Get instant access to this case solution for only $19

Lululemon Athletica Pitching An IPO Case Solution

The expansion of the company in the United States is associated with great risks as compared to returns. The company has to face fierce competitors to fight for the market share, but if the company succeeds in setting its foot successfully, the rewards are huge. Since the company deals with the sale of costumes associated with Yoga, there is a great risk that yoga may not remain in fashion, and some other sport gets popular among Women. This business risk is especially dangerous for the company because it does not spend a significant amount of money on marketing and brand management.

Following questions are answered in this case study solution

-

If Lululemon were to issue $50 million of new common stock what should be suggested price range for the IPO? McDonald is expecting you to employ both the comparable methods of valuation (P/E and market/book ratios) as well as a discounted cas approach.

-

Assuming that the proceeds to the company are $50 million in each case, should Federal recommend a debt issue or an IPO? Disregard issuing costs.

-

What are the key opportunities and risks that should be highlighted for investors in the proposed IPO?

Case Analysis for Lululemon Athletica Pitching An IPO

1. If Lululemon were to issue $50 million of new common stock what should be suggested price range for the IPO? McDonald is expecting you to employ both the comparable methods of valuation (P/E and market/book ratios) as well as a discounted cas approach.

To calculate the suggested price range for Lululemon three methods have been used.

-

Price-to-Earnings

-

Price-to-Book Value

-

Discounted Cash Flows

Many companies use discounted cash flow method to find the optimal value price range for IPO. However, price / Earning ratio and Price to book value have been used frequently in the past. The advantages of using discounted cash flow method are more than those of other methods. Discounted cash flow method estimates the intrinsic value of the company’s stock accurately. While other methods like the Price Earnings ratio and Price-to-book value are based on the market performance of the company and are therefore not accurate depiction of the true value of the company’s stock.

However, for this case study all three methods have been used and a price range has been estimated. Due to the fact that the company is highly financed by equity, the overall ratios are pretty low. The company plans to expand rapidly which indicates that capital expenditures will increase. To finance those expenditures the company intends to hold an IPO.

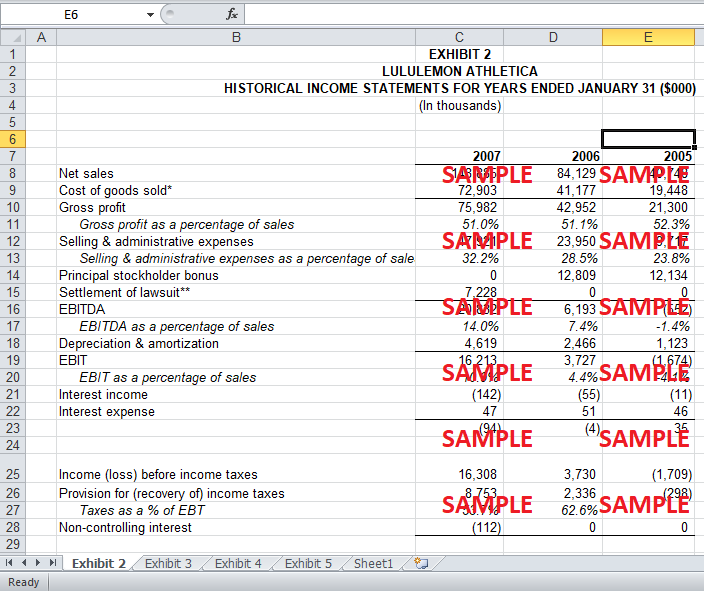

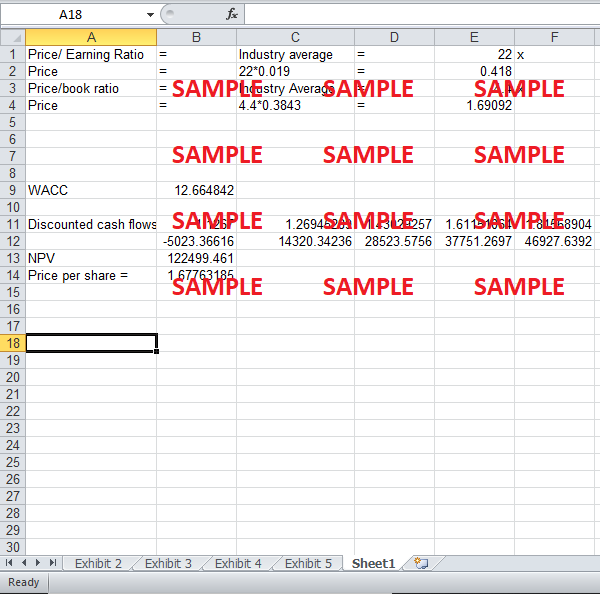

In the first method, using the data provided in the case study, an average Price-to-Earnings ratio has been calculated for Lululemon. This ratio comes out to be 22x. This number is plugged into the formula for the price to Earnings to calculate the market price per share for the company. The value for Earnings per share has been calculated using data from Income Statement provided in exhibit. Through this method, the value comes out to be $0.418.

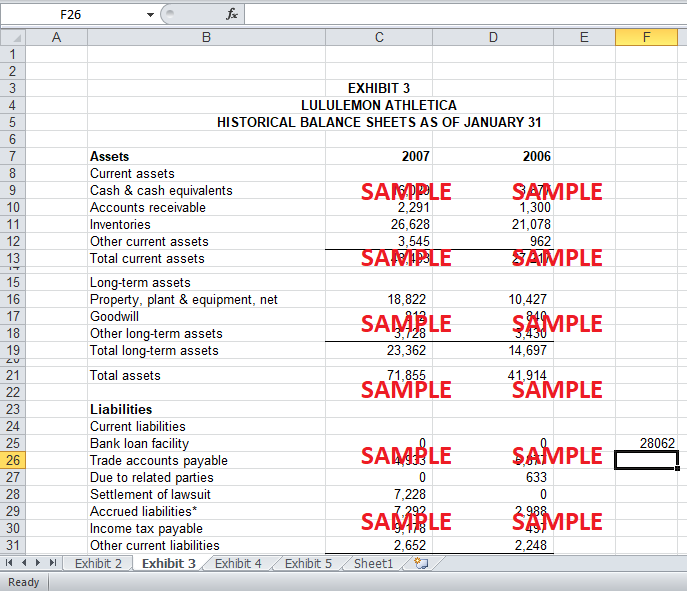

The second method used to calculate the price per share of Lululemon is the Price-to-book value. As stated above, the data for competing firms in the market has been used to calculate the average value and that has been used to find the price per share of the company. Through this method, the price comes out to be $ 1.69 per share.

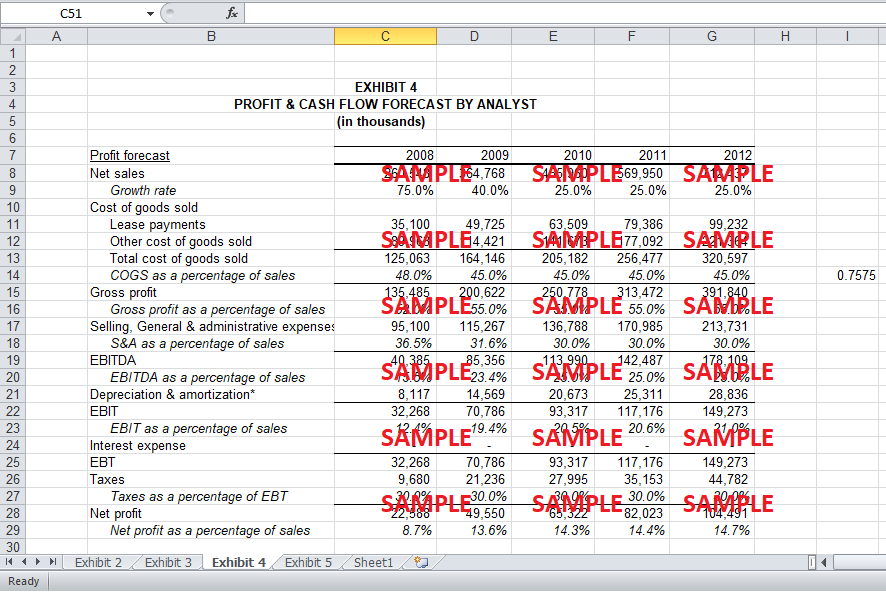

Lastly, discounted cash flow method has been used to calculate the net present value of the company. In this method, cash flow forecasts have been discounted back and summed up to arrive at the net present value. The discount rate (WACC) has been calculated using the return on S&P 500 given in the case study, the interest rate on debt and the average beta of the industry. These values have been plugged in the formula for WACC using the capital structure specified in the data sheet. The value attained through this method is $ 1.67 per share.

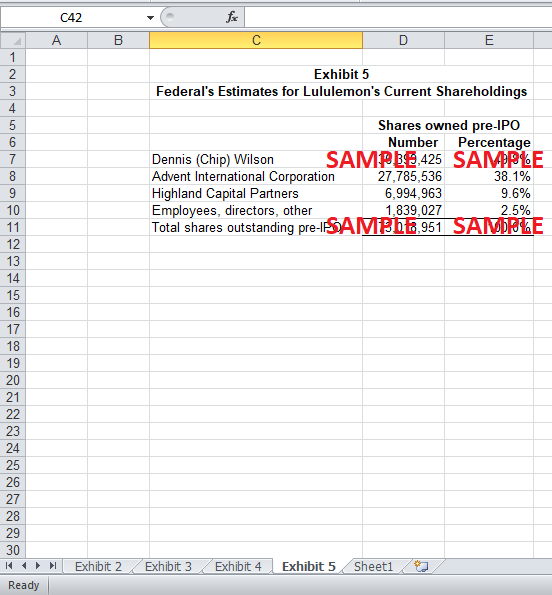

The price range for the new IPO can thus be set using the results form above calculations. The price range should be from $.04 per share to $ 1.70 per share. The IPO of $ 50 million should be carried out at a price between the prices ranges calculated above. This estimate is based on the true value of the company regardless of the price at which its stock is currently trading in the market.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.