Get instant access to this case solution for only $19

The Super Project Case Solution

General Foods Corporation has many major US product divisions included Post, Kool-Aid, Maxwell House, Jell-O, and Bird Eye. Now General Foods is looking forward to starting a new project i.e. Super Project. Super is a new instant dessert, based on flavored, water-soluble, and agglomerated powder. Manager-financial analysis has a notion that sunk cost is relevant in the evaluation of the Super project. The sunk cost, in this case, includes the cost of the capacity of Jell-O building and agglomerator utilized by the super project. While evaluating the project in an incremental basis, the overhead capital and expenses are not included; as incremental basis only includes the cost that could be directly identified with the decision to accept the Super project. Now the question is whether the sunk costs, overhead capital, and overhead expenses should be taken into account while evaluating the project or not if yes, then how? Or if anyone of sunk cost and overhead cost should be accounted for?

Following Questions Are Answered In This Case Study Solution:

-

What are the relevant cash flows for General Foods to use in evaluating the Super project? In particular, how should management deal with issues such as

a. Test-market expenses?

b. Overhead expenses?

c. Erosion of Jell-O contribution margin?

d. Allocation of charges for the use of excess agglomerator capacity?

-

How attractive is the investment as measured by various capital budgeting techniques (i.e., accounting rate of return, payback period, internal rate of return, net present value)? How useful are each of these measures of investment attractiveness?

-

How attractive is the Super project in strategic and competitive terms? What potential risks and benefits does General Foods incur by either accepting or rejecting the project?

-

Should General Foods proceed with the Super project? Why, or why not?

Case Study Super Project Questions Answers

1. What are the relevant cash flows for General Foods to use in evaluating the Super project? In particular, how should management deal with issues such as;

a. Test-market expenses?

b. Overhead expenses

c. Erosion of Jell-O contribution margin?

d. Allocation of charges for the use of excess agglomerator capacity?

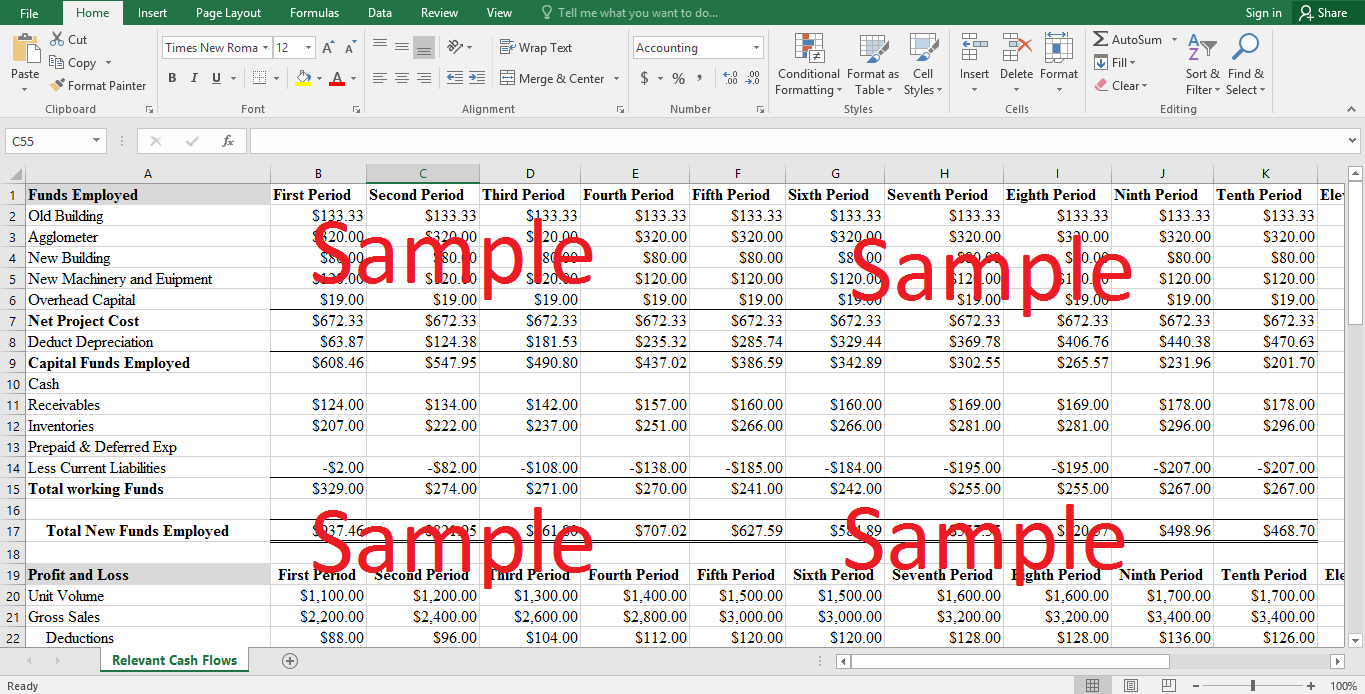

The Relevant Cash Flows for General Foods to use in evaluating the super project for next ten periods of operation is found out by adding depreciation and change in net working capital from profit after tax and then resultant is subtracted by capital expenditure. Cash Flows keep on increasing throughout the period. It starts from 14 thousand US dollars in the first period and ends at 632 thousand dollars in the tenth period. Ten year average for relevant cash flow is $488 thousand, and compound annual growth rate is 46%.

a. Test-market Expenses

Test-market expenses might be a sunk cost at the time capital funds were requested, but because the new product had to pay for test market expenses cost of a market test is included as the "Other Expenses" in profit and loss statement. Moreover, the cost of a market test is onetime expense before the first period; hence, it is included in the first period.

b. Overhead Expenses

Overhead expenses include manufacturing cost, selling expense, general and administrative expense. Evaluating the project on an incremental basis or facilities-used basis does not include these overhead expenses as these expenses could not be directly identified with the decision to produce the super project. But these overhead expenses, as well as, overhead expenses do have an impact on the decision about the project. Also, $19 thousand dollars are added in the net cost of capital which is a 47.5% share of total overhead capital that is just associated with the super project. As super volume increases the division business by 10 percent, it has been assumed that 10% overhead expense will also be increased. Keeping these facts in mind, selling, general and administrative expenses head of the profit and loss statement is increases by the ten percent of the previous period expense on an incremental basis. Then these overhead expenses are increased on the basis of the compound annual growth rate of overhead expenses during the last ten periods i.e. 10%.

c. Erosion of Jell-O Contribution Margin

Erosion of Jell-O contribution margin is due to the super volume which leads to decreased sales of Jell-O. Eighty percent of the sales of the super volume come from growth in the powder segments or growth in total market share, and 20% comes from the erosion of Jell-O sale resulting in the erosion of Jell-O contribution margin. This is an incremental cost to the company which is added in profit and loss statement as an expense under the head Adjustments.

d. Allocation of charges for the use of excess agglomerator capacity

The super project is utilizing two-third of the Jell-O's building and half of the agglomerator capacity. Therefore, it is necessary to keep this utilization of capacity into an account while evaluating the super project. The charges for the use of excess agglomerator capacity are allocated in net project cost i.e. $320 thousand.

2. How attractive is the investment as measured by various capital budgeting techniques (i.e., accounting rate of return, payback period, internal rate of return, net present value)? How useful are each of these measures of investment attractiveness?

Investment in Super project is evaluated by various capital budgeting techniques. Following are the results and practicality of these techniques:

Accounting Rate of Return

Two types of accounting rate of returns are calculated, PAT (Profit after Tax) return and PBT (Profit before Tax) return. The PAT return of this project is 13% and it is calculated by dividing the ten-year average net profit from ten year average new funds employed. The PBT return is 26% and it is calculated by dividing ten year average of profit before taxes from average new funds employed. Super project is a proven project, and the risk of mortality is small. So the required 10-year PBT return should be at least 20%. As the PBT return is 26%, so this investment is attractive.

Payback Period

The payback period is calculated by adding a number of full years to payback and part-year calculation of last period. The number of full years is equal to the number of periods the "New funds to repay" head remain positive i.e. 8 years. Part-year calculation of last period is determined by dividing amount still to be repaid at the end of the last full period by net profit plus the annual depreciation in the following year. Part-year calculation of last period is 0.62 years. Total Payback period of Super project is 8.62. As the payback period of this project, having a small risk of mortality is less than 10 years, so the project is acceptable.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.