Get instant access to this case solution for only $19

Microsoft's Financial Reporting Strategy Case Solution

The inability of Microsoft to report the intangible assets and the conservative accounting policies are the root causes of the difference between market and book value of equity. The market capitalization of any company is the product of its share price and the number of outstanding shares. Meanwhile, the share price is determined by employing various techniques, and most of them take into consideration the future earnings of the company along with the features that determine them. A close look at the balance sheet of Microsoft reveals that the intangible asset’s portion does not report the value of brands, customer loyalty and most importantly the human capital. On the other hand, the market participants take these factors into consideration for determining future earnings. Hence, essentially, the absence of these intangible assets renders a huge difference between the market capitalization and the equity value. Additionally, the conservative policies of revenue recognition defer the earnings. Hence, the retained earnings of the company do not represent its fair value. This disparity results in the temporary and artificial decrease in the equity figure.

Case Study Questions Answers

Question 2A

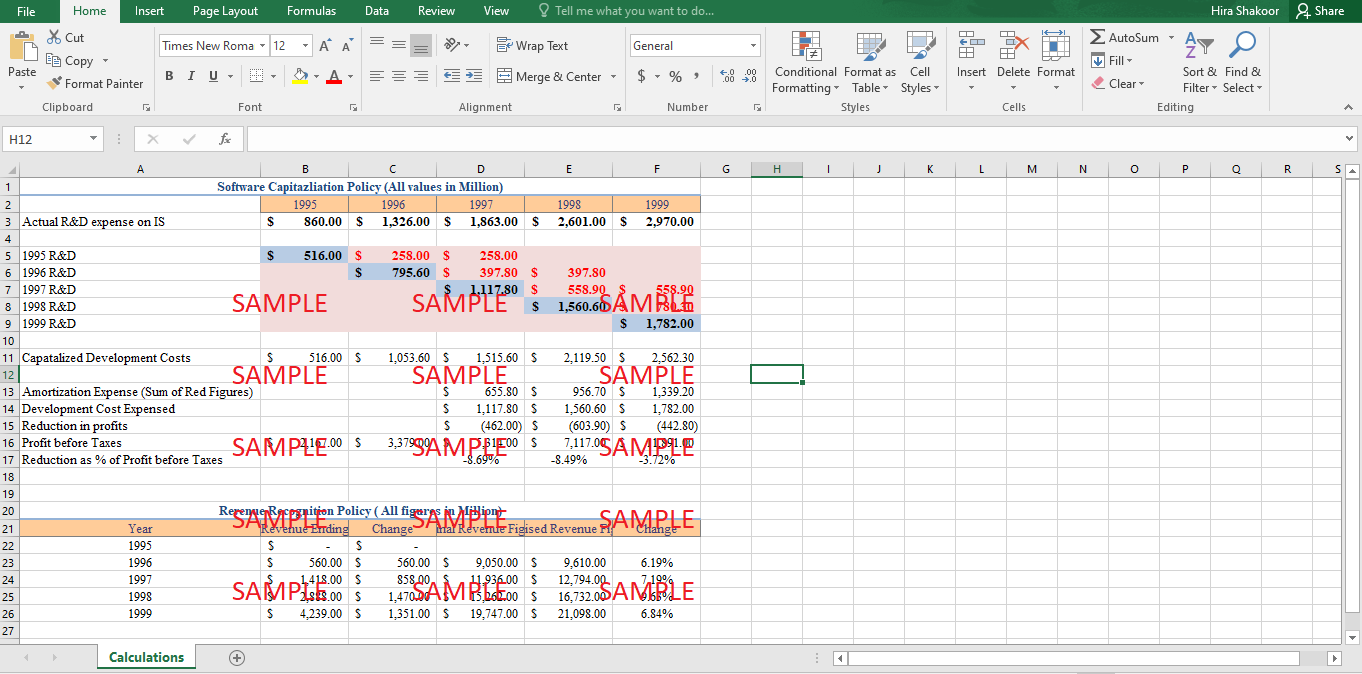

The detailed calculations for the R&D expenses are shown in the following table:

|

Software Capitalization Policy (All values in Millions) |

|||||

|

|

1995 |

1996 |

1997 |

1998 |

1999 |

|

Actual R&D expense on IS |

$ 860.00 |

$ 1,326.00 |

$ 1,863.00 |

$ 2,601.00 |

$ 2,970.00 |

|

|

|

|

|

|

|

|

1995 R&D |

$ 516.00 |

$ 258.00 |

$ 258.00 |

|

|

|

1996 R&D |

|

$ 795.60 |

$ 397.80 |

$ 397.80 |

|

|

1997 R&D |

|

|

$ 1,117.80 |

$ 558.90 |

$ 558.90 |

|

1998 R&D |

|

|

|

$ 1,560.60 |

$ 780.30 |

|

1999 R&D |

|

|

|

|

$ 1,782.00 |

|

|

|

|

|

|

|

|

Capitalized Development Costs |

$ 516.00 |

$ 1,053.60 |

$ 1,515.60 |

$ 2,119.50 |

$ 2,562.30 |

|

|

|

|

|

|

|

|

Amortization Expense (Sum of Red Figures) |

|

|

$ 655.80 |

$ 956.70 |

$ 1,339.20 |

|

Development Cost |

|

|

$ 1,117.80 |

$ 1,560.60 |

$ 1,782.00 |

|

Reduction in profits |

|

|

$ (462.00) |

$ (603.90) |

$ (442.80) |

|

Profit before Taxes |

$ 2,167.00 |

$ 3,379.00 |

$ 5,314.00 |

$ 7,117.00 |

$ 11,891.00 |

|

Reduction as % of Profit before Taxes |

|

|

-8.69% |

-8.49% |

-3.72% |

As depicted by the analysis, the net profit on the income statement will decrease in the prescribed time. Additionally, the reported retained earnings balance on BS will also be less.

Question 2b

Originally, the criterion provided by FASB dictates that the software development costs can only be capitalized once the technological feasibility was established. However, the policy of Microsoft reported that the guidelines provided by FASB have no material effect in the financial statements. The first line of reasoning follows that Microsoft projects its technological feasibility to occur at the latter half of the project. This implies that, at the time when costs are eligible to be capitalized, their absolute figure is so small that it does not disturb the financial ratios of the company. Moreover, Microsoft could also have projected the useful life of their products to be short-lived.

Question 3A

The effect of the change in the revenue recognition policy is depicted in the following table.

As a result of the change in the revenue recognition policy, the revenue will change by 6.19%, 7.19%, 9.63%, and 6.84% respectively in the year 1996, 1997, 1998 and 1999.

Question 3B

The first and foremost motive behind the deferral of the revenue arises from the notion of ‘smoothing out’ of the revenues. One can furnish the example of the sales of new software, Windows 95. It should be noted that the major portion of the revenue from the sale of windows was attained in 1995 when the customers buy the product or place an order. The frictional increase in the revenues will post huge revenue on the balance sheet. However, in the following years, the revenue is expected to decrease as no major software is expected to be introduced in the market. This inconsistency in the revenues will not only cast a negative externality on the share price, but the earning, ratios and forecasts will also suffer. Hence, the shrewd step to defer the revenue may be related to the idea of smoothing out the balance sheet and income statement. Secondly, with the introduction of Windows 95, Microsoft also incurred some contractual obligations to provide free of costs services to the customers. Hence, in this situation, the recognition of the entire revenue base will be inconsistent with the accrual concept of accounting. Later, Apple Inc also adopted a similar revenue recognition policy when it introduced the IStore and free updates to the new operating systems for the iPhone users.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.