Get instant access to this case solution for only $19

The Timken Company Case Solution

The case talks about several factors that should be considered by Timken company when acquiring Torrington for the following reasons. Firstly, it will increase market share within the global industry from 7% to 11%. Secondly, Timken will become the third-largest bearing producer in the world. This also means that Timken can utilize economies of scale to achieve high returns. Again, Timken and Torrington only overlap 5 percent of their products (lower erosion effect) and have 80 percent of their customers overlap (increasing "bundling "strategy). Finally, Timken has expected annual cost savings of 80 million by 2007.”

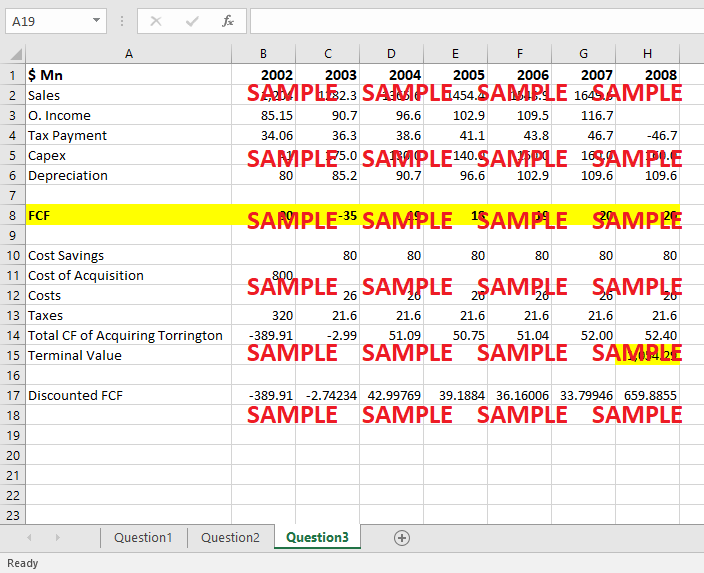

The report further discusses and analyses the acquisition of the bearing company Torrington by Timken. Going through the process of valuing the companies on a stand-alone basis with different valuation techniques, valuing the synergies and finally structuring the deal. The report finds that the acquisition should go ahead as the synergy benefits outweigh integration costs.”

Following questions are answered in this case study solution:

-

Review the data to identify the relevant cash flows on a forecast basis. Identify the free cash flows. Determine the discount rate appropriate to value the cash flows of Torrington or The Timken Company.

-

Attempt a fundamental valuation of Torrington on a standalone basis (i.e. no synergies) the valuation.

-

How would one perform a multiples valuation of Torrington and which multiples should be used and why?

-

How does Torrington fit with the Timken Company; What are the expected synergies and what is your synergy valuation of Torrington?

-

How do you think Timken should structure the deal – i.e. cash or a stock for stock deal – explain why?

Case Study Questions Answers

1. Review the data to identify the relevant cash flows on a forecast basis. Identify the free cash flows. Determine the discount rate appropriate to value the cash flows of Torrington or The Timken Company.

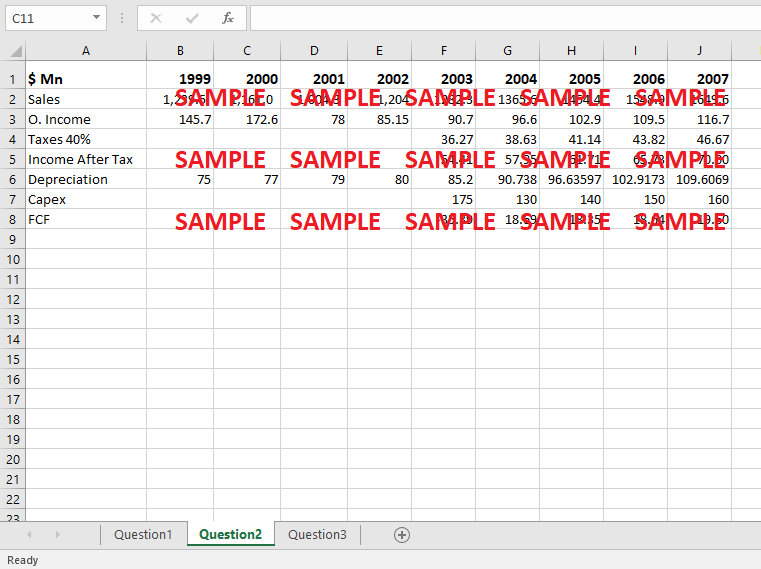

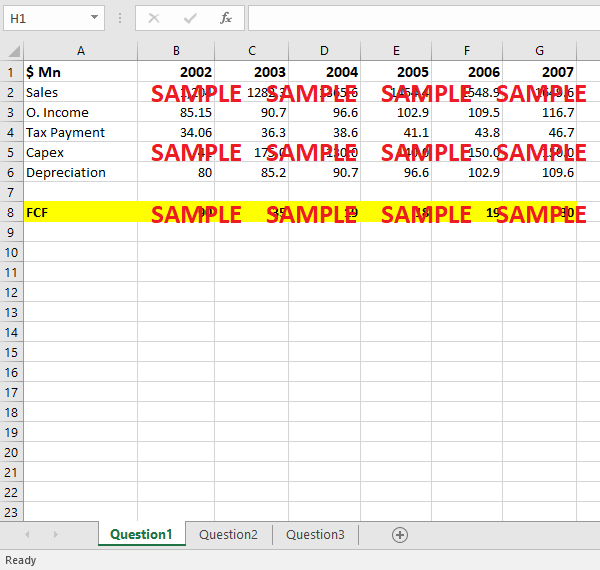

From the calculations, we have identified the forecasted cash flows:

We can see that during 2003, the FCF will be negative because of the high capex done by the company, and post-2003, the FCF is going to remain stagnant. However, in 2007, the company will further experience a higher FCF of $30 million.

Moreover, in terms of the Free cash flow = EBIT - Tax + Depreciation - CAPEX - NWC In this case, there is no NWC; therefore, FCF 2001 = 37-14.8+152.5-102.3 = 72.4

FCF 2002 = 110.7-34.1+146.5-90.7 = 132.4”.

Furthermore, to identify the relevant discount rate, "Assume that Torrington has the same capital structure as Timken. Therefore, from exhibits 2 and 8, we can find that the market value of debt is $461.2 million (d), and the market value of Timken's equity is $609.1 million (e). Since the discounted rate is equal to the WACC and we can get the formula as below: WACC=RD(1-T) *d/v+ RS*e/v from exhibit 9, we can get the long-term risk-free rate: 4.97%, assume the risk premium is 6% and beta is equal to 1.1, cost of equity is 12.7%, the tax rate is 40%. d/v=43.1%, e/v=56.9% put all the data back into the formula, we can get WACC=9.1%.".

2. Attempt a fundamental valuation of Torrington on a standalone basis (i.e., no synergies) the valuation.

One of the hardest things with valuation is estimating the future value of synergies, which should cause an increase in cash flows. For Torrington, it needs to make incremental investment planning, which includes hidden costs that might cause overvaluation of the target; of course, this would cause value destruction. An initial valuation supports the fact that Torrington's automotive business is stronger than expected, meaning the synergy is strong. Another valuation is that the two products from the company complement each other, meaning there will be no loss. Yet the investment planning showed that the acquisition is debatable because of the hidden costs. The case estimates the hidden costs to be $130 million, and the cost would have been incurred in a number of years, which is a lot compared to the savings of $80 million. My valuation is that if the acquisition is expected to bring returns on a short-term basis, then the Timken company should not take over Torrington. However, if the goal of the acquisition is long-term return, then the acquisition is justified."

3. How would one perform a multiples valuation of Torrington, and which multiples should be used and why?

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.