Get instant access to this case solution for only $19

Estimating Walmarts Cost Of Capital Case Solution

The weight of debt and equity is calculated using the book value of both. However, the market value of debt and equity are also disclosed in the calculations. However, the book values are preferred to determine the rates since historical values focus on the capital structure of the company whereby target capital structure can be accounted for while calculating the WACC. The weigh of debt and equity comes out to be 42% and 58%, respectively.

Following questions are answered in this case study solution

-

Cost of Debt

-

Cost of Equity

-

Weights of Debt and Equity

-

Weighted Average cost of capital (WACC)

Case Analysis for Estimating Walmarts Cost Of Capital

1. Cost of Debt

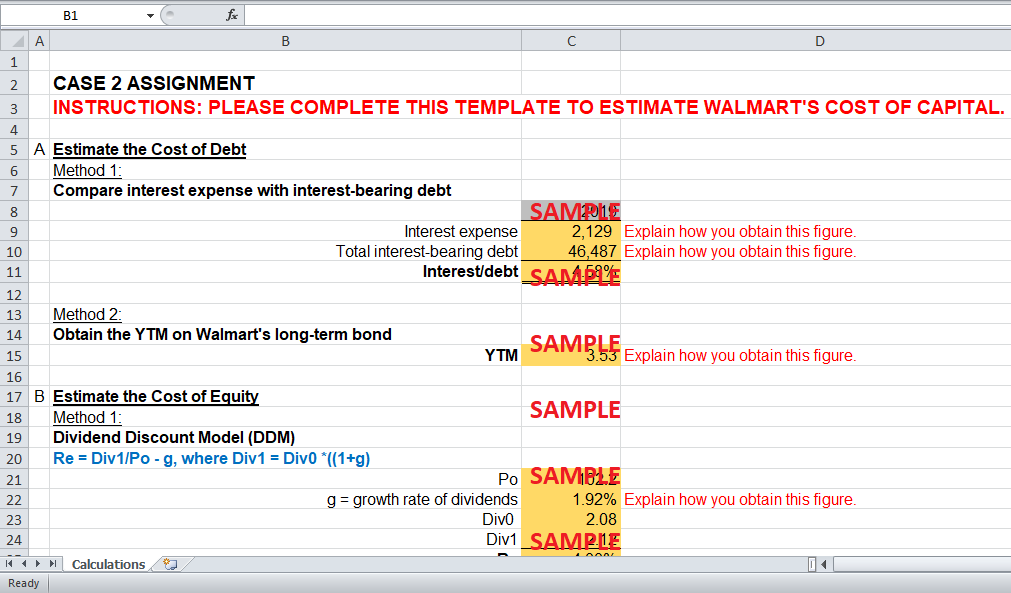

There are two methods for calculating the cost of debt of Walmart.

-

Firstly, the cost of debt can be determined from the existing interest expense and outstanding debt for the previous year. As per the balance sheet for FY19, the total interest expense of Walmart amounts to USD 2,129M. Whereas, the total debt amounts to USD 46,487M as per the balance sheet of FY18, which includes short term and long-term debt. Dividing the interest expense with the debt gives the cost of debt of 4.58%. The average balance of total debt may also be used to find the cost of debt.

-

The cost of debt can be estimated from the yield to maturity of the long-term debt of Walmart. As discussed in the case, Walmart has issued USD 1B in bonds with a 7.55% coupon for 30 years. The same bonds are to be matured after 11 years and are currently selling at USD 136.38, with a yield of 3.53%. This yield represents the market expectation of required return on similar fixed-income security; therefore, it may be a good estimation of the cost of debt.

2. Cost of Equity

The cost of equity can be estimated by using 1) dividend discount model (DDM) and 2) capital asset price model (CAPM).

-

DDM estimates the cost of equity by two components, which are dividend yield and growth rate. The dividend yield is the ratio of future dividend and current stock price. From exhibit 4, the historical dividends of Walmart can be reviewed. It is interesting to find out that since 2014, the company has increased divided by a fixed amount of USD 0.04 / stock. Therefore, the dividend (D1) for FY20 is assumed after adjusting for the same increment, which resulting in USD 2.12 / stock. The growth rate for the dividend is 1.92%.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Booster Juice Bringing Canadian Smoothies To The Indian Market Case Solution

- Medicine Hat Meat Traders Beefing Up A Family Business Case Solution

- Zara The Capabilities Behind The Spanish Fast Fashion Retail Giant Case Solution

- Budget Carriers In India The Economist Case Solution

- Kipp Houston Public School Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.