Get instant access to this case solution for only $19

Medco Engergi Internasional Case Solution

Panigros first sold it shares after restructuring its debt due to the financial crisis of 1998 when investors started pulling money out of Indonesia due to the devaluation of the currency which led to restructuring of debt when Panigros and family inked a deal with CSFB in which the stake of CSFB was 51% Panigros and family were left with 37% shareholding. In the year 2001, when CSFB sold 40% of New Links holding to PTTEP or 34% of Medco’s share. The holding of shares was 37% Panigros and Family, PTTEP 34%, CSFB 17% and the remaining 12% was publically owned.

Following questions are answered in this case study solution

-

How will the transaction proposed by Temasek alter the current balance of power between the Panigoro family and other shareholders?

-

How big a premium (if any) is Temasek offering? Relative to what?

-

What do the stock prices of comparable companies suggest about Medco’s target share price?

-

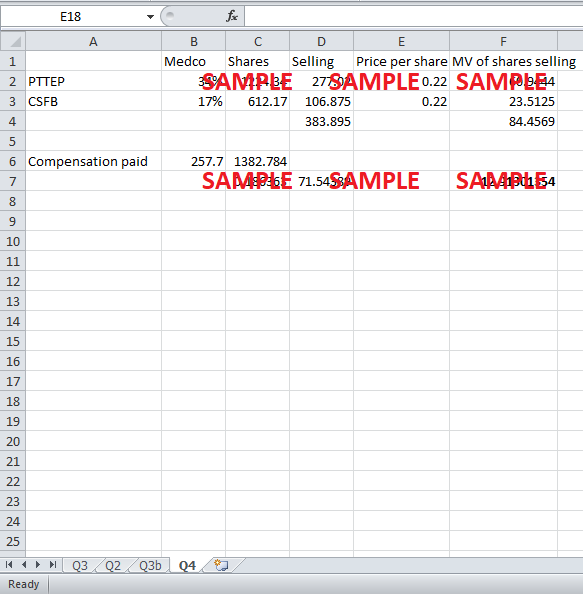

Under the proposed offer, what returns would CSFB and PTTEP be getting on their investment?

Case Analysis for Medco Engergi Internasional

In this scenario, the majority holding of shares remained in the hands of Panigros after holding a minority from 1998 to the year 2001. In 2001, CDFB and PTTEP planned to sell their stake and selected Taemesk to buy a stake of 49.9% stake in New links i.e. 38.4% share in Medco. If the transaction proposed by Temasek is accepted the balance of power will change as the biggest stake will be Temasek 38.4%, Panigros and family 37%, 12% public owned and remaining 12.6% of CSFB and FFEP.

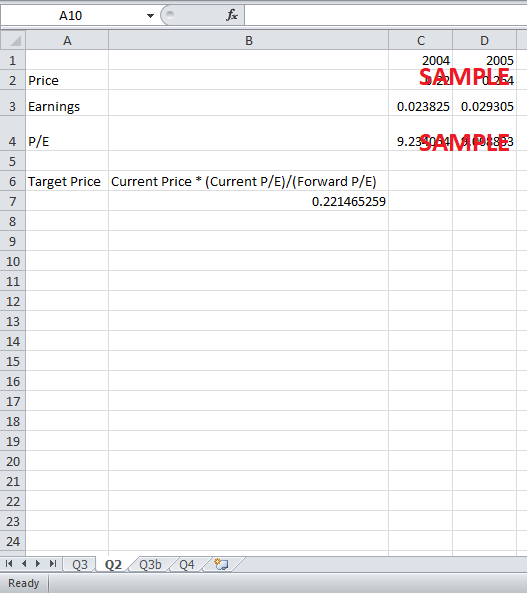

2. How big a premium (if any) is Temasek offering? Relative to what?

In case, there is calculated the target price taking the P/E multiple. If earnings increase at the same rate as last year using the price earnings multiple; then, there can be projected the target price:

Price Earnings Ratio = 0.22 / (74M / 3106 mn) = 0.22 / 0.02 = 9.23

Estimating earnings grow at the same rate as last year 23% and price also increases at 20% forward P.E so the future P/E multiple will be:

= 0.264 / 74(1.2) / 3106 mn = 9.008

Current Stock Price x ((current P/E) / (forward P/E)) = future price (or price target)

= 0.21606 * (11 / 8.33) = $0.285

Shares bought by Temasek are 38.4% * 3,106,000,000 = 1,192,704,000 shares

Price offered is 257,700,000

= 257700000 / 1192704000 = 0.21$ per share

The target price is $ 0.285, and Temasek is offering 0.21 per share that is not a very good offer.

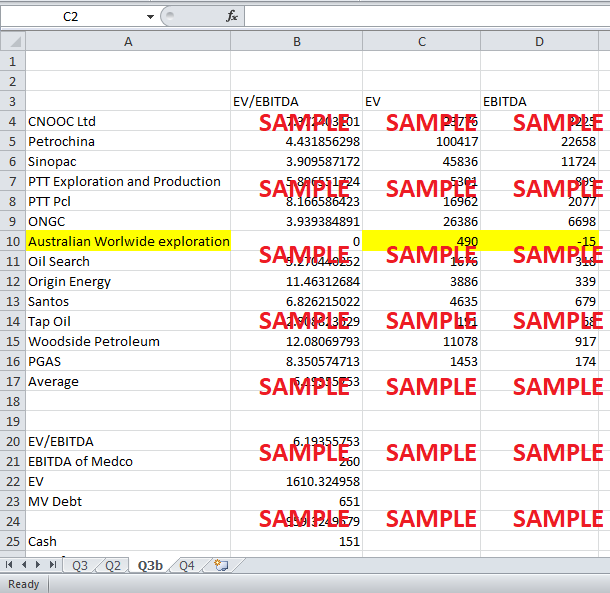

3. What do the stock prices of comparable companies suggest about Medco’s target share price?

In order to find the comparable prices, we used the market multiples approach for which we used the Price/Earnings and Price/EBIAT multiples of comparable companies and averaged them. We then multiplied the P/E ratio with Medco’s Net Income/share to find the target share price as per what was prevailing in the market. As per the P/E ratio, the market price turned out to be $0.46 mn that was approximately the double of the offering of 0.22 per share. As per this multiple the current bid price is understated We have used another multiple EV/EBITDA which provides us with the EV of Medco when multiplied by EBITDA of the company, we can deduct debt and cash from it to find the value of equity and from that method we get $0.26 mn per share, which again shows that out current price is understated.

So as per the comparables, the current bid price is understated.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.