Get instant access to this case solution for only $19

USEC Inc Case Solution

This case study deals with the profitability analysis of American Centrifuge project to USEC. Mackovjak, an analyst working for Rivvana was given a task by the management of the company to recommend whether the shares of USEC are undervalued or overvalues. Before, he could make a final recommendation; he had to assess the value addition of American Centrifuge Project that would affect the share price of the company significantly in coming years if the company adopts that project.

Following questions are answered in this case study solution

-

Introduction

-

Advantages of American Centrifuge Project

-

Cost-Benefit Analysis

-

Weighted Average Cost of Capital

-

Choice of Discount Rate and the Riskiness of ACP

-

Assumptions for NPV Analysis

-

NPV and IRR Analysis of American Centrifuge Project

-

Conclusion

Case Analysis for USEC Inc

2. Advantages of American Centrifuge Project

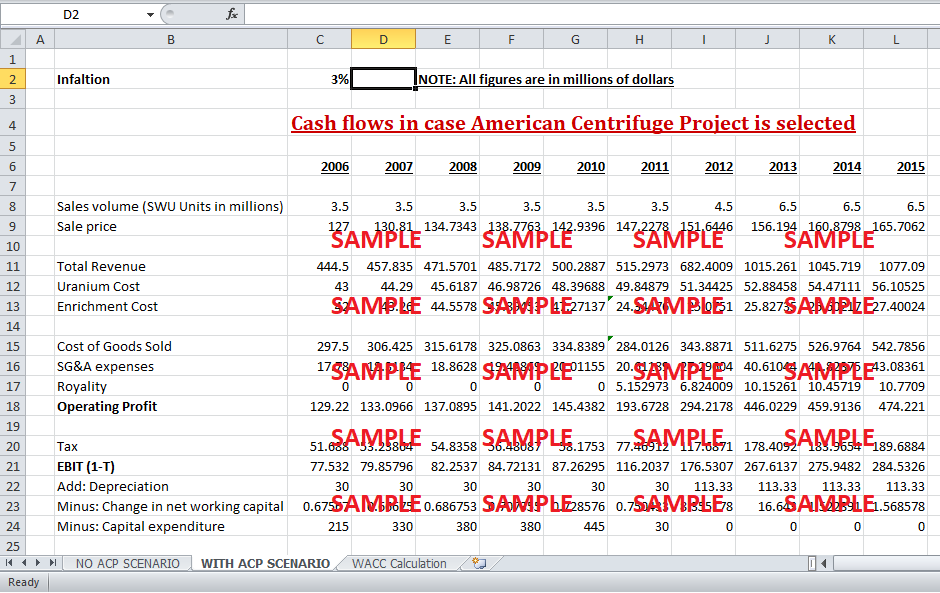

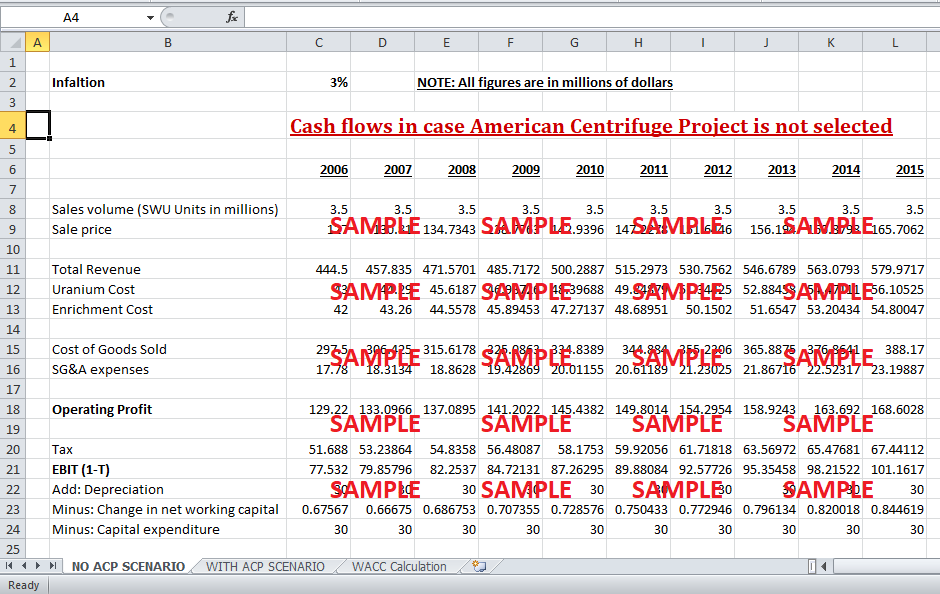

USEC is one of the largest energy companies in the world, and it is the only company in United States that operates the uranium enrichment facility in the country. The current market share of the company was 50% in North American and 30% in the globe. A successful implementation of American Centrifuge Project would double the scale of operations of the company. Currently, even if the company operates its Pudacah plant at full capacity, its annual production will be 3.5 million SWU’s. However, by replacing Pudacah by American Centrifuge Project, USEC will be able to expand its production capacity to a maximum of 6.5 million SWU’s by the year 2013. Also, this new project was expected to increase the competitive position of the company by bringing in cost efficiencies. The demand and price of SWU’s were expected to increase significantly in the future. Therefore, the company wanted to exploit these growth opportunities by expanding its scale of operations and increasing operational efficiency. The variable elements of production costs were expected to decrease significantly by replacing Pudacah by ACP.

3. Cost-Benefit Analysis

However, the company cannot make a decision solely based on the advantages of ACP. The company has to take into account huge fixed costs associated with the project and do a cost benefit analysis. One way to do this is “Discounted Cash Flow” method where incremental cash flows should be discounted to get the value addition of project in dollar terms. The discount rate used should represent the level of riskiness of American Centrifuge Project.

4. Weighted Average Cost of Capital

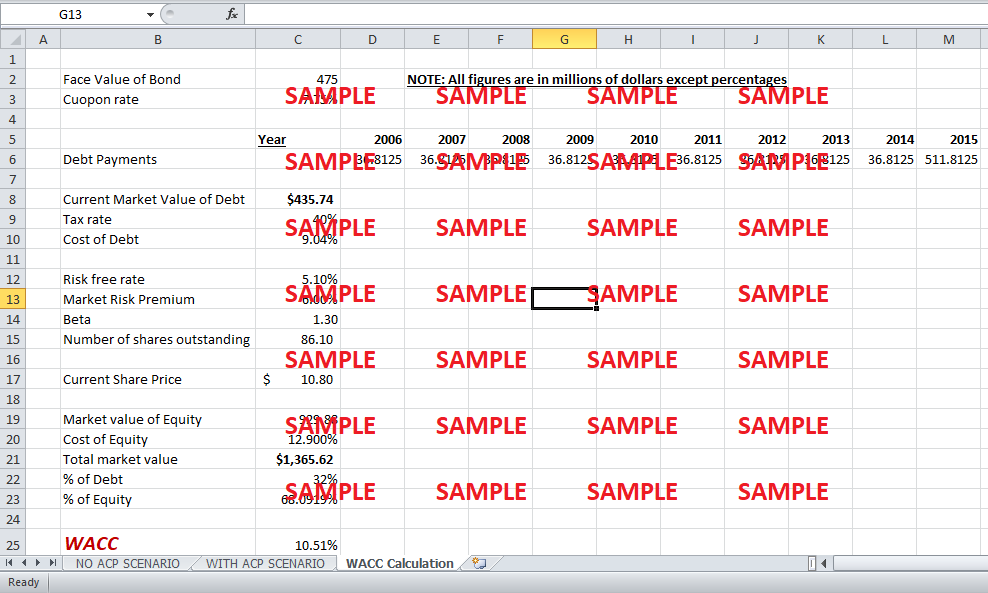

The weightage average cost capital for USEC can be calculated by finding the market values of both debt and equity of the company. Market value for equity is very easy to calculate. The market value of equity or market capitalization can be calculated by multiplying the number of shares outstanding by the current share price of the company. The average number of shares outstanding for the company is 86.1 million. Current share price of the company is $10.8. Thus, the product of these two values gives the market capitalization of the company of value $929.88 million. The calculation for market value of debt is slightly tricky because the bond is not selling at the par value since the yield to maturity is not equal to the coupon rate for the bond. Annual coupon payments can be calculated by multiplying the coupon rate of 7.75% with the face value of debt ($475 million). This gives the coupon payments of 36.8125 million for 10 years until 2015. The last year payment also includes the principal repayment of $475 million and hence, the total payment at the end of year 2015 is $511.81 million. These payments should be discounted at the discount rate equal to yield to maturity (9.04%). The present value of all these payments for ten years comes out to be $435.74 million. The total market value of the company can be calculated by adding the market value of debt and equity. Thus, when the market value of debt ($435.74 million) is added to market value of equity ($929.88 million), total market value of the company comes out to be $1365.62 million. This market value of the company is composed of 32% debt and 68% equity. The beta for the company is 1.3 while the risk premium and risk free rate are assumed to be 6% and 5.1%. Thus, the cost of equity using the CAPM formula comes out to be 12.9%. Using all these values and the tax rate of 40%, WACC for the company comes out to be 10.51%.

5. Choice of Discount Rate and the Riskiness of ACP

The discount rate used for discounted cash flow analysis depicts the level of riskiness of a project. WACC for a company is essentially the weighted average required rate of return asked by the lenders and shareholders. The higher the level of the business risk, the higher the WACC for that purpose. American Centrifuge Project will be assimilated in the existing operations of the company, and the riskiness of the overall operations of the company remains the same even after the ACP is adopted. The suitability of the project and depends upon the level of cash inflows, outflows and opportunity costs associated with the project. All of these aspects are represented by the incremental cash flows. Therefore, WACC calculated for the company can be used for the American Centrifuge Project because it has the same risks associated with it as are with the existing operations.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.