Get instant access to this case solution for only $19

Pinkleys Prospect Case Solution

Robert Buck was deciding whether to lease mineral rights on a 200 acres land in Texas so he could drill a shallow exploratory well. The area was mapped out by George Pinkley around 15 years ago, but no one had drilled there as the area was surrounded by dry holes. The prospect was of medium quality but would result in ten very shallow but productive oil fields if oil was there. If no oil was there and it was a dry hole, it would be plugged and abandoned. However, if oil was discovered, the project would prove to be profitable. The choice that the team needs to make is whether they should drill the oil or skip this area and abandon the project right now.

Case Analysis for Pinkleys Prospect

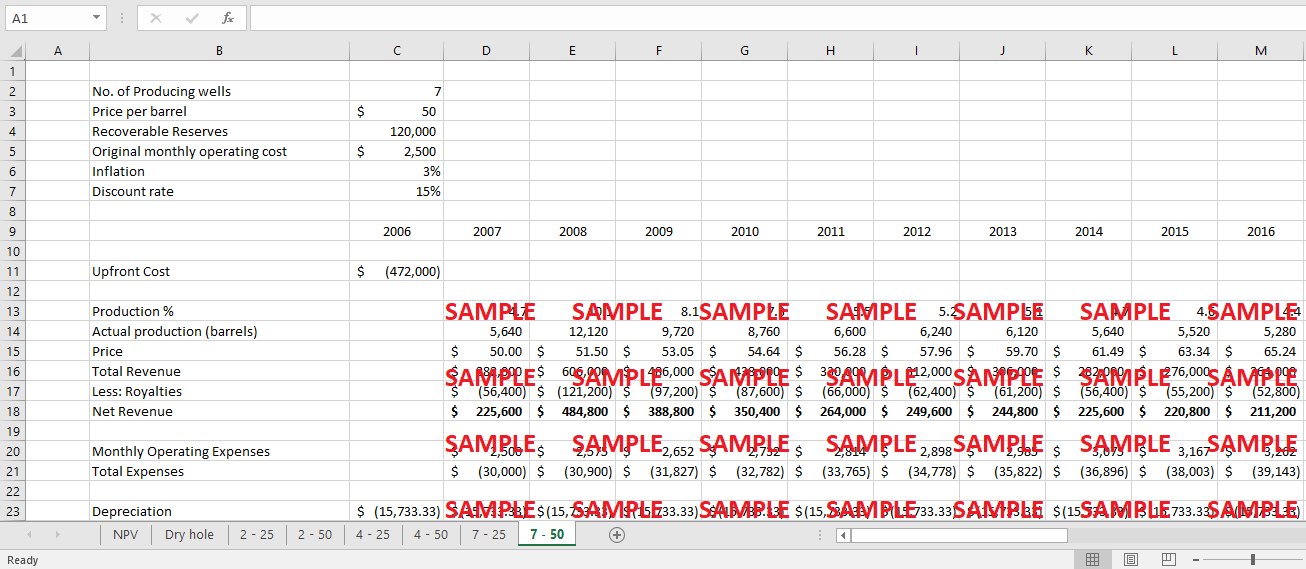

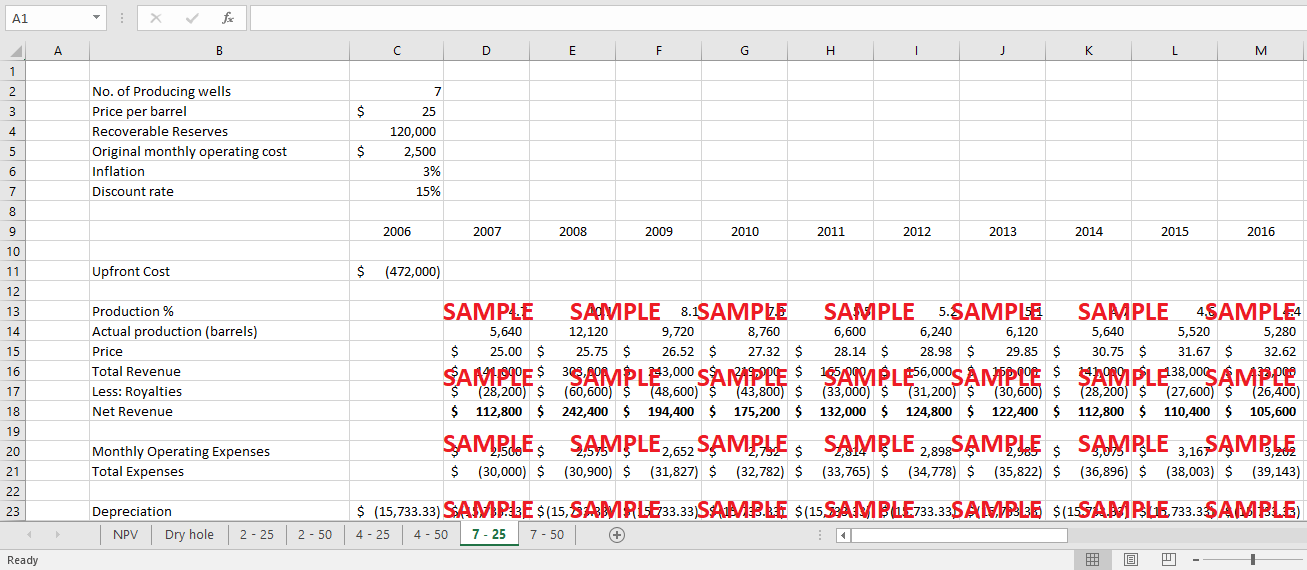

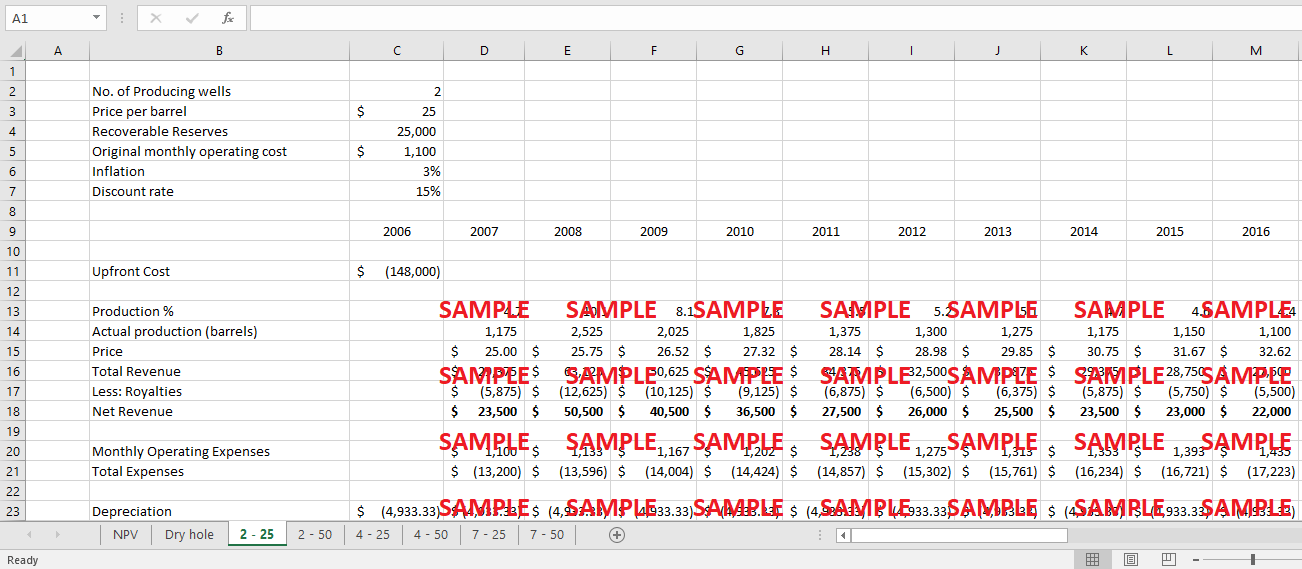

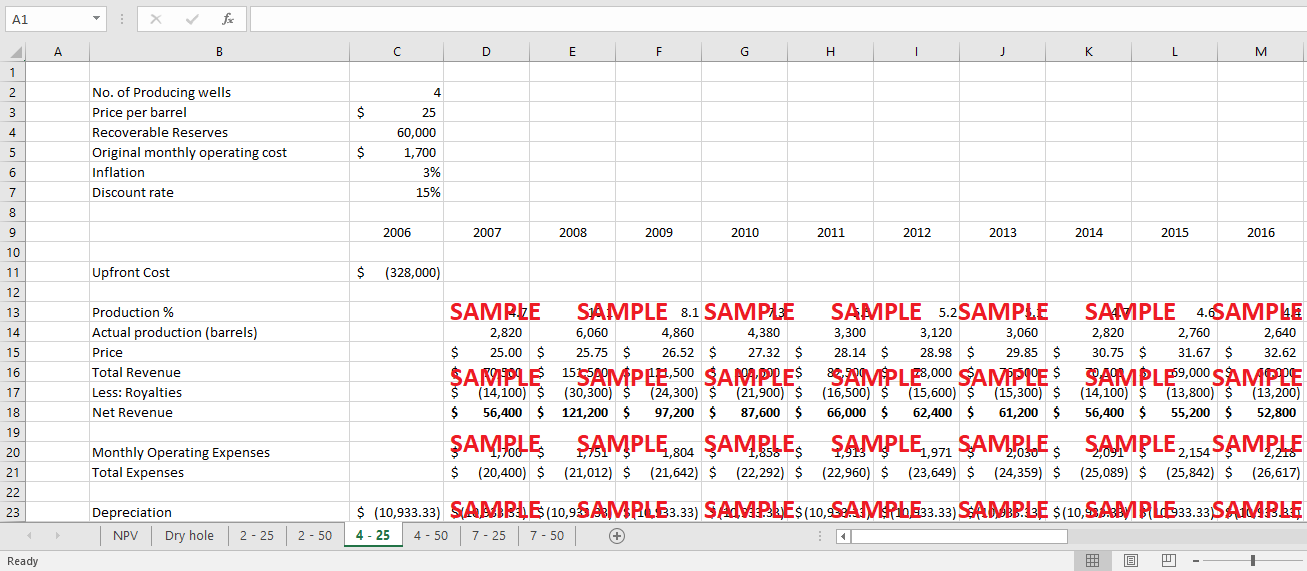

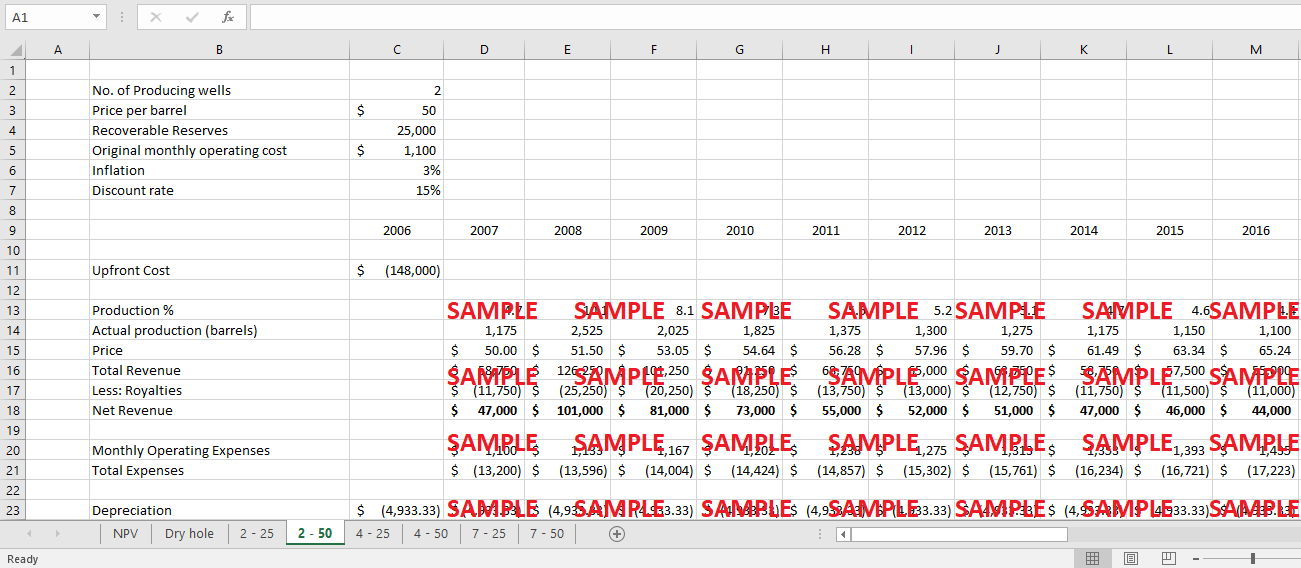

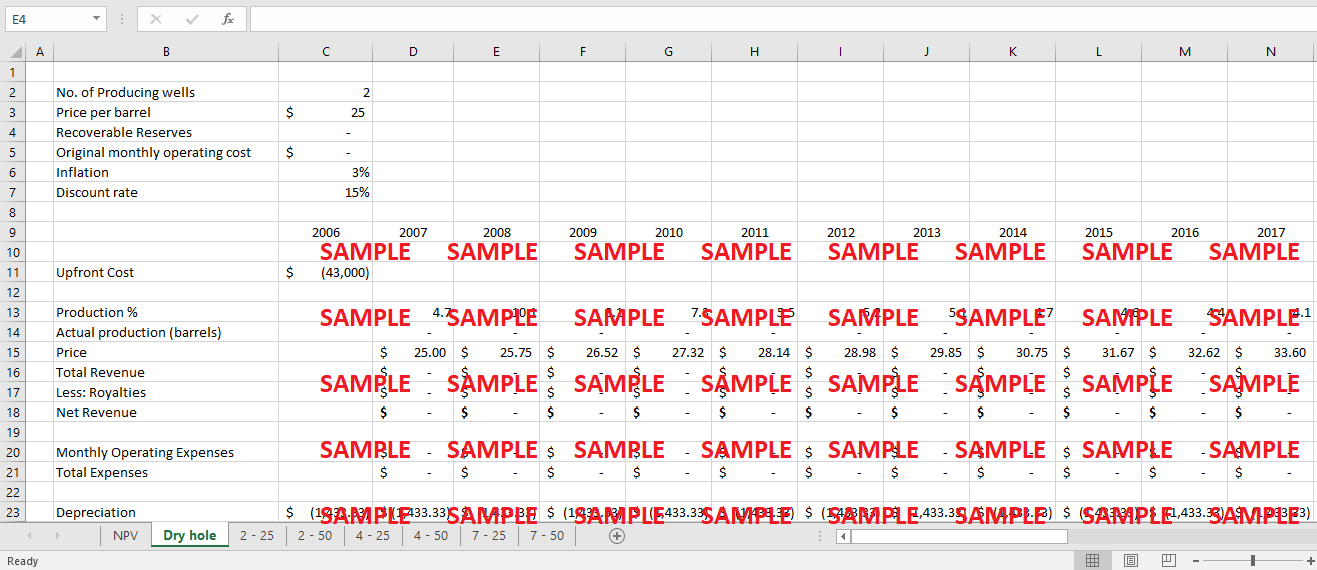

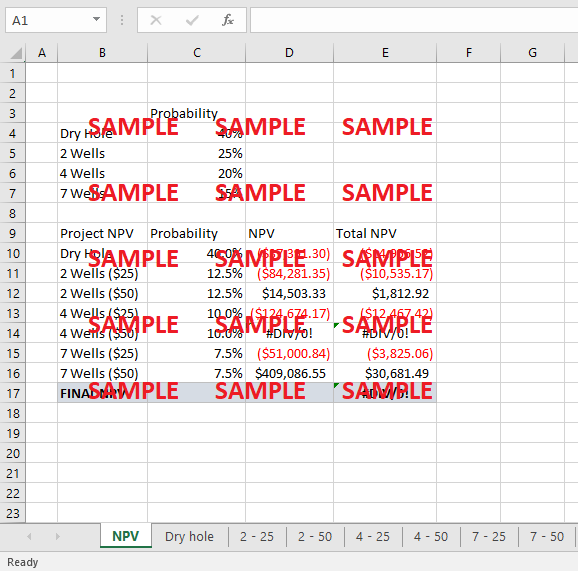

The project has seven alternatives available, whereby drilling would result in a dry hole, two oil-producing wells, four oil-producing wells, and seven oil-producing wells. Additionally, if oil is discovered, the price per barrel would either fall to $25 or remain at the $50 level. This makes the total number of scenarios seven. Each scenario has its own set of revenues and operating costs, which has been used to work out the net present value of the prospects. In the dry hole scenario, the net present value is negative, which is a complete loss and would result in the system being plugged and abandoned. If oil is discovered, but the price falls to $25, then the project would have a negative net present value irrespective of the number of oil-producing wells. If the price remains at the $50 level, then the net present value would be positive for the three scenarios and would be highest if the drilling resulted in seven oil-producing wells.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.