Get instant access to this case solution for only $19

Motilal Oswal Financial Services Ltd An IPO in India Case Solution

Furthermore, the company would be in a position to reduce its debt burden which means that the company will be able to increase the profits. The increase in profits would come from the savings that will be originated from interests. Although, there are some costs as well which are inevitable in going public. The first is underwriting cost paid to the investment bank. Other than that the regulations get more stringent once the company goes public and it had to comply with the security exchange commission regulations. But the benefits outweigh all these costs and compliance processes. Therefore, the company should go public.

Following questions are answered in this case study solution

-

MOFSL has raised capital through VCs. Explain the role of VCs in the company. The case mentions that the VCs had the option of putting back their shares to the company at a pre-specified IRR. Explain this feature and explain the role of IRR assumed. What is an acceptable IRR on this put feature?

-

Carefully explain the value drivers for MOFSL. State and define your assumptions about the future of brokerage in India and the value implications for MOFSL.

-

Should MOFSL go public? Do not give a laundry lists of pros and cons. Rather, prioritize. Discuss the top reasons why or why not and discuss how any concerns about your decisions are mitigated. What is your recommended issue size?

-

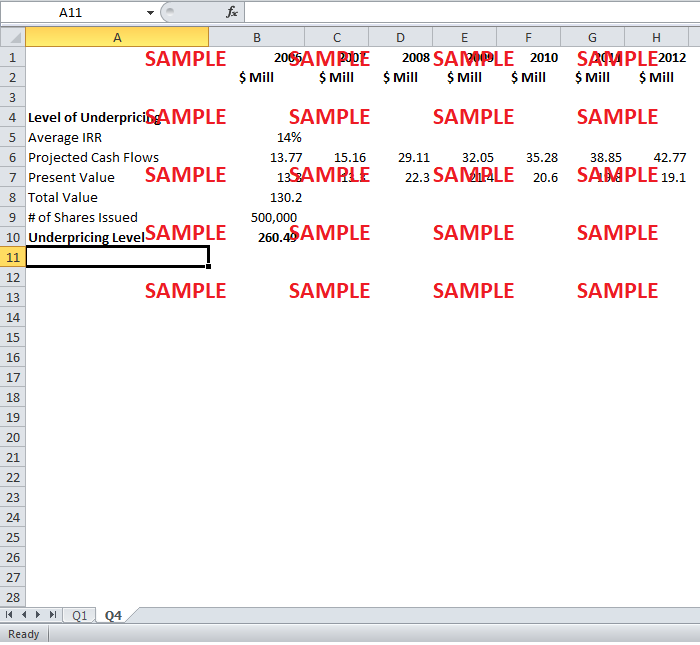

IPOs are usually underpriced. Recommended a level of expected underpricing for MOFSL?

-

Regarding the timing of the IPO. Given the information in the case regarding the P/E multiples of companies above and below $100 M in revenues, do you think MOFSL should go public now and hold off? Explain why

Case Analysis for Motilal Oswal Financial Services Ltd An IPO in India

1. MOFSL has raised capital through VCs. Explain the role of VCs in the company. The case mentions that the VCs had the option of putting back their shares to the company at a pre-specified IRR. Explain this feature and explain the role of IRR assumed. What is an acceptable IRR on this put feature?

The role of venture capital chosen for the private equity investment is very important. Firstly, both the private equity firms Bessemer and New Vernon were much familiarised with the business of the company, and one of the members of New Vernon is someone who has long relationship with the company. The idea was to get a critical appraisal from the venture capitalists and improve the business. The partners at New Vernon had experienced of working in top investment banks such as Merrill Lynch and huge exposure to the international markets. Moreover, since MOFSL has a mission which benefits them in a longer term, they are finding investors who are in match with this vision. Both the venture capital firms were able to full fill that criterion.

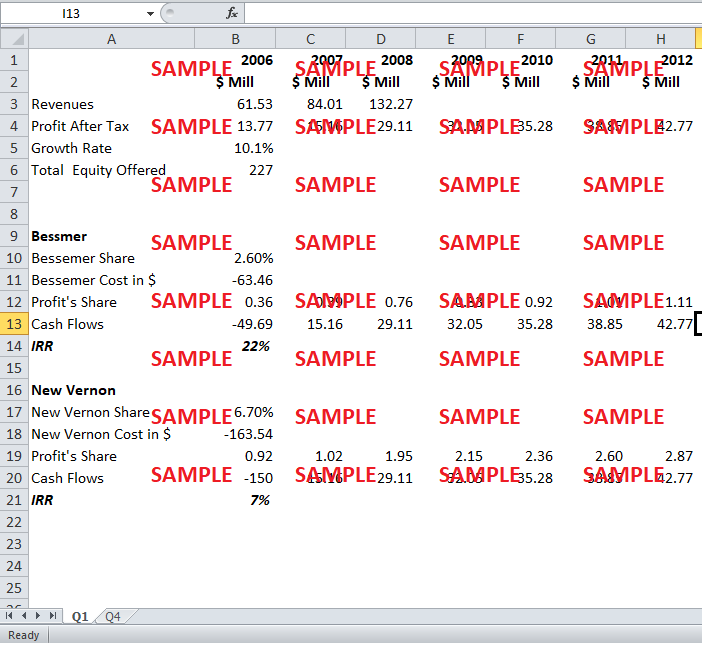

They investor bought 9.3% equity in the form and added an unusual term in the deal which stated that the if in five years the company will not go public, the investors have the right to put their stock back in the company at a predetermined internal rate of return. To calculate the rate of return projected cash flows are used. The growth rate is used to forecast cash flows and the internal rate of return in calculated for each investor. This rate is the rate at which the present value of the cash flows is equal to present value of outflows. The IRR for Bessemer comes out to be 22%, and for New Vernon, it is 7%.

2. Carefully explain the value drivers for MOFSL. State and define your assumptions about the future of brokerage in India and the value implications for MOFSL.

There were many factors that were the cause of value for MOFSL which were there solely because of the fact that the firm was operating in India. India has several advantages that make it a heaven for international investors. Firstly, English was vastly spoken and understood in the country which allows it to conduct intensive business with other nations. Secondly, the availability of Western Legal Institutions, a modern stock market and private banks and corporations are other value drivers for MOFSL.

Moreover, India benefits out of the growing work force which is more educated than before. In 2008, the number of professionals in Finance was expected to increase in number which is greater than in the US. These are the main value drivers for the brokerage houses like MOFSL have by operating in India.

3. Should MOFSL go public? Do not give a laundry lists of pros and cons. Rather, prioritize. Discuss the top reasons why or why not and discuss how any concerns about your decisions are mitigated. What is your recommended issue size?

Considering the company’s financial performance in the past few years, the option of going public could help the company to grow. By going public, the private equity investors and the employee who are currently the primary shareholders of the firm would get an escape. Secondly, the idea of going public would allow the company to invest more in growth opportunities. Hence the market share of the company would gradually start to increase as the company have more access to capital to acquire the small growing financial service companies.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- The Unionville Gift Store Case Solution

- Groupe Ariel S A Parity Conditions And Cross Border Valuation Case Solution

- Holt Lunsford Commercial Case Solution

- Netflix Continues To Change The Face Of In-Home Movies Around The Globe Case Solution

- Toronto Dominion Bank Green Line Investor Services 1996 Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.