Get instant access to this case solution for only $19

Hansson Private Label Case Solution

Hansson Private Label (HPL) is a manufacturer of personal care products such as shampoo, soap, mouthwash, sunscreen and shaving cream. The company started in 1992 when it purchased assets from Simon Health and Beauty Products. The company was purchased by Mr Hanson for $42 million - $17 million of which was raised through debt financing. The investment represented significant risk for Hanson because a significant portion of his wealth was tied up is a single investment. However, Hanson considered it an attractive investment because he believed that he was paying significantly less than the replacement cost of the assets purchased. Over the past sixteen years, Hanson has grown the company at a conservative but persistent fashion. He is now faced with an investment opportunity that promises swift growth, but also accompanies significant amount of risk.

Following questions are answered in this case study solution:

-

Introduction

-

Company Performance

-

Cash Flow Projections

-

Discount Rate

-

Analysis & Recommendation

Hansson Private Label Case Analysis

2. Company Performance

Hansson Private Label (HPL) operates in the personal care market in the United States with sales of $681 billion in 2007. The growth in this market segment is largely driven by price increases (average increase of 1.7% over the past four years), as volumes have grown by a meager amount of less than 1% in the past four years. HPL has posted strong performance since its inception. Financial statements for the last five years show that revenues have increase from about $500 million in 2003 to $681 million in 2007. During the same time, the operating profit also increased by $24.3 million and net income increased by $9.6 million. Thereby, the company has been able to increase revenue while exhibiting sufficient control over its costs. The operating cash flow of the company has also increase steadily over the past five years. The company also invests sufficiently in capital expenditures with the company’s assets increasing steadily to $381 million in 2007. The long-term debt of the company has also decreased to a five-year low of $54.8 million.

A focus on conservative expansion has led to strong operating performance in the past. However, all four plants of the company are operating at 90% capacity. Therefore, the company does not have flexibility to further expand its operations significantly. The sales of the private labels are dependent on few larger customers, and customer retention is very important to a company like HPL. Recently, HPL’s largest customer has approach the company for a large order. The company will need to invest in expanding its facilities in order to meet the order requirements. This is an excellent opportunity for HPL in a consumer segment (retailing) where there is intense competition for shelf-space. The downside is that the customer would only commit to a three-year contract. The investment opportunity is very attractive if the customer keeps on buying the company’s products, but the company can bear significant losses if the customer refuses to buy the product after the contract expires. Therefore, Hansson needs to accurately calculate the cash flows related to the investment and account for the risk inherent in the investment before he can make decision on the expansion project.

3. Cash Flow Projections

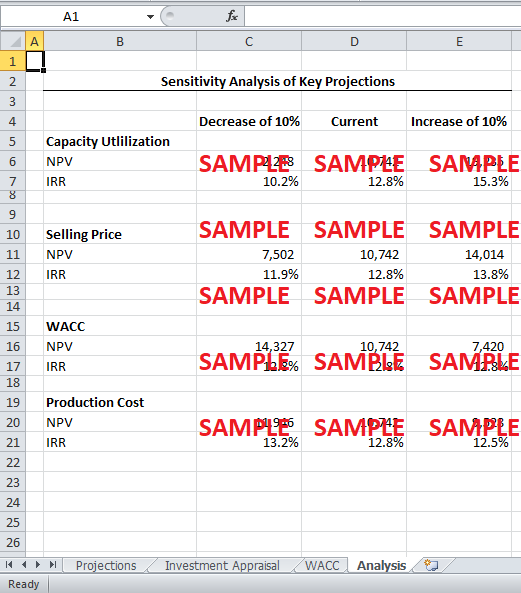

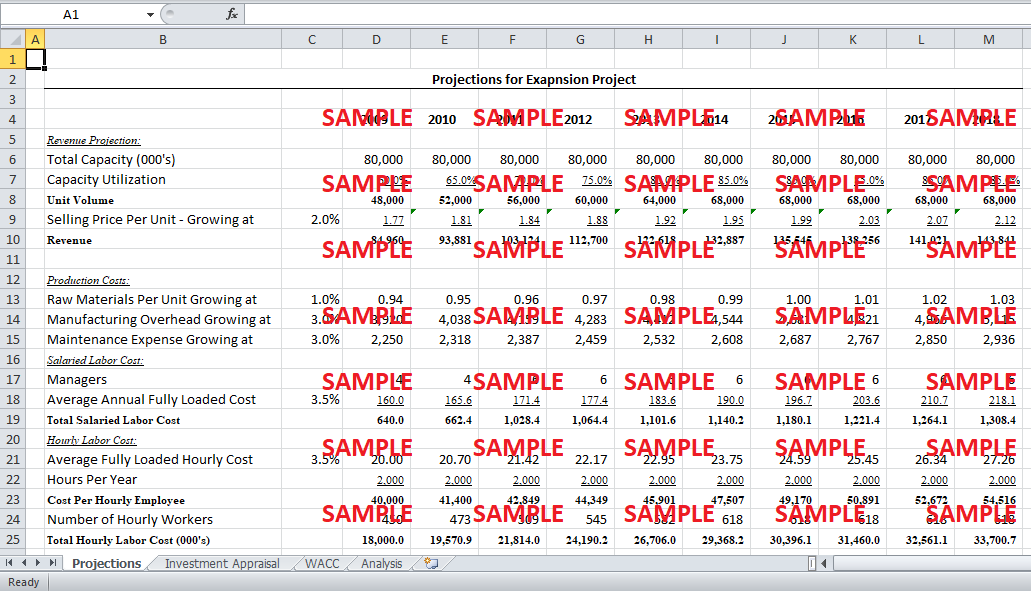

The Executive VP of manufacturing, Robert Gates, has made a number of assumptions regarding the future operating performance of the new facility. Gates starts with a starting operating capacity of 60% and steadily increases it to 80% by the end of tenth year. It is not clear whether there will be sufficient demand to produce so many units of the product. The customer has only agreed to a three-year contract. Therefore, it is reasonable to assume that the demand from the next three years can be estimated with sound accuracy. However, the demand after the first three year is subject to speculation. It is possible that the customer continues to buy products from HPL even after three years, or other customers start buying the same product. Under such circumstances, the capacity utilization may even exceed the level speculated by Gates. On the other hand, it is also likely that the customer will not buy HPL’s product after the contract expires. If the company cannot find an alternate buyer under such a scenario, the capacity utilization may be much lower than the speculated level. In the absence of any information to the contrary, it is assumed that the capacity utilization forecasts represent the best estimate of the future demand for the company’s product. Nevertheless, it will be interesting to see how the expansion project’s value varies with different levels of capacity utilization.

Similarly, Gates has assumed an annual increase in selling price of 2%. The forecasted increase is higher than the historical increase, which averaged 1.7% over the past five years. An overestimation of the increase in projected price might overestimate the revenues from the expansion project. In reality, the bargaining power of the customer of strong especially after the contract period ends, and the company might not be able to increase price at the projected rate. It will also be interesting to see how increases in the projected expenses affect the value of the company. The management is worried that Hansson is avoid growth and looking for stagnation. Therefore, Gates has an incentive to undervalue expenses and overvalue revenues in order to present the project in a positive light and convince Hansson to undertake the project. Such a move might not be beneficial for the company as it might force Hansson to accept a project that is actually destroying value for the company by generating a negative NPV.

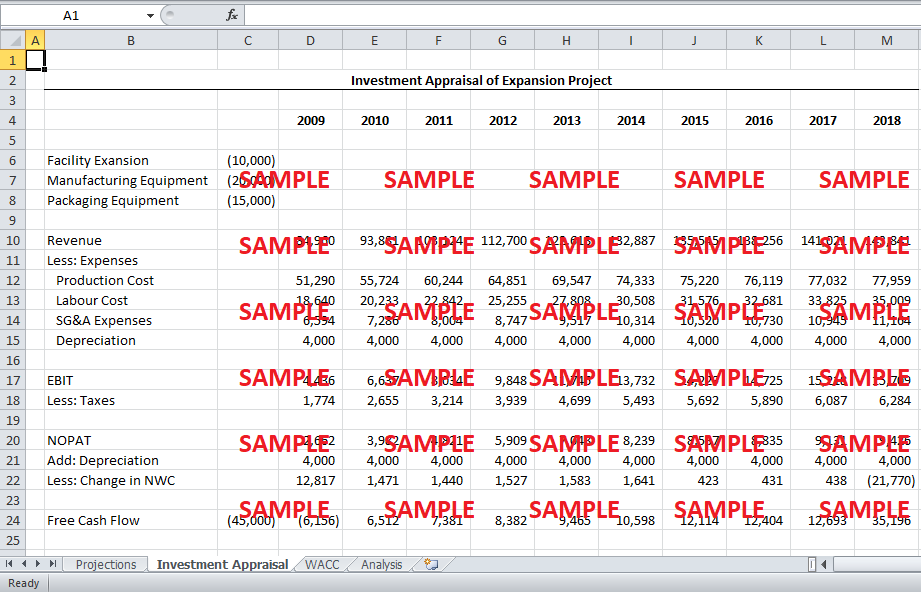

The cash flow projections generated by Gates will be tested for sensitivity analysis in the later portion of this response. In this section, the project will be appraised assuming that Gates’ projections accurately reflect the economic reality of the project. Using Gates projections, the earning before interest and tax can be calculated by subtracting both operating and administrative expenses from revenues. The depreciation on the new equipment is also subtracted, as it is a tax-deductible item and hence affects cash flows. The net operating profit after tax is calculated by subtracting the tax expenses from the earnings before interest and tax. The depreciation expense in then added back to the net operating profit after tax because depreciation is a non-cash expense – that is it does not affect cash flow. The result is then adjusted for the changes in net working capital to get free cash flows. The net working capital is calculated using the ratios provided in the case study as well as the revenue and costs projections. At the end of the life of the project, it is assumed the working capital is returned, amounting to the difference between accounts receivable and accounts payable. It is also assumed that all inventories will be sold and inventory levels will be zero at the end of ten years.

Using this information about projected free cash flows and the required initial investment, the internal rate of return (IRR) for the company can be calculated to be 12.8%. However, this information about the IRR is irrelevant if we do not know the required discount rate for the project. Similarly, we cannot calculate the net present value (NPV) without the information about discount rates. The project will attractive if it has a positive NPV, which will only be the case if the discount rate for the project is less than the calculated IRR. In essence, we cannot make a decision about the expansion project without calculating the appropriate discount rates for the project.

4. Discount Rate

A case could be made that the expansion project is more risky than average project of the company on multiple grounds. One reason that the project can be assumed to be more risky is that the revenues from the project are largely dependent on the behavior of the customer after the contract expires. It is true that the project might suffer if the customer decides against buying the company’s products after the expiration of the contract. However, it is not certain how the project forecasts should account for such a risk. There is no economic rationale for adjusting the discount rate to reflect this kind of risk. Firstly, the nature of this risk is one-sided: the company suffers if it loses the customer, but it is probably not equally likely that the customer will increase its purchases after the contract expiration. The nonsymmetrical nature of the risk means that the discount rate cannot accurately reflect the risk because discount rates are used for risks that are symmetrical in nature. Secondly, it is not clear how much of an increase in discount rate will be an adequate compensation for such a risk. It seems more prudent that the company conducts a scenario analysis and recalculates the project cash flows if the customer leaves after the contract expiration. The company can then use the probability of customer leaving to calculate a weighted average of project’s cash flows. Alternatively, the company can also conduct a qualitative analysis of the project under both scenarios.

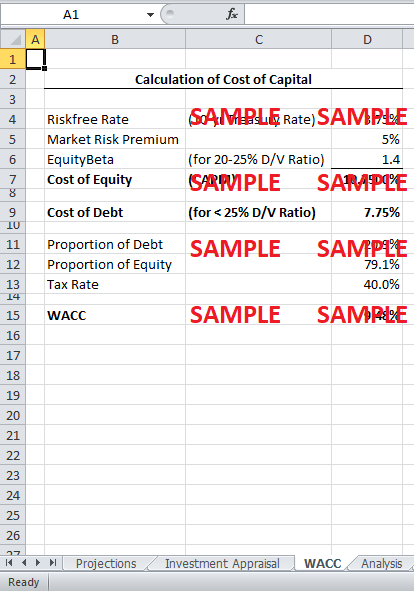

On the hand, the risk resulting from the increase in debt should increase the cost of capital. An increase in debt could represent an increase in riskiness for both lenders and equity owners. Equity owners are subject to additional risk because lenders have a preferential claim on the company’s cash flows, and restrict dividend payments and operating performance by imposing negative covenants. If leverage increases beyond a certain point, lenders’ risk could also increase because the company may face difficulties in meeting that non-discretionary interest and principal payments on the debt. The case points out that the level where lenders start to experience additional risk (and interest rate on debt increases) is at the debt to value ratio of 25%. The company’s debt to value ratio is expected to remain lower than this level. Therefore, the interest rate on debt is projected to remain at 7.75%. However, the cost of equity might increase with the increase in debt. The capital asset pricing model can be used to estimate the cost of equity. The beta, required in the CAPM, can be estimated using the information given for similar companies. Considering the projected debt to value ratio of the company, it is estimated that the equity beta for HPL will be close to 1.4. Using the information of risk free rate and market risk premium provided in the case study, the CAPM can be applied to estimate the cost of equity. Using this information, the weights of debt and equity and the assumed effective tax rate, the weighted average cost of capital (WACC) can be estimated. This WACC is the discount rate that the company should use to evaluate the project.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.