Get instant access to this case solution for only $19

Metapath Software September 1997 Case Solution

Meta path, a software provider of software services for the telecommunication industry is faced with two distinct options. Meta path can either raise additional funds in the form of equity or it can accept the merger offer from CellTech. In the case of fundraising, the Meta path will increase its equity by more than 100% by offering a participating preferred stock with an 8% dividend at a per-share price of $6. Only at an equity exit, multiple of $50 will the common stockholders receive a profit. In the case of cash flow problems after 5 years down the lane, it is better accepting the acquisition offer of $20 million. The merger with CellTech offers a viable opportunity for the Meta path for future growth.

Following questions are answered in this case study solution

-

Construct the share capitalization table post Series E investment by RSC. *Use Exhibit 12.2 *Assume $11.75m raised in Series E *Breakdown by Class of Shares, $ investment, no of shares,% ownership *Assume all other Common Shares are owned by Management

-

Compare the equity values at the exit for each class of shareholders; Common, Preferred A, B, C, D and Series E investors for Sale of the company at exit valuations of $20m, $30m and $50m

-

Hypothetical Scenario: Meta path encounters serious cash flow issues 5 years post Series E investment. Existing investors are tired and want to divest. The only offer after exhaustive fundraising was an acquisition for $20m. Management must also stay for another 2 years post-acquisition. You are the CEO of Meta path, what would you do?

-

You are the Partner at Bessemer Ventures. What are your major concerns about the offer from CellTech?

Case Analysis for Metapath Software September 1997

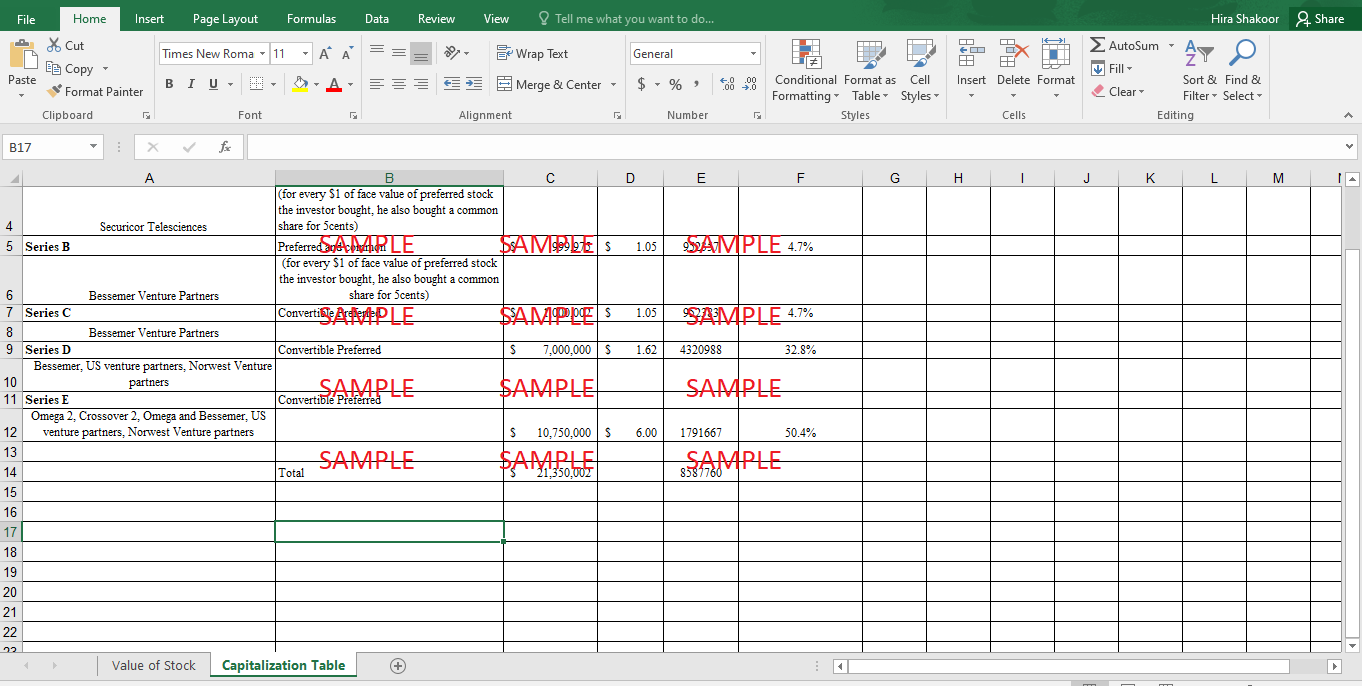

1. Construct the share capitalization table post Series E investment by RSC. *Use Exhibit 12.2 *Assume $11.75m raised in Series E *Breakdown by Class of Shares, $ investment, no of shares, % ownership *Assume all other Common Shares are owned by Management.

As of August 1997, the Meta path has carried out four equity financing transactions. The first two transactions amounted to a value of $1.59 million. The third and fourth financing phases were extensive and they incorporated $8 million in total. The current financing arrangement shows that the class E preferred stocks will amount to $11.75 million. The post E class investment table is depicted below:

This stock issue is the biggest in the history of the Meta path as it accommodates fundraising of $11.75 million dollars. If this option is successfully executed, the equity of the Meta path will rise by more than 100%. The share price for the transaction is $6 which is substantially high in relation to the last four comparable transactions’ prices. This per-share value is based on an equity valuation of $75 million. After this proposed transaction, the preferred stockholders of class E will make up the largest percentage of ownership. Also, the per-share price in this proposed transaction is also way higher than the past per share prices for similar transactions. The stock E holders are entitled to an annual dividend of 8%. The type E preferred stock has also a participating feature. Therefore, these stockholders bear a liquidation preference, in addition to the share of common stock upon liquidation or sale. The Class E participating preferred shares also encompass the right of one demand registration. Above all these privileges, the size of the board of directors will also be increased to 6. This infers that class E shareholders may appoint an industry executive with the consent of the company. The breakdown of the amount is given below.

-

The largest contributors will contribute $5 million. Omega 2, Crossover 2 and Omega are planned to invest this amount. The exact percentage of these entities is not decided.

-

This $5 million investment is complemented by an approximately equal amount of financing contributed by the existing investors. These investors include US venture partners, Bessemer and Norwest.

-

An amount of $250,000 will also be invested by the contributing partners of WA&H.

-

The rest of the amount may be invested either by Integral capitals or Omega.

2. Compare the equity values at the exit for each class of shareholders; Common, Preferred A, B, C,D and Series E investors for Sale of the company at exit valuations of $20m, $30m and $50m.

Currently, there are two types of shares at the Meta path, common shares, and preferred shares. Preferred shares differ from the common share in the sense that they claim payment before the common stockholders. Additionally, the preferred stock also contains the participating feature. This means that this type of preferred share will receive a liquidation preference and also the privilege of cash conversion to common shares. At the equity value of $20m, all the money is distributed among the preferred shareholders, class C, D, F. All of them receive a liquidation preference according to their level of investment; after the distribution of the liquidation preference, only 0.25 million cash remains. This cash is in turn utilized in payment to preference shareholders for the purpose of their share in common stock conversion.

In the case of a $30 million exit valuation, there is enough cash left for payment to common shareholders. However, the participating feature of preferred stock adversely affects their payments. In total, $19.75 million cash is paid to preferred stock as a liquidation preference. Moreover, they also receive their share of common stock that amounts to $9.48 million. Payment to Stock A and Stock B is made on a pro-rata basis (0.6/1.599 & 0.99/1.599 respectively). Hence, Common shareholders A and B receive a payment of $0.29m and $0.49m respectively.

In the third scenario, the exit equity valuation stands at $50 million. The liquidation preference of C, D and E preference stock remains the same at $19.75 million. However, the share for common stock conversion may differ. From the remaining cash ($30.25 m), $16.65 million, $9.92 million, and $1.42 million are given to E, D, and C respectively. Consequently, Common stockholders A and B receive $0.85 million and $1.4 million respectively. This is the only scenario in which common stockholders realize a gain on their initial investment.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.