Get instant access to this case solution for only $19

Transaero Turbulent Times Case Solution

Transaero shows a negative cash conversion cycle, which indicates that it is earning from its clients before paying its suppliers for inventory. The negative cash conversion cycle is good for the Transaero in these difficult times because it does not have finances to pay its suppliers. Which means that customers are paying before it has to pay its suppliers. Leverage ratios show how much asset is financed from debt and equity.

Case Analysis for Transaero Turbulent Times

Transaero was one of the largest private airline company in Russia. It was established in 1990 and became one of the top 30 airlines in the world in the year 2012. It believed in increasing the efficiency of the airline and providing good quality service to its customers. The number of passengers increased by 21.04% in the year 2013. Despite the increase in revenue, the company go bankrupt in the year 2015. The increase in the oil prices in the year 2014 and the depreciation of the Russian ruble resulted in the decline in the financial position of the Transaero. Moreover, limitations were levied against flying over Ukraine, which led to a rise in the operating expenses of the Transaero airline. The sharp growth in the interest rates leading to an increase in the debt reimbursement resulted in the liquidity problems for the company. Also, banks started limiting lending and Transaero was not able to obtain financing for paying its liabilities.

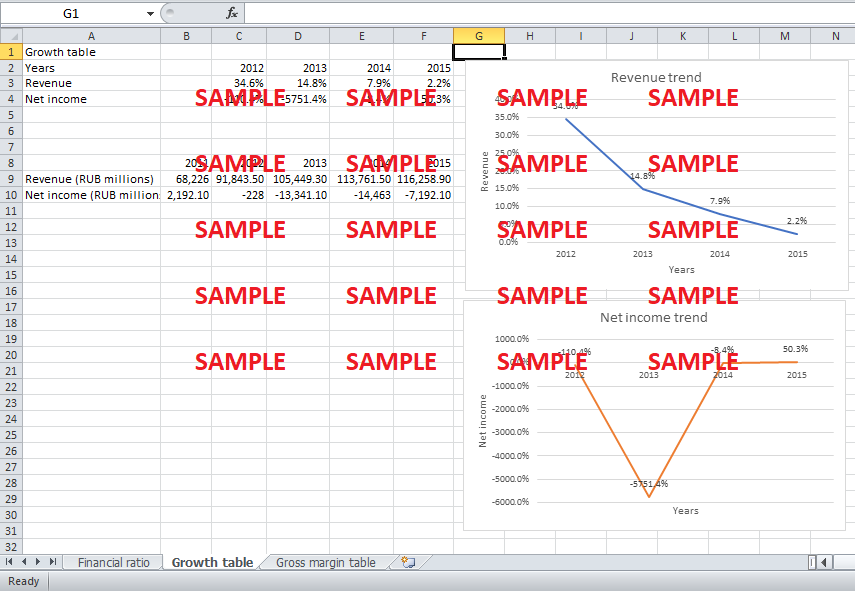

The Table-1 below shows the Revenue and Net income of Transaero from the year 2011 to 2015. The growth table (Table-2) shows a positive trend in the revenue of Transaero company. The revenue of Transaero increased at a decreasing rate from the year 2011 to 2015. The increase in the year 2012 was the largest, i.e. 34.6%. Then the revenue increased at a slow rate, i.e. 14.8%, 7.9% and 2.2% in the year 2013, 2014 and 2015 respectively. However, net income shows a decreasing trend. Transaero generated a profit of RUB 2,192.10 million in the fiscal year 2011, and then the profit declined t0 RUB 228 million in 2012. In 2014, the net income change was -8.4% because the decline in the net income from the previous year was low. However, the net income showed a positive trend in 2015 of 50.3% because the net loss was reduced. The chart of both the revenue and net income is shown below.

|

|

2011 |

2012 |

2013 |

2014 |

2015 |

|

Revenue (RUB millions) |

68,226 |

91,843.50 |

105,449.30 |

113,761.50 |

116,258.90 |

|

Net income (RUB millions) |

2,192.10 |

-228 |

-13,341.10 |

-14,463 |

-7,192.10 |

Table-1: Revenue and Net income for Transaero

|

Growth table |

|

|

|

|

|

|

Years |

|

2012 |

2013 |

2014 |

2015 |

|

Revenue |

|

34.6% |

14.8% |

7.9% |

2.2% |

|

Net income |

|

-110.4% |

-5751.4% |

-8.4% |

50.3% |

Table-2: Growth Table

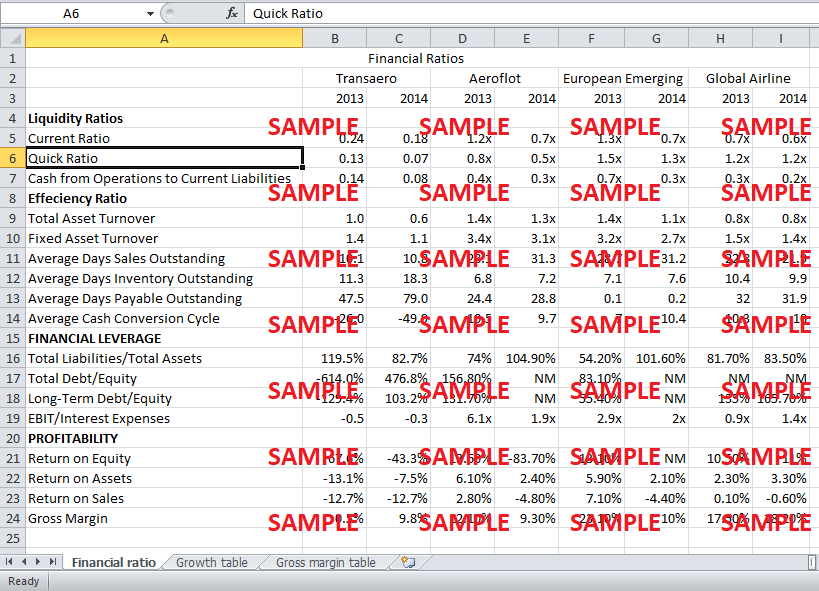

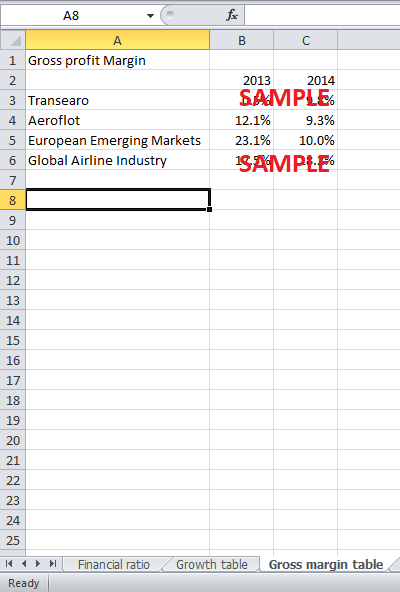

The table below shows the financial ratios calculated for the Transaero company for the year 2013 and 2014 and the data of its competitors for comparison. The liquidity ratios show whether the firm has sufficient assets to pay off its liabilities or not. The current ratio is calculated by dividing current assets by current liabilities. Current ratio indicates the ability of the firm to pay off its current liabilities from current assets. The current ratio of Transaero was lower than 1, i.e. 0.24 and 0.18 in 2013 and 2014, respectively, which signifies that it does not have enough assets to settle its current obligations. The current ratio was also lower than its major competitor, Aeroflot. The quick ratio was also less than that of the industry, i.e. 1.2, for both the years.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

- Supply Chain Optimization At Madurai Aavin Milk Dairy Case Solution

- Nexgen Structuring Collateralized Debt Obligations CDOs Case Solution

- Mcphee Distillers Accounting Policy Choices In The Preparation Of Financial Statement Case Solution

- East Coast Lifestyle Expanding A Regional Apparel Brand Case Solution

- Managed By Q Case Solution

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.