Get instant access to this case solution for only $19

Implementing Quantitative Risk Management And VaR In A Chinese Investment Bank Case Solution

Jasper aimed to use the VaR model for rationalizing the trading function to moderate the impact of risk being taken in the organization. This is because VaR model is an effective risk metric tool and helps in determining the minimum capital to be held in the banks to retain the liquidity position. Hence, when there will be a control on the trading activities, the trading group will be able to hedge itself against large losses, resulting in a better strategic risk management.

Following questions are answered in this case study solution

-

Why does Jasper choose to make the VaR the first step towards rationalizing the trading function? What is the appeal of the VaR model generally?

-

Based on the excel data provided, run back tests of the VaR predictions against actual daily gains or losses for both the S&P 500 index and the Shanghai index using the following parameters:

a. Starting with a look back period of three months with a 95% confidence level, observe the number of exceptions in all years for both the Shanghai and S&P indexes. How do they compare?

b. Try different look back periods such as 6 and 9 months at a 95% confidence level and see if the length of the period changes your conclusions.

c. Based on the VaR model, did the backtesting support his model?

d. How might Jasper use the backtest results to bolster his case for utilizing the VaR model?

-

Based on the data provided, what would be the Conditional VaR (CVaR) in this example? Explain your model and assumptions.

Case Analysis for Implementing Quantitative Risk Management And VaR In A Chinese Investment Bank

This is because then through VaR, it would be able to determine the maximum amount of acceptable loss on a certain portfolio, by using a certain confidence level over a certain period of time.

2. Based on the excel data provided, run back tests of the VaR predictions against actual daily gains or losses for both the S&P 500 index and the Shanghai index using the following parameters:

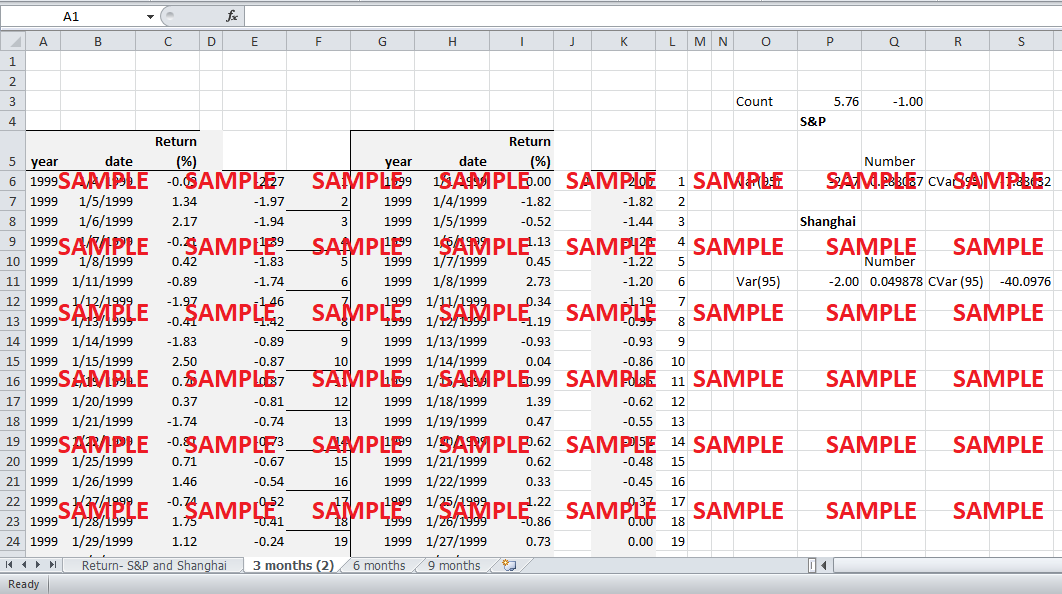

a. Starting with a look back period of three months with a 95% confidence level, observe the number of exceptions in all years for both the Shanghai and S&P indexes. How do they compare?

Ans. 2a- On Excel

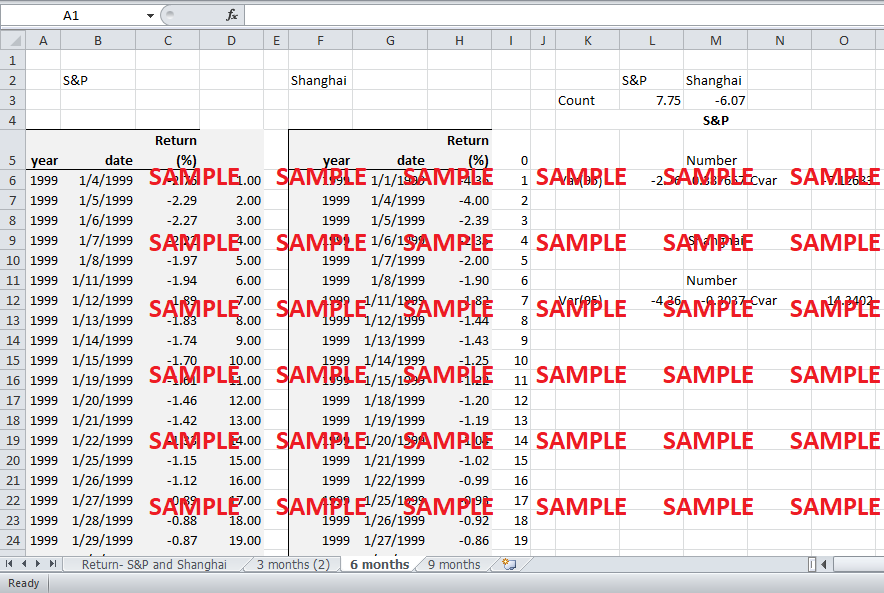

b. Try different look back periods such as 6 and 9 months at a 95% confidence level and see if the length of the period changes your conclusions.

Ans. 2b- On Excel

c. Based on the VaR model, did the backtesting support his model?

Ans. 2c Based on the VaR model, the back testing supported Jasper’s model as the number of variations fall within the set limit of the 95% interval. As the time period has extended, the VaR for Shanghai can be seen to be converging at 4% indicating that 5% of the time, the average loss would be more than 4% for the portfolio of the bank. Comparing this with S&P index, the results achieved are the same, hence supporting the hypothesis

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Langtry Falls Expansion Plan Case Solution

- Estimating Walmarts Cost Of Capital Case Solution

- Booster Juice Bringing Canadian Smoothies To The Indian Market Case Solution

- Medicine Hat Meat Traders Beefing Up A Family Business Case Solution

- Zara The Capabilities Behind The Spanish Fast Fashion Retail Giant Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.