Get instant access to this case solution for only $19

Petrolera Zuata, Petrozuata C.A Case Solution

PetroZuata is $2.4 billion oil field development project in Venezuela. Conoco (A DuPont subsidiary) and Maraven (A PDVSA subsidiary) are planning to meet with various firms to decide the structure of a possible financial deal regarding Petrozuata. To reach the desired interest rate on bond, PDVSA needs to secure an investment grade rating. Neither PDVSA nor the home country of Venezuela has the required rating. Upon analysis, it is found that the hurdle of investment grade rating can be overcome, but it may take some time. It is also found that it would be feasible for PDVSA to finance this opportunity with project financing. 60% proposed debt ratio is perfect as both the IRR and DSCR are quite ideal at this specific ratio. The NPV of the project, using an equity beta of 0.60, comes out to be $ 585953. The IRR is also greater than the required rate of return.

Following questions are answered in this case study solution:

-

How should PDVSA finance the development of the Orinoco Basin? What are the costs and benefits of using project finance instead of traditional internal finance?

-

What are Petrozuata’s three or four most important operating risks? How does the deal structure address these risks? Who would bear these risks if the project were financed internally by PDVSA instead?

-

As currently envisioned, debt will comprise 60% of the funds needed for the project. Would you recommend a higher or lower leverage ratio? What happens to the minimum debt service coverage ratio and internal rate of return on equity as project leverage increases to 70% of project funds? Decreases to 50%?

-

What kind of debt (agency debt, bank debt, or Rule 144A bonds) should the sponsors use to fund the deal? What are the advantages and disadvantages of each kind of debt?

-

Will project bonds receive an investment grade rating? What is the “weakest link” in the project?

-

As one of the sponsors, what are your expected returns? Please assume the asset beta for an integrated drilling, pipeline and refining firm is 0.60.

-

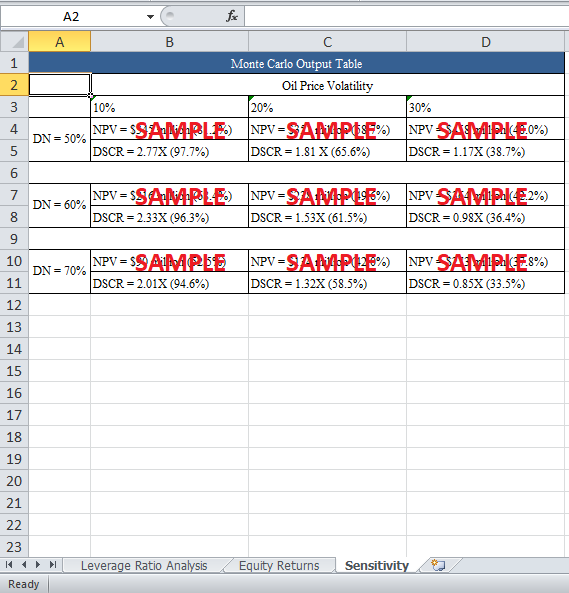

What kind of sensitivity/scenario analysis would you do to verify the project’s economics?

-

Would you invest in project bonds? Would you invest equity capital as Conoco?

-

How should PDVSA finance its other oil field projects?

Petrolera Zuata Petrozuata C A Case Analysis

1.How should PDVSA finance the development of the Orinoco Basin? What are the costs and benefits of using project finance instead of traditional internal finance?

As compared with the project financing, internal financing is easy and quick to arrange. The EBDITA of PDVSA for year 1996 is almost $13 billion. At the same time, the debt rating on PDVSA is quite low which implies that internal financing would be more expensive than project financing. If PDVSA gets an investment grade rating than the overall difference in the debt rate would be 2.4% (10.17%-7.70%).

The project financing will be feasible if and only if, its financial and non financial benefits overweight that of internal financing. Let’s analyze all the relevant factors one by one.

i. Cost of Bankruptcy

This is a standalone project. The tangible asset base is also very high. Hence, the cost of financial distress will be least.

ii. Tax Benefits

Normally, the project financing makes room for more leverage and hence an enhanced tax shield. In the current case, the project would get a special tax treatment than PDVSA. Hence, there would be huge savings in taxes.

iii. Transaction costs

In terms of transaction costs, project financing is not a feasible option. In the current case, $15 million will be utilized in the transaction costs.

iv. Agency Issues

Greater leverage will force management to perform better as a standalone project will be transparent. Therefore, the overall cash flows of the company would increase. Also, as a private company, PetroZuata can bypass the government bidding regulations.

Considering all the above factors, it is clear that project financing is more expensive yet is helping in various scenarios. Therefore, the benefits must outweigh the costs.

2. What are Petrozuata’s three or four most important operating risks? How does the deal structure address these risks? Who would bear these risks if the project were financed internally by PDVSA instead?

There are a number of operational risks for this project. The three main and most pertinent risks are described below, and these three risks cover most of the risk in them.

i. Completion Risk

This risk constitutes two distinct risks, namely, technological risk (technology use can delay the results) and timing risk (failure to meet intermediate milestones). The sponsors minimized this risk by providing guarantees of completion, which were backed by their parents (PDVSA and DuPont).

ii. Market Risk

The risk that prices and quantities of future output are uncertain is referred to as market risk. This is a key risk in this case as the prices of oil are highly volatile. Following steps are taken to minimize this risk. PetroZuata’s breakeven price is quite low ($8.63 per barrel).

The price of Syncrude is tied to the price of Maya.

iii. Expropriation Risk

This risk takes the government into consideration by assuming that the government may, Change the taxation or royalty policy.

Seize the project cash flows (diversion of Syncrude) or project’s assets. Firstly, the diversion of Syncrude is not feasible as there are not many refineries to process the crude oil. Secondly, as this is the first project in a series of projects, there is a very minute chance that the government will take these steps.

3. As currently envisioned, debt will comprise 60% of the funds needed for the project. Would you recommend a higher or lower leverage ratio? What happens to the minimum debt service coverage ratio and internal rate of return on equity as project leverage increases to 70% of project funds, Decreases to 50%?

The debt service coverage ratio is calculated as:

SCR = Cash available for debt service / Debt service

Where Cash available for debt service is:

CADS = EBDITA -Taxes - CAPEX - ∆Net working capital – other cash items

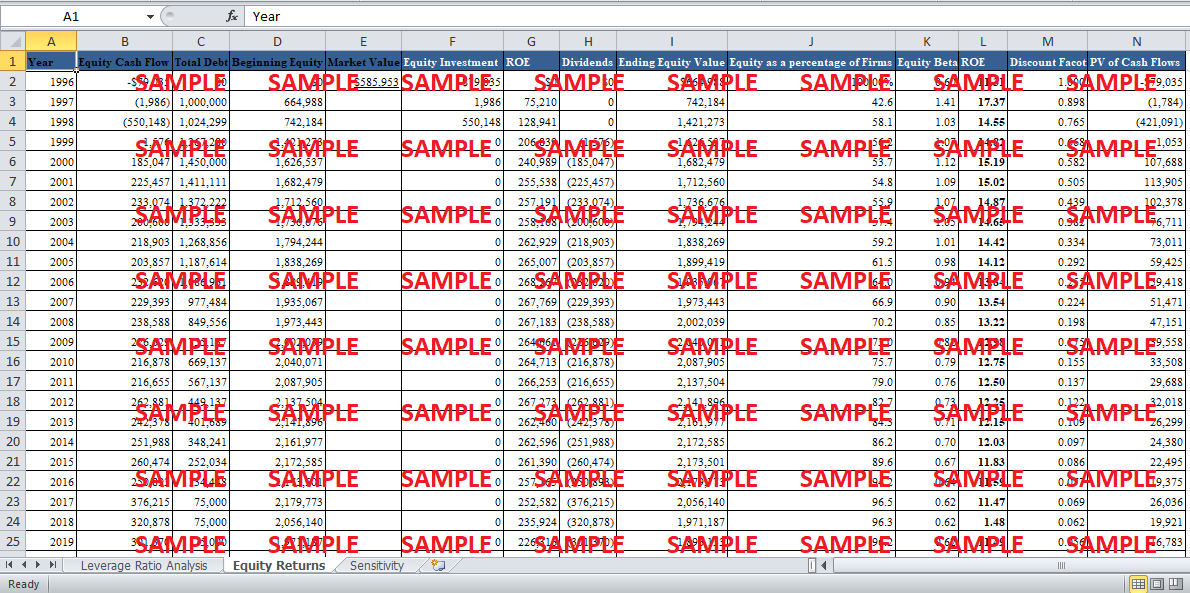

It is important to note that when debt ratio is increased, both the IRR and the DSCR change and they move in the opposite direction. The IRR for the base case is 25.6% (60% leverage). At the same time, the DSCR if 2.08X; when leverage increases, DSCR increases, and the IRR decreases. The following table depicts the values of IRR and DSCR for respective values of leverage.

Table 1: Leverage Sensitivity Analysis

|

Leverage Sensitivity Analysis |

||

|

Leverage (%) |

Minimum DSCR (x Times) |

IRR (%) |

|

40 |

3.13 |

19.6 |

|

45 |

2.78 |

20.7 |

|

50 |

2.5 |

22 |

|

55 |

2.27 |

23.5 |

|

60 |

2.08 |

25.6 |

|

65 |

1.92 |

28.3 |

|

70 |

1.79 |

32.1 |

|

75 |

1.67 |

37.8 |

|

80 |

1.56 |

46.8 |

Hence, by changing the leverage ratio, there seems to be a tradeoff between financial risk the rate of return. The above table shows that at 50% leverage, the IRR is 22%, and the DSCR is 2.5%. At 70% ratio, the IRR increases to 32.1% but the DSCR decreases to 1.79. This value is below the minimum acceptable value for getting an investment grade rating. By taking into consideration all the values in the table, it appears that 60% is an ideal leverage ratio. This ratio provides a handsome return and at the same time maintaining an investment grade rating.

4. What kind of debt (agency debt, bank debt, or Rule 144A bonds) should the sponsors use to fund the deal? What are the advantages and disadvantages of each kind of debt?

There are three distinct options for PetroZuata. Let’s analyze each option one by one.

i. Agency Debt

The major advantages of using the agency debt are:

Political risk insurance

Loan guarantees &

Halo effect of agency debt

The major disadvantage in the case of agency debt is the high cost and a longer time period to arrange the debt.

ii. Bank Debt

The biggest advantage of using a bank loan is that Petrozuata can draw a commitment fee on its credit line as needed. This would allow Petrozuata to match cash inflows with cash outflows. However, bank loan has numerous disadvantages including:

Restricting Covenants

Short maturity

Limited amount etc

iii. 144A Bonds

These types of bonds have attractive advantages, which include:

Longer Maturities

Fixed interest rate

Flexible and less restraining Covenants

Possibility of a large amount (Principle)

However, 144A has a major disadvantage. They disperse ownership, and this increases the cost and complexity of negotiations in an event of bankruptcy.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.