Get instant access to this case solution for only $19

Tax For The CFO Should Pfizer Acquire Allergan? Case Solution

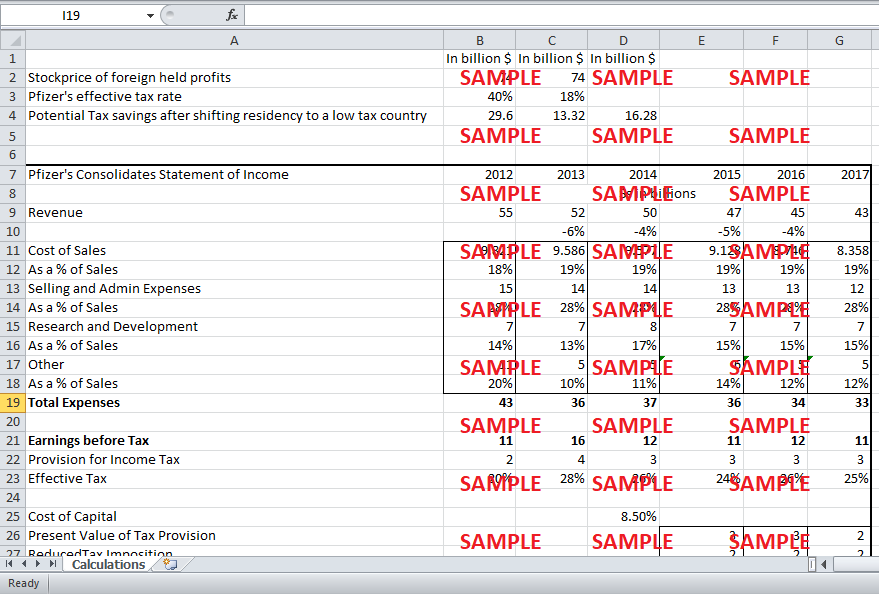

The given case study talks about the decision of merger between Pfizer and Allergan. Since Allergan was located in a low tax country, the merger by Pfizer was considered as tax inversion by many. Therefore, D' Amelio’s legal team at Pfizer decided to see if the tax savings were indeed equivalent to the value of the merger.

Following questions are answered in this case study solution

-

Introduction and Problem Identification

-

Analysis

-

Recommended Action Plan

Case Analysis for Tax For The CFO Should Pfizer Acquire Allergan?

2. Analysis

The merger would allow the Pfizer to change its residence country, enabling it to repatriate its profits of $74 billion, without paying tax on them, which amounted to $16 billion. Furthermore, the shift will cause it to shift from the tax bracket for 25% to 18%, which in itself would result in the present tax savings of $1 billion. Thus, on a standalone basis, Pfizer would be saving approximately $17 billion in taxes from its operations, if the merger proceeds.

The $135 billion price tag cannot be justified for just the tax savings, because even if the newly merged entity of Pfizer and Allergen helped increase profits and revenue, those will be as a result of the synergies of the merger in the form of increased portfolio of the product mix and a larger market (Garzella & Fiorentino, 2014). The financial benefits that Pfizer would gain from the merger apart from the higher profitability would be a doorway to repatriate its profits at a lower rate, although they are not that much a significant amount to solely justify the price tag pf the merger. Considering Pfizer’s declining revenue, having another large brand, with a strong market on board greatly justified Pfizer’s move to the merger, as means of countering to the declining volume in the uncertain market.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.