Get instant access to this case solution for only $19

M&M Pizza Case Solution

The proposed repurchase plan calls for issuing new debt of F$500 million at the borrowing rate of 4%. With the cash coming in from the debt, the company will buy back shares at the market price. The amount of $500 million raised through debt will be used to repurchase 20 million shares at the price of $25 each per share. The financial statements for M&M Pizza will not vary much with the proposed repurchase plan. The revenue and operating income will stay the same and so will the current and fixed assets. However, the profits will drop to F$105 million due to the addition of interest expense. Moreover, the financial side of the balance sheet will vary such that the debt to equity ratio will become 1 with 50% debt and 50% equity.

Following questions are answered in this case study solution

-

Financial Statement with the Proposed Repurchase Plan

-

Repurchase Plan and Weighted Average Cost of Capital

-

Value of Debt and Equity Claims and Recommendation

-

Scenario if New Tax Law is Implemented

Case Analysis for M&M Pizza

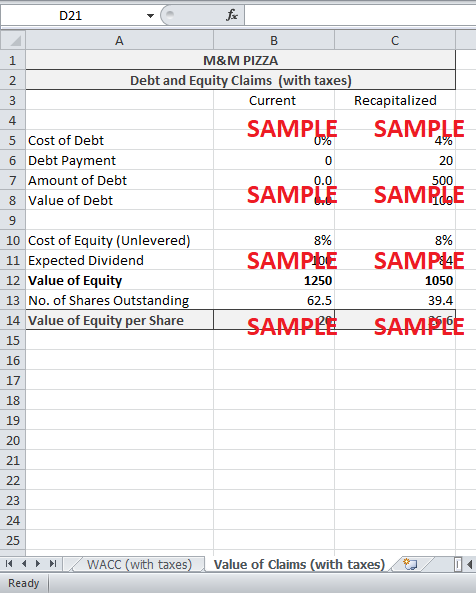

See table 1 below for the revised financial statements.

|

M&M PIZZA |

||

|

Pro-Forma Financial Statements |

||

|

|

Current |

Recapitalized |

|

Income Statement |

|

|

|

|

|

|

|

Revenue |

1500 |

1500 |

|

Operating Expenses |

1375 |

1375 |

|

Operating Profit |

125 |

125 |

|

Interest Expense |

0 |

20 |

|

Net Income |

125 |

105 |

|

|

|

|

|

Balance Sheet |

|

|

|

Current Assets |

450 |

450 |

|

Fixed Assets |

550 |

550 |

|

Total Assets |

1000 |

1000 |

|

|

|

|

|

Book Debt |

0 |

500 |

|

Book Equity |

1000 |

500 |

|

Total Capital |

1000 |

1000 |

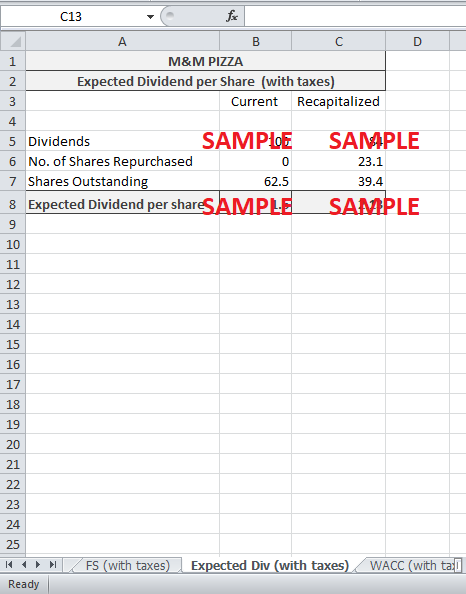

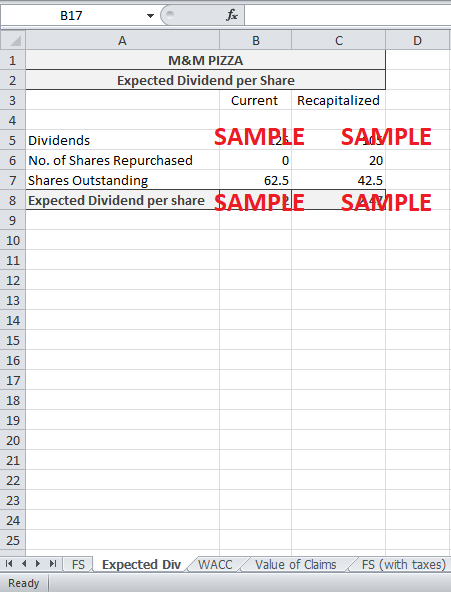

i. Expected Dividend Per Share

The distribution policy of the company is that they distribute 100% of the net income to shareholders. The expected net income for M&M Pizza will be F$105 million, as mentioned above. Based on the distribution policy of the company, the complete F$105 million will be distributed as dividends among the remaining shareholders. The remaining number of shares outstanding will be 42.5 million. The expected dividend per share with the current capital structure would have been F$2 while the expected dividend per share with the revised capital structure will be F$2.47. Hence, although the total dividends have decreased, the expected dividend per share for the remaining shareholders has improved.

|

M&M PIZZA |

||

|

Expected Dividend per Share |

||

|

|

Current |

Recapitalized |

|

|

|

|

|

Dividends |

125 |

105 |

|

No. of Shares Repurchased |

0 |

20 |

|

Shares Outstanding |

62.5 |

42.5 |

|

Expected Dividend per share |

2 |

2.47 |

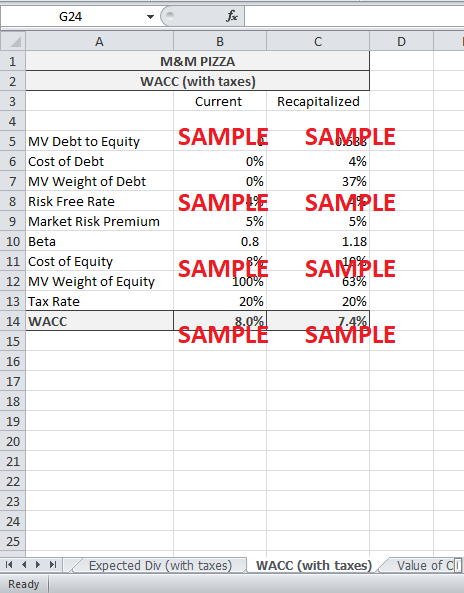

2. Repurchase Plan and Weighted Average Cost of Capital

In order to estimate the value of the expected cash flows, weighted average cost of capital (WACC) is an essential tool when the capital structure of the firm does not change. M&M Pizza does not have any debt outstanding currently. All of its assets are being financed through equity. Using the risk free rate of 4%, company beta of 0.8 and a market risk premium of 5%, the cost of equity for M&M Pizza has been estimated as 8%. Under the same capital structure, the weighted average cost of capital (WACC) for M&M Pizza will be the same as the cost of equity as it is the only source of financing.

Under the revised capital structure, the market value debt to equity ratio is expected to be 0.471. Based on this D/E ratio, the market value weight of debt is 32%. This also reduces the weight of equity to 68%. The cost of debt is 4% where the cost of equity, according to CAPM model, will rise to 10%. Due to the increase in debt, the business risk to the equity investors also rises, causing the required return on equity to increase. With a corporate tax rate of 0%, the WACC for M&M Pizza will remain the same, i.e. 8%. Hence, an increase in debt has resulted in no change in the WACC if there are no taxes.

|

M&M PIZZA |

||

|

WACC |

||

|

|

Current |

Recapitalized |

|

|

|

|

|

MV Debt to Equity |

0 |

0.471 |

|

Cost of Debt |

0% |

4% |

|

MV Weight of Debt |

0% |

32% |

|

Risk Free Rate |

4% |

4% |

|

Market Risk Premium |

5% |

5% |

|

Beta |

0.8 |

1.18 |

|

Cost of Equity |

8% |

10% |

|

MV Weight of Equity |

100% |

68% |

|

Tax Rate |

0% |

0% |

|

WACC |

8.0% |

8.0% |

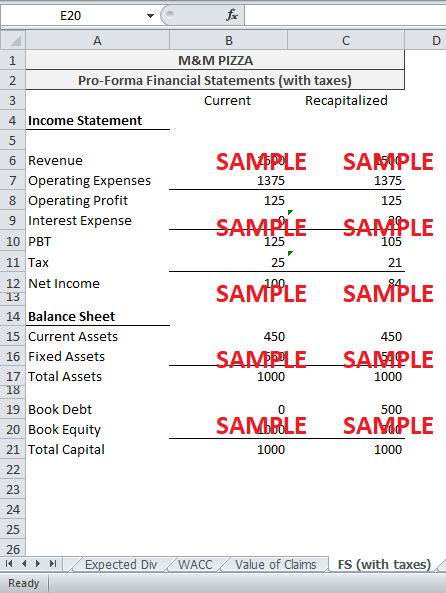

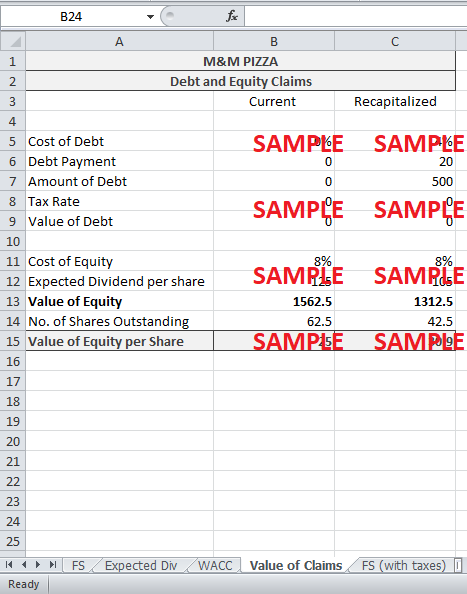

3. Value of Debt and Equity Claims and Recommendation

The total debt outstanding under the revised capital structure is F$500 million. At the cost of borrowing of 4%, the interest payment to the debt holders is F$20 million per year. Assuming that the debt is perpetual, the present value of the cash flows has been estimated by estimating the value of debt tax shield. Since the rate of tax is 0%, the value of debt will be zero under the revised capital structure plan. The value of debt claim under the current plan will also be zero. See table below.

The total number of shares outstanding is 62.5 million under the current capital structure. The expected dividend per share with the current capital structure is F$2. With the cost of equity at 8%, and perpetual expected dividend of F$2, the value of equity is F$1562.5 million.

After raising F$500 million in debt and repurchasing 20 million shares, the debt to equity ratio will become 0.471.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Marilyn Carlson Nelson and the Carlson Companies Renaissance Case Solution

- Martha Goldberg Aronson: Leadership Decisions at Mid-Career Case Solution

- Martingale Asset Management LP in 2008, 130/30 Funds, and a Low-Volatility Strategy Case Solution

- Massachusetts General Hospital and the Enbrel Royalty Case Solution

- Medco Engergi Internasional Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.