Get instant access to this case solution for only $19

Waltham Motors Division Case Solution

Waltham Motors produced a single design electric motors used to manufacture household appliances. Waltham Motors was a subsidiary of Macro Corporations. In May, Sharon Michaels, the controller of the firm, was concerned about the performance of the firm during the month because of the loss of a major customer contract. She asked the accountant to prepare a performance report as soon as possible. The report indicated that Waltham’s plant performance was good because all the costs were under budget. However, the actual income reported a loss of $7,200. The actual cost and revenue had to be compared with a flexible budget of 14,000 units and adjusted for the loss of contract.

Following questions are answered in this case study solution

-

Using budget data, how many motors would have to be sold for Waltham Motors Division to break even?

-

Using budget data, what was the total expected cost per unit if all manufacturing and shipping overhead (both variable and fixed) was allocated to planned production? What was the actual per-unit cost of production and shipping?

-

Comment on the performance report and the plant accountant’s analysis of results. How, if at all, would you suggest the performance report be changed before sending it on to the division manager and Marco Corporation headquarters?

-

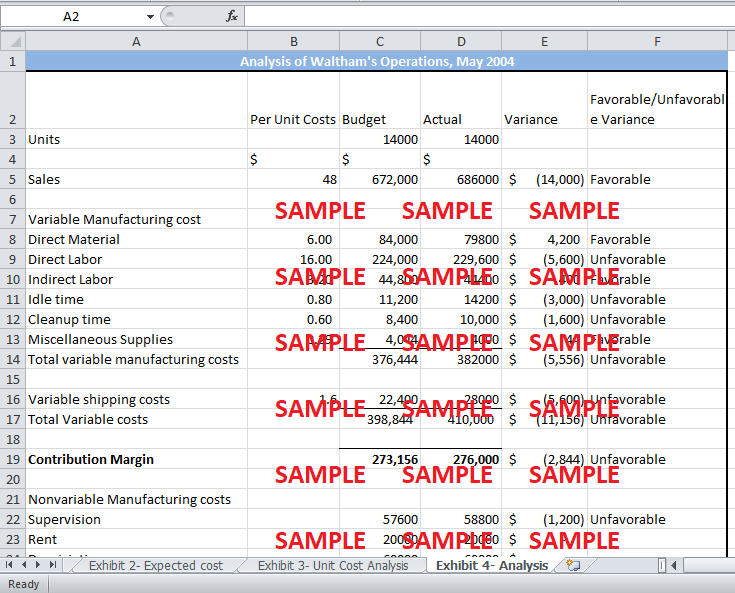

Prepare your own analysis of the Waltham Division’s operations in May. Explain in as much detail as possible why income differed from what you would have expected.

Case Analysis for Waltham Motors Division

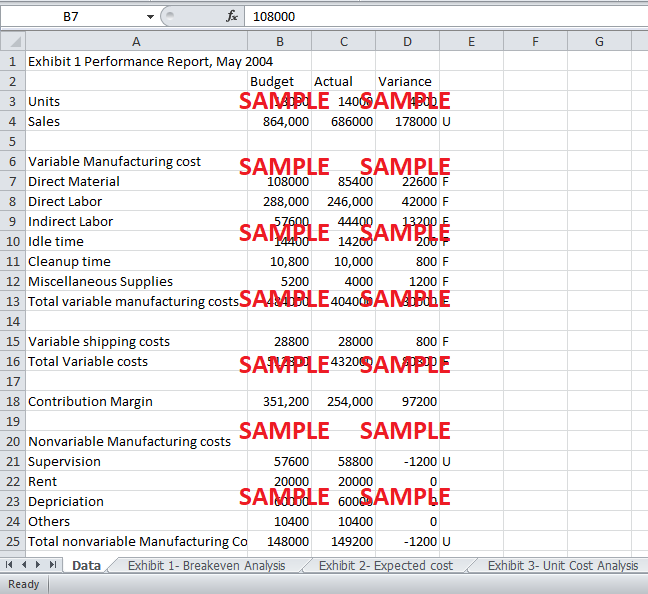

1. Using budget data, how many motors would have to be sold for Waltham Motors Division to break even?

To calculate the number of units sold for the Waltham Motors Division to breakeven, it is essential to calculate the contribution margin per unit by dividing the contribution given in the case by the number of units produced. The contribution margin per unit is $19.51. Exhibit 1 shows the breakeven analysis done using the budget data. The total budgeted fixed cost is 260,000. Hence, the breakeven units are calculated by dividing the total fixed cost by the contribution margin per unit. The breakeven number of units is 13,326. This means that Waltham has to sell 13,326 units in order to cover all the fixed costs.

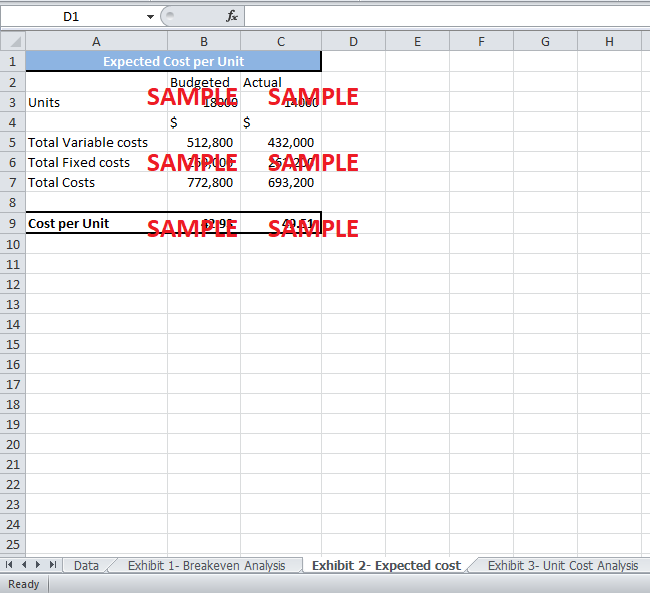

2. Using budget data, what was the total expected cost per unit if all manufacturing and shipping overhead (both variable and fixed) was allocated to planned production? What was the actual per-unit cost of production and shipping?

The planned units of production were 18,000. The total budgeted cost for production and shipping of the product is $772,800. Hence, the expected per unit cost of manufacturing and shipping is 42.93. The actual units of production were 14,000. The actual total cost for manufacturing and shipping was $693,200. The resulting actual per-unit cost for production and shipping is $49.51. Exhibit 2 shows the calculation of expected manufacturing and shipping cost per unit. It also shows the calculations for actual manufacturing and shipping cost per unit.

The actual unit cost for production and shipping is significantly higher than planned because the units produced were 4,000 units lower than budgeted. The fixed cost remains constant. As the units produced a decrease, the fixed cost per unit rises as the fixed cost is spread over lesser units. On the other hand, the unit variable cost remains constant with the change in production level.

3. Comment on the performance report and the plant accountant’s analysis of results. How, if at all, would you suggest the performance report be changed before sending it on to the division manager and Marco Corporation headquarters?

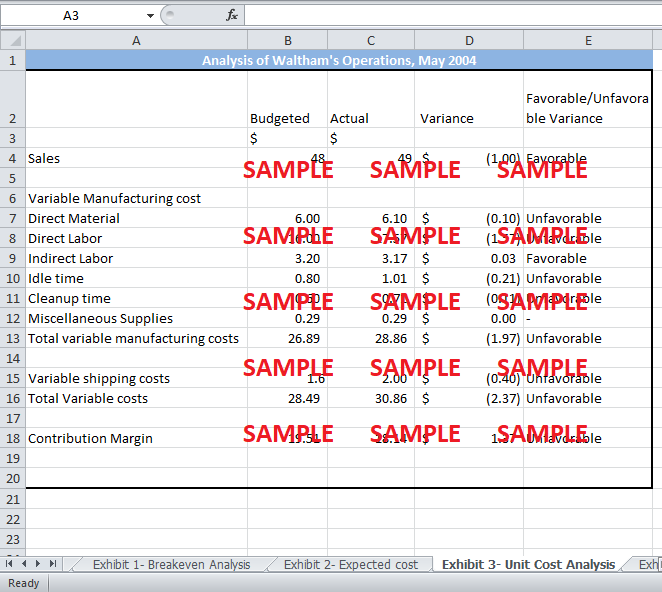

The analysis done by the plant accountant is not accurate. According to the plant accountant’s performance report, all the actual variable costs are under the budgeted cost. However, the accountant compares the actual costs for 14,000 production units to the planned costs for 18,000 units. Hence, the variable costs for 14,000 units will always be lower than the variable costs for 18,000 units. Therefore, comparing the absolute dollar amounts in the budget and actual, when a number of units differ, is unfair and incorrect. A comparison of per-unit cost, in this case, would be more accurate.

Exhibit 3 shows the variable cost per unit of the budget and the actual cost. The unit costs are calculated by dividing the aggregate of a variable cost by 18000 for the budget and 14000 for the actual. These figures are comparable. All the actual unit costs were higher than budgeted per unit. The material cost fell by 5% to a cost of $5.7 per unit. However, the actual per-unit material cost in Exhibit 3 is $6.10. This could mean that more material was used per unit than planned. Similarly, the direct labor cost per hour is $8.2. As each product requires two hours of labor, the labor cost per unit should be $16.40 per unit. However, according to the actual numbers, direct labor cost is $17.57 per unit. The labor cost per unit could be higher, due to inefficiency in production resulting in more labor hours per unit.

In the performance report, the accountant also failed to mention the loss of customer contracts during the month. The significant difference in expected and actual income could be due to more production than sales. The reason for the higher per-unit cost of direct material and direct labor could be that the plant produced more units than it sold. Therefore, the actual values of direct material and direct labor appear to be the cost for 15000 units of production.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.