Get instant access to this case solution for only $19

Vyaderm Pharmaceuticals The EVA Decision Case Solution

Vyaderm Pharmaceuticals is considering introducing economic value added as its prime instrument for bonus and incentive decision making criteria. For the purpose of NOPAT, four pertinent adjustments are to be made in operating earnings. However, due to these adjustments, the management is unsure about the bonus for the years 2000 and 2001. After the adjustments, the calculations show that the EVA of the North American dermatology division for the year 2000 comes out to be $116,081,929. The bonus for the same year is $395,994. The EVA performance is negative for the year 2001; therefore, no bonus is paid in that year. At the current moment, the company should restrain from EVA as a bonus calculation criteria.

Following questions are answered in this case study solution

-

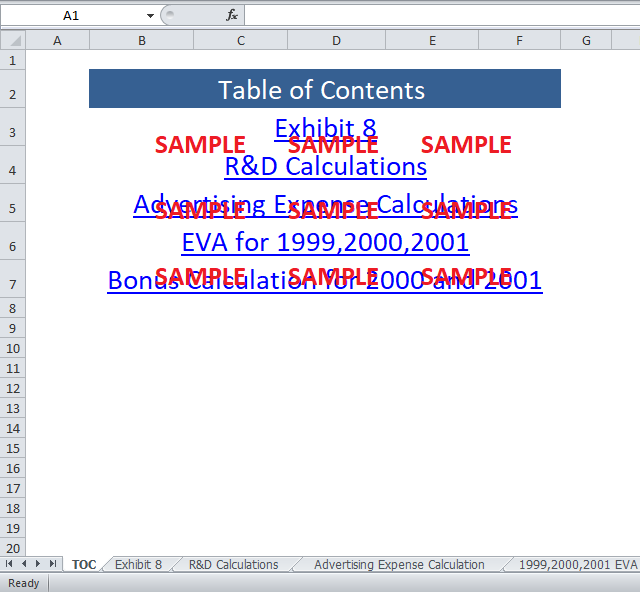

Using data from the case Exhibit 8, calculate the following items:

-

2000 EVA for the North American Dermatology Division.

-

2000 EVA bonus payout for a manager earning $200,000, assuming that the manager’s bonus is based 100% on the Division’s EVA?

-

2001 EVA and estimated bonus payout for the same manager, assuming that Vyaderm profits fall back to historical levels and the EVA improvement goal remains constant.

-

Based on your analysis, what would you recommend to Mr. Vedrine?

Case Analysis for Vyaderm Pharmaceuticals The EVA Decision

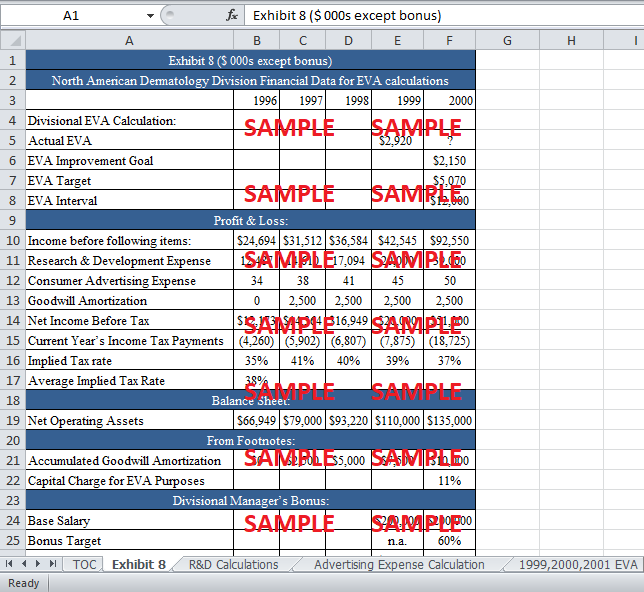

1. Using data from the case Exhibit 8, calculate the following items:

i. 2000 EVA for the North American Dermatology Division.

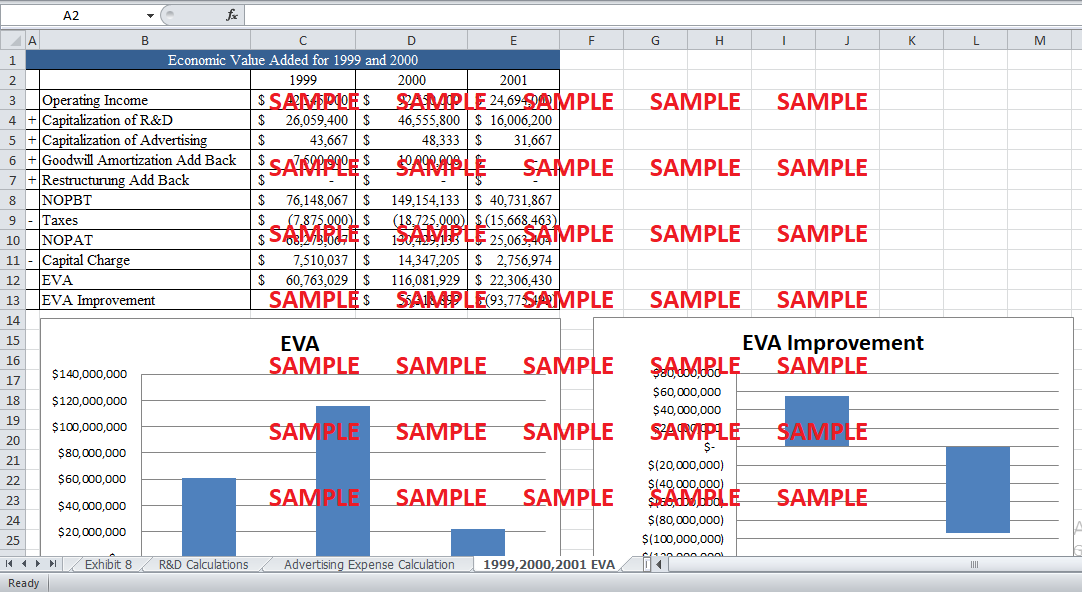

EVA is a measure of a company’s financial performance based on the residual wealth concept. There could be several methods of gauging the company’s financial performance. However, many of these methods do not take into account the concept of opportunity cost by not incorporating them to the cost of capital. The concept of economic value added was derived to get a true picture of a company’s return on invested capital. The formula for calculating economic value-added is as follows:

EVA = NOPAT - (Cost of Capital * Invested Capital)

However, there were several changes made in the accounts of the company or the relevant division in order to reach the value of net operating profit after tax. The following for adjustments are to be made with correct calculations.

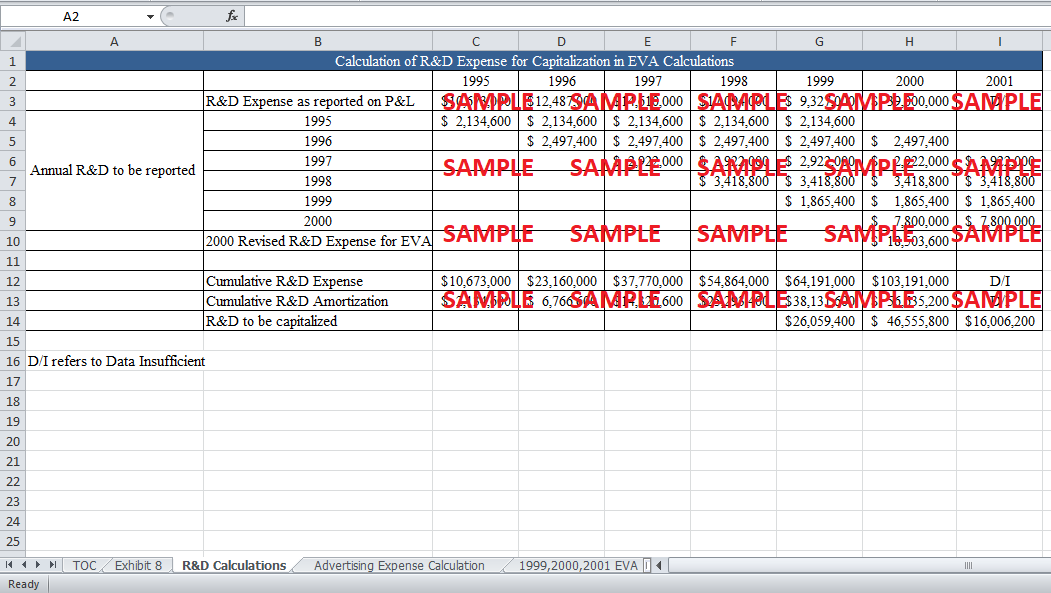

1. Research and development expenses: For the purpose of calculating the net operating profit of tax, all the decision development expenses for a particular year should be added back to the operating earnings. The company has a policy of amortizing the research and development expenses for a period of five years. Therefore, a single year’s R&D expense is capitalized for the next five years to make equal amounts. The formula for calculating R&D expense for particularly is as follows:

R&D expense for a particular year = cumulative R&D expense - cumulative R&D amortization

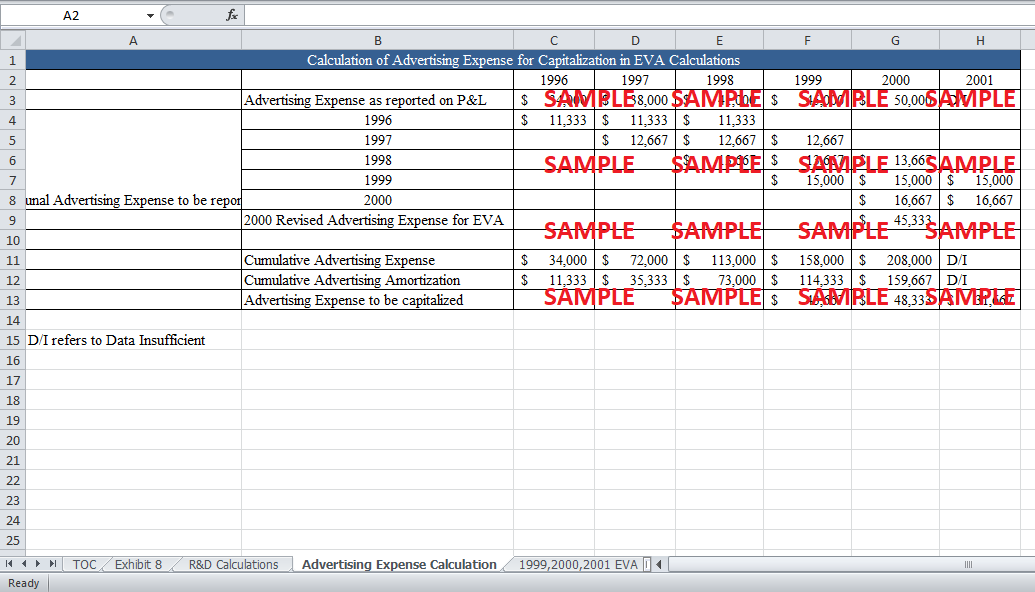

2. Advertising expenses: Regardless of the fact that any cash outflow related to advertising in the normal course of business is treated, and expense, the final formal of the EVA capitalize it. The advertising expense is added back to the operating income. The advertising expenses for particularly as amortized on a station with for the coming three years. The formula for calculating advertising expense for a particular year is as follows:

Advertising expense for a particular year = cumulative advertising expense - cumulative advertising expense amortized

3. Goodwill: Any goodwill that arises from the business combination or a business acquisition is treated as an intangible asset. This intangible asset can be amortized for a maximum time period of 40 years. Therefore, after the recording of goodwill, every year a certain amount is amortized by taking it as an expense. However, in the calculation of net operating profit after tax, the current year amortized goodwill is added back.

4. Restructuring expenses: For the purpose of calculating EVA, any restructuring expense is added back in operating earnings.

After all, these expenses are added back to the operating earnings, the final value of NOPAT is calculated. The capital charge is deducted from the net operating profit after tax at a rate of 11%. The value of EVA is then calculated by utilizing the above-mentioned formula. The calculations show that the EVA of the North American dermatology division for the year 2000 comes out to be $116,081,929.

ii. 2000 EVA bonus payout for a manager earning $200,000, assuming that the manager’s bonus is based 100% on the Division’s EVA?

The method for calculating the bonus payout for a manager was extensive. Firstly, the EVA improvement is calculated by subtracting the previous year’s EVA from the current year’s figure. Subsequently, the EVA performance is computed from the following formula:

EVA Performance = 1+ (Actual Performance – Improvement Goal) / EVA Interval

After this, the bonus amount is calculated by multiplying the figure of EVA performance with the target bonus. Finally, the bonus payout is calculated. Any amount above the target bonus is put in the ending bank balance. The ending bank balance of a certain year is the starting balance for the next year. If the EVA performance is negative, a reverse entry is made in the bank balance. This entry essentially decreases the value of the bank balance. The 2000 EVA bonus payout is depicted in the following graph.

Figure 1: Bonus 'Calculated Vs Payout' for the Year 2000

The target bonus for the year 2000 was $120,000. However, the calculated bonus comes out to be $671,989.

Get instant access to this case solution for only $19

Get Instant Access to This Case Solution for Only $19

Standard Price

$25

Save $6 on your purchase

-$6

Amount to Pay

$19

Different Requirements? Order a Custom Solution

Calculate the Price

Related Case Solutions

Get More Out of This

Our essay writing services are the best in the world. If you are in search of a professional essay writer, place your order on our website.