Get instant access to this case solution for only $19

Newell Company The Rubbermaid Opportunity Case Solution

Newell should not acquire Rubbermaid because the risks are too high. The costs associated with materializing unrealized profit may be too high considering the risk involved. The organizational culture of the two companies is quite different. If inefficiencies in operations of Rubbermaid were easily corrigible, the company should have stabilized its income after spending huge sums of money for restructuring programmes. These restructuring programmes have gone in vain and lost market share and reputation of the company cannot be regained through standard 18 months “Newellization” process. Extra ordinary efforts and a lot of time are required to stabilize the income of Rubbermaid. The management of the Newell Company needs to realize that this acquisition is much more impactful and large in scale as compared to the acquisitions done beforehand. So, the management should not use the same standard evaluation principles for assessing the suitability of business for acquisition.

Following questions are answered in this case study solution

-

What are the common denominators of Newell’s businesses, for example, their markets, strategies and operations?

-

What are the critical corporate resources at Newell that are shared by or transferred among the businesses?

-

How does Newell corporate handle the coordination of the business units?

-

Does the Newell corporate strategy create corporate advantage?

-

What makes a good acquisition target for Newell? What does success in “newellization” depend upon?

-

On the basis of your understanding of Newell’s strategy and the “newellization” process does Rubbermaid look like a good merger candidate? Please discuss any and all similarities, and differences between Newell’s current product lines and those of Rubbermaid.

-

Are the projected benefits of the merger credible? Is the proposed “price” reasonable and are the risks acceptable? Should the relative size of the deal be a concern?

-

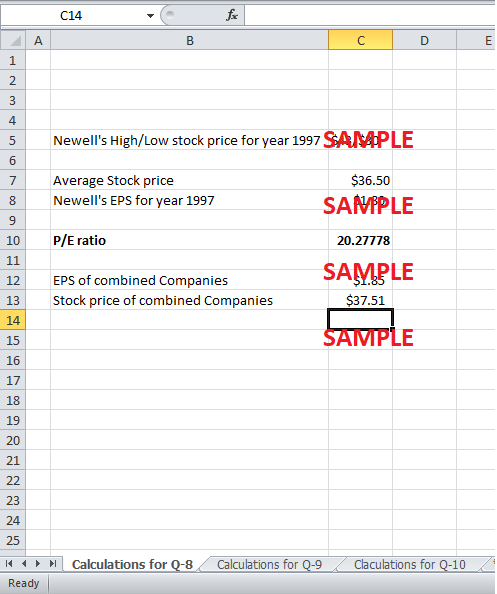

Using Newell’s current multiple (P/E ratio) at its average trading price for 1997 and assuming that the Newell multiple applies to the pro forma combined results in the Exhibits, what is the value of the combined deal?

-

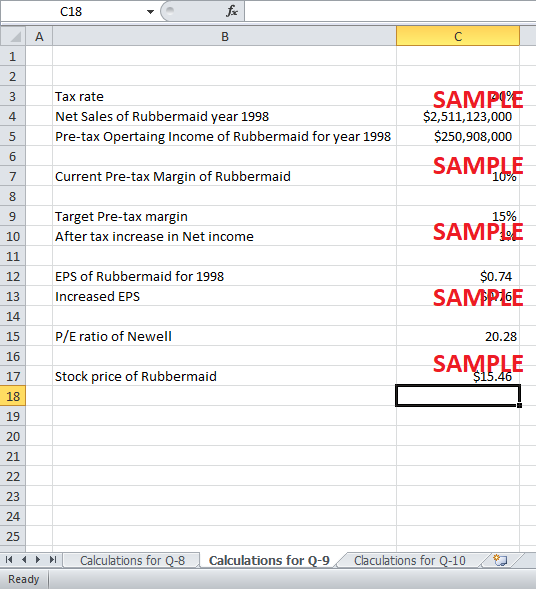

The case mentions improving Rubbermaid efficiencies and obtaining a minimum 15% pretax margin on Rubbermaid’s operating income. Assuming a 40% tax rate, how much would this increase the earnings per share? Applying Newell’s current multiple (from above), what is the deal value?

-

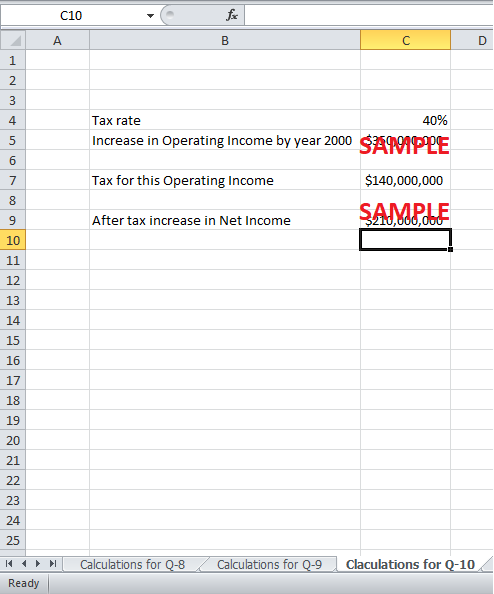

Assuming Newell achieves the $350 million increase in operating income it mentions, how much would this increase net earnings? What is the deal value under this assumption?

-

How would you vote on this matter?

Case Analysis for Newell Company The Rubbermaid Opportunity

1. What are the common denominators of Newell’s businesses, for example, their markets, strategies and operations?

Newell is a large manufacturer of a wide range of products. The company supplies its low cost portfolio of products to retailers like Wal Mart. Instead of focusing merely on internal growth, the company looks for new horizons of businesses by expanding externally through acquisitions. Firms that are deemed suitable for acquisition undergo “Newellization” process in less than 18 months after acquisition. This process ensures successful integration of new companies with the parent company.

Businesses that are not in line with the corporate strategy were given up even if they were profitable. The strategy is to acquire undervalued companies with mature markets and diverse product lines. The strategy of the company is largely driven by the needs of mass retailers. With the advent of large scale mass retailers like Wal-Mart and K-Mart, the bargaining power of retailers over their suppliers increased. Their demands of timely delivery of high quality merchandise at a low price had to be met if the suppliers wanted to survive in the market. Since the relations of mass retailers were very long term and marked with high volume merchandise sale, loss of a single client could translate into huge losses. The very survival of the company became questionable if it does adjust to the ever changing needs of the retail markets. The mass retailers needed a supplier that could rapidly respond to the trends in the market by updating the product mix. Newell responded to this need by adopting the strategy of growth through acquisitions.

Just in time delivery system was adopted to cater to the needs of mass retailers. The implementation of JIT requires a high level of efficiency in operations and data management. Effectiveness of “Just in time” depends entirely on the ability of the company to transmit relevant, reliable and timely information across different departments of the company. Computer systems were updated to ensure timely and effective exchange of information across different departments. Electronic Data interchange was used primarily for order placements and shipment purposes. Sales invoices and shipment orders etc were all processed through sophisticated information systems.

To ensure continuous improvements in operations, extremely difficult targets were set for the management so that top management thinks out of the box rather focusing on traditional methods. “Newellization” process was designed to ensure successful acquisitions of business so that the parent company can operate on economies of scale and provide low cost products.

The marketing needs of the company were also catered to a large extent by acquisition of competitors. Companies with strong brand name and shelf place were acquired and later integrated in the parent company. Mature businesses with unrealized potential provided Newell Company with new market niches that could be captured by creating synergy.

2. What are the critical corporate resources at Newell that are shared by or transferred among the businesses?

For successful coordination among divisions, resources must be shared in such as to get the maximum return from the investment. Efficient exchange of information and use of resources help generate synergy among different divisions of the company. Following are a few examples of the resources that are shared across different divisions of the company.

-

The manufacturing facilities capable of producing high volume of products are the greatest resources shared by all divisions in the company. All the divisions share the benefit of low manufacturing cost of the products when the manufacturing facilities operate on economies of scale due to the acquisition of similar production facilities.

-

Global presence of the company helps the divisions to cater to the needs of costumers across different countries. This global presence is the upshot of corporate strategy of growth through acquisition.

-

The company uses just in time model and uses advanced data management soft wares to ensure successful implementation of just in time model. Costumer relationship management is operated through a centralized system, and this resource is used by all the divisions o provide superior services to the costumers.

-

Financial resources are shared by all the businesses. The increased market capitalization has also increased ability of the company to borrow money. These financial resources can be used by businesses if they need funds to invest in profitable projects.

-

The goodwill of the company is an intangible resource that is shared by different businesses in the corporation.

-

Human resources, having a diverse set of expertise, can be use by businesses to cater to their needs whenever required. Cross hiring of employees can be used to use the expertise of experts for specific purposes.

-

Electronic Data Interchange is used to benefit from discounts of retailers by effective and timely information exchange.

-

Distribution system is largely centralized, and over the years huge sums of money were spent to update the computer systems to cater to the needs of large scale operation.

3. How does Newell corporate handle the coordination of the business units?

Basic administrative functions and acquisitions were two main areas that were centralized. Data management, divisional control and financial management were the key areas that were managed by the corporate headquarter. Costumer relationship management, internal and external financing decisions and HR decisions were controlled and influenced by the corporate strategy at the headquarters. The individual business divisions were responsible for the operational and financial performances of their respective divisions. Aggressive targets were set for the divisions and managers of the divisions were responsible for meeting those targets. A wide range of monetary and non-monetary rewards served as incentives for the managers of the divisions. The remuneration of the divisional managers was driven by the financial performances of their respective divisions. The role of the corporate headquarter was more of a regulator and supervisor. Financial and operational performances were evaluated on a monthly basis. Key performance indicators used for evaluation were the growth rate of EPS, return on beginning equity and SG&A expenses as percentage of net sales. Minimum growth rate of EPS has to 15% whereas return on beginning equity has to at least 20%. SG&A expenses had to be less than 15% of sales across all the division. The decisions taken by the management of divisions were mainly concerned with design, manufacturing, sales, merchandizing and service. Each division was basically treated as a profit centre. Divisions were responsible for increasing revenue and decreasing costs through operational efficiencies. Corporate headquarter was responsible for external growth of the company through acquisitions and management of divisions was responsible to maintain internal growth to ensure the success of the acquisitions.

So, corporate head was responsible for looking for growth opportunities by looking for businesses of comparable sizes that were suitable for acquisition. For this purpose, certain standard criteria were set to evaluate the suitability of businesses. The business division heads were subsequently responsible for ensuring the successful implementation of “Newellization”. The performances of individual divisions were evaluated based on their ability to create synergy from the addition of new product lines to the existing portfolio. Performance indicators used to gauge the extent of their success were purely financial. The nature of the business and operations across different divisions was so similar that standard KPI’s could be used for all divisions. Expertise of different divisions can be used by cross hiring employees among divisions.

The primary challenge for the company corporate is to delegate responsibilities to their divisions in such a manner that there is no cannibalization. The profitability of the company depended entirely on the extent of correlation between the objectives of divisions and corporation. The challenge for the corporation is that divisions should not compete for same niches in the market. The objectives of the divisions should not be in conflict with those of the corporation. These risks can be mitigated by linking partially the remuneration of divisional managers with the KPI’s of the company as a whole so that there is no conflict of interest.

4. Does the Newell corporate strategy create corporate advantage?

Yes, the corporate strategy of the company does create corporate advantage. The strength of core competency of the company depends on the successful implementation of corporate strategy. The corporate strategy was to expand the operations of the company through acquisitions of suitable companies rather than focusing merely on internal growth. The company has been financially successful so far solely due to its ability to acquire undervalued businesses and integrate their operations in such a way as to decrease production costs. Continuous acquisitions also helped the company increase its size, strengthen distribution system and increase market share. Niches and unrealized profit potential can be targeted by acquiring firms that can provide the expertise and access required to capture new markets.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.