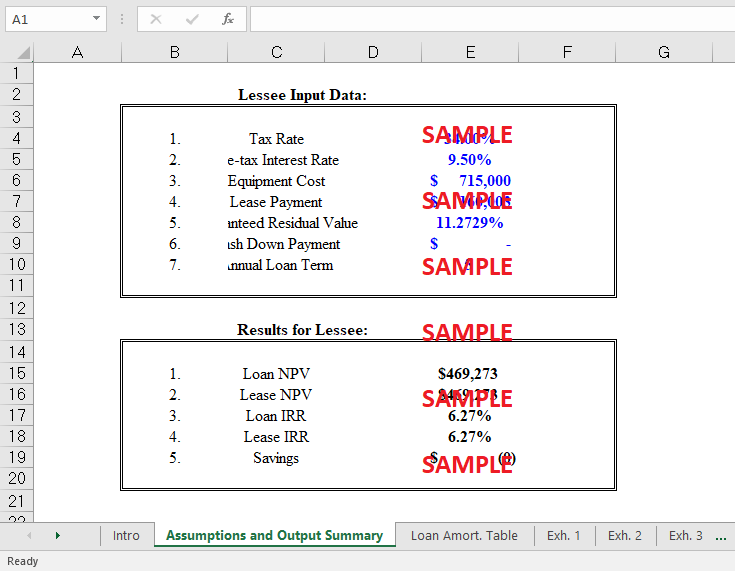

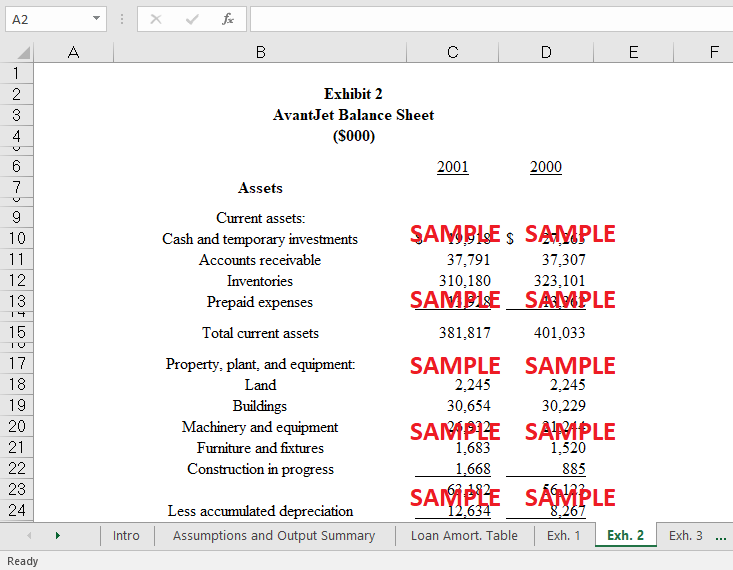

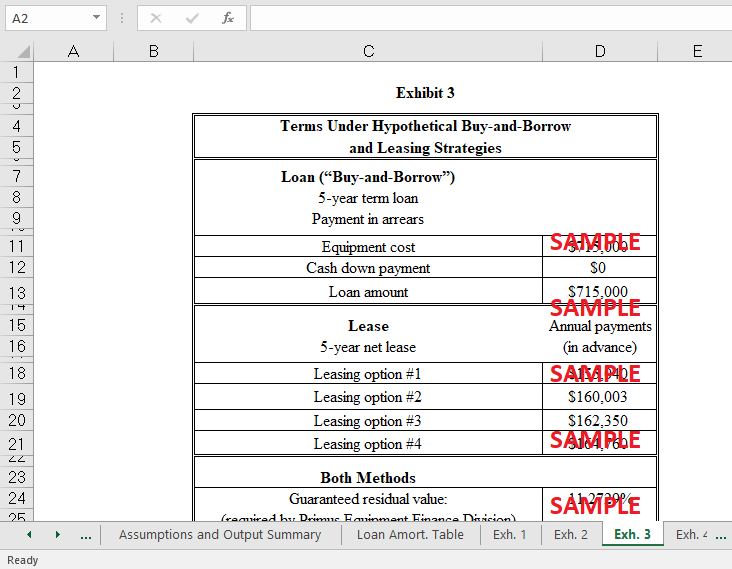

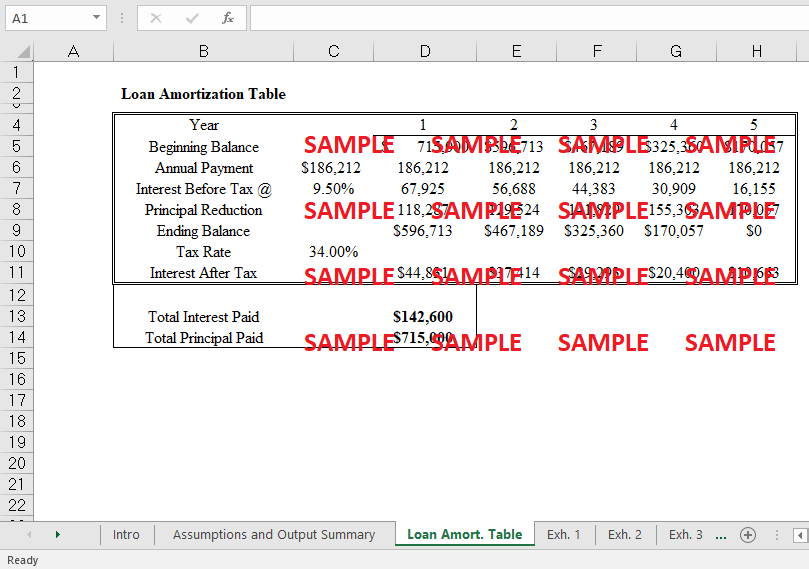

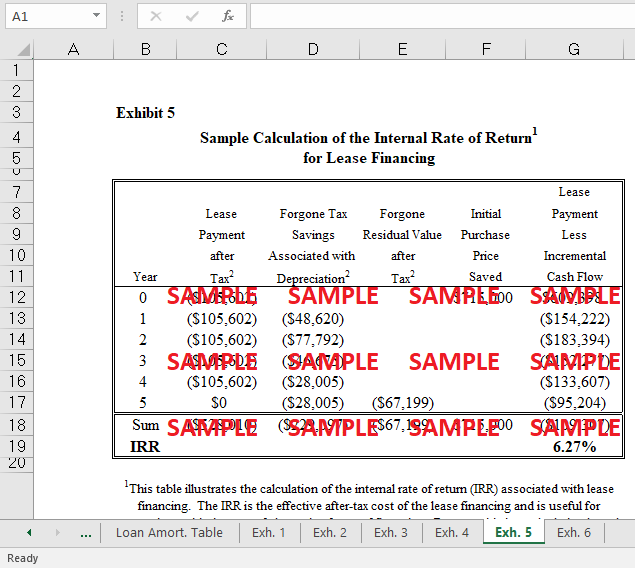

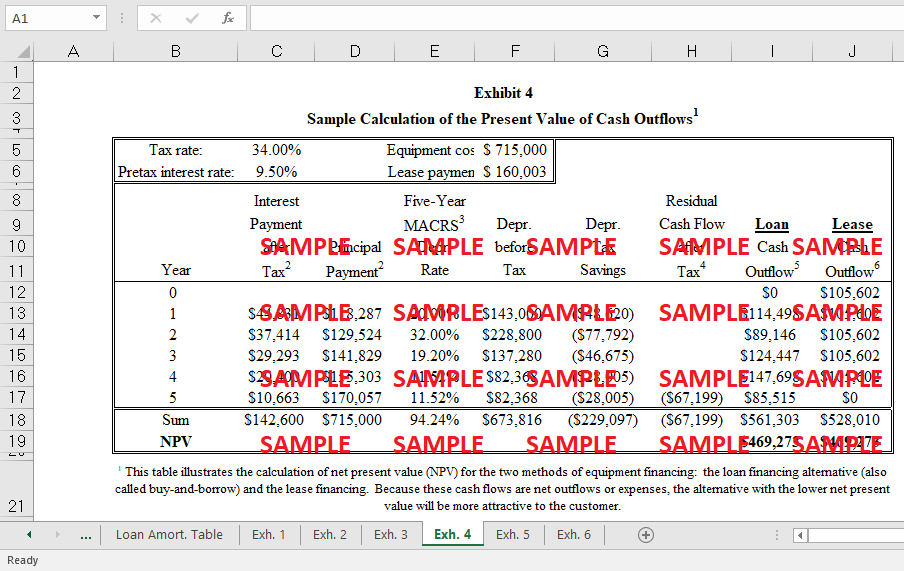

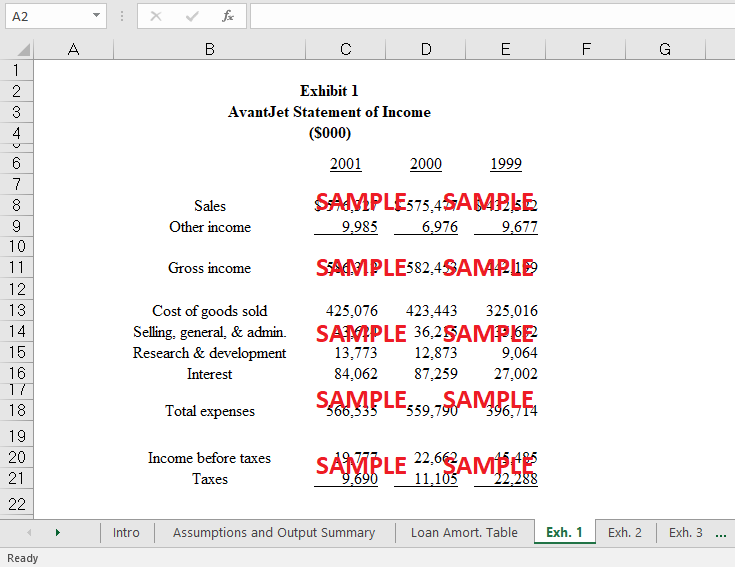

Primus Automation thinks about leasing its industrial automation system because of a variety of variables. According to the lawsuit, Primus' financial performance has been poor, and leasing might help the company achieve its annual sales goal. Avantjet's stock price has fallen, and its financial sheet has deteriorated as a result of the economic downturn. The financial statements that have been disclosed show that the company is in financial trouble and adding assets to the mix will only make matters worse. Leasing makes sense for both Primus and Avantjet, who both need to sell or buy. Baumann believed that Avantjet's cost of debt was equivalent to Primus's at 9.5 percent, but that the company was taxed at a lower rate than Primus. Lease finance becomes less appealing to buyers when the tax rate is reduced. The growing cost of debt, on the other hand, makes lease financing more appealing (Hengelbrok, 2014).

Following questions are answered in this case study solution

-

Why is Primus Automation considering the lease of its factory automation system to Avanjet?

-

How did Tom Baumann analyze the problem of setting the lease-financing terms?

-

How does he calculate NPV and IRR for the lease and borrow-and-buy alternatives? (Complete case exhibit 6 to help answer this question.)

-

How are Faulhaber and Honshu Heavy Industries using their leasing plans?

-

What lease terms should Baumann recommend? How would you approach the negotiations with Avanjet?

Case Analysis for Primus Automation Division

1. Why is Primus Automation considering the lease of its factory automation system to Avanjet?

Because of the current state of the economy, avantjet's most important customer has banned the company from making any new investments in capital. It's possible that this had a negative impact on the income statement as well as the balance sheet of the organization. Both the value of Avantjet's shares when they were traded on the market and the overall financial health of the company showed signs of deterioration over the course of time. As a direct consequence of this, Primus comes to the realization that in order for the lease to be organized in a manner that is acceptable to the market, it has to be organized in a way that allows it to keep up with two additional competitors. Primus arrives at this understanding as a direct result of this, and that is the conclusion that he draws. Primus Automation is a worldwide supplier of goods and services to a part of the automation sector in which it competes and operates. This subset includes the automotive industry. The company continued to grow, but at a rate that was far less rapid than what would have been expected under normal circumstances. This was a direct result of the greater competition for market share that had evolved as a direct result of the expanding market competition. This result came about as a direct consequence of the growing market competition. This shift came about as a direct consequence of the considerable shift that has taken place in the environment in which organizations operate as a direct result of which this transition has taken place. The business has arrived at the conclusion that some of its most important objectives will be to fulfill targets for net income and working capital; continue to control the market; expand yearly sales by 15 percent, and retain market dominance.

2. How did Tom Baumann analyze the problem of setting the lease-financing terms?

As a part of Baumann's analysis of the leasing scenarios, he developed a leasing model to compute the net present value (NPV) and interest rate (IRR) of the cash flows for the lease, borrow, and purchase options. This was done in order to determine which of the three options would yield the highest return on investment. If you're concerned about your finances, the one that will set you back the least amount of money right now is the one you should go with. The internal rate of return, or IRR, is a metric that is used to assess how much it really costs to finance a lease. If the rate of the lease is lower than the cost of the loan after taxes, and if the discount rate is computed by utilizing this cost, then leasing is the most tempting form of financing option. In the course of making this comparison, we have taken into consideration not only the outcomes of two other competitors but also those of two extra competitors.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.