Get instant access to this case solution for only $19

John M. Case Company Case Solution

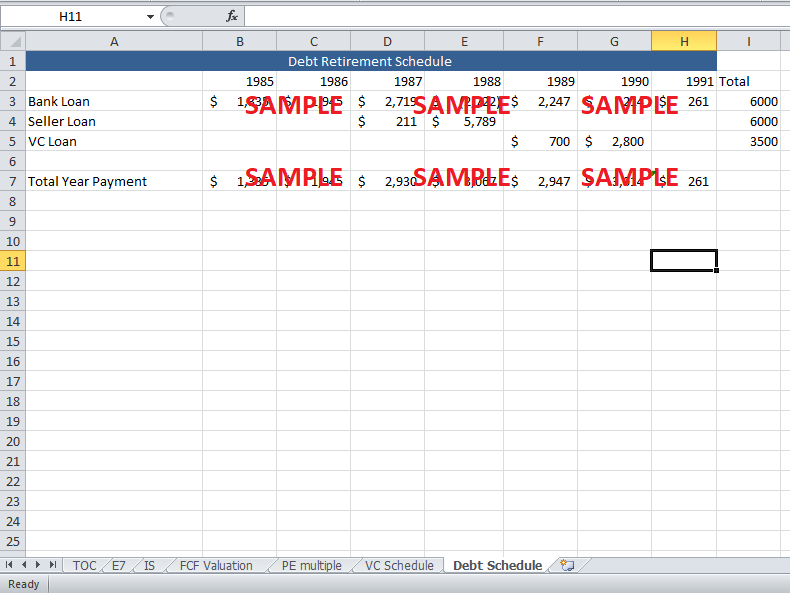

The key issue in this buyout is that the borrowing party, which in this case are the ‘four managers’, should gain a reasonable return after paying up all the debt. If the proposed buyout is carried forward, the company will not be able to pay any dividend for next 6 years due to interest and principle repayments. At the same time, all the earnings of the company will be utilized in payout. However, if someone takes a view of the proposed debt retirement schedule, it is evident that, by the end of 1991, all the debt will be repaid, and 51% of ownership will also be steady afterwards. Therefore, any amount after 1991 can possibly benefit the concerned managers as both the dividends and salary raise will be possible due to excess cash flows.

Following questions are answered in this case study solution

-

What are the most important operating and financial characteristics of the Case Company?

-

Is the company worth Mr. Case $20m asking price?

-

Can the $20m purchase be financed so that Management can retain at least 51% ownership? What sources should Management tap? In what amount? Is the return being sought by the venture capital firm reasonable?

-

How compelling a buyout opportunity is this in proposition for the four managers?

-

Would you, as a commercial banking lender, provide the loan needed to finance the seasonal build-up in accounts receivable and inventory? On what terms?

-

Would you, as the venture capital firm; provide the balance of the funds needed? If so, in what terms?

Case Analysis for John M. Case Company

1. What are the most important operating and financial characteristics of the Case Company?

The major operating and financial characteristics of the case company are described below:

i. Operating Characteristics

-

The Company operates in a market which has a stable product outlook.

-

The key managers who are operating the business are well aware of the relevant market.

-

Even though sales are stable, yet the growth potential is quite limited.

-

The particular type of product offered by case company is difficult to be protected by a patent.

ii. Financial Characteristics

-

Case Company enjoys relatively high profit margins (9.4% in 1980 and 12.4% in 1984) in comparison with comparable firms.

-

The business of commercial desk calendars is fairly asset intensive.

-

There are quite fewer chances of a major new entrant as the high initial start-up investment and consequent less market share and growth potential make this industry an unfeasible target.

-

The Company has not yet utilized any sort of debt in financial perspective.

2. Is the company worth Mr. Case $20m asking price?

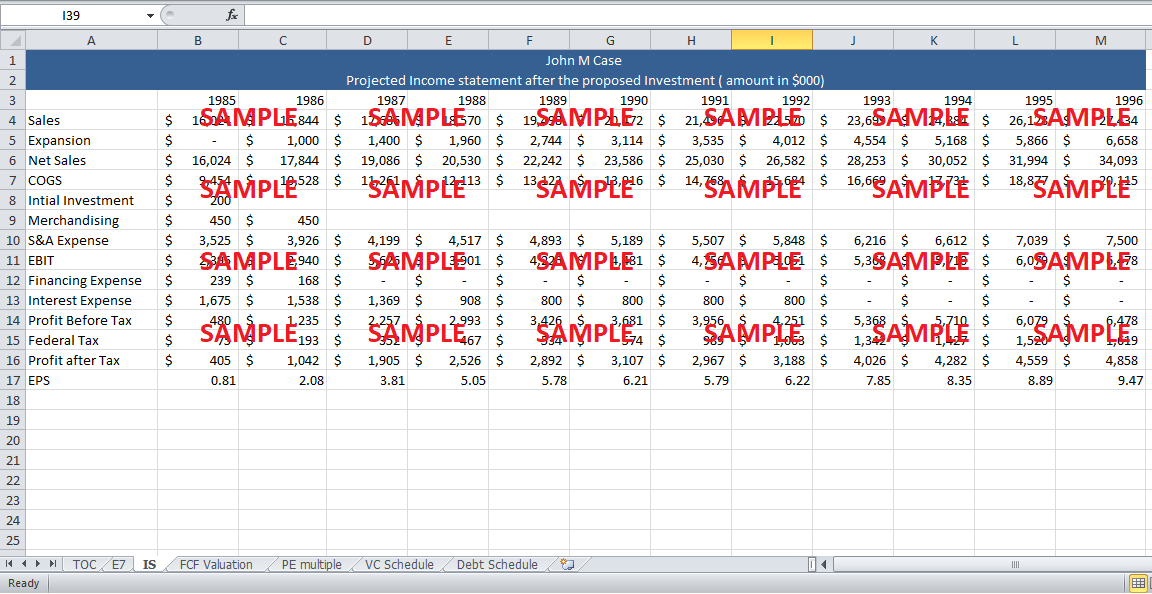

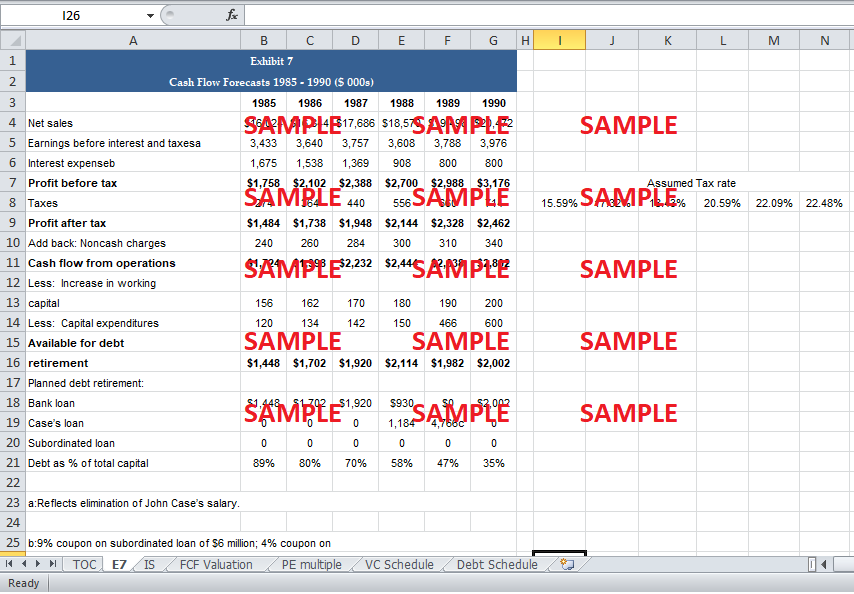

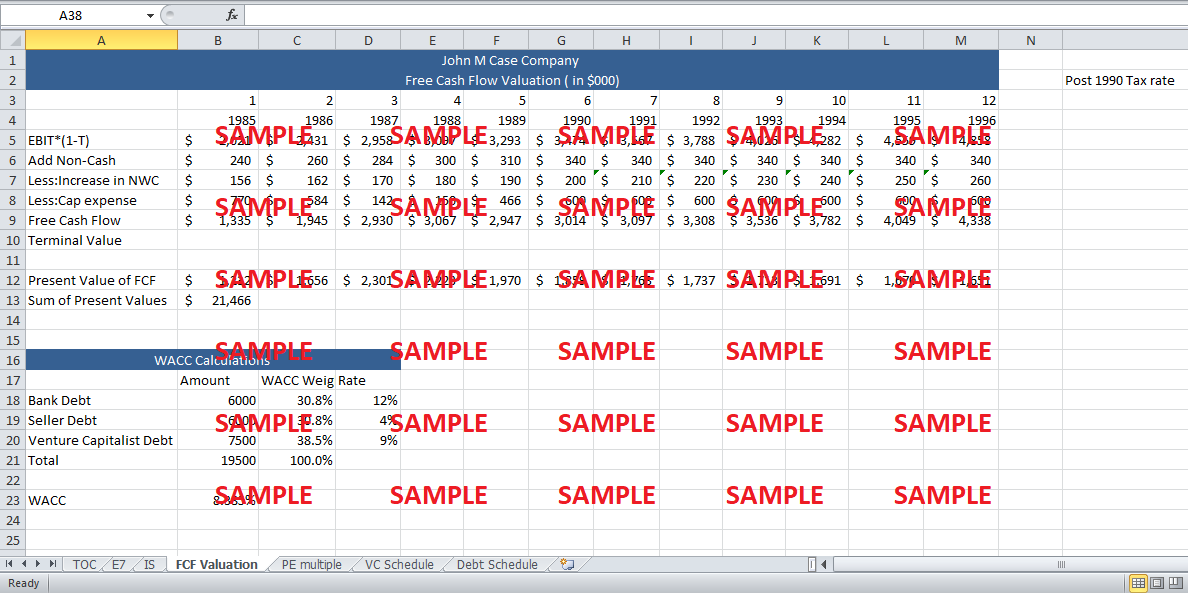

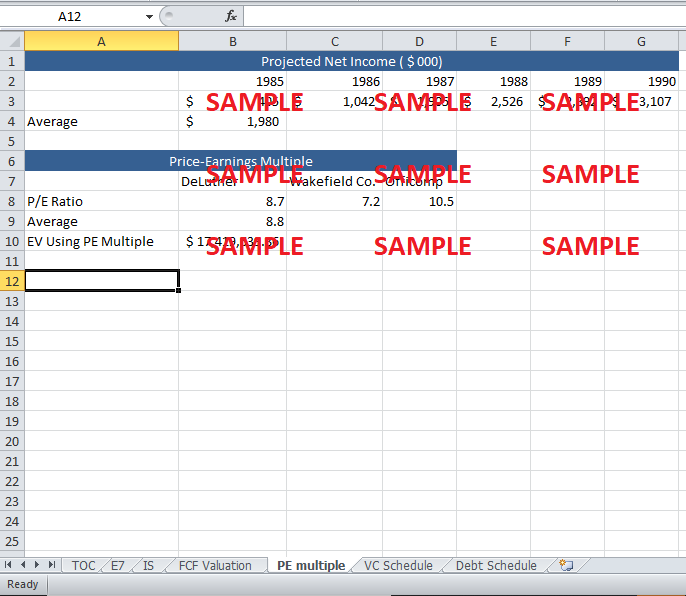

There can be various methods of valuing a company. The result of every method will vary. Therefore, there is a need to carry out valuation analysis using multiple valuation instruments in order to determine the ‘enterprise value’ of a company. Let’s first analyze the value of the company using the P/E multiple approach. For the year 1984, the average P/E ratio for the under consideration industry is 8.8. Taking into account the average future earnings of the case company, the enterprise value comes out to be $17.4719 million. This value is quite below than the quoted price of $20 million. As far as the free cash flow valuation is concerned, the calculated corresponding enterprise value exceeds $20 million easily. When the average enterprise value is calculated by averaging out these two values, the final EV comes out to be around $20 million. Even though the quoted price is not a true depiction of company’s value, it is on average equal to the numerical estimates of EV.

3. Can the $20m purchase be financed so that Management can retain at least 51% ownership? What sources should Management tap? In what amount? Is the return being sought by the venture capital firm reasonable?

The total of $20 million should be arranged in such a way that all the following conditions are met.

-

Venture Capital gets an average IRR of 22%.

-

All the debt, including the bank note, seller debt and venture capital debt has to be retired and paid by the due time.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.