Get instant access to this case solution for only $19

Textron Corporation Benchmarking Performance Case Solution

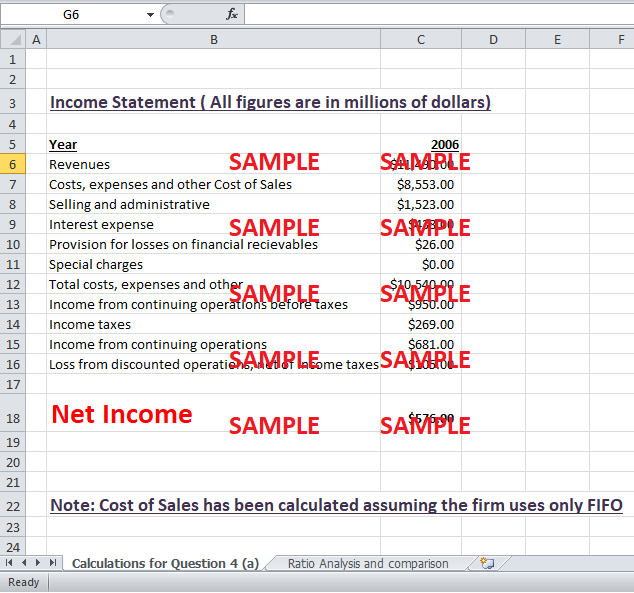

LIFO reserve for 2005 and 2006 for Honeywell Inc are $145,000 and $170,000. For Textron Corporation, these values are $251,000 and $275,000 respectively. Both of these companies use LIFO/FIFO use the same costing method and hence their LIFO reserves can be compared with each other. A higher reserve for Textron Corporation shows that the costs of sales on financial statements of the company are highly undervalued. Even with data of undervalued inventory, day’s inventory of the company is very high as compared to day’s inventory of Honeywell Inc. Therefore, inventory management of the company is very poor as compared to its competitors. Therefore, the resources of the company are being inefficiently used and consequently, the return on assets of the company is much lower than its competitors.

Following questions are answered in this case study solution

-

Describe Textron’s business and how it “makes money”.

-

What is your assessment of the Textron's profitability, leverage and asset management in 2004-2006? In what areas might the company improve its financial performance?

-

Textron uses a combination of LIFO and FIFO to value inventories (see Note 6).

-

Using information about the LIFO reserve for aerospace and defense firms, what is your assessment of Textron's inventory management performance versus its competitors?

Case Analysis for Textron Corporation Benchmarking Performance

1. Describe Textron’s business and how it “makes money”.

Textron has always been updating the business portfolio of the company in response to opportunities that arose with time. The product portfolio of the company changed in response to changes in market. By using excess cash generated from textile business, the company acquired Bell Aerospace. This acquisition of a completely different business explains the core strategy of the company i.e. rather than sticking to a single business and using excess cash to expand in the same industry, the management of company believed in acquiring new businesses that have profitability potential. Instead of investing in operations, the company focused on investing on the enterprise management. Resources were continually invested in updating skills of management and using these skills for taking maximum benefit from optimal portfolio management. Therefore, enterprise and portfolio management were the two key core competencies that enabled the company to create shareholder value. This objective was achieved by focusing all the resources of the company for keeping costumers happy, inducting the best human resources and using state of the art production processes. Therefore, the company earns money by using superior management skills for portfolio management by diversifying the investment in order to create a portfolio of businesses with optimal return.

2. What is your assessment of the Textron's profitability, leverage and asset management in 2004-2006? In what areas might the company improve its financial performance?

Although the share price of the company had shown much better performance than S&P 500, but still there were many areas in which Textron was lagging behind other players in the same industry. Comparison with S&P 500 in the past does not depict the complete picture of the financial performance of the company. The firm needs to compare the performance indicators of the company with those of other players in the industry to understand the true performance of the company. One of the most common ways to do this is to use the industry average for comparison with the financial indicators of the company. A comparison of the profitability ratios of the company with those of the industry shows that the company has remained highly inefficient in using its resources. Return on sales of the company is 5% whereas average return on sales of the industry is 16%. Gross margin of the company is 26% while average gross margin of the comparable companies is 30%. Return on assets of the company is 3% while average return on assets of the industry is 8%. This shows that the company is not using its resources efficiently. The share price of the company is bound to suffer in the long run if the company does not earn return at least as much as the industry average. The leverage of the company is 6.63 whereas average leverage of the comparable companies if 2.75. This means that default risk for the company is very high as compared to other businesses. Inventory and cash management of the company are very poor due to which company has been earning very low returns on assets. Day’s sales of inventory of the company are much higher than other players in the industry. Therefore, a complete analysis of the company shows that the performance of the company is not up to the mark and comparison of the share price with S&P 500 does not show the complete picture of the performance of the company.

The company has shown a very irregular pattern of cash flows from 2004-2006. Net cash flow for 2004 and 2006 remained negative while it remained positive for 2005 in between. This has been the pattern of cash flows for many past years. This puts a very serious question on the cash management of the company because the company can only acquire new businesses if it has excess cash to buy businesses. Therefore, poor cash flow creates a serious business risk for the company. Ratio analysis shows that acid test ratio for the company is 0.04 whereas average acid test value for the industry is 0.06. Similarly, current ratio for the company is 0.58 while average current ratio of all the competitors of the company is 0.71. This means that the company’s default risk is slightly higher than that of its competitors. The reason why the company has shown negative cash flows in between is that the company is investing a lot by buying new businesses in the portfolio of the company, but returns from these investments have been very low. This is evident for return of asset value of 0.03 for 2006. Cash flow from investing activities has been a very high negative value for past three years due to huge investments and capital expenditures.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.