Get instant access to this case solution for only $19

Valuing a cross-border LBO Bidding on the Yell Group Case Solution

Yell Group consists of two businesses that are operating across countries. Yellow Pages is a classified directory business in the UK, while Yellow Book is an independent directory business in the USA. These businesses are currently owned by British Telecom which is contemplating a sale in order to reduce its leverage. Apax Partner and Hick Muse are two private equity firms that are interested in buying the Yell Group. The private equity firms face a challenge when valuing a cross border business involved in a LBO. It is believed that Yell Group can be best valued using the Adjusted Present Value Approach, which individually measures the debt and equity of a company. The equity can be valued by discounted the Capital Cash Flows by the unlevered cost of equity capital. Whereas, the value of debt equals the tax shield generated by each strand of debt. During the valuation process, the management’s calculations are evaluated and complemented to arrive at a proposed bid price for the Yell Group.

Following questions are answered in this case study solution

-

Introduction

-

Yell Group Operations

-

Valuing Yell Group

-

The Bid Price

-

References

Case Analysis for Valuing a cross-border LBO Bidding on the Yell Group

1. Introduction

Two private equity firms, Apax Partners and Hicks, Muse, Tate & Furst, are looking to buy Yell Group. Yell is a division of the telecom giant British Telecom (BT). British Telecom is considering a sale of the the business in a bid to reduce its high leverage. Yell consists of two main assets: Bt Yellow Pages that operates in United Kingdom, and Yellow Book that is based in USA. The cross border nature of the deal poses significant valuation problems for the acquirer. Moreover, Apax and Hicks Muse are not the only party interested in acquiring the Yell Group. Some other private equity groups and competitors have also shown interest in Yell. British Telecom is also considering a demerger of the Yell Group where 90% of the shares would be allocated to existing shareholders of British Telecom. Therefore, it is important for Apax and Hicks Muse to come up with a fair bid for Yell in a short period of time. The deal would be finance through £1.45 billion in debt and the remaining would be contributed by the private equity firms. The management would also participate with a contribution of 7.3% of the total equity.

2. Yell Group Operations

Yell Group is the proposed holding company for the Yellow Pages business in the UK and the Yellow Book enterprise in the USA. These businesses were the market-leaders in the directory business within their geographical areas. Apart from the different geography of operations, the businesses had different growth rates and cash flow characteristics. The UK business was facing a possible legislation on the advertising prices and its future revenues were highly dependent on the outcome of the legislation. The US business was expanding in new market and its growth projections were unstable and subjective. These factors created doubts about the rate at which the companies could grow in the future.

Value Drivers

Both the divisions of Yell enjoyed a great market position. Yellow Pages, the UK business, earns majority of its revenues from advertising. It is a stable and non-cyclical source of revenue. The overall classified directories advertising market has grown at a stable rate but has experienced a recent decline while the total advertising market has remained stable. This implies that the directories advertising may be losing out to other forms of advertising during the recent years. Besides the number of advertisements sold, the price of the advertisements was also a significant determinant of revenue. The price of advertisements is at a risk of being negatively affected by legislation. Under the possible regulatory changes, the company can be forced to even decrease its advertisements price in the future. Such a change could have a major impact on the future cash flows of Yellow Pages.

Yellow Book is an independent publisher of the yellow page directories in USA. The yellow pages market, while growing at a steady 4% to 5% per year, has been traditionally dominated by Regional Bell Operating Companies. However, the independent publishers like Yellow Book are expected to gain market shares in the coming year. Their market share is expected to increase from 11% to 30% in the next four years. Therefore, the industry dynamics produce a high growth opportunity for Yellow Book. The company is involved in a lot of new launches in a bid to capture the market share. This poses problems as the revenues from these new launches cannot be determined with accuracy and the cost is also significantly high.

3. Valuing Yell Group

Valuing Across Borders

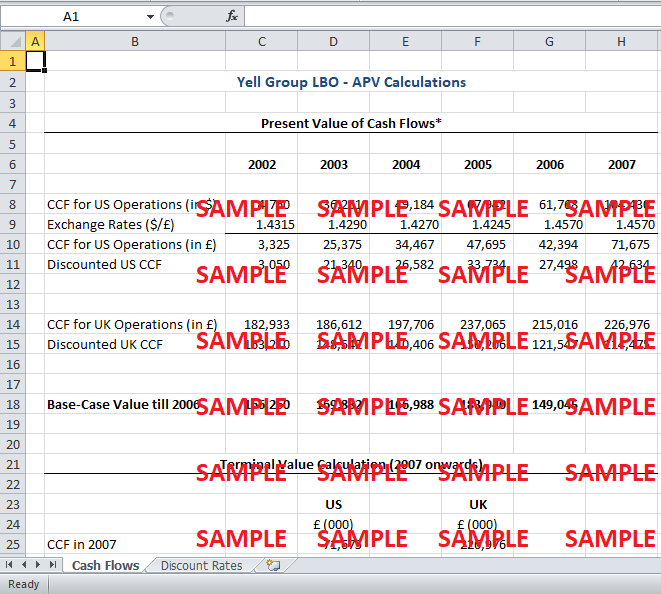

The most prominent challenge in the valuation process is the cross border nature of the deal. One part of the company is located in US while the other part is in UK. The bid has to be made to British Telecom is UK pounds. Therefore, the value of the US operations needs to be determined in British pounds. The exhibit provides exchange rate data for US dollars against British pounds. The forward rate has been provided for the next five years and has been used to convert the projected cash flows from dollars to pounds. It is granted that these exchange rates are subject to change but they provide the best projection of the future exchange rates. The projected cash flows from US business are significantly lower than the projected cash flows from UK business. Therefore, minor changes in future exchange rates will not have a major impact on the overall valuation of the firm. Nevertheless, the involvement of two currencies exposes Yell Group to currency risk. However, such a risk can be managed by using hedging techniques and through the use of derivatives like futures contracts and currency swap agreements.

Adjusted Present Value Approach

An LBO is a high leverage transaction where the debt levels reach considerably high levels. Moreover, the different categories of issued debt and the complex debt structuring make it difficult to predict the debt repayment schedules. In such circumstances, the adjusted present value approach seems like an appropriate valuation techniques for Yell Group. An advantage of the APV approach is that unlike WACC, which incorporates various factors into a single discount rate, APV measures the impact of different factors like debt and equity separately. In a complicated situation like an LBO, APV is much easier to measure as it isolates the effect that the added debt might have on the valuation of the company. APV calculated the value of a project as if it were all equity financed and then considers the impact financing side effects in isolation. These financing side effects can range from tax shields to issuance costs.

The Equity Valuation

The equity value is calculated by discounting the capital cash flows of the company by an unlevered equity discount rate. Since the operations in the US and UK have different cash flow features and are characterized by their own market risks, their cash flows will discounted separately on the basis of their own discount rates. The discount rates for US and UK can be calculated through the Capital Asset Pricing Model (CAPM). CAPM views discount rate as a measure of systematic risk and adjusts the discount rate for each company on the basis of its beta. Therefore, the determination of an appropriate beta is at the heart of calculating the equity discount rate.

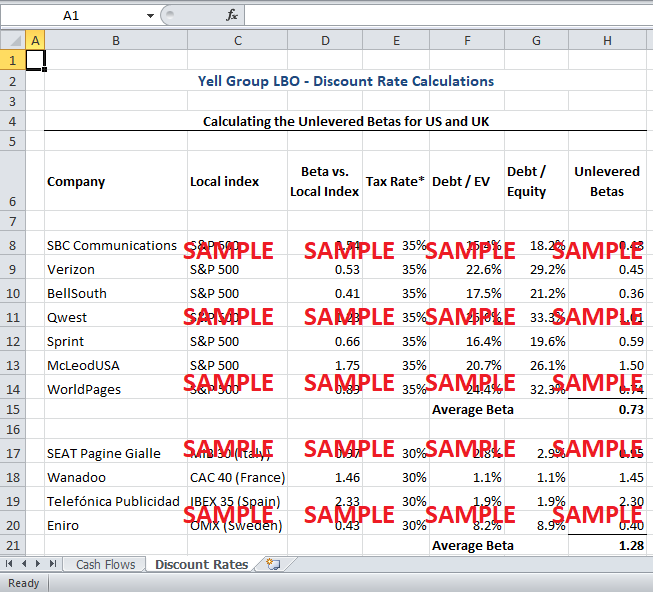

Since the cash flows need to be discounted at the unlevered costs of equity, unlevered betas for both US and UK operations are required to be calculated. The unlevered betas can be calculated for Yell Group using the competitors’ data. The data about the competitors’ betas and leverage is provided in the appendix. The data can be used to calculate the unlevered betas for each of the competitors using the Hamada’s equation. The Hamada’s equation requires tax rate as a necessary component during the process of unlevering the betas. The tax rate has been assumed to be 35% for US companies and 30% for European companies. This is consistent with the tax rates for the US and UK operations for Yell Group. The competitors are classified into two groups according to their area of operations: US and European. The average unlevered beta for US competitors’ is assumed to be the beta for Yellow Book USA; whereas the average beta for the European competitors is taken to be the beta for Yellow Pages UK.

Other required inputs to calculate equity discount rate under CAPM are the riskfree rate and the market risk premium. For the riskfree rate, the 5-year, 10-year and 30-year t-bill rates are provided for both UK and US. The time horizon the relevant Treasury bill yield should match the time horizon for the equity. Since, equity is long-term (eve perpetual) in nature, the 5-year t-bill yield is not appropriate. 30 years seem to be too long a period and the company may not even last that long. Therefore, 10-year t-bill yield seems to be a more appropriate time horizon for selecting the risk-free rate. The appropriate risk premium can be selected from studying the historical stock returns for a major index within the US and UK market. Recent surveys suggest that the appropriate market risk premium is 5.3% in US and 5.6% in UK (Fernandez and Baonza, 2010).

Using the Capital Asset Pricing Model (CAPM), two separate equity discount rates have been determined for each of the US and UK operations. The Capital Cash Flows, as determined by the case writer and adjusted for currency effects, have only been forecasted for the future five years of operation till 2007. Therefore, a terminal value for Yell, beyond 2007, needs to be determined to properly evaluate the worth of the Group. Assuming that the company grows at constant rate after 2007, the terminal value can be determined using the Gordon-Growth Model. The Gordon-Growth Model is usually highly receptive to the assumption about the long-term growth rate of the company. Owing to the degree of uncertainty attached with the cash flows, the long-term growth rate has been assumed to be 2% for both US and UK operations. This estimate is quite conservative considering the current industry growth rate of over 3% for both US and UK markets. After obtaining the terminal values, the overall Capital Cash Flows can be discounted at the unlevered cost of equity to obtain the equity value for the company.

Financing Side Effects

The equity value of the company needs to be adjusted for the financing side effects before the overall value of the Yell Group can be determined. The most prominent side effect is usually the tax shield generated by the long term debt, while other sources include issuance costs and distress costs. The debt shield can be calculated using different assumptions. One assumption is that the current level debt will remain constant throughout the life of the company and the tax shield from each strand of debt will be discounted at the debt’s relevant interest rate. Following this assumption, the debt tax shield is calculated by multiplying the tax rate by the total amount of debt. The applicable tax rate, in the case of Yell, is the UK corporate rate of 30% while the total debt is £1.55 billion

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.