Get instant access to this case solution for only $19

Satelite Distribuidora de Petroleo Case Solution

Satélite Distribuidora de Petróleo is considering injecting some financial resources to cater for growth opportunities. DOI Ltd, the funding company, on the other hand, demands board seats and exceptionally high return. The analysis shows that SAT should better use the current market strength to negotiate the deal in such a way that no board seat is compromised. On the other hand, DOI Ltd should limit the investment horizon to 5 years. In case SAT refuses for minority share DOI Ltd should demand a higher return over the investment horizon. Future M&A can be extremely beneficial to both companies as they might result is possible synergies due to post M&A business operation enhancement.

Following questions are answered in this case study solution:

-

Abstract

-

Strengths and Weaknesses of SAT.

-

Strengths and Weaknesses of DOI Ltd

-

Investment Appraisal from SAT point of view.

-

Investment Appraisal from DOI Ltd point of view..

-

The Role of Future Mergers and Acquisitions

Satelite Distribuidora de Petroleo Case Analysis

2. Strengths and Weaknesses of SAT

The financial and non financial strengths and weaknesses of SAT are described below.

-

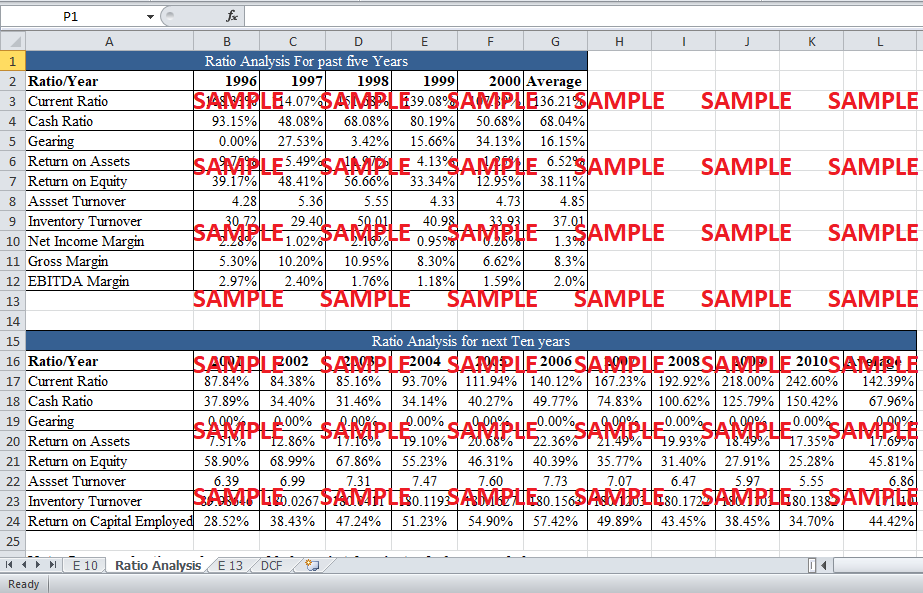

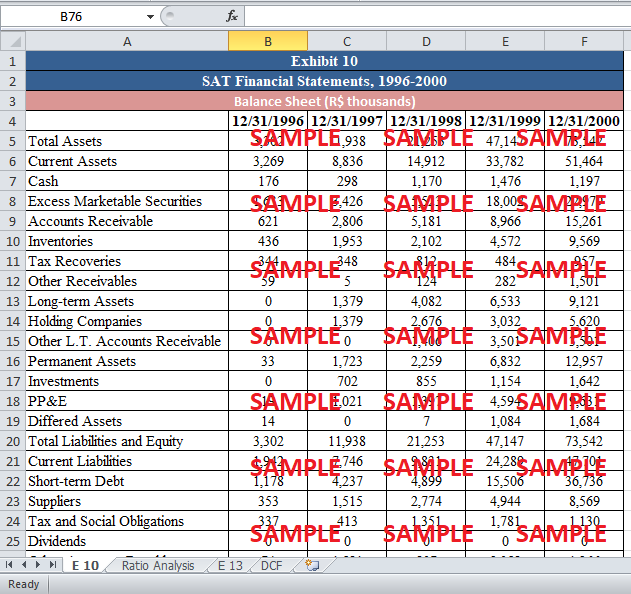

The liquidity ratios of SAT are exceptional. In the last five years, the average of both current and cash ratios are above 68%.

-

Apart from liquidity, profitability ratios of SAT are also worth mentioning. The averages of ROA and ROE for last five years are 7% and 38% respectively.

-

The inventory turnover of SAT is relatively high and stands at an average of 37.

-

The biggest financial drawback that SAT possesses is the projected ‘low gearing ratio’. The company has leverage of 34% in 2000 which is quite sufficient. However, the future leverage ratio implies that SAT is not fully utilizing the tax shield and debt benefits.

-

The Company is ‘probably’ incurring huge costs on fuel transportation. For example, RN synthesizes 21% of revenue, yet it possess only one fuel depot.

-

The Company’s policy for selecting new franchisees is admirable (minimum 20% ROCE).

3. Strengths and Weaknesses of DOI Ltd.

The strengths and weaknesses are described below.

-

DOI Ltd has a strong management team that possesses adequate market knowledge.

-

The targeted return to investors on investment is not compatible with the idea of minority interest. In the case of new or risky firms, capital injection is necessary; therefore they might agree on some board positions. On the other hand, most of the times growing companies reject the idea of board seats with the high specified investor return.

4. Investment Appraisal from SAT point of view

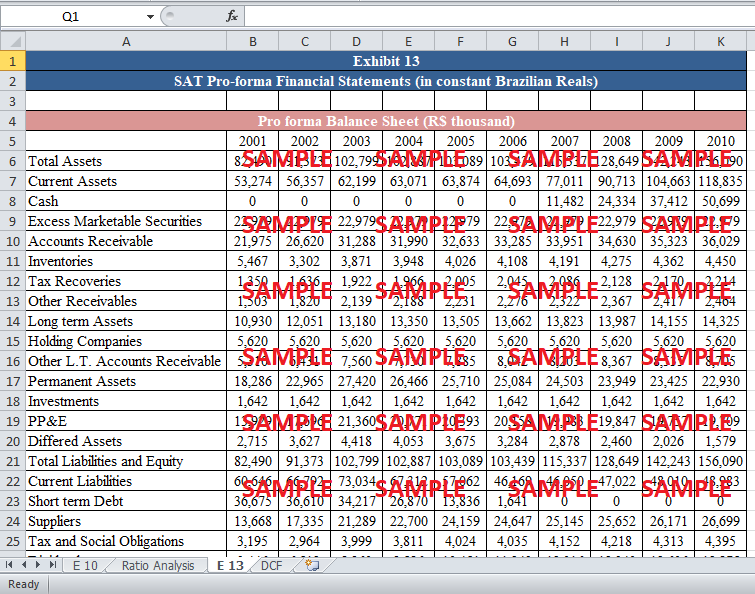

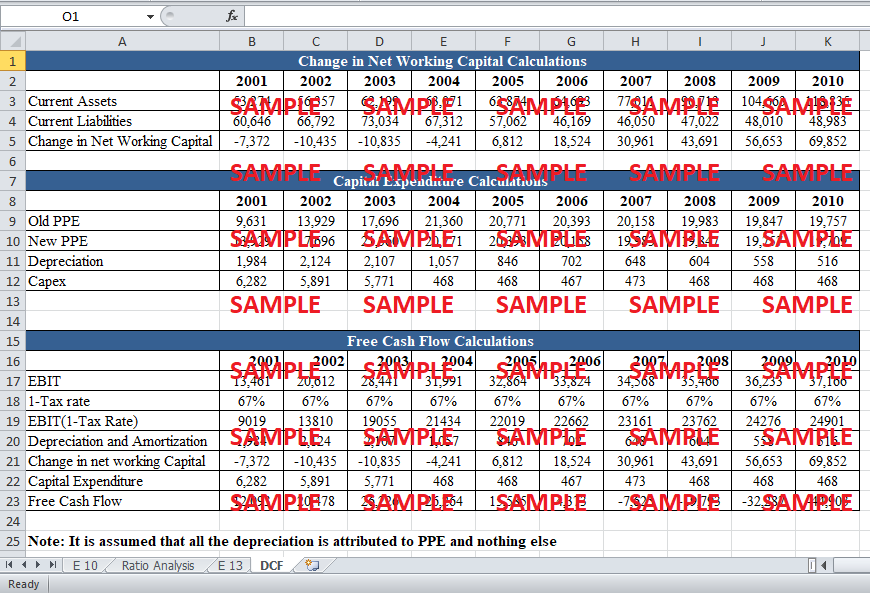

SAT has witnessed an average revenue growth rate of 86% in the last five years. This is a phenomenal figure. Before moving forward to the examination of ‘growth and fund needs’, this is vital to consider the current financial resources of the company. In the year 2000, the cash and cash equivalents comprise 32% of overall assets. This ratio is impressive for day to day operations of the business. At the same time, company operates on a 34% leverage ratio. Raising new debt will not be cheap because of the high leverage ratio. Meanwhile, the fact that existing gas stations were relatively not satisfied with the services of their distributors was a notion of worthwhile importance. Due to high competition and price wars, product diversification was also recommended. This product diversification would enable SAT to experiment a brand new idea. If the plan goes successful and generated revenues, company can gain a handsome amount of financial reward. Additionally, SAT was also ISO 2002 certified which was an added advantage for future acquisitions. Other prominent companies are also looking forward for acquisitions. If SAT defers the growth idea to a further date, it may lose possible small and medium size acquisition candidates. On the other hand, DOI Ltd demands a minority interest in SAT. The funding could prove expensive as a net return of 25-30% is additional to the board seats. If DOI Ltd, which is not a national or local company, gains minority interest, prospective acquisition candidates may be alarmed. The company backs itself on the strong management team of Marcelo Alecrim. The impression of a ‘new entrant’ in decision making process may hamper the image of the company. The best way for SAT is to negotiate the deal with DOI in such a way that no ‘board seat’ is compromised. The negotiations can be backed up by the ideas that the projected conservative ROCE of SAT for next five years is 44% and that the brand name and possible future growth opportunities complement this fact.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.